Technical Analysis DayTradeIdeas

Technical Analysis DayTradeIdeas

Daily Technical Analysis is provided by Jason Sen of Day Trade Ideas, who has been day trading since the late 1980’s. Jason has been a contributor of Traders Summit since the beginning. He primarily focuses on providing technical analysis of the financial markets, including stock chart patterns, Forex and Metals setups, and other useful technical analysis.

Join Telegram https://t.me/daytradeideas

Emini S&P December futures still just drifting aimlessly after the long holiday weekend. We are still holding just above minor support at 4542/38 to keep bulls in control & perhaps on the next leg higher we can reach my next target of 4591/94, perhaps as far as 4615/19 eventually.

Strong support again at 4542/38. Longs need stops below 4533. A break lower risks a slide to 4505/00 & even 4480/75 is possible.

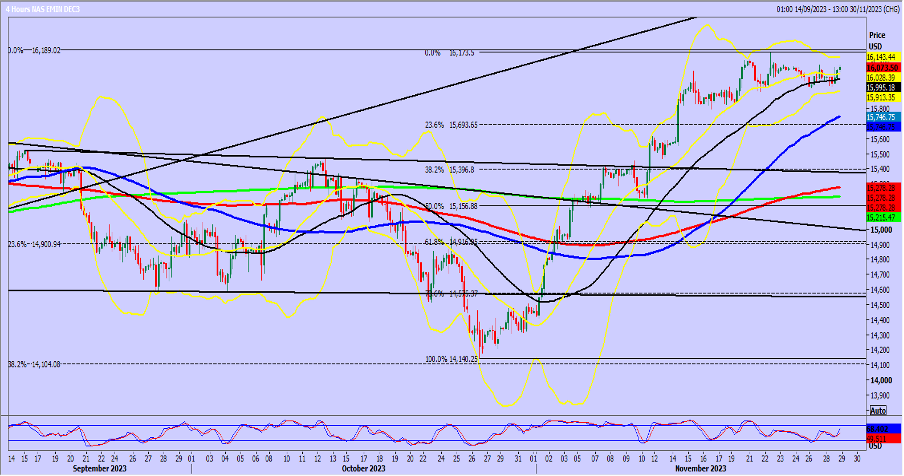

Nasdaq December futures edged higher to 16173 last week as we look for 16300 next target. Further gains can target 16390/410.

We have held a very tight range from around 15940/920 up to 16090/16120 for a week. The best buying opportunity should be at 15850/830 & longs need stops below 15770. We should also have strong support at 15700/660.

Emini Dow Jones December continues higher through 35080/35100 to my next targets of 35170/190 & 35230 & now we are edging above 35400/450, so we look for 35570/590. Further gains this week can target 35650/670. Support again at 35390/360. Longs need stops below 35250.

- Global Stock Index and Dollar Movement:

- Global stock indexes advanced on Tuesday.

- The U.S. dollar fell to a 3-1/2 month low, marking its biggest monthly drop in a year.

- Federal Reserve official signals that the central bank may consider rate cuts if inflation continues to ease.

- Fed Governor Christopher Waller’s Comments:

- Waller suggested the possibility of lowering the Fed policy rate in the coming months if inflation continues to decrease.

- He expressed increasing confidence that the current interest rate setting would be sufficient to lower inflation to the Fed’s 2% target.

- Fed Governor Michelle Bowman’s Remarks:

- Bowman mentioned that the central bank might need to raise borrowing costs further to bring inflation back down to its target.

- Market Response and Rate Cut Expectations:

- Traders increased bets for the first rate cut, with March being a possibility.

- Probability for a 25 basis-point cut rose to nearly 33% from 21.5% on Monday, according to CME Group’s Fedwatch tool.

- Majority expected a cut, at least one notch, in May.

- Wall Street Indexes Performance:

- Wall Street indexes closed higher.

- Dow Jones rose 0.24%, S&P 500 gained 0.10%, and Nasdaq Composite added 0.29%.

- U.S. Consumer Confidence Survey:

- A survey showed U.S. consumer confidence rose in November after three months of declines.

- However, households still anticipated a recession over the next year.

- Upcoming Economic Data:

- The spotlight will be on the U.S. October personal consumption expenditures report (PCE), including core PCE (Fed’s preferred inflation measure).

- Euro zone consumer inflation figures are expected to provide clarity on price and monetary policy directions.

- U.S. Treasury Yields and Dollar Index:

- After the Fed commentary, U.S. Treasury yields dipped, with benchmark 10-year notes down 6 basis points.

- Dollar index fell 0.368%, with the euro up 0.32% to $1.0988.

- Currency Movements:

- Japanese yen strengthened 0.82% against the greenback.

- Sterling was last trading at $1.2694, up 0.55% on the day.

- Gold Prices:

- Spot gold prices were up 1.4% at $2,040.79 an ounce, hitting their highest level since May.

- Oil Prices:

- Oil prices settled higher on the possibility of OPEC+ extending or deepening supply cuts, a storm-related drop in Kazakh oil output, and the weaker U.S. dollar.

- U.S. crude settled up 2.07% at $76.41 per barrel, and Brent settled at $81.68, up 2.13% on the day.

- Australian and New Zealand Dollars:

- Australian dollar held near a four-month peak.

- New Zealand dollar scaled a roughly four-month top of $0.61495.

- Australian inflation data and a rate decision from the Reserve Bank of New Zealand are awaited.

Please email me if you need this report updated or Whatsapp: +66971910019 – To subscribe to this report please visit daytradeideas.co.uk or email jason@daytradeideas.co.uk

Jason Sen, Director

https://www.daytradeideas.co.uk

20231129