Making Hay Monday – June 26th, 2023

Making Hay Monday

High-level macro-market insights, actionable economic forecasts, and plenty of friendly candor to give you a fighting chance in the day’s financial fray.

Damn The Icebergs, Full Speed Ahead!

“Optimism means better than reality; pessimism means worse than reality. I’m a realist.” -Margaret Atwood

“The Conference Board’s leading economic indicator (LEI) is telling us to brace for a recession that will be deep and long. Throw mild and shallow out the window.” -David Rosenberg

When you are a financial commentator, such as I am, there is a considerable amount of pressure to maintain your recommendations in a range between bullish and very bullish. This is particularly the case when you cash your paycheck at a major Wall Street firm like Morgan Stanley. That is why its lead strategist, Mike Wilson, is to be admired for his willingness to express cautious views when the situation so warrants.

Whenever the market rallies against him, as it did in late 2021, and again this year, he takes the heat. This includes getting hauled before The Judge — in this case, CNBC’s Scott Wapner — to defend his reasoning. (By the way, he’s not related to the real judge, Joseph Wapner.) When Mike is vindicated, as he was most dramatically in 2022, the reward is usually silence. That also tends to be true even when he makes a tactically bullish — and correct — call, within his overarching view a bear market is still underway, as he did last October. Mike’s anticipation that stocks were poised to rally back then was perfectly timed. What wasn’t so perfect was his switch back to defensive once the rally occurred.

In early December, after catching a nifty 14% rally, Mike warned that the spurt was likely over. For a few weeks, that looked like another spot-on forecast. In fact, nearly four months later the S&P was basically just treading water. At that point, however, the AI meme went viral and Mike was back on the hot seat.

To learn more about Evergreen Gavekal, where the Haymaker himself serves as Co-CIO, click below.

Unfortunately for those of us with a cautious inclination, the S&P rose another 9% before last week’s modest retracement. That’s not exactly a major whiff, but Mike’s been forced to repeatedly defend his stance. Nearly every Monday, he puts out an extremely well-reasoned research note with numerous charts to back up his contentions.

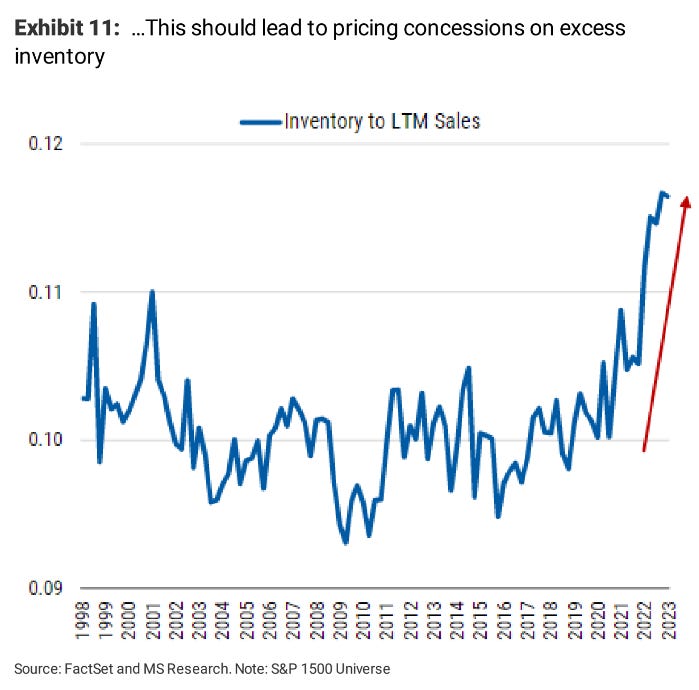

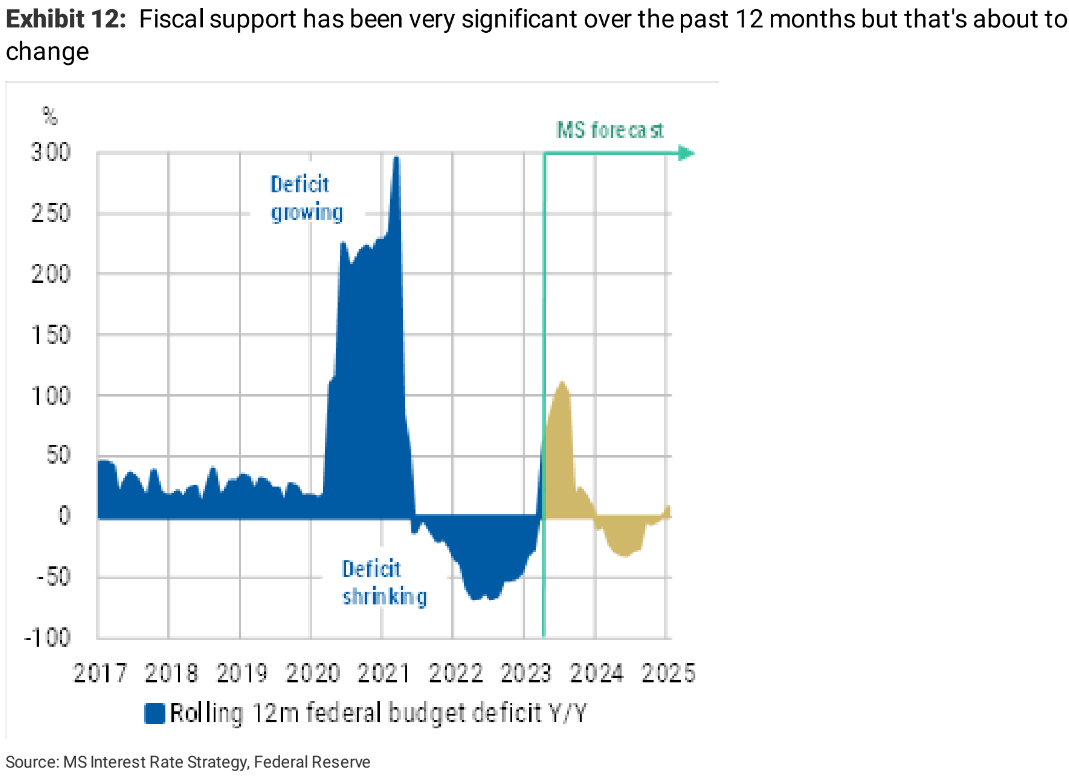

Accordingly, I want to highlight a couple of charts from Mike’s June 20th edition which indicate the economy is sailing into some seriously dangerous waters. Too much inventory and U.S. government fiscal largesse flipping to restraint are major threats to the hull of the USS Expansion.

Unlike this author, Mike has avoided calling for an outright recession. Yet, he’s been unambiguous in his belief that an earnings contraction was a high probability, a view I shared. As regular Haymaker readers know, that’s now in the record books. Despite that, the bull camp, which is currently running wild, is adamant that the profits contraction is over, or very to close to complete. Moreover, it is convinced that earnings are poised to bounce back. You are likely not surprised to read that Mike Wilson vehemently disagrees. And, as you will soon see, for good reason.

Early last week, I received an email containing a powerful slide deck from François Trahan, one of Wall Street’s finest. As you will see from some of the bullet points below, he’s making an extremely convincing case that the worst economic — and profitability — damage is yet to come.

François, a former All-America Research Team Hall of Famer, who was ranked first for portfolio strategy in 10 out 11 years in the first part of this century, asked that his presentation not be widely disseminated. Accordingly, I’m just going to merely summarize some of his key points:

- LEIs, or Leading Economic Indicators, are screaming recession. (Since he wrote those words, the LEIs fell for the 14th consecutive month)

- The Fed’s recession model Is at its highest level since the early 1980s

- Recessions are always associated with stock market declines (my note: which is why you should care about this debate)

- The Fed is tightening at a time when the economy is barely growing

- Tightening (monetary and credit) conditions have an enormous economic impact

- Simultaneous tightening from banks & the Fed is rare… and worrisome

- U.S. corporations and consumers are awash in debt (my note: corporate and personal defaults/delinquencies are rising appreciably)

- Pressure on consumer credit is already intensifying

- The denial phase of the cycle likely shifts into crisis fears later in 2023

Pledge your support

Considering that this was a 64-page slide deck (which I’ve gone through several times!), the above is a very concise summary; however, it gives you a strong sense of where he stands. Of course, it’s fair to note that there is a lengthy list of economic soothsayers who disagree with him… and me. To wit, this week Barron’s prestigious Up and Down Wall Street column sported the following title: “Take It To the Bank: There Won’t Be a Recession This Year”.

The investment community consensus these days is largely in sync with that sentiment. Yet, it wasn’t many weeks ago that this was also the attitude toward Europe. Unfortunately for the Continent, the latest data has turned hard against it, particularly in its typical economic engine: Germany.

The relaxed attitude toward a recession in America also begs the question: What happened to “Don’t Fight the Fed”? It seems like almost the entire pundit community has come down with a serious case of collective amnesia toward this saying’s repeatedly validated track record.

Economic bulls might also want to compare and contrast the historic accuracy of two influential individuals who both opined of late on the economic prospects: Jim Cramer and Stanley Druckenmiller. The week before last, “Booyah! Jim” skipped right over soft-landing and went straight to no-landing. On the other hand, Stan told the elite audience at the Sohn Conference in early May that he thinks a recession might already be underway. Considering “Hail Cramer’s” incessant frequent forecasting air balls, and that Stan achieved an average annual return of roughly 30% for his investors when he was managing other peoples’ money, there’s no question whose opinion should carry more tonnage.

Pledge your support

To my way of thinking, even as the majority of strategists are becoming increasingly convinced there is no recession in sight, I’m more and more of a belief that the opposite is true. The Leading Economic Indicators (LEIs) are called leading for a rather simple reason: they lead! Fourteen straight months in the red has never failed to predict a downturn. And it’s far more than the LEIs. Nearly all of the economic metrics that have proven themselves in the post-WWII era are sending the same eardrum-shattering warning.

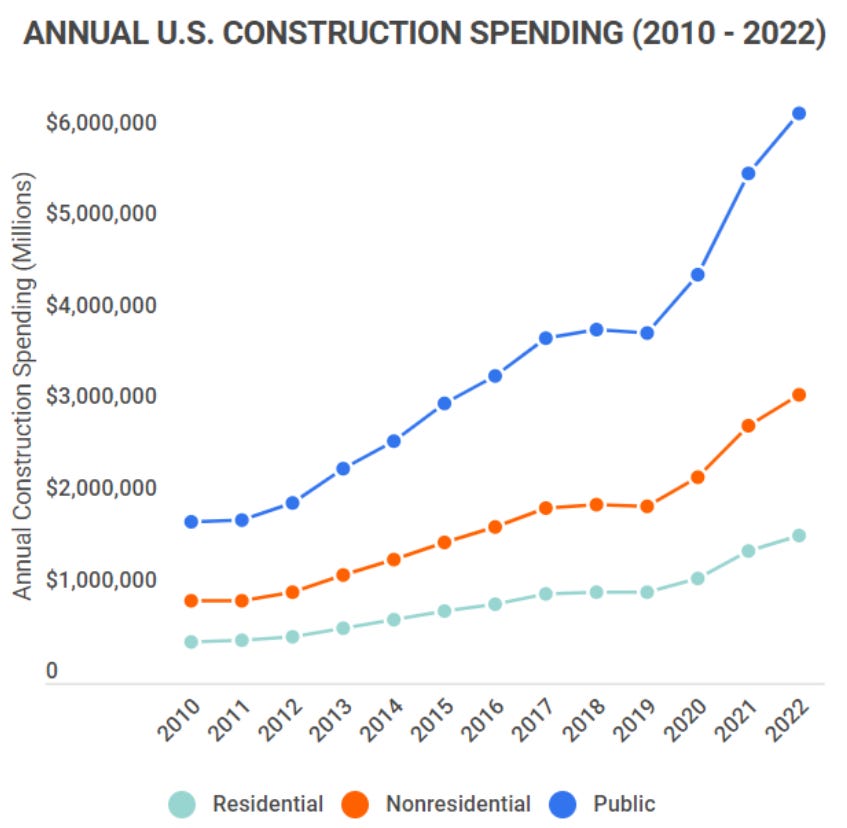

To blow these off, one needs to believe there is something very different. And, admittedly, that could be the case. Here is a visual indicating what it might be:

Thanks to both the Inflation Reduction Act, which is opening the money sluices for a plethora of green energy projects, and the powerful “reshoring” trend, there is a boom in new plant construction in the U.S. (in some instances, over the strident protests of our supposed allies). Will that be enough to offset all of the above-listed headwinds? Personally, I doubt it; but it’s for sure a trend worth closely monitoring.

The author of the Barron’s article cited this as a key reason we won’t have a downturn. He also brought up several other positives such as on-going worker shortages. However, he failed to disclose the plethora of negatives, such as high inventories, a long and deeply inverted yield curve, the plunge in cardboard box shipments, a trucking industry that is reeling, and a banking industry that’s under extreme duress. Another that gets nearly zero press is that delivery giants UPS and FedEx are seeing falling revenues for the first time since the Great Recession. You’d think an objective journalist would have brought up at least a few of these.

Further, the fact that the U.S. government’s budget deficits are blowing out, as is also happening to many big Blue States, is indicative that the construction boom isn’t enough to offset the other myriad drags. It’s not just higher spending on The Great Green Energy Transition that’s behind this because tax revenues are plunging.

Yet, what I’ve found over the years is that when the stock market is rising, all is forgiven. Those warning of trouble ahead are treated like Mike Wilson — as in, lepers only Father Damien could love. Frankly, that includes yours truly. After a recent podcast I did with Wealthion’s super-smooth Adam Taggart, a few accused me of excessive bearishness. Over the years, some have even labeled me a perma-bear (Grrrr!).

Because of that, I wanted to end this MHM edition with an excerpt from a newsletter I wrote during the worst of the Covid crash, back on March 20th, 2020:

To emphasize for clarity, this is the time to buy, especially those market segments exceedingly pummeled by the most intense bout of involuntary liquidation seen since the darkest days of the Global Financial Crisis. This is truly great news for millions of Boomers whose retirement, future or present tense, was imperiled by the systematic eradication of interest rate perpetrated by central banks over the last ten years. The yields available now are the kinds people can actually live on like 6% to 8%, or even higher.

The financial stocks I highlighted at the time would produce extraordinary returns over the next two years.

Unfortunately, most investors were too terrified to capitalize on the bargain-rich environment. The same thing happened in late 2008 and early 2009 during the Global Financial Crisis. What I’ve repeatedly noticed over my 44-year career is that most investors talk a brave game when prices are rising but freeze — or, worse, become panicky sellers — when they crater. The latter, of course, is when the really big money is made, as seen above.

Last fall, when there was also a panoply of outstanding chances to lock in high yields and depressed prices, I was on record in these pages suggesting that readers should be consistently and methodically buying. Many of you let us know you took our advice.

It’s my belief the Fed is going to walk its tough talk while Wall Street is once again disbelieving its warnings. That can’t make Powell & Co. happy. Consequently, I believe it will keep tightening until Jim Cramer starts screaming for mercy… yet again. That will give brave investors another chance to put more capital to work when most investors are back in the full fetal position.

The current market environment strikes me as similar to a hot craps table where almost everyone is winning. The problem is that this one is on the Titanic, with some nasty economic icebergs up ahead. There are lifeboats but, like on that supposedly unsinkable ship, there aren’t enough to go around — at least when everyone tries to get into them at the same time. (The recent tragedy involving the Titanic has unfortunately added to the death toll. Originally, over 1500 souls perished and only 706 survived.)

So, be ready — another burst of volatility is coming your way soon. The key is to embrace it, not try to erase it. There’s massive money to be made when prices are set by those who have to sell, or the margin clerks who take control — invariably, whenever there are more bargains than there are stars in the heavens.

IMPORTANT DISCLOSURES

This material has been distributed solely for informational and educational purposes only and is not a solicitation or an offer to buy any security or to participate in any trading strategy. All material presented is compiled from sources believed to be reliable, but accuracy, adequacy, or completeness cannot be guaranteed, and David Hay makes no representation as to its accuracy, adequacy, or completeness.

The information herein is based on David Hay’s beliefs, as well as certain assumptions regarding future events based on information available to David Hay on a formal and informal basis as of the date of this publication. The material may include projections or other forward-looking statements regarding future events, targets or expectations. Past performance is no guarantee of future results. There is no guarantee that any opinions, forecasts, projections, risk assumptions, or commentary discussed herein will be realized or that an investment strategy will be successful. Actual experience may not reflect all of these opinions, forecasts, projections, risk assumptions, or commentary.

David Hay shall have no responsibility for: (i) determining that any opinion, forecast, projection, risk assumption, or commentary discussed herein is suitable for any particular reader; (ii) monitoring whether any opinion, forecast, projection, risk assumption, or commentary discussed herein continues to be suitable for any reader; or (iii) tailoring any opinion, forecast, projection, risk assumption, or commentary discussed herein to any particular reader’s investment objectives, guidelines, or restrictions. Receipt of this material does not, by itself, imply that David Hay has an advisory agreement, oral or otherwise, with any reader.

David Hay serves on the Investment Committee in his capacity as Co-Chief Investment Officer of Evergreen Gavekal (“Evergreen”), registered with the Securities and Exchange Commission as an investment adviser under the Investment Advisers Act of 1940. The registration of Evergreen in no way implies a certain level of skill or expertise or that the SEC has endorsed the firm or David Hay. Investment decisions for Evergreen clients are made by the Evergreen Investment Committee. Please note that while David Hay co-manages the investment program on behalf of Evergreen clients, this publication is not affiliated with Evergreen and do not necessarily reflect the views of the Investment Committee. The information herein reflects the personal views of David Hay as a seasoned investor in the financial markets and any recommendations noted may be materially different than the investment strategies that Evergreen manages on behalf of, or recommends to, its clients.

Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this material, will be profitable, equal any corresponding indicated performance level(s), or be suitable for your portfolio. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Investors should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

20230627