GBP/USD in Sharp Focus as Attention Turns to US and UK Inflation

GBP/USD in Sharp Focus as Attention Turns to US and UK Inflation

The GBP/USD edged higher in reaction to the firmer wages and jobs data from the UK earlier this morning, ahead of the release of even more top-tier data from both sides of the pond. It is inflation figures from both the UK and, first, the US, which is likely to set the tone for both currencies. Ahead of the release of the much-anticipated US CPI later today, the GBP/USD was a touch firmer, holding onto a slight gain for the week around 1.2650. All told, consolidation was name of the game for this pair, as traders awaited direction from the inflation data. But the cable could start trending once this week’s inflation figures are out of the way.

All eyes on US CPI

At the start of this and much of last week, the FX markets predominantly favoured the US dollar, with the greenback maintaining support despite the absence of significant news developments. The preceding week witnessed a robust US jobs report and several other data indicators surpassing expectations, alongside indications from Fed Chair Powell and the FOMC signalling against an early rate cut. Nonetheless, the buoyancy in the tech sector persisted on Wall Street, culminating in the S&P 500 reaching the historic 5K milestone, largely driven by robust company earnings reports. The strong performance of the stock market weighed on the dollar against some risk-sensitive currencies, including the Australian, Canadian and New Zealand dollars, as well as the British pound. However, losses for the negative-yielding Japanese yen and Swiss franc, where interest rates are among the lowest among developed economies, helped to provide some support for the dollar index. As a result, the Dollar Index posted another, albeit small, weekly gain. The DXY closed higher in January, ending a run of two consecutive monthly losses.

So, on the one hand, strong data is helping to provide the dollar support while the ongoing stock market rally is encouraging some investors to dip into the more risk-sensitive currencies. Therefore, a potentially stronger inflation report today could further bolster the dollar’s strength against the lower-yielding currencies, whereas a softer reading would be welcomed by GBP/USD and in fact all traders favouring foreign currencies over the USD.

The key data on US economic calendar today is the Consumer Price Index, which is seen falling to 2.9% annual pace in January from 3.4% in December, with a month-over-month print of +0.2% compared to +0.3% in the previous month. Core CPI is expected to print +3.7% y/y, down from +3.9%, or +0.3% month-on-month.

The resilience of the US consumer has been underscored by recent retail sales figures exceeding forecasts for six consecutive months. December saw a 0.6% rise in retail sales, accompanied by a 0.4% increase in core sales. These encouraging retail figures have coincided with an upsurge in consumer sentiment over the past few months. Consequently, the unemployment rate remains low, wages continue to grow, and inflation is experiencing a gradual moderation. With these factors in play, the Fed has found no compelling reason to expedite its policy loosening. Should this week’s data releases, particularly in retail sales, signal further economic resilience in the US, anticipate further gains for the US dollar.

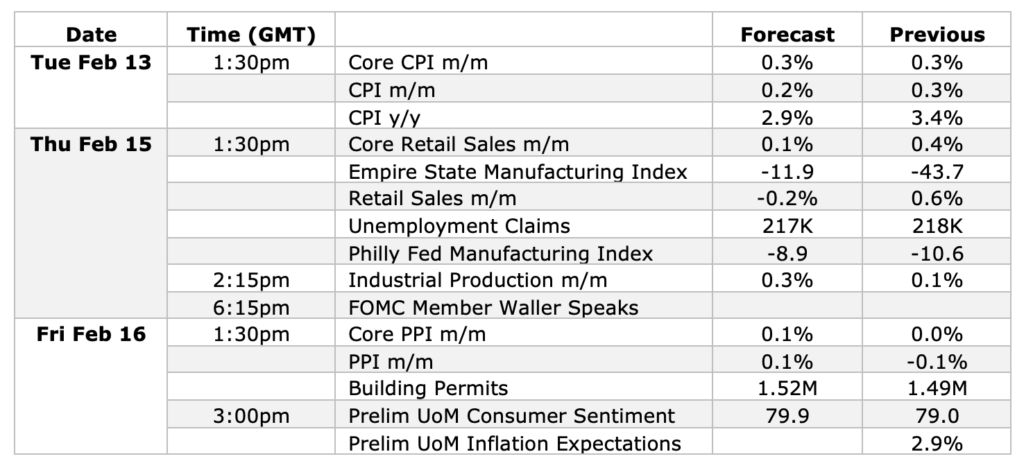

However, retail sales are expected to decline this time by 0.2% on a month-over-month basis, although core sales are seen rising +0.1%. Let’s see if we will get another surprise print. Here’s a list of key data to watch this week from the US:

Busy week for pound traders

The GBP/USD will be influenced by those US data releases, along with all the other major pairs. But the GBP faces additional volatility due to a busy week of data here in the UK too.

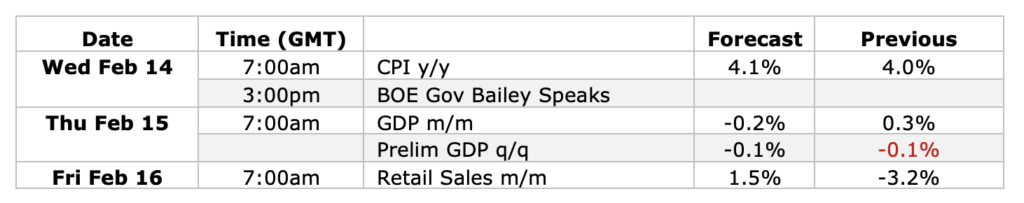

Among the UK data highlights, we have CPI, GDP and retail sales figures all due for release starting on Wednesday.

Earlier today, we had stronger data from the UK as wages beat and the unemployment rate fell more than expected.

The Average Earnings Index, which included bonuses, came in at 5.8% in the three months to December, compared to a year-ago period. This was stronger than 5.6% expected and the previous month’s data was revised up to 6.7% from 6.5%, suggesting that wage inflation is still going strong. On top of this, the annual rate of unemployment fell more than expected to just 3.8% in the three months to December, down from 4.2% in November. In fact, the employment sector remained quite strong at the start of the year as jobless claims rose less than expected at 14.1K in January. Here’s a list of key data to watch for the remainder of this week from the UK:

The pound, stronger today, could become under pressure if UK inflation turns out to be surprisingly weak, although economists think prices have risen further to 4.1% y/y in January from 4.0% in December. That said, the price action on the GBP/USD will also depend on the US data. Therefore, if you want to isolate the pound’s reaction to the upcoming data from the UK, then it is best to concentrate on a pound cross, such as the EUR/GBP or GBP/JPY, rather than the GBP/USD itself, which will be influenced by the upcoming CPI data from the US later. But if you exercise some patience, the GBP/USD could be in for a potentially sharp move once inflation figures are released, potentially providing it good trading opportunities.

GBP/USD technical analysis and trade ideas

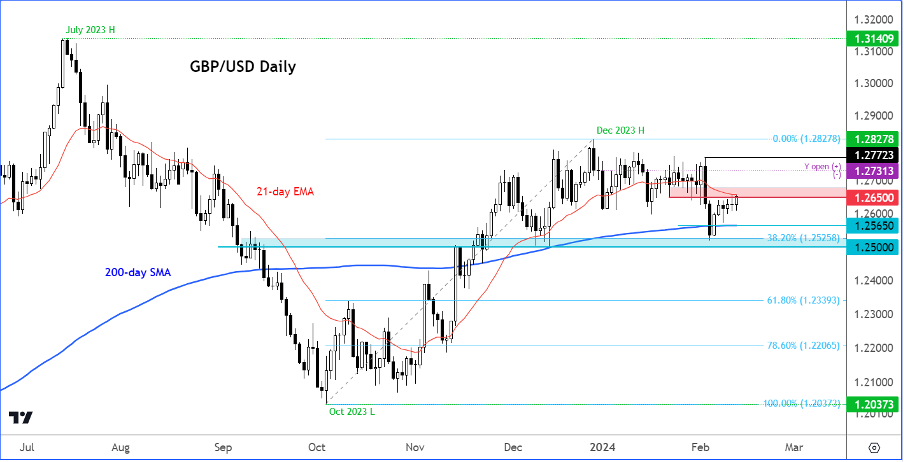

Source: TradingView.com

The key short-term resistance level to watch on the GBP/USD is around 1.2650, which was being tested at the time of writing. This level was formerly support and we have the 21-day exponential moving average coming into play here. Above this level, 1.2730ish to 1.2770ish is an additional resistance zone, where previous rally attempts have failed in the last few weeks, including last week. Therefore, if we go above last week’s high of 1.2772 and stay there, then this will be a key bullish reversal sign.

On the downside, interim support is seen around the 200-day average circa 1.2650 area. Below this, the area between the psychologically important level of 1.2500 and the long-term 38.2% Fibonacci level at 1.2525 is key. A potential daily close blow 1.25 handle would be a key bearish reversal sign.

Therefore, as things stand, the GBP/USD is inside a trading range with a modest bullish bias, but without a clear longer term directional bias. This week’s upcoming inflation data could change that and set the tone for potentially weeks to come. So, the GBP/USD should definitely be in your watch list of markets to trade, especially if we see a surprisingly weak US inflation print.

Trader | Analyst | TradingCandles.com

e: Fawad.Razaqzada@TradingCandles.com

20240213