Steno Signals #58 – Rebound or Recession? Or Both?

Rebound or Recession? Or Both?

We are at macro crossroads as markets start to chase a cyclical rebound in the economy. Is a cyclical rebound true or is this the famous fatamorgana of a soft landing just before the actual recession?

****Due to popular demand, we have now opened for paid subscriptions for Steno Signals (our weekly flagship editorial) via Substack. If you want access to our EM and Geopolitical basic coverage, you will get that at the same price (including Steno Signals) over at www.stenoresearch.com.

Our premium coverage and live-portfolio/data-hub will only be available at www.stenoresearch.com as well*****

Happy Sunday and welcome to our flagship editorial!

We have spent the last week studying the business cycle intensively to gauge how various asset classes look at the cycle right now. It is safe to say that nothing has been normal in this post-Covid “cycle” and that is probably exactly the reason why we are currently stuck in a debate on whether the economy rebounds or goes into a recession.

Let’s have a look at the evidence.

Rebound or recession? Consensus needs to turn much more upbeat before a recession is worth betting on

The recession has been postponed and postponed and postponed by the economic consensus in recent quarters and advisors and fund managers have been positioned for economic weakness for too long.

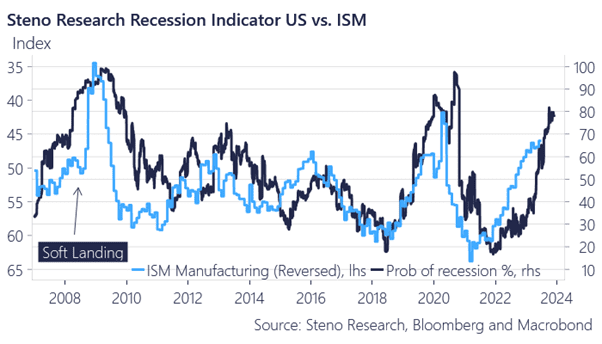

Our quant-based recession probability model entered the year with a relatively benign recession risk of 20-25%, which led us to buy risk assets when everyone was negative during January of 2023.

Our recession indicator is starting to hint of much more elevated risks during Q3 and Q4 in particular, but why is the market chasing a cyclical rebound if the recession risk is still very present?

Chart 1: Steno Research recession indicator (with exact timings of empirical lags)

DISCLAIMER

The content provided in Stenos Signals newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.

20230723