Making Hay Monday – April 1st, 2024

Making Hay Monday

High-level macro-market insights, actionable economic forecasts, and plenty of friendly candor to give you a fighting chance in the day’s financial fray.

Charts of the Week

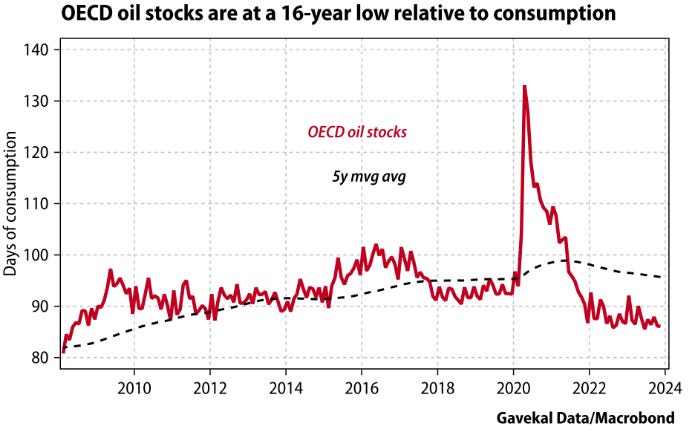

Bears on the oil market have become less strident as prices have been vigorously rallying this year. However, whenever crude corrects, they tend to come out of the woodwork, often focusing on high levels of oil inventories. In reality, however, those are at exceedingly low levels, especially relative to demand. The Biden administration’s release of approximately 200 million barrels from the Strategic Petroleum Reserve (SPR) obscured the ultra-tight inventory situation for over a year. At this point, though, it is no longer able to use this ploy to create an illusion of ample supplies.

(OECD refers to the largest developed countries.)

Booth

The homebuilding stocks continue to be on fire. There are several oddities about this situation. One of them is the low level of residential construction workweeks. This is despite a fairly high level of payrolls, implying very poor productivity in this industry, as some pundits have noted. That should mean profit margins are under pressure, particularly as new home prices have been falling, especially including buyer subsidies (like interest rate buy-downs) that often don’t show in official pricing data.

“The whole problem with the world is that fools and fanatics are always so certain of themselves, and wiser people so full of doubts.” -Bertrand Russell

Evergreen Compatibility Survey

April IEA Fools’ Day

Shutterstock

Champions

Yes, it’s that day again when you need to be on alert for practical jokes that are usually followed by “April Fools!”. It’s simply human nature to want to be on the administering, rather than receiving, end of these gags. But what if the fooling goes on 365 days a year… and for decades? Further, what if it comes from one of the most (unjustifiably) important sources of energy information in the world? …

Subscribe to Haymaker to read the rest.

Become a paying subscriber of Haymaker to get access to this post and other subscriber-only content.

A subscription gets you:

| Subscriber-only posts and full archive | |

| Post comments and join the community |

IMPORTANT DISCLOSURES

This material has been distributed solely for informational and educational purposes only and is not a solicitation or an offer to buy any security or to participate in any trading strategy. All material presented is compiled from sources believed to be reliable, but accuracy, adequacy, or completeness cannot be guaranteed, and David Hay makes no representation as to its accuracy, adequacy, or completeness.

The information herein is based on David Hay’s beliefs, as well as certain assumptions regarding future events based on information available to David Hay on a formal and informal basis as of the date of this publication. The material may include projections or other forward-looking statements regarding future events, targets or expectations. Past performance is no guarantee of future results. There is no guarantee that any opinions, forecasts, projections, risk assumptions, or commentary discussed herein will be realized or that an investment strategy will be successful. Actual experience may not reflect all of these opinions, forecasts, projections, risk assumptions, or commentary.

David Hay shall have no responsibility for: (i) determining that any opinion, forecast, projection, risk assumption, or commentary discussed herein is suitable for any particular reader; (ii) monitoring whether any opinion, forecast, projection, risk assumption, or commentary discussed herein continues to be suitable for any reader; or (iii) tailoring any opinion, forecast, projection, risk assumption, or commentary discussed herein to any particular reader’s investment objectives, guidelines, or restrictions. Receipt of this material does not, by itself, imply that David Hay has an advisory agreement, oral or otherwise, with any reader.

David Hay serves on the Investment Committee in his capacity as Co-Chief Investment Officer of Evergreen Gavekal (“Evergreen”), registered with the Securities and Exchange Commission as an investment adviser under the Investment Advisers Act of 1940. The registration of Evergreen in no way implies a certain level of skill or expertise or that the SEC has endorsed the firm or David Hay. Investment decisions for Evergreen clients are made by the Evergreen Investment Committee. Please note that while David Hay co-manages the investment program on behalf of Evergreen clients, this publication is not affiliated with Evergreen and do not necessarily reflect the views of the Investment Committee. The information herein reflects the personal views of David Hay as a seasoned investor in the financial markets and any recommendations noted may be materially different than the investment strategies that Evergreen manages on behalf of, or recommends to, its clients.

Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this material, will be profitable, equal any corresponding indicated performance level(s), or be suitable for your portfolio. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Investors should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

20240402