Tokyo Inflation: Here we go a Yen

Tokyo Inflation: Here we go a Yen

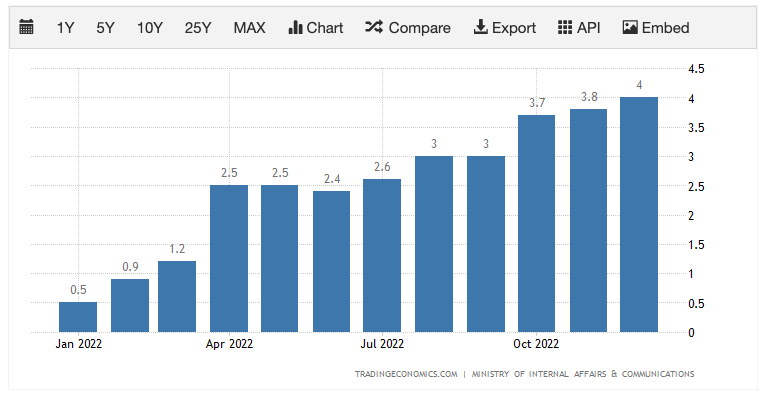

How long can the BoJ hold out? That’s the question JPY and JGB traders want to know. Last week saw another nudge from market data which suggests the BoJ needs to abandon its yield curve policy. Tokyo’s CPI print, a good indicator of Japan’s overall inflation, came in higher than expected. In fact, the print showed the fastest rate of increase for Tokyo’s Inflation since 1981. Headline inflation for Japan was at 4% for December (and rising) which was the highest reading since 1991.

The BoJ is not panicking at these high inflationary prints as it is apparently still not convinced that the inflation level will sustainably rise to 2%. However, many traders are getting carried away. They see this inflationary pressure building and reason, ‘the BoJ will have to adjust policy to prevent these inflationary pressures from getting worse’.

The takeaway

The reasoning is sound. If inflation keeps building the BoJ will need to act by abandoning the yield curve and/or raising rates. These would be JPY-positive moves. So, how can traders profit from it? Look for key areas where risk can be easily defined. Huge events like this can be very volatile, so if you want to trade the JPY, you may consider picking a weak currency to trade the JPY against and also looking for big, obvious tech levels to define risk. Also, make sure that you are 100% happy with the potential risk you are taking. With big bank moves like the BoJ, it can result in whiny price action even when you have a good sense of overall direction. One example is given with the CHFJPY and obvious selling zones and stop placements marked on the chart.

About: HYCM is the global brand name of HYCM Capital Markets (UK) Limited, HYCM (Europe) Ltd, HYCM Capital Markets (DIFC) Ltd and HYCM Limited, all individual entities under HYCM Capital Markets Group, a global corporation operating in Asia, Europe, and the Middle East.

High-Risk Investment Warning: Contracts for Difference (‘CFDs’) are complex financial products that are traded on margin. Trading CFDs carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information please refer to HYCM’s Risk Disclosure.

20230130