Shrinkage!

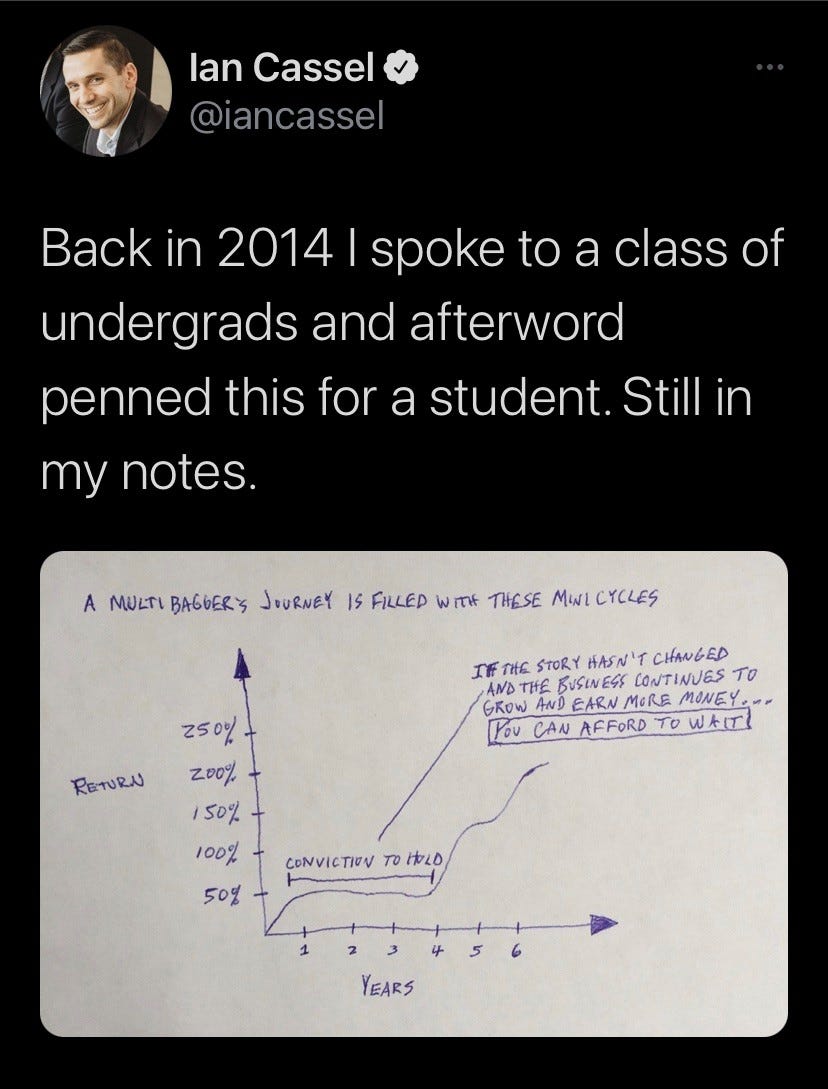

It’s been a seasonably soft summer in cannaland, which feels more like a famine after how fat and happy we got during our Covid-induced feast. Given those hunger gains persisted for as long as they did, driving eye-popping year-over-year multibaggers, I suppose we can’t be shocked that digestion was needed before the next cycle higher.

Those five-letter symbols represent U.S cannabis multistate operators that are listed on the pink sheets due to the federal treatment of cannabis; the adjacent triple-digits are the percentage returns since March 2020. And yes, those are the numbers after this most recent not-so-pleasant reminder that we must all stay humble…

…or the market will do it for us. But something significant happened to U.S cannabis as volumes dried up, news got sold, levels broke and holes got poked: states continued to adopt, fundamentals continue to improve, TAM continued to expand and for those of us looking for a silver linings playbook, the signs aligned for us to find.

What might one expect to pay for such an opportunity? A massive premium to market multiples? Our least-favorite major appendage? First born? No siree Bobby McGee; as this generational opportunity continues to blossom, there’s been a sale at Penney’s!

And not just any sale, it’s one of those once-in-a-blue summer sales that mom used to drag us to. For those allergic to annoying analogies, it’s yet another “too good to miss even though it’s scary af” sale that sometimes saunters through the space, a byproduct of the many artificial impediments that continue to litter the landscape.

And for sure I get that it’s not all cream puffs and powdered sugar. We’ve lost the technical metric (< leaderships’ respective 200-day MAs), it’s been solid six months since the Feb 10 cyclical top—you remember that, right?—and every piece of good news has taken a five-finger Sally while the broader tape embracing it’s risk-on roots.

But a quick sniff of the fundies finds U.S cannabis multiples meaningfully lower than they were on Valentine’s Day. How much lower?

That’s right Umfufu, per Needham’s Matt McGinley, MSO valuations started the year @ 16X EV/EBITDA, raced to 26X in Feb and have retreated to, on average, 13X now.

But wait, there’s more: looking out to 2023, MSO’s trade @ 8X EBITDA on average while offering 25% profit growth; the S&P trades @ 12.8X for 8% profit growth; giving MSO’s the same multiple / growth ratio suggests that MSO’s *should* trade @ 40X.

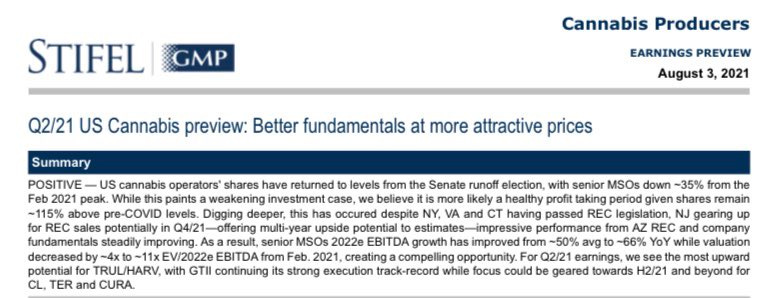

The Greek Freak Andrew Partheniou sees it too, noting in his recent earnings preview that fundamentals are improving as stock prices retreat, noting “NY, VA and CT adult-use legislation, NJ gearing up for adult-use (potentially by Q421—offering multi-year upside potential to estimates) and impressive performance in AZ adult-use.”

So while I understand / appreciate that the last six months have been the definition of frustration for those of us who stare at screens—and for those of us playing longball with this generational opportunity—the current setup may well be As Good As It Gets…

…as long as we remember to sync our risk profile and time horizon and demonstrate some psychology patience as this still-illegal cottage industry evolves, matures and develops into the economic / employment / wellness engine that we we all know it is.

There are different strokes for different folks, of course, and there’s no uniform approach how to navigate this frontier. I know several traders that had hoped to lighten into the summer but never got the chance unless they did so in the snow. We saw it manifest in the post-Schumer price action and from the look and feel of the recent price action, the fear of losing is still dominating the fear of missing (FOMO).

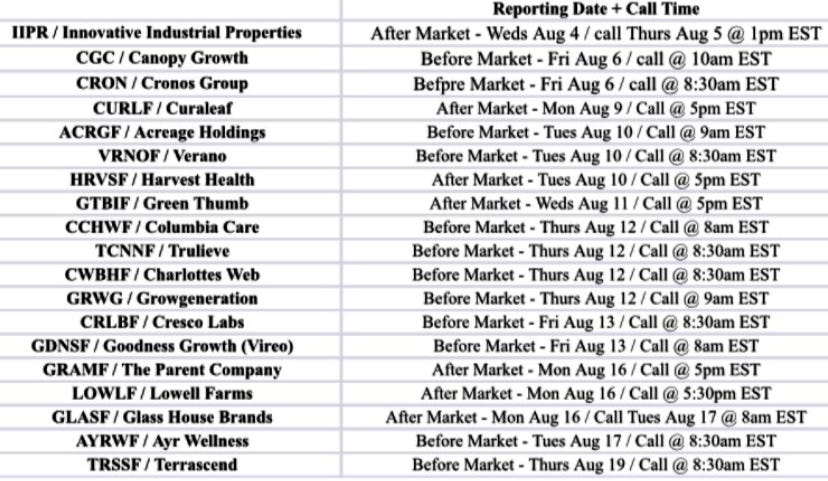

Until such time these billion dollar franchises list on U.S exchanges, shady traders, naked shorts and pernicious algos will continue to shape what’s become a very thin tape and it doesn’t take much. The bulls will point to the stellar fundamentals that’ll be on full display next wk, noting that while cheap can get cheaper in the near-term…

…investors should weigh the disconnect between operating results / forward guidance and these discounted prices in the context of a secular bull predicated on continued state level adoption and sprinkled with the specter of movement at the federal level.

[still think ^ happens by hook or by crook by the midterms and maintain my Blutarsky-esque 0.0% odds that Schumes / Booker will return to NY / NJ w/o functional banking for their state-level social justice programs; a fact seemingly supported by the recent inclusion of pro-cannabis amendments in the House Minibus package]

That’s about it from where I sit as we sharpen our pencils and await the earnings avalanche. If you’re looking for a deeper dive on all things cannabis, this recent alpha nooner with U.S cannabis ETF $MSOS Puh-bah Noah Hamman does just that…

…or, if you’re too A.D.D to sit through a solid half hour, which I completely get, you can spy last week’s Fox Business hit on U.S canna here @ 4:20.

Finally, if you wanna champion the cannabis-related charity of your choice and score some super soft schwag, please visit Canna4Good and show ur support for US canna!

/positions in stocks mentioned.

/advisor $MSOS

Todd Harrison