Making Hay Monday – August 28th, 2023

Making Hay Monday

High-level macro-market insights, actionable economic forecasts, and plenty of friendly candor to give you a fighting chance in the day’s financial fray.

Hello, Haymaker Subscribers:

Today we have a double-serving of MHM content for you (along with our usual Charts of the Week). Last week, I was happy to re-join my friend David Lin on his growing YouTube channel for a little over a half-hour of conversation. David has been a great friend to me and to the Haymaker project since my appearance on his previous show at Kitco News. Since then, I’ve made several appearances on The David Lin Report, inclusive of the one we’ve linked a little ways down the page. In the latest David Squared entry, we cover my current takes on some familiar Haymaker topics, including energy prices, some of the conflicting realities of the home-building industry and residential real estate prices, how to understand money velocity in relation to economic health, and (everyone’s big question) what’s going on with the popular “soft landing” thesis. David has provided timestamps on the video page, so if time is short, jump ahead to any sections that particularly interest you.

https://www.youtube-nocookie.com/embed/k_vyfXIudp8?rel=0&autoplay=0&showinfo=0&enablejsapi=0

Charts of the Week

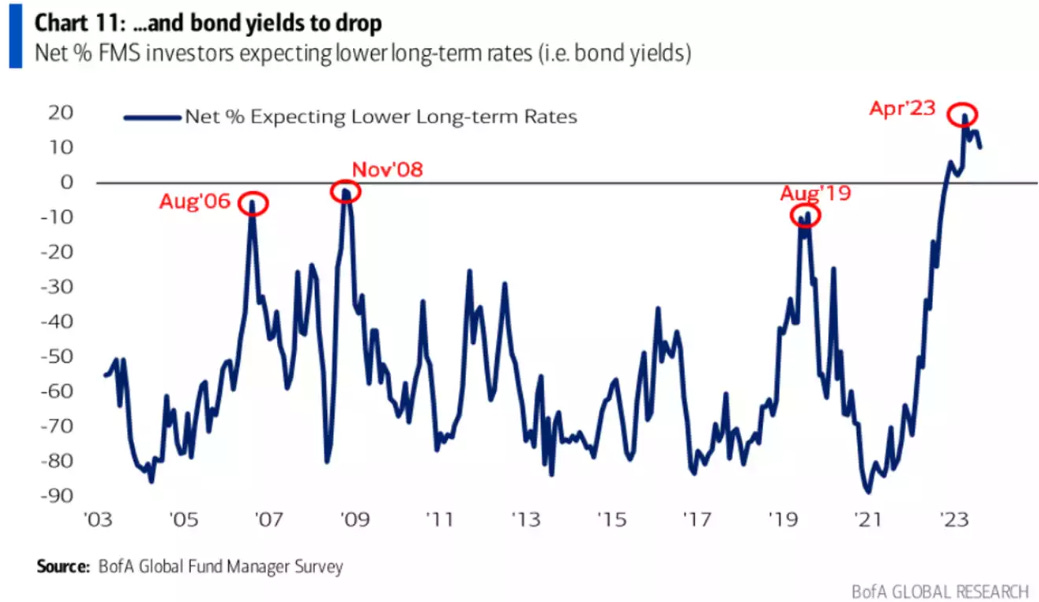

Despite the widespread belief that there is an enormous short position on long-term Treasury bonds, reflecting intense bearishness, the reality may be the polar opposite. The above image displaying the BofA Global Fund Manager Survey (FMS) strongly suggests large institutional investors in long maturity Treasurys are, in reality, nearly as bullish as they have ever been over the last two decades. In fact, the only time they were more optimistic on long-term U.S. government debt was this past spring. That was likely a result of the flight-to-safety shift back then due to the nearly overnight collapse of three big U.S. banks.

One of the most troubling facts for those who believe we’ve entered a new bull market is the puny rally by small cap stocks since last October’s trough. Per previous Haymaker notes, a year into a renewed bull phase small caps have typically ripped higher by 74%. There’s still time but not much. The visual above, from the astute folks at Stack Financial Management, drives home how deficient has been this bounce by small cap stocks. At the 10-month mark, there’s never been anything close to the pathetic pace of this recovery in the index that usually leads new bull markets.

IMPORTANT DISCLOSURES

This material has been distributed solely for informational and educational purposes only and is not a solicitation or an offer to buy any security or to participate in any trading strategy. All material presented is compiled from sources believed to be reliable, but accuracy, adequacy, or completeness cannot be guaranteed, and David Hay makes no representation as to its accuracy, adequacy, or completeness.

The information herein is based on David Hay’s beliefs, as well as certain assumptions regarding future events based on information available to David Hay on a formal and informal basis as of the date of this publication. The material may include projections or other forward-looking statements regarding future events, targets or expectations. Past performance is no guarantee of future results. There is no guarantee that any opinions, forecasts, projections, risk assumptions, or commentary discussed herein will be realized or that an investment strategy will be successful. Actual experience may not reflect all of these opinions, forecasts, projections, risk assumptions, or commentary.

David Hay shall have no responsibility for: (i) determining that any opinion, forecast, projection, risk assumption, or commentary discussed herein is suitable for any particular reader; (ii) monitoring whether any opinion, forecast, projection, risk assumption, or commentary discussed herein continues to be suitable for any reader; or (iii) tailoring any opinion, forecast, projection, risk assumption, or commentary discussed herein to any particular reader’s investment objectives, guidelines, or restrictions. Receipt of this material does not, by itself, imply that David Hay has an advisory agreement, oral or otherwise, with any reader.

David Hay serves on the Investment Committee in his capacity as Co-Chief Investment Officer of Evergreen Gavekal (“Evergreen”), registered with the Securities and Exchange Commission as an investment adviser under the Investment Advisers Act of 1940. The registration of Evergreen in no way implies a certain level of skill or expertise or that the SEC has endorsed the firm or David Hay. Investment decisions for Evergreen clients are made by the Evergreen Investment Committee. Please note that while David Hay co-manages the investment program on behalf of Evergreen clients, this publication is not affiliated with Evergreen and do not necessarily reflect the views of the Investment Committee. The information herein reflects the personal views of David Hay as a seasoned investor in the financial markets and any recommendations noted may be materially different than the investment strategies that Evergreen manages on behalf of, or recommends to, its clients.

Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this material, will be profitable, equal any corresponding indicated performance level(s), or be suitable for your portfolio. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Investors should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

20230829