Making Hay Monday – October 10th, 2023

Making Hay Monday

High-level macro-market insights, actionable economic forecasts, and plenty of friendly candor to give you a fighting chance in the day’s financial fray.

Chart of the Week

Many, if not most, Haymaker readers are aware that I believe long-term trading ranges are crucial to track. We define “long-term” as at least three years, but the longer the trading band has held, the more significant the breakout or breakdown, at least based on my experience. Per the below yield chart on the 30-year U.S. T-bond, there is a 15-year “range expansion” presently underway. This implies long Treasury yields are likely to continue rising. From the below chart, you can see that the breakout above 3½% last year did lead to a major upside yield move; 4% was next taken out (the peak at the end of 2013) and now the 4.7% level has also been shattered. That was where 30-year UST yields double-topped in 2010 and 2011. Yields are definitely extended right now and may well correct (i.e., there might be a near-term rally in USTs with prices moving up and rates down). Over the next few months, though, I believe even higher yields are in the offing.

Daunting Challenges & An Inexplicable Miracle

“I’m pleasantly surprised, even stunned, that a credit crunch hasn’t happened so far.” -Austan Goolsbee, president of the Chicago Fed.

“My biggest concern is that if we get a big unwind in this leveraged trade, it could really cause liquidity to dry up in the Treasury market.” -Matthew Scott, head of rates trading at Alliance Bernstein.

“If hedge funds stopped buying Treasuries, I don’t know who would buy them.” -A top executive at a large hedge fund, as reported by Luke Gromen

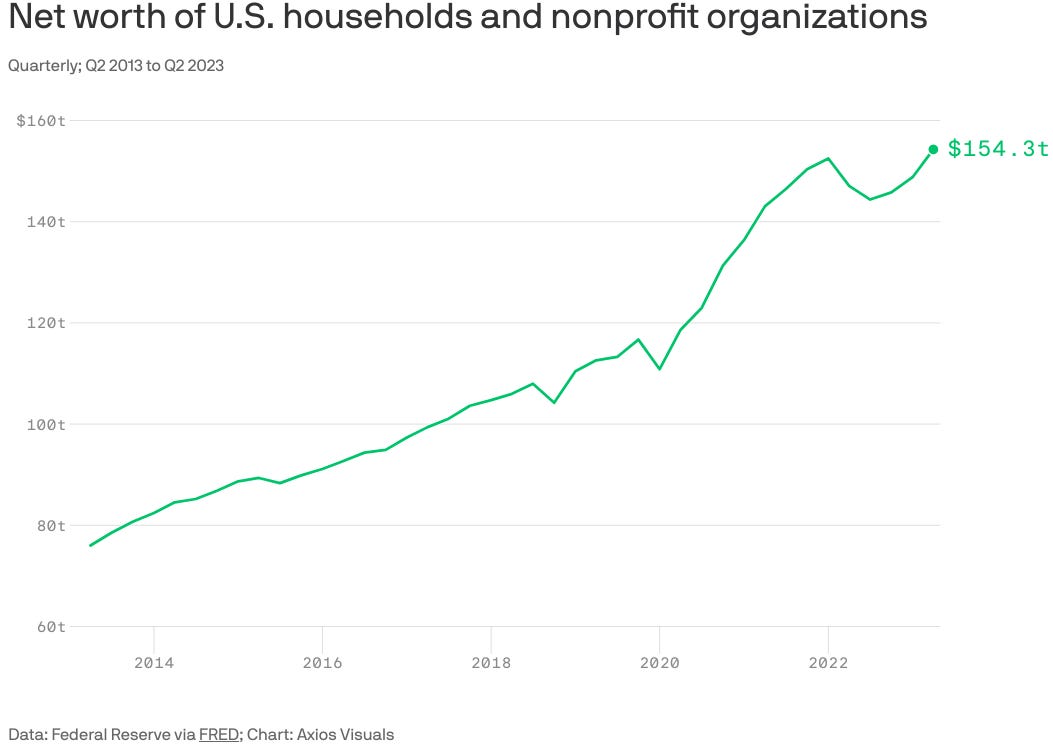

Charts are frequently circulated such as the one below showing how much U.S. households’ net worth has increased since 12/31/19, i.e. on the eve of the pandemic. There’s little doubt the drivers of that have been stocks and real estate. It certainly hasn’t been bonds.

The world, both the real and investment versions, is chock-full of stunning statistics in this bizarre era. One of the most arresting I’ve seen lately is the amount of wealth that has vaporized over the last three years due to one of the worst bear markets ever to hit the fixed income domain. In case you haven’t seen this — and I wouldn’t blame you if you haven’t, as it has received scant press — that number, on a global basis, is $70 trillion (see ZeroHedge headline below). In this day and age, we are for sure becoming numb to numbers in the trillions. But that is truly a whopper. To put it into perspective, the world’s total stock market value is around $107 trillion.*

*Deutsche Bank’s Jim Reid has calculated this rough estimate based on $307 trillion of outstanding global bonds. Considering that $17 trillion had negative yields back in late 2020, this strikes me as plausible. This is in addition to the fact that very long-term U.S. government bonds have plunged 50% or more over the last three years. Fortunately, the U.S. never resorted to negative yields; those bonds have obviously been totally nuked given the magnitude of the global yield explosion.

Yet, other than the failure of three large U.S. banks and the forced merger of a storied Swiss financial institution, there has been a mystifying lack of collateral damage from these enormous losses. A meta-question I think investors should be asking themselves is if those $70 trillion of bond losses will continue to be effortlessly absorbed by the global financial system. Equally critical is whether they will trigger a cascade of defaults that produce the next economic and/or market crisis.

Frankly, my esteemed partner, Louis Gave, and I are both perplexed that nothing more serious has yet occurred (as is Austan Goolsbee). This is particularly the case considering the speed and magnitude of the latest long-term Treasury sell-off. Adding to our amazement is a condition which I suspect few Haymaker readers appreciate, though I have started calling attention to it: the so-called “basis trade” in the U.S. Treasury (UST) market.

In the past, I’ve frequently given credit to Luke Gromen for so presciently warning about what I’ve been calling the 4F scenario: the Federal Fiscal Funding Fiasco. His October 3rd Forest For The Trees contained these provocative words:

Add it all up, and we think that we could see a waterfall decline (yield spike) in the UST market in October.

What’s the catalyst? The forced deleveraging of the 50-500x levered (per the FT)* hedge fund UST relative value trade.

*The UK’s version of the Wall Street Journal, The Financial Times.

Evergreen Compatibility Survey

This is vital stuff; therefore, I want to clarify some of the above jargon. Firstly, what he’s warning about is a 10 to 20 point decline in the most popular long-term U.S. Treasury ETF, the TLT (the iShares 20 Plus Year Treasury Bond Exchange Traded Fund). That would be the above-referenced “waterfall” decline which in turn would drive T-bond yields potentially into the 7% yield zone.

The forced deleverage catalyst he’s describing is due to the “relative value trade” which is another way of saying the “basis trade”. This involves hedge funds (usually) shorting the Treasury futures contracts to lock in a price very slightly above the price of actual USTs. The theory is that this is a riskless maneuver since they are essentially the same security. (Astute readers may recognize the parallels with the Long Term Capital fiasco that nearly crashed the global financial system back in 1998.) …

Subscribe to Haymaker to read the rest.

Become a paying subscriber of Haymaker to get access to this post and other subscriber-only content.

A subscription gets you:

| Subscriber-only posts and full archive | |

| Post comments and join the community |

IMPORTANT DISCLOSURES

This material has been distributed solely for informational and educational purposes only and is not a solicitation or an offer to buy any security or to participate in any trading strategy. All material presented is compiled from sources believed to be reliable, but accuracy, adequacy, or completeness cannot be guaranteed, and David Hay makes no representation as to its accuracy, adequacy, or completeness.

The information herein is based on David Hay’s beliefs, as well as certain assumptions regarding future events based on information available to David Hay on a formal and informal basis as of the date of this publication. The material may include projections or other forward-looking statements regarding future events, targets or expectations. Past performance is no guarantee of future results. There is no guarantee that any opinions, forecasts, projections, risk assumptions, or commentary discussed herein will be realized or that an investment strategy will be successful. Actual experience may not reflect all of these opinions, forecasts, projections, risk assumptions, or commentary.

David Hay shall have no responsibility for: (i) determining that any opinion, forecast, projection, risk assumption, or commentary discussed herein is suitable for any particular reader; (ii) monitoring whether any opinion, forecast, projection, risk assumption, or commentary discussed herein continues to be suitable for any reader; or (iii) tailoring any opinion, forecast, projection, risk assumption, or commentary discussed herein to any particular reader’s investment objectives, guidelines, or restrictions. Receipt of this material does not, by itself, imply that David Hay has an advisory agreement, oral or otherwise, with any reader.

David Hay serves on the Investment Committee in his capacity as Co-Chief Investment Officer of Evergreen Gavekal (“Evergreen”), registered with the Securities and Exchange Commission as an investment adviser under the Investment Advisers Act of 1940. The registration of Evergreen in no way implies a certain level of skill or expertise or that the SEC has endorsed the firm or David Hay. Investment decisions for Evergreen clients are made by the Evergreen Investment Committee. Please note that while David Hay co-manages the investment program on behalf of Evergreen clients, this publication is not affiliated with Evergreen and do not necessarily reflect the views of the Investment Committee. The information herein reflects the personal views of David Hay as a seasoned investor in the financial markets and any recommendations noted may be materially different than the investment strategies that Evergreen manages on behalf of, or recommends to, its clients.

Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this material, will be profitable, equal any corresponding indicated performance level(s), or be suitable for your portfolio. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Investors should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

20231010