Has Bitcoin triggered a Magazine Cover Indicator buy signal?

Has Bitcoin triggered a Magazine Cover Indicator buy signal?

The ‘magazine cover indicator’ is the belief that by the time an instrument reaches the front page of a major magazine cover it is a contrarian indicator. So, if the front page of the magazine speaks about a great bull market, is it a time to sell? If the front page speaks of a great bear market is it a time to buy?

Professional analysts and traders will know this from personal anecdotal experience. By the time one of the non-trading friends or family speaks about a certain investment the market is usually saturated and about to reverse. It is a strange counterintuitive phenomenon that when everyone says ‘buy’ it can be a great time to sell. Why? Because saying ‘buy’ has probably already been bought. So, here is the latest ‘Economist’ front page titled ‘Crypto’s Downfall’.

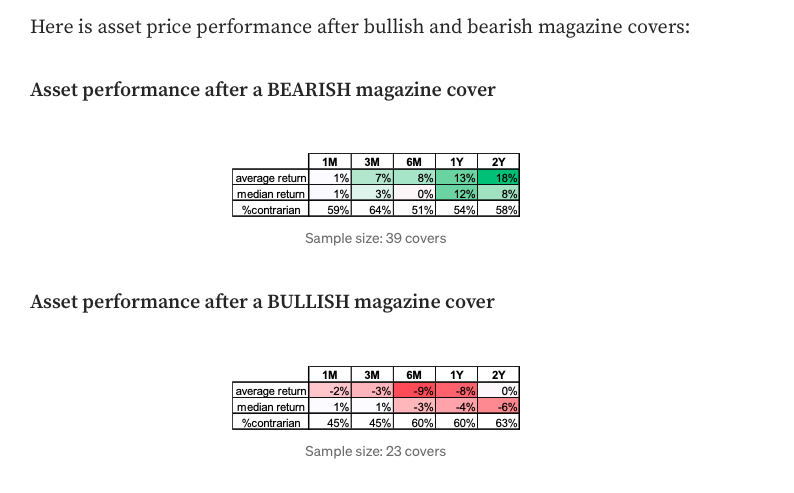

So, is this a contrarian signal that suggests buying Bitcoin may actually be a good move? Brent Donelly had a look at the validity of the magazine indicator and you can check out his helpful piece and the criteria he used here. The summary of his results was as follows; his research found that the magazine cover indicator was a decent reversal indicator.

The latest cause of crypto angst has been over the collapse of the FTX exchange. This has led to a big crisis in crypto confidence which has brought voice to crypto cynics, concern to neutrals, and grime resolve for holders. The point of this article is not to argue for or against Bitcoin in principle but to recognise we may be at peak bearishness now.

If the USD has peaked, a weak USD tends to help Bitcoin higher. So, with BTCUSD around its 100EMA on the monthly chart will it hold?

About: HYCM is the global brand name of HYCM Capital Markets (UK) Limited, HYCM (Europe) Ltd, HYCM Capital Markets (DIFC) Ltd and HYCM Limited, all individual entities under HYCM Capital Markets Group, a global corporation operating in Asia, Europe, and the Middle East.

High-Risk Investment Warning: Contracts for Difference (‘CFDs’) are complex financial products that are traded on margin. Trading CFDs carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information please refer to HYCM’s Risk Disclosure.

*Any opinions made in this material are personal to the author and do not reflect the opinions of HYCM. This material is considered a marketing communication and should not be construed as containing investment advice or an investment recommendation, or an offer of or solicitation for any transactions in financial instruments. Past performance is not a guarantee of or prediction of future performance. HYCM does not take into account your personal investment objectives or financial situation. HYCM makes no representation and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or other information supplied by an employee of HYCM, a third party, or otherwise. Without the approval of HYCM, reproduction or redistribution of this information isn’t permitted.

20221123