Steno Signals #52 – Remember 2007? It’s Here Again… 5 Reasons Why we will Repeat All Mistakes

“Remember 2007? It’s Here Again… 5 Reasons Why we will Repeat All Mistakes”

Should the Fed skip/pause on Wednesday, we’d argue that market positioning will turn optimistic. The soft-landing narrative is back and all the mistakes of the past are likely to be repeated.

******Due to popular demand, we have now opened for paid subscriptions for Steno Signals (our weekly flagship editorial) via Substack. If you want access to our EM and Geopolitical basic coverage, you will get that at the same price (including Steno Signals) over at www.stenoresearch.com.

Our premium coverage and live-portfolio/data-hub will only be available at www.stenoresearch.com as well*******

Happy Sunday and welcome to our flagship editorial. As per usual, expect loads of charts with a few paragraphs to support them. If you cannot show it in a chart, then it’s not true 😊

We are back discussing a soft landing in most of our client interactions and consensus economists currently flock around a non-recessionary narrative for H2-2023. The vibes are getting increasingly reminiscent of Q1-Q3 2007, where the crisis was called off by almost all economists and markets rallied after a Fed pause.

This may be an obvious occasion to remind you of the two rules of economists:

1) For every economist, you’ll find another economist with the opposite opinion

2) They are both wrong

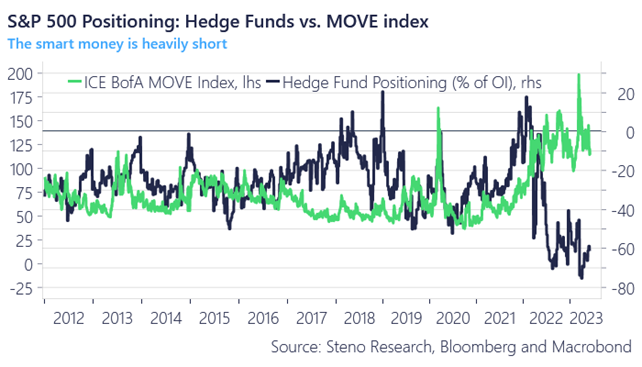

BofA’s most recent monthly fund manager survey now reveals an overwhelming consensus expecting a soft landing, but we are yet to see that optimism spilling over to positioning in equities. If the Fed pauses/skips on Wednesday (still our base case), then expect positioning to move FAST in an optimistic direction (for US equities).

Rates volatility is the #1 explanatory variable for equity positioning and as a pause/skip clearly puts a dampener on rates volatility, we should also expect a rapid bullish re-positioning in the fast/smart money sector.

Chart 1: Rates vol down -> equity positioning up!

DISCLAIMER

The content provided in Stenos Signals newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.

20230612