Making Hay Monday – July 10th, 2023

Making Hay Monday

High-level macro-market insights, actionable economic forecasts, and plenty of friendly candor to give you a fighting chance in the day’s financial fray.

Charts of the Week

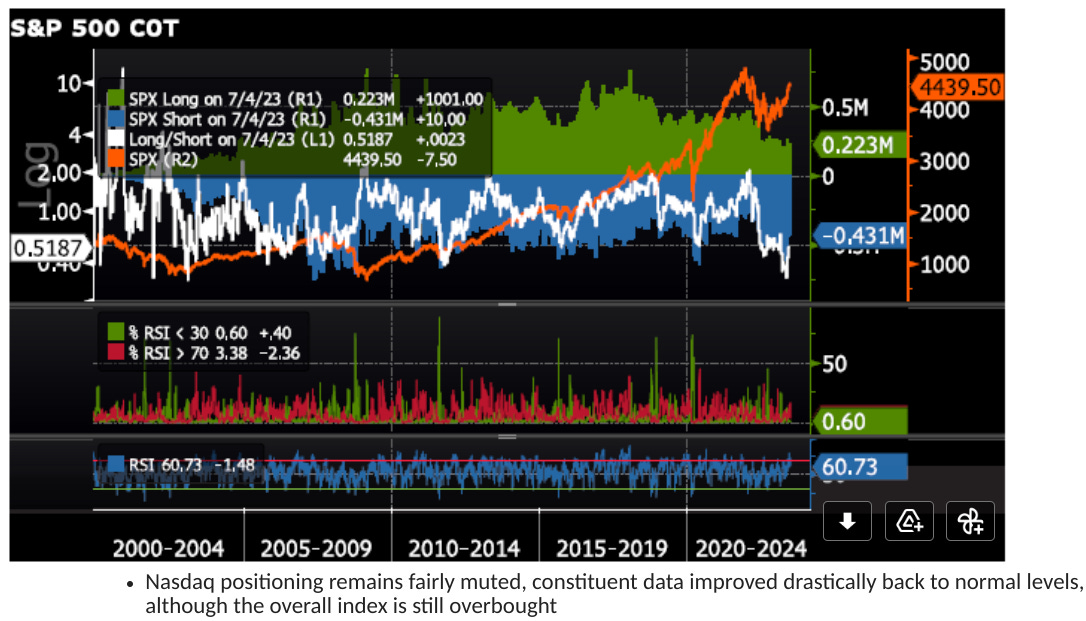

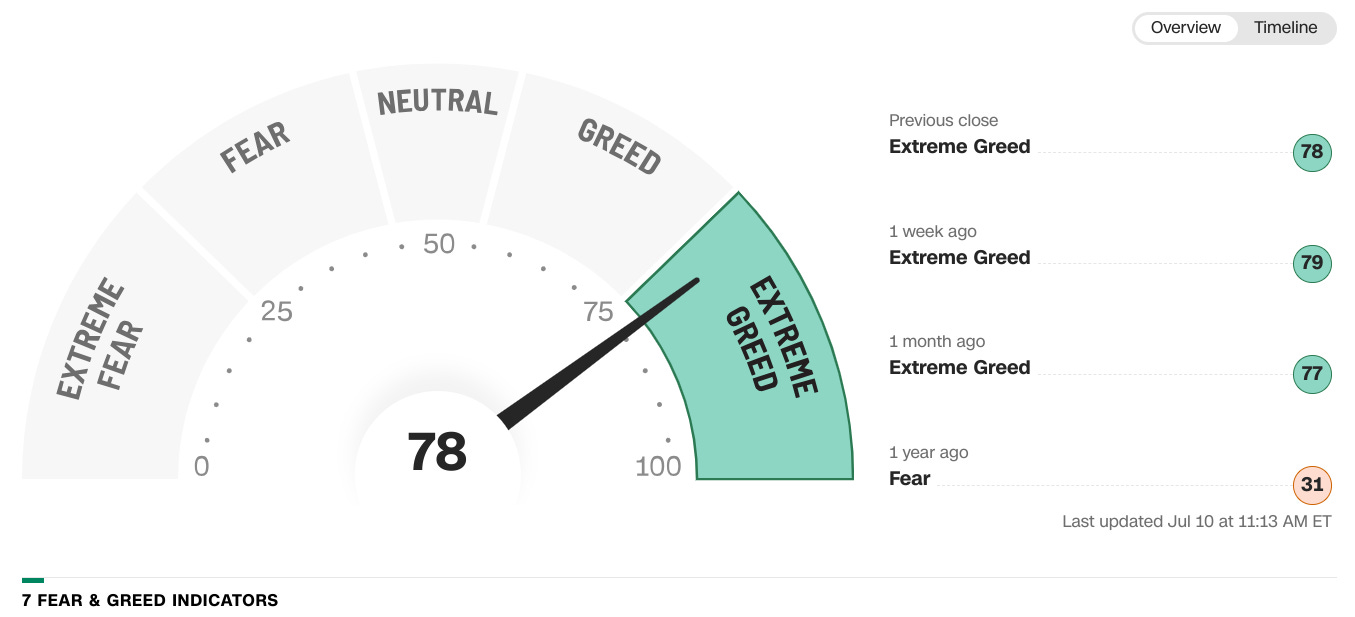

One thing I repeatedly read and hear from those bullishly inclined is that everyone is so bearish. That’s certainly a reasonable point when it comes to speculative positioning in the futures market where shorts are much bigger than longs. (COT stands for Commitment of Traders.) The net result is the white line you see below which does argue for a continuing rally. (When the line is low, this indicates bearish bets on the S&P futures contract are greater than bullish positions; this tends to coincide with rallies while high readings often precede corrections, though, as you can see, there are exceptions.) On the other hand, CNN’s “Fear and Greed Index” for the U.S. stock market remains in the Extreme Greed zone. As a result, it’s another muddled situation with facts to back up both bulls and bears. In an upcoming Haymaker edition, I plan to address this issue and what might be behind such divergent data.

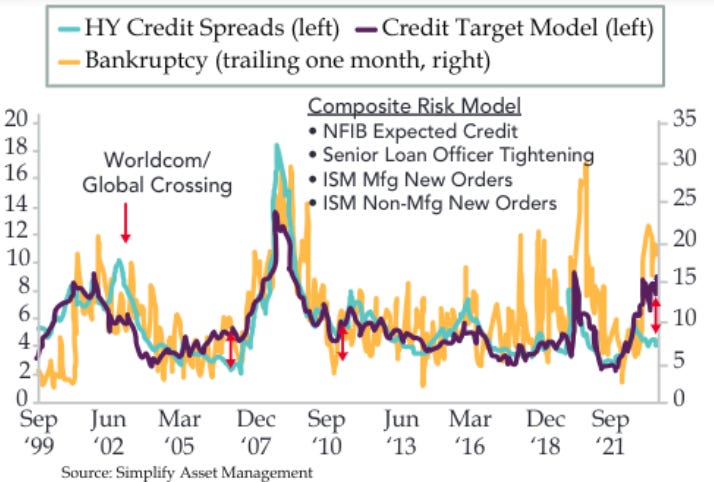

The below chart from my close friend Danielle DiMartino Booth is admittedly a bit on the busy side. But I’m going to simplify it for you. Speaking of “simplify”, the Composite Risk Model was created by Mike Green and his team at Simplify. As you will soon read, Mike figures prominently in this edition of Making Hay Monday. The purple line below of its related Credit Target Model is one of the keys from this visual. When it is high, the economy is under stress. You’ll notice that the purple line is near the highest of the last nearly quarter-century, with the exception of 2008’s Global Financial Crisis (which actually spilled over into 2009). It was around this level in 2002, when two of the largest corporate bankruptcies on record — Worldcom and Global Crossing (I’d also add Enron) — happened. This time we’ve already seen three of the largest bank failures in U.S. history. Yet, you’d never know that from another critical line, in green, shown below: credit spreads.

Veteran Haymaker readers know that credit spreads — the difference between what the government pays on its debt versus the prevailing interest rates on corporate bonds — is an extremely important financial factor. Spreads soared in 2022, which played a leading role in why it was such a nasty year for both stocks and corporate bonds. Fortunately, spreads have been narrowing since last fall and that has been a strong catalyst for the stock market rally (narrow as it has been). What’s clear is that it’s very unusual to have spreads at calm levels when the Credit Target Model is far more elevated. Spreads are also dissonant with corporate bankruptcies, which are obviously spiking, undoubtedly due in large part to the extreme rise by interest rates. One of my main concerns for the second half of this year is another pronounced spread-widening event. If so, the stock market is likely to pull back, potentially by quite a lot.

Borrower Alert: Unsafe to Float

“The Chinese use two brush strokes to write the word ‘crisis.’ One brush stroke stands for danger; the other for opportunity. In a crisis, be aware of the danger–but recognize the opportunity.” -John F. Kennedy

“It’s been coming for 11 months, well, guess what? I don’t think it is going to come.” -President Joe Biden

Among the tactics employed by Evergreen Gavekal (the firm of which I am co-Chief Investment Officer) to protect client bond portfolios last year against the Fed’s belated war on inflation was floating-rate debt. While many of these securities declined in value, they did provide rising income, unlike their fixed rate brethren. They also generally held up better than traditional bonds, at least those with long-term maturities. In addition, we used copious amounts of short-term debt to insulate our clients against what we felt would be much higher rates than the consensus was expecting… or the Fed was projecting.

To learn more about Evergreen Gavekal, where the Haymaker himself serves as Co-CIO, click below.

Although being a holder of adjustable-rate debt is pleasant when the cost of money is rising at the fastest clip in 40 years, it’s not much fun to be on the other side. The reality is that floating-rate bonds are infrequently used by retail investors, but in the institutional world it’s a very different story. This is particularly true in the realms of private credit and commercial real estate. Adjustable-rate lending is the norm with the former and fairly common with the latter.

These are far from niche lending areas. There is a total of almost $3 trillion of leveraged loans and the closely related private credit. Both of these are part of the oft-discussed Shadow Banking System. This is the province of the big players, like Blackstone and Ares, but a plethora of smaller entities have also entered this space. The growth in this field has been explosive due to how long the Fed suppressed rates, creating an acute need for cash flow in what used to be the 5% range. Due to the previously mentioned rate surge, the going rate for private credit loans is more like 10% to 12%.

Again, this is great news for the lenders, but for the borrowers it’s more than a tad problematic. In fact, for many, it might be downright fatal. Many leveraged companies were barely able to cover the debt service at 5%. Paying rates north of 10% is, in many cases, simply impossible.

If you are wondering if there is evidence that it’s truly this serious, I would point you toward statistics showing bankruptcies soaring to the highest rate since 2010. That would be when the economy was in the early stages of recovering from the worst economic contraction since the 1930s.

Per one of the financial industry’s most astute observers, Jim Grant, 37% of non-financial U.S. firms are already in distress. This is compared to a bit over 20% during the pandemic and is essentially back to where it was during the Great Recession. (Jim was relying on a June 23rd research paper by two staff analysts from the Fed.) The probability that most of the damage from the interest-rate eruption lies ahead renders this statistic even more alarming. The study’s authors went on to state (emphasis mine):

Our estimates suggest that the recent policy tightening is likely to have effects on investment, employment and aggregate activity that are stronger than in most tightening episodes since the late 1970s” and “that these effects might be most noticeable in late 2023 and 2024.

You may notice that their conclusion flies in the face of the consensus perception of a soft landing or, even, per Jim Cramer and Joe Biden, no landing. Their work also indicates the jobs market is at-risk. As we all know, that’s been the Energizer Bunny of the post-pandemic expansion. Additionally, there have been a lot of serious tightening episodes since the 1970s, making their observation particularly noteworthy.

Of course, they could be wrong, but I doubt it, in no small part due to the escalating pain being felt by highly leveraged companies. In addition to the $3 trillion of private credit and leveraged loans described above, there is another $1.7 trillion of junk bonds outstanding. Fortunately, most of the latter is fixed-rate and doesn’t start maturing en masse until next year. However, the bulk of the $3 trillion is floating. Per Jeffries’ Christopher Wood, author of Greed and Fear, one of my regular weekly reads, interest cost at the median private equity-backed company jumped to 43% of gross cash flow last year. That is six times as much as the median S&P 500 company, per Chris. Please realize that was in 2022 when rates averaged well below where they are currently. He also added that rates on the largest U.S. leveraged loans are now 10% versus 3.9% at the end of 2021.

Over the 4th of July break, I listened to an episode of my friend Adam Taggart’s show Wealthion in which he hosted Simplify’s wicked-smart Mike Green. As some of you know, I was on Adam’s show a week before Mike. Adam had informed me he was up next, which I have to admit was intimidating. In addition to his manifest brainpower, Mike is also articulate enough to make me more than a little envious. (Yes, I realize I shouldn’t admit that, but it’s the truth.) The subject of Corporate America’s dangerous exposure to higher rates was one of their main topics.

We’ve attached a link to that podcast at the end of this note. If you listen to minutes 10 through 15, you’ll hear Adam’s shock at a number Mike put forth. This pertained to the percentage of junk-rated companies that would be cash-flow positive if they were forced to refinance at current rates. The jaw-dropper was that it is a miniscule 7% in his estimation, down from 85% based on 2021’s borrowing rates.

Please realize this won’t happen right away, but next year and 2025 are different stories. As Mike also observed, it’s extremely risky for companies to wait until the last minute to refinance. It’s plausible that many of them with debt coming due next year should be prepping for a re-fi later this year. Regardless, the almost $3 trillion of leveraged loans and private credit debt is experiencing an immediate and excruciating cost of capital spike.

As Mike said several times in conversation with Adam, credit markets embed their own catalysts, unlike the stock market. His point is that stocks don’t mature but bonds do and, further, interest payments need to be made. If the bonds can’t be rolled over at an affordable rate or cash flow is inadequate to service the debt, it’s default time. This is a growing likelihood at yields running as high as 12% in the secondary market for private credit.

Though Mike didn’t mention it, CCC-rated junk bonds, toward the lowest credit quality rung, are presently yielding about 14%. It’s improbable the majority of them can handle that type of financing cost. Consequently, investors should brace themselves for a wave of defaults and restructurings. This is also negative for employment as companies fighting for their lives have an unfortunate tendency to fire workers.

There is also another $2.3 trillion of commercial real estate debt. According to the Mortgage Bankers Association, half of that is floating. Additionally, $1.5 trillion comes due between now and the end of 2025. Thus, there isn’t just a “maturity wall” in the junk bond market but with commercial real estate, as well. Small- and mid-sized banks hold 70% of commercial real estate loans. That’s another reason I don’t believe we’ve heard the last of this Spring’s banking crisis. According to Scott Rechler, CEO of a leading real estate firm and also NY Federal Reserve board member, 500 to 1,000 smaller banks are at risk of insolvency or consolidation (the latter is unlikely to be a desired outcome, either).

As Bloomberg Businessweek wrote in a June 26th article titled The End of Extend and Pretend:

One risk is that banks tring to cut their real estate exposure will have to offload their loans at significant discounts—even if the loans are not in trouble, they were made when rates were low, so a buyer wouldn’t touch them without a discount. This could initiate a vicious cycle in which banks mark down the value of their loans and investors punish them for it, putting the banks under even more pressure.

Adding to the risks, 88% of Commercial Mortgage-Backed Securities (CMBS) are interest only, up from just 18% in 2010. That puts the banks that hold buildings as collateral even more in jeopardy due to the lack of an equity buffer that accrues over time as a result of principal paydowns. Even if they hold direct real estate loans vs CMBS, should defaults become widespread, all lenders suffer.

The first part of the banking crisis was caused by banks getting clobbered on government securities that had plummeted in value thanks to much higher interest rates. In my view, the next phase of the latest banking fiasco will be the credit losses they incur from both their real estate and business loan books. The reality that the SLOOS — Senior Loan Officer Opinion Survey, which tracks bank lending conditions — is already at recession-type levels is not encouraging.

Yet, a NASDAQ that has been in hyperdrive has blinded investors to these very real threats to the economy and their own financial wellbeing. They are being seduced by a handful of stocks, that we all can easily name, which have exploded this year. As Mike Green points out in the previously mentioned Wealthion episode, consumer confidence seems to be a direct result of the stock market these days. (He also describes the near-impossibility for professional money managers to keep up with such a narrow market due to diversification mandates. Index-type funds have exemptions to these rules, which is why I think another bloodbath, like 2000 to 2003, is coming for these vehicles that have crowded into names such as Nvidia. When this tide goes out, it will be like right before a tsunami is poised to hit the beach.)

These days, the CNBC crowd is crowing about how wrong those of us who see recession risks rising have been, ignoring that there is already an earnings and industrial recession underway. Moreover, Gross Domestic Income (GDI) is also in recession.

In my opinion, they’ll be eating some serious crow before long, unfortunately for the economy and the stock market. (I’d much rather root for good times but, in my position, I need to be realistic.) They seem totally oblivious to the impending disaster that both the U.S. government and Corporate America are facing in being able to finance themselves at affordable interest rates. As I’ve written in past Haymaker editions, the Treasury needs to come up with almost $2 trillion of new money, when it also has several trillion of maturing debt between now and year’s end ($6.7 trillion of old bonds mature in this fiscal year). This is happening at a time when the Fed is selling $60 billion/month, or over $700 billion/year, instead of their much more familiar buying of government IOUs.

If all this sounds to you like the makings of a continuing bear market rally, I admire your optimism but question your judgement. Yet, if Mike Green and I are wrong — not to mention Jeremy Grantham, Stan Druckenmiller and Mike Wilson — the odds are you’ll be much better off in the beaten-down value stocks than in priced-beyond-perfection mega-cap tech names.

Mike Green on Wealthion

https://www.youtube-nocookie.com/embed/0vkGjSybTLg?rel=0&autoplay=0&showinfo=0&enablejsapi=0

IMPORTANT DISCLOSURES

This material has been distributed solely for informational and educational purposes only and is not a solicitation or an offer to buy any security or to participate in any trading strategy. All material presented is compiled from sources believed to be reliable, but accuracy, adequacy, or completeness cannot be guaranteed, and David Hay makes no representation as to its accuracy, adequacy, or completeness.

The information herein is based on David Hay’s beliefs, as well as certain assumptions regarding future events based on information available to David Hay on a formal and informal basis as of the date of this publication. The material may include projections or other forward-looking statements regarding future events, targets or expectations. Past performance is no guarantee of future results. There is no guarantee that any opinions, forecasts, projections, risk assumptions, or commentary discussed herein will be realized or that an investment strategy will be successful. Actual experience may not reflect all of these opinions, forecasts, projections, risk assumptions, or commentary.

David Hay shall have no responsibility for: (i) determining that any opinion, forecast, projection, risk assumption, or commentary discussed herein is suitable for any particular reader; (ii) monitoring whether any opinion, forecast, projection, risk assumption, or commentary discussed herein continues to be suitable for any reader; or (iii) tailoring any opinion, forecast, projection, risk assumption, or commentary discussed herein to any particular reader’s investment objectives, guidelines, or restrictions. Receipt of this material does not, by itself, imply that David Hay has an advisory agreement, oral or otherwise, with any reader.

David Hay serves on the Investment Committee in his capacity as Co-Chief Investment Officer of Evergreen Gavekal (“Evergreen”), registered with the Securities and Exchange Commission as an investment adviser under the Investment Advisers Act of 1940. The registration of Evergreen in no way implies a certain level of skill or expertise or that the SEC has endorsed the firm or David Hay. Investment decisions for Evergreen clients are made by the Evergreen Investment Committee. Please note that while David Hay co-manages the investment program on behalf of Evergreen clients, this publication is not affiliated with Evergreen and do not necessarily reflect the views of the Investment Committee. The information herein reflects the personal views of David Hay as a seasoned investor in the financial markets and any recommendations noted may be materially different than the investment strategies that Evergreen manages on behalf of, or recommends to, its clients.

Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this material, will be profitable, equal any corresponding indicated performance level(s), or be suitable for your portfolio. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Investors should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

20230711