Making Hay Monday – December 4th, 2023

Making Hay Monday

High-level macro-market insights, actionable economic forecasts, and plenty of friendly candor to give you a fighting chance in the day’s financial fray.

Charts of the Week

Prior Haymakers have contended that during periods of economic transition — like from expansion to contraction or vice versa — it’s more important to pay more attention to the revisions to the all-important jobs’ numbers. This is in no small part because the Bureau of Labor Statistics’ (BLS) birth-death model continues to show business formations, the usual pattern, even as a slowing economy causes business closures to surge (or the opposite during the early stages of a recovery). The former is precisely what’s been happening this year. The ultimate reveal in this regard is the fact that the BLS has revised Nonfarm Payrolls down every month so far in 2023. Yet, this gets almost no media coverage. In my view, that’s a huge mistake.

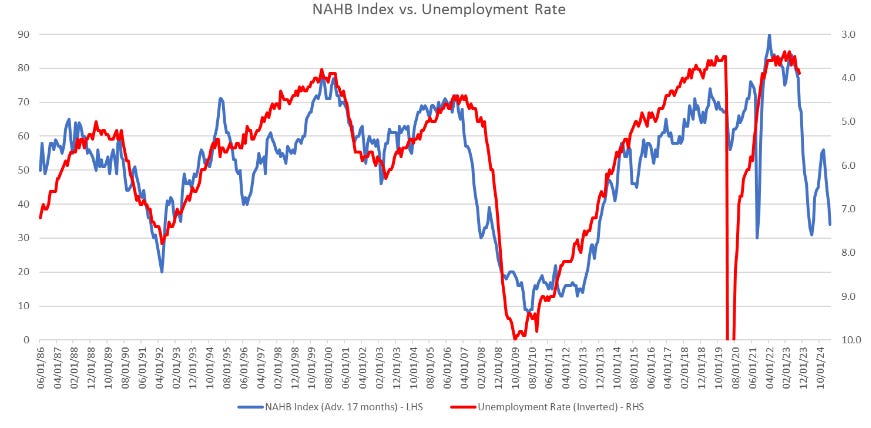

Along similar lines, my friend Jim Colquitt, author of a nifty (and, for now, free) weekly chart review on Substack, ran the below relevant visual recently. In Jim’s words, the National Association of Homebuilders (NAHB) Index is:

… based on a monthly survey of NAHB members designed to take the pulse of the single-family housing market. The survey asks respondents to rate market conditions for the sale of new homes at the present time and in the next six months as well as the traffic of prospective buyers of new homes.

Jim then overlays the unemployment (UE) rate, comparing the two back to the mid-1980s. (Note, the UE rate is inverted; thus, a falling red line means rising joblessness.) This is compelling evidence that the already eroding jobs’ market is likely on the verge of a precipitous decline. All soft-landing believers should take note of this… and the alarming trend in BLS revisions.

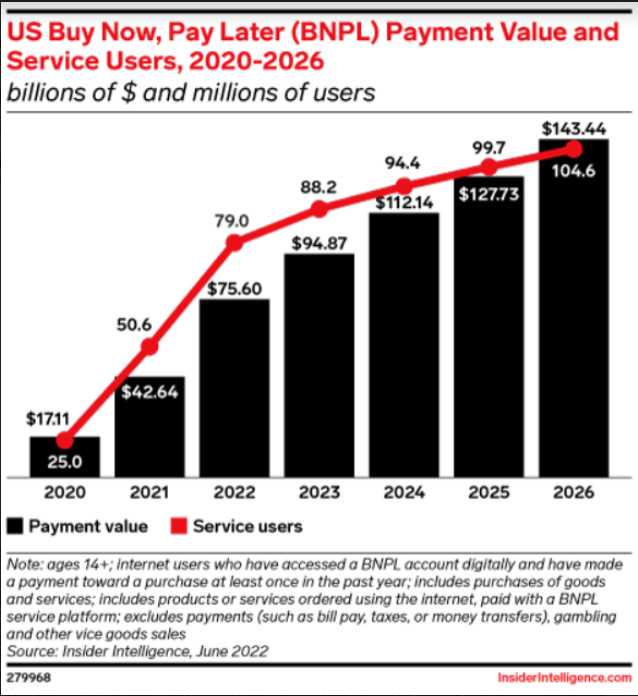

So-called “Buy Now, Pay Later” (BNPL) programs have been surging in popularity this year. Adobe reported last week that usage of BNPL has vaulted by 42.5% compared to 2022. There are reports of consumers using these to make installment payments on items costing as little as $24. Accordingly, the following visual (which we also shared last week and for our webinar attendees) is not entirely tongue-in-cheek.

As with soaring credit card debt — now pushing $1.1 trillion with 20%-plus interest rates — this may be a sign U.S. households are increasingly struggling to maintain their spending levels. And, just like with revolving debt, the piper must eventually be paid with BNPL. Consequently, before long this instant gratification technique may soon be known as “Buy Now, Pain Later”.

Evergreen Compatibility Survey

Double Bubble

Periodically, I come across a missive that so clearly and succinctly describes the big picture that I feel like my efforts to do the same are mere clumsy ramblings. That happened to me last week when I read Michael Lewitt’s The War for Civilization.

Michael is the founder and author of The Credit Strategist. It is one of my many must-reads and I usually check it out as soon as it hits my inbox. As I’ve previously and repeatedly conveyed, I feel that identifying and highlighting particularly interesting articles is among the most important services I provide Haymaker subscribers.

In this case, the contrast between the hard truths that Michael outlines below and the constant stream of euphoric commentary that is dominating the financial media these days is chasmic. It echoes my quip from back in the summer, before the late July correction began, that “there’s reality and then there’s the stock market”.

With the wide array of existential challenges that Michael outlines, it’s truly incredible that many legitimate experts, like legendary mania debunker Jeremy Grantham, are warning of a bubble in stock prices. To me, this one isn’t nearly as extreme as was the case in 2021 during what I, and others, have called “peak insanity”. The carnage since then in meme stocks, most cryptos, NFTs*, SPAC*s, and profitless tech shares, has been spectacular. While I haven’t seen an estimate of the total damages, it has to be in the many trillions.

Despite that, per another pal, Fred Hickey, the stock market is trading at a price-to-sales ratio (in my mind, a more accurate valuation metric than the P/E ratio), 10% above where it was at the peak of the late ‘90s monster tech bubble. Yet, mega-cap tech stars like Microsoft and Google/Alphabet don’t look outrageously pricey. After its recent swoon, AI superstar Nvidia seems almost (note the “almost”) like a bargain at an undemanding 22 times next year’s estimated earnings (for the fiscal year, starting in February). This assumes its profits continue to grow, no mean feat after such a stupendous earnings explosion in 2023.

However, there is abundant evidence of rampant speculative behavior. The action in parts of the wonderful world of crypto is one example. Certain meme stocks are once again also rallying hard. Tesla, the most speculative of the Magnificent Seven, continues to trade at full-on bubble valuations, despite the wicked bear market that has struck almost all green-energy members and the growing awareness of the EV industry’s travails.

But beyond the debate about bubble-like valuations, there is almost no doubt the stock market is presently in a bubble of a different kind. This one is akin to living in a gated community surrounded by escalating violence and social disintegration. It’s great, unless you have to venture outside… or the walls no longer keep out the chaos.

The mere fact that Wall Street analysts are projecting double-digit earnings growth next year, despite the escalating recession warnings, is worrisome enough. But the bond market’s cavalier assumptions that the government can effortlessly raise and refinance five trillion — or, likely, more — in 2024 at reasonable interest rates may be more worrisome. There is simply a plethora of evidence that financial markets are fully in the grips of a reality-distortion field right now. As pleasant as it is to savor our recent gains, the ice is getting thinner by the day (unless you live in Northern Europe which is in the midst of a severe pre-winter freeze).

Admittedly, this is the time of the year when good tidings seem to naturally flow. The market’s laser focus on easing inflation and the potential for Fed rate cuts is a salient example of that yearning to accentuate the positive, particularly during the Holiday Season. Yet, ignoring the very real threats that Michael articulates is likely to be an expensive exercise in obliviousness.

As he writes toward the end:

Formulating a successful investment strategy in the coming years requires an understanding of global trends. While it will certainly be worthwhile to study and form opinions on individual investments, macroeconomic forces will continue to be the primary driver of investment returns because of how markets are currently dominated by passive strategies and momentum trading.

In other words, the no-think crowd is in control. Most worrisome, it’s at a time when thinking, including recognizing reality, is of paramount importance. No Haymaker reader should be unaware of the gravity of the situation, despite the giddiness on display on CNBC nearly every day.

If you find Michael’s analysis to be as valuable as I do, his newsletter costs just a bit more than $1/day. Unlike myriad stocks, that’s a true bargain! It might be an ideal Holiday gift for a relative or friend you’d like to help understand the tumultuous economic and financial landscape. Like with the Haymaker and Jim Colquitt, you can find his work on Substack.

Immediately after Michael’s essay, our paid subscribers will see Louis Gave’s note. As a refresher, it provides you with more reasons to be bullish on Brazilian bonds. Much of his rationale also applies to emerging market debt in general. Be alert for a pullback in the funds that invest in it during the next market reality-check. You shouldn’t have to wait too long!

The War for Civilization

The Credit Strategist, Michael Lewitt

The world is currently driven by two broad trends as it emerges from the post-Great Financial Crisis ZIRP/QE regime: (i) sustained higher inflation due to extremely high global debt levels, and (ii) erosion of the post-Second World War global order. Management of these forces poses the greatest test facing American leaders in decades; their shortcomings in meeting them are increasingly apparent. Investors must understand the world as it is, not as Wall Street and the financial media would portray it. As such, they need to acknowledge the following realities:

· While there remains abundant liquidity from pandemic stimulus in the system, this liquidity is abating. That unprecedented liquidity infusion left behind much higher prices that will rise more slowly but remain much higher than before the pandemic.

· Governments are expected to spend a net $2 trillion on interest on their debts in 2023, up more than 10% from 2022 according to the International Monetary Fund and Fitch Ratings. By 2027 that figure could exceed $3 trillion according to research firm Teal Insights. Increasing interest costs will face governments with increasingly difficult spending choices.

· The levels of global debt are so high that there is no reasonable prospect that they can ever be repaid in constant dollars. The only way to deal with these obligations is by default, inflation or currency debasement (the latter two are two sides of the same coin). Western economies are effectively insolvent if the present value of their long-term entitlement obligations are added to their balance sheets (and likely even before those obligations are included) and their banking systems are also insolvent on a mark-to-market basis due to their holdings of bonds trading at steep discounts. But the problem is not limited to the West. China’s debt problems are severe as reflected in its failing real estate sector. One of the tragedies of countries increasing defense spending to pursue hegemonic goals is the diversion of economic resources away from growth and other life-affirming activities, yet this trend will only accelerate.

· Valuations of financial assets remain near record levels and far beyond the ability of these assets to generate sufficient income to justify their trading levels. Virtually all of them were priced during a period of negative or zero interest rates which are unlikely to return absent a severe financial crisis which will seriously impair asset values. Private asset prices have yet to be marked-to-market by many funds in the hope they will return to bubble levels. Very few of them will do so and those that do will eventually collapse in value all over again.

· Corporate and real estate borrowers are wrestling with higher interest rates that are impairing the value of their assets and potentially leading the highly leveraged private sector toward a debt-deflationary bust. The longer the benchmark interest rate stays at its current level of 5.25-5.5%, the odds of such an outcome rise uncomfortably. Even if that rate drops by 100 basis points, it leaves financial assets at risk of significant further losses.

· Heavily over-indebted governments are incurring unsustainable deficits that are diverting increasing percentages of their budgets to servicing their debts rather than funding entitlements, military spending, climate change, and other priorities. And funding growth is an increasingly unlikely possibility. But rather than take responsible action to address a problem that can only be called a crisis, governments are ducking the issue and making it worse. Debt, which grows exponentially rather than in a straight line, isn’t going to sit and wait politely while politicians fight about nonsense. It is going to wrap its iron grip around their throats and squeeze the life out of them and the people they are supposed to serve. It’s starting to do that already.

· Further hurting global economic growth is poor demographics in the West, even worse demographics in China and Russia and Japan, the continuing energy transition (driven by green policies distorted by ideology rather than based on science), ongoing struggles between labor and management, and rising compliance costs to meet unproductive and politically-driven agendas in Western pseudo-democracies.

· Many industries are experiencing seminal changes that are altering their business models and hurting their profitability – media and entertainment, transportation (especially automobiles), finance, shipping, and energy. Change is accelerating against a background of monetary, fiscal and geopolitical turmoil that seems beyond the capability of governments to manage effectively.

· In contrast to these troubled industries, the global defense industry is likely to flourish as violence and war spreads.

· Growing doubts about monetary and fiscal policies will encourage de-dollarization efforts (perhaps better understood as a general movement away from fiat currencies and not just the dollar into hard assets, commodities and cryptocurrencies) flights of businesses from heavily regulated jurisdictions, increasing concentration of industry and finance in the West, and rising political division and violence as nationalism and nativism spike and globalization reverses.

Formulating a successful investment strategy in the coming years requires an understanding of these global trends. While it will certainly be worthwhile to study and form opinions on individual investments, macroeconomic forces will continue to be the primary driver of investment returns because of how markets are currently dominated by passive strategies and momentum trading. In the end, financial outcomes will be largely driven by politics and policy rather than pure market fundamentals which requires investors to be focused on macro as well as microeconomic and company-specific factors.

Subscribe to Haymaker to read the rest.

Become a paying subscriber of Haymaker to get access to this post and other subscriber-only content.

A subscription gets you:

| Subscriber-only posts and full archive | |

| Post comments and join the community |

IMPORTANT DISCLOSURES

This material has been distributed solely for informational and educational purposes only and is not a solicitation or an offer to buy any security or to participate in any trading strategy. All material presented is compiled from sources believed to be reliable, but accuracy, adequacy, or completeness cannot be guaranteed, and David Hay makes no representation as to its accuracy, adequacy, or completeness.

The information herein is based on David Hay’s beliefs, as well as certain assumptions regarding future events based on information available to David Hay on a formal and informal basis as of the date of this publication. The material may include projections or other forward-looking statements regarding future events, targets or expectations. Past performance is no guarantee of future results. There is no guarantee that any opinions, forecasts, projections, risk assumptions, or commentary discussed herein will be realized or that an investment strategy will be successful. Actual experience may not reflect all of these opinions, forecasts, projections, risk assumptions, or commentary.

David Hay shall have no responsibility for: (i) determining that any opinion, forecast, projection, risk assumption, or commentary discussed herein is suitable for any particular reader; (ii) monitoring whether any opinion, forecast, projection, risk assumption, or commentary discussed herein continues to be suitable for any reader; or (iii) tailoring any opinion, forecast, projection, risk assumption, or commentary discussed herein to any particular reader’s investment objectives, guidelines, or restrictions. Receipt of this material does not, by itself, imply that David Hay has an advisory agreement, oral or otherwise, with any reader.

David Hay serves on the Investment Committee in his capacity as Co-Chief Investment Officer of Evergreen Gavekal (“Evergreen”), registered with the Securities and Exchange Commission as an investment adviser under the Investment Advisers Act of 1940. The registration of Evergreen in no way implies a certain level of skill or expertise or that the SEC has endorsed the firm or David Hay. Investment decisions for Evergreen clients are made by the Evergreen Investment Committee. Please note that while David Hay co-manages the investment program on behalf of Evergreen clients, this publication is not affiliated with Evergreen and do not necessarily reflect the views of the Investment Committee. The information herein reflects the personal views of David Hay as a seasoned investor in the financial markets and any recommendations noted may be materially different than the investment strategies that Evergreen manages on behalf of, or recommends to, its clients.

Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this material, will be profitable, equal any corresponding indicated performance level(s), or be suitable for your portfolio. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Investors should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

20231205