Making Hay Monday – April 22nd, 2024

Making Hay Monday

High-level macro-market insights, actionable economic forecasts, and plenty of friendly candor to give you a fighting chance in the day’s financial fray.

“Over the past decade, three fields have been responsible for nearly all US natural gas supply growth: the Marcellus, Permian, and Haynesville… After such prolific growth, most analysts seem to believe these fields will grow forever. We disagree. Instead, our models suggest US production will experience unanticipated declines over the next several years.” -From the highly regarded natural resource asset management and research firm, Goehring & Rozencwajg, April 4th, 2024

Charts of the Week

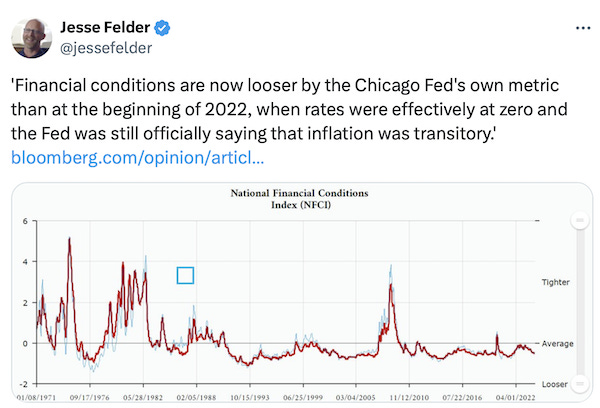

Despite the Fed’s 500 basis points (5%) of rate hikes and trillions of quantitative tightening (the opposite of QE, quantitative easing) financial conditions are exceptionally easy. Much of that is due to the contraction of credit spreads, the yield gap between government and corporate bonds, to near-record tight levels. (The buoyant stock market, at least until recently, has also served to offset the Fed’s tightening.) As I’ve often observed, credit spreads have a profound impact on financial conditions. When they narrow, stocks and corporate bonds perform well — often, extraordinarily well. When they materially widen, corrections are the norm. When they blow out dramatically, bear markets usually ensue, as in 2008, 2020, and 2022. The Fed does seem to realize the criticality of keeping spreads from approaching the danger zone. For now, though, narrow spreads are working against its mission to constrict financial conditions and dampen resurgent inflation.

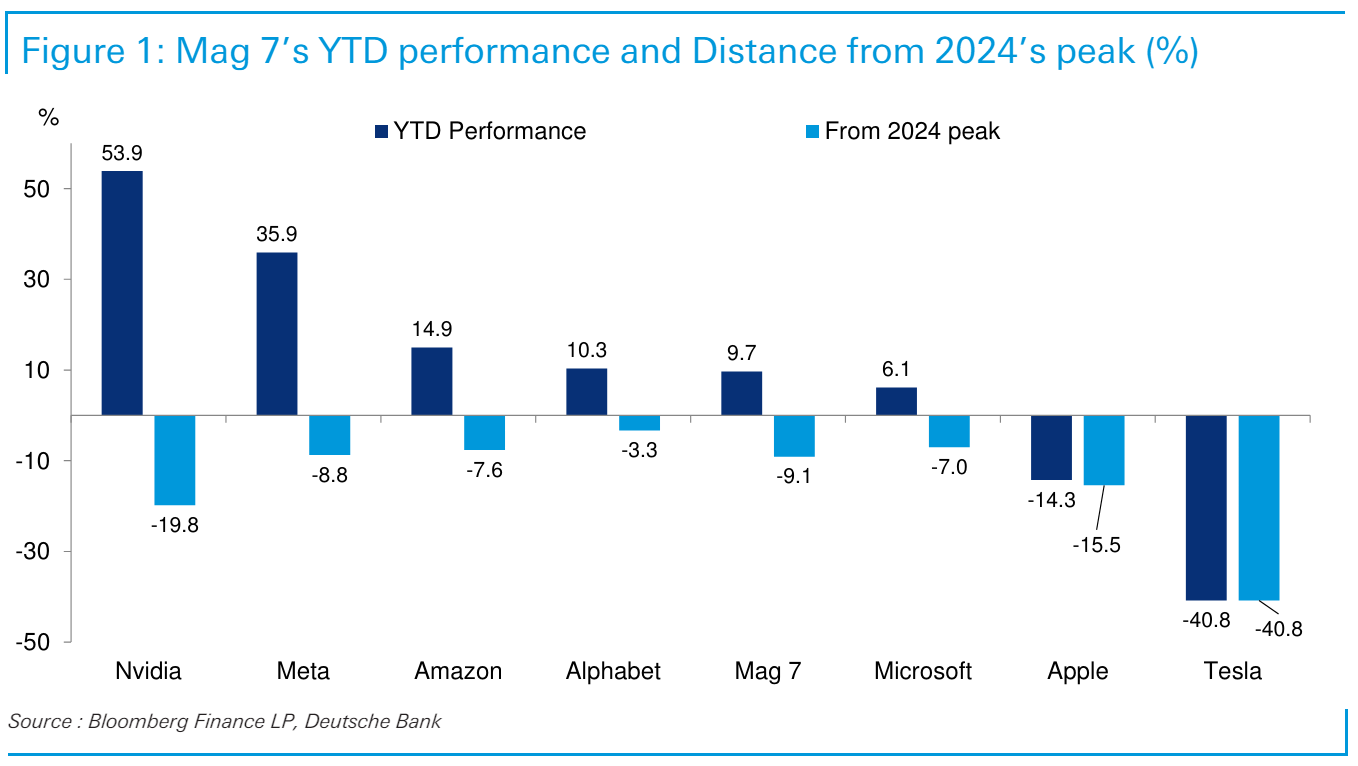

Lately, the Magnificent Seven have behaved much less magnificently. As you can see above, even this year’s best performers have been correcting recently. The world’s largest EV producer has been particularly pounded. But even mighty Apple has shed approximately $450 billion of market value this year, a truly staggering sum. In fact, it is roughly equivalent to the total capitalization of United Healthcare, America’s 10th largest company by market value. As a result, the NASDAQ 100, which is heavily represented by the Magnificent Seven, is now up a mere 3.8% thus far in 2024.

Evergreen Compatibility Survey

Royalties Rule

Shutterstock

Champions

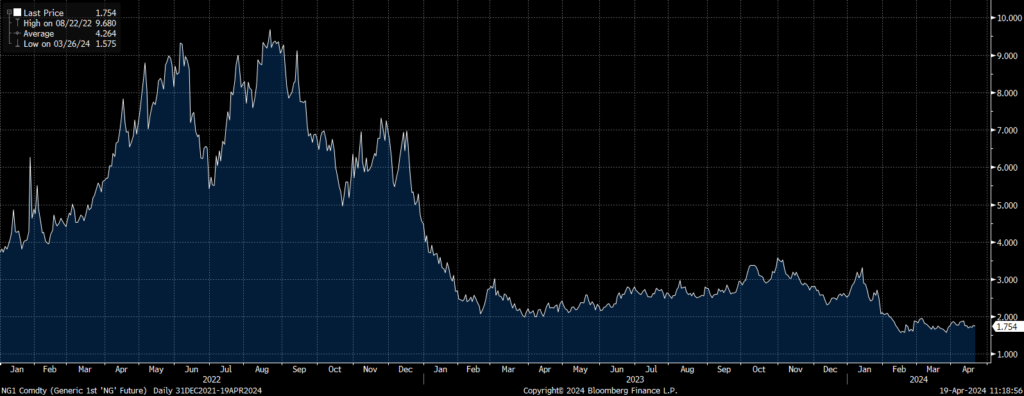

Calling all contrarians! Going back to 2022, there aren’t many price charts that look as sick as this one does.

Natural Gas

Bloomberg

This isn’t a stock chart but, rather, it displays the pummeling natural gas has experienced since the immediate aftermath of the invasion of Ukraine. That’s when U.S. natural gas prices briefly hit $10 per million British Thermal Units (mmBTUs). Over in Europe, prices truly did a moonshot, slightly exceeding $90 in the summer of 2022.

Bloomberg

It’s safe to say nat gas has been my worst commodity highlight since we launched our Haymaker publication. (As many of you know, prior to that my newsletter was called the Evergreen Virtual Advisor, or EVA.) While I waited until it pulled back to around $3, I was clearly too early in my expectations for a turnaround. Yet, despite — or, perhaps, because of — this sorry price action, I’m reiterating my bullish take on the blue fuel.

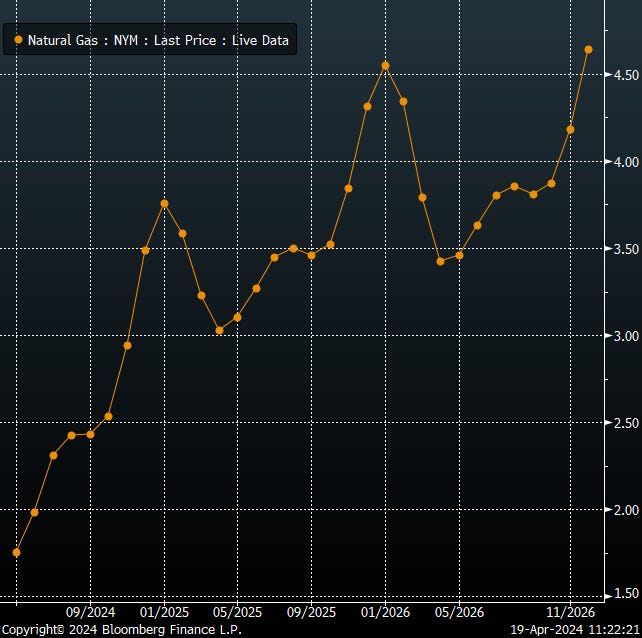

However, it is both interesting and relevant to look at the futures market for more distant price expectations for “natty”, as commodity traders often refer to this essential energy source. As you can see, a year from now the price is expected to be about 70% higher. Per earlier Haymakers, commodity prices generally do step up as you go out into the future.

Natural Gas Futures Contract Pricing (going out to the end of 2026)

Bloomberg

That’s the normal condition known as contango. But a 70% premium out a year is extraordinarily high. In contrast, oil for delivery in a year trades at about a 10% discount to today’s trading level. That’s unusual, but this “backwardation”, as it is known in the trade, has persisted for years.

This week I’m going to focus on a specific natural gas-related security that has the ability to capitalize on this odd market pricing structure. In addition, it’s a way to profit from the AI-catalyzed boom in both electricity consumption and U.S. natural gas exports. Making the situation even sweeter, the subject of my affection yields over 9%, despite depressed gas prices. As usual, the actual name will be reserved for our precious paying readers.

To be fair, its distribution is not carved in stone. In fact, it is expressly variable. For example, last year the yield would have been around 12% at this price. Hence, weak natural gas prices – and, to an extent, softer oil prices – have already taken a toll on its cash flow paid to unit holders thus far in 2024.

It is also important to note that this entity, like many of its ilk, hedges its production by selling forward futures contracts. This provides a more stable cash flow profile. Based on the foregoing, when the one-year forward natural gas contract is selling far higher than current, or spot, prices, natural gas producers are able to lock in profitable prices.

At the start of this year, said company, which is structured as a publicly traded partnership (PTP), had hedged roughly two-thirds of its production for 2024. (Note that as a PTP this does generate a K1.) It has the ability to go out as far as five years on as much of 50% of their output, if they so choose.

Perhaps this is why the only time this entity cuts its distribution in a meaningful way (i.e, other than the relatively mild reduction seen recently), was during the Covid lockdowns. At this point, with gas prices so depressed, at least on the nearby months, there could be substantial upside to the payout… note the “could be”.

It’s also important to note that this entity, which owns mineral and royalty rights on producing properties, actually generates more revenue and cash flow from oil than it does from gas. Yet, the gas price offers much more upside should prices move back up to $10 per mmBTU (think of that as like a gallon of gasoline) – $10, by the way, is much more in sync with where gas trades in other parts of the world, at least among consuming countries.

This is an opportune segue into the reasons why I am so bullish on natural gas. However, in fairness to our financially supportive readers, those can be found just behind the paywall…

Subscribe to Haymaker to read the rest.

Become a paying subscriber of Haymaker to get access to this post and other subscriber-only content.

A subscription gets you:

| Subscriber-only posts and full archive | |

| Post comments and join the community |

IMPORTANT DISCLOSURES

This material has been distributed solely for informational and educational purposes only and is not a solicitation or an offer to buy any security or to participate in any trading strategy. All material presented is compiled from sources believed to be reliable, but accuracy, adequacy, or completeness cannot be guaranteed, and David Hay makes no representation as to its accuracy, adequacy, or completeness.

The information herein is based on David Hay’s beliefs, as well as certain assumptions regarding future events based on information available to David Hay on a formal and informal basis as of the date of this publication. The material may include projections or other forward-looking statements regarding future events, targets or expectations. Past performance is no guarantee of future results. There is no guarantee that any opinions, forecasts, projections, risk assumptions, or commentary discussed herein will be realized or that an investment strategy will be successful. Actual experience may not reflect all of these opinions, forecasts, projections, risk assumptions, or commentary.

David Hay shall have no responsibility for: (i) determining that any opinion, forecast, projection, risk assumption, or commentary discussed herein is suitable for any particular reader; (ii) monitoring whether any opinion, forecast, projection, risk assumption, or commentary discussed herein continues to be suitable for any reader; or (iii) tailoring any opinion, forecast, projection, risk assumption, or commentary discussed herein to any particular reader’s investment objectives, guidelines, or restrictions. Receipt of this material does not, by itself, imply that David Hay has an advisory agreement, oral or otherwise, with any reader.

David Hay serves on the Investment Committee in his capacity as Co-Chief Investment Officer of Evergreen Gavekal (“Evergreen”), registered with the Securities and Exchange Commission as an investment adviser under the Investment Advisers Act of 1940. The registration of Evergreen in no way implies a certain level of skill or expertise or that the SEC has endorsed the firm or David Hay. Investment decisions for Evergreen clients are made by the Evergreen Investment Committee. Please note that while David Hay co-manages the investment program on behalf of Evergreen clients, this publication is not affiliated with Evergreen and do not necessarily reflect the views of the Investment Committee. The information herein reflects the personal views of David Hay as a seasoned investor in the financial markets and any recommendations noted may be materially different than the investment strategies that Evergreen manages on behalf of, or recommends to, its clients.

Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this material, will be profitable, equal any corresponding indicated performance level(s), or be suitable for your portfolio. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Investors should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

20240423