Haymaker Friday Edition + Trading Alert

Haymaker Friday Edition

In The Ring – December 22nd, 2023

Shutterstock

Seasons Greetings, Readers and Subscribers:

We’ll soon reach the end of our first full calendar year producing this newsletter, and what an interesting year 2023 ended up being for us all. Thanks to each of you for continuing to welcome into your lives our ideas, our theories, our research, and the brilliant guest content we love to share out from time to time. It’s been a year of growth for us and one of change, as most of you know, particularly those who switched over to become paid subscribers and/or Founding Members to receive our premium material and Trading Alerts. The re-configuring and lesson-learning are certain to continue as we take in your feedback and work on new ways to ensure the Haymaker-headed emails reaching your inbox twice each week (thrice for Founding Members) are packed with value and honest interpretations of what the heck’s going on in the markets!

All that aside, let’s leave you with the most important message this time of year: Happiest Holidays from the Haymaker team to you and your loved ones, and know that we truly are looking forward to special days for this newsletter in the year to come.

-The Haymaker Team

Evergreen Compatibility Survey

“What we will note as it stands now is that the recent oil price rout is not consistent with the state of the global balance and, in particular, a touted concern about weak global demand.” -Cornerstone Analytics’ Mike Rothman

Seven

It’s broken-record time. At the admitted risk of standing accused of being redundant, and/or a shill for OPEC, I nevertheless believe among the best year-end opportunities is with crude oil itself and in certain energy equities.

Regarding oil, it does infuriate me how much misinformation is floating around about why it deserves to be as depressed as it is right now. In fairness, though, I’m not an energy market expert, though I have followed that space closely for decades.

Frankly, I’ve got what I call “The Curse of the Portfolio Manager”. My definition of that is knowing less and less about more and more until you know practically nothing about everything. That might be a bit harsh, and I do have my areas of specialization, but the reality is that those of us who carry the Chief Investment Officer title are, by definition, generalists. As a result, we need to lean heavily on specialists within our own firms, as well as from outside resources.

With about as much surprise as the fact that the Seattle Mariners continued their longest streak in Major League Baseball history of NOT making the World Series (and, in the post-season, their front office seems intent on ensuring that ignominious streak continues), I will once again highlight a true energy expert: Mike Rothman of Cornerstone Analytics. (For those who care, it’s been 47 years, their entire existence, during which the M’s have been World Series-less.)

One of the many traits I admire about Mike is that he doesn’t cave into always-fickle investor emotions and trends, relying instead on data that has proven its worth over the many decades he’s been following oil markets.

His analysis has consistently proven far more accurate than that of the International Energy Agency (IEA). Repeatedly, the IEA has needed to retroactively adjust its statistics on the crude market to roughly match Cornerstone’s. It has now mismeasured oil inventories (mostly via underestimated demand) by a cumulative total of roughly 2.7 billion barrels since 2007. Despite this inexcusable tabulation whiff, it continues to be considered the Planet’s authority on the state of the oil market. As they say, go figure. (For sure, the IEA needs to do a much better job of figuring!)

As all of us who earn our living in the financial world know there is a fine line between having the courage of your convictions and being just downright stubborn. When oil prices have slid as hard as they have since late September, it’s human nature to accuse someone like Mike of being guilty of the latter mindset. That could also certainly apply to yours truly, despite my suggestions of profit-taking during the sublime oil rally that ran from late June through September.

Now, with what feels like the entire world negative on oil, Mike is, true to form, defending his beliefs with hard facts. When it comes to rebutting the growing bearish contingent, he recently pulled no punches per the list he sent out this week. To wit:

SEVEN BIG LIES:

1. US crude output is surging

2. Global oil demand is weak

3. OPEC is cheating

4. Oil inventories are high

5. Saudis want to flood the market with oil

6. Oil prices are overvalued

7. The 2024 oil balances will loosen dramatically

The in-your-face title takes both chutzpah and a high degree of confidence in your methodolgy. If he’s wrong about his disinformation contention, you can bet he’s going to take an enormous amount of heat. From most of my research on the oil market, however, including from other sources, the Haymaker is in Mike’s corner.

The constant chatter about inventories being high is particularly galling in its inaccuracy. The reality is the polar opposite, as I’ve written many times in the past. As Mike has repeatedly pointed out, the correlation between inventories and prices is extremely tight on a long-term basis. (When stocks are low, prices are high and vice versa — big shock, I know, but it’s amazing how many are presently overlooking that.)

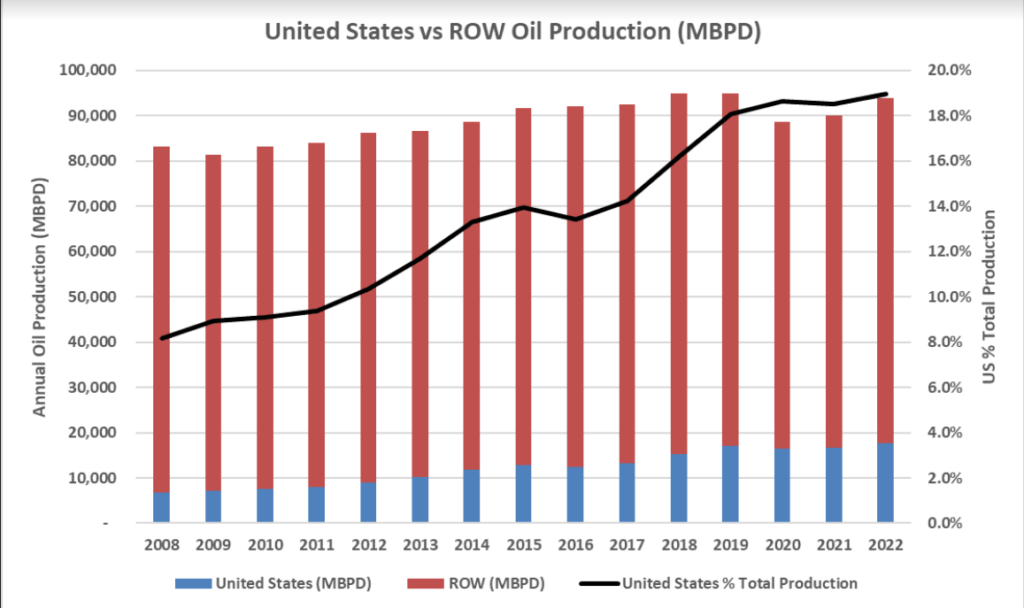

While it sounds like the stuff of conspiracy theories, it’s almost as if there is a campaign to lower oil prices. While that’s nice for consumers, it’s also politically expedient. The problem in the long run is that artificially suppressed prices (such as from massive emergency reserve releases) discourage desperately needed exploration. It’s my belief — and, more importantly, Mike Rothman’s — that we will soon find how desperate it truly is. The below chart makes abundantly clear the world’s extreme reliance on U.S. oil output growth. (ROW stands for “Rest of the World”)

Evergreen

Moreover, this has nearly entirely come from the much-detested fracking – especially by Vladmir Putin and his own powerful deception apparatus – of shale basins. The sobering reality is that shale formations’ production declines about 40% per year in their first 24 months of life. As I noted last week, every basin in America is now displaying falling output — except for the mighty Permian Basin, by far the most prolific U.S. oil-producing region. But, as I also mentioned, even it is looking very close to topping out and rolling over.

Moving onto my other year-end money-making (hopefully) idea, if you think the conspiracy theory I mentioned above is outlandish consider what has happened in the gold market. Two senior JPMorgan officials were convicted in August of illegally manipulating the gold market. Quoting Acting Assistant Attorney General Nicole M. Argentieri:

The defendants used their positions as some of the most powerful traders in the worldwide precious metals markets to engage in an egregious effort to manipulate prices for their benefit.

One of the perps, was an Executive Director of JPMorgan; the other was a managing director who ran JPMorgan’s precious metals desk. In other words, these were far from low-level employees.

Certain goldbugs have long argued the big bullion banks, like JPMorgan, have artificially suppressed the price of the yellow metal. The rationale is that this was due to these huge market-makers being massively short as a result of having sold large quantities of derivative contracts. Is it true? Of course, I have no way of knowing, but the kind of behavior these senior JPMorgan officials engaged in doesn’t instill confidence and trust in the sanctity of the system.

Regardless of potential shenanigans, gold, as you may have noticed, has had a nice year. It’s up 10% despite Western investors being largely on the sell side. (Perhaps a supporting factor is that those two are now behind bars.) Foreign central banks have been a very different story. This looks to be the second straight year of record overseas central bank gold accumulation.

As I’ve noted many times, gold miners have lagged bullion this year and, actually, for over a decade. Yet, they are showing signs of life. This sector is historically one of the prime beneficiaries of a Fed easing cycle, as I’ve also previously written.

There is a growing cohort of shrewd investors and strategists, including my partner Louis Gave, who believe the Fed is determined to do all it can to prevent Donald Trump from returning to the White House. This may be why Jay Powell did a surprising 180° — one that left stock and bond investors jubilant — in a mere two weeks.

It’s possible that Joe Biden’s plummeting poll numbers have put the fear of God — or someone who seems to think he is — into Mr. Powell and the rest of his cronies. Something certainly catalyzed an attitude shift by the Fed chair who in early December was warning against premature easing of expectations, but then, last week, let those hopes run wild.

Without a doubt, the head of the U.S. Treasury, Janet Yellen, is no fan of The Donald. Consequently, it is plausible that the two most financially potent branches of the U.S. government are poised to pull out all the stops to help Joe Biden gain re-election. If you think that’s outlandish consider this quote from one of the most senior Fed officials at the time, back in the summer of 2019:

I understand and support Fed officials’ desire to remain apolitical.

But Trump’s ongoing attacks on Powell and on the institution have made that untenable. Central bank officials face a choice: enable the Trump administration to continue down a disastrous path of trade war escalation, or send a clear signal that if the administration does so, the president, not the Fed, will bear the risks — including the risk of losing the next election. There’s even an argument that the election itself falls within the Fed’s purview. After all, Trump’s reelection arguably presents a threat to the U.S. and global economy, to the Fed’s independence and its ability to achieve its employment and inflation objectives. If the goal of monetary policy is to achieve the best long-term economic outcome, then Fed officials should consider how their decisions will affect the political outcome in 2020.

It’s important to point out that my senior Evergreen Gavekal team members vehemently disagree that Powell’s latest pivot was politically motivated. Interestingly, my great mate Grant Williams doesn’t believe that, either. Yet he also doesn’t think it matters. His view is, essentially, it is what it is — another relaxation of monetary policies. At this point, it’s being driven by financial markets which are pricing in six Fed rate cuts (assuming ¼% per move). But the Fed has only half-heartedly tried to rein in the escalating euphoria.

Regardless of the Fed’s and the Treasury’s motivations, a double-barreled dose of fiscal (massive and rising deficits) and monetary (a projection of three rate cuts in 2024) stimulus, should be extremely gold- and gold miner-friendly.

For paying subscribers, Trading Alerts to immediately follow:…

Subscribe to Haymaker to read the rest.

Become a paying subscriber of Haymaker to get access to this post and other subscriber-only content.

A subscription gets you:

| Subscriber-only posts and full archive | |

| Post comments and join the community |

IMPORTANT DISCLOSURES

This material has been distributed solely for informational and educational purposes only and is not a solicitation or an offer to buy any security or to participate in any trading strategy. All material presented is compiled from sources believed to be reliable, but accuracy, adequacy, or completeness cannot be guaranteed, and David Hay makes no representation as to its accuracy, adequacy, or completeness.

The information herein is based on David Hay’s beliefs, as well as certain assumptions regarding future events based on information available to David Hay on a formal and informal basis as of the date of this publication. The material may include projections or other forward-looking statements regarding future events, targets or expectations. Past performance is no guarantee of future results. There is no guarantee that any opinions, forecasts, projections, risk assumptions, or commentary discussed herein will be realized or that an investment strategy will be successful. Actual experience may not reflect all of these opinions, forecasts, projections, risk assumptions, or commentary.

David Hay shall have no responsibility for: (i) determining that any opinion, forecast, projection, risk assumption, or commentary discussed herein is suitable for any particular reader; (ii) monitoring whether any opinion, forecast, projection, risk assumption, or commentary discussed herein continues to be suitable for any reader; or (iii) tailoring any opinion, forecast, projection, risk assumption, or commentary discussed herein to any particular reader’s investment objectives, guidelines, or restrictions. Receipt of this material does not, by itself, imply that David Hay has an advisory agreement, oral or otherwise, with any reader.

David Hay serves on the Investment Committee in his capacity as Co-Chief Investment Officer of Evergreen Gavekal (“Evergreen”), registered with the Securities and Exchange Commission as an investment adviser under the Investment Advisers Act of 1940. The registration of Evergreen in no way implies a certain level of skill or expertise or that the SEC has endorsed the firm or David Hay. Investment decisions for Evergreen clients are made by the Evergreen Investment Committee. Please note that while David Hay co-manages the investment program on behalf of Evergreen clients, this publication is not affiliated with Evergreen and do not necessarily reflect the views of the Investment Committee. The information herein reflects the personal views of David Hay as a seasoned investor in the financial markets and any recommendations noted may be materially different than the investment strategies that Evergreen manages on behalf of, or recommends to, its clients.

Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this material, will be profitable, equal any corresponding indicated performance level(s), or be suitable for your portfolio. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Investors should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

20231223