Dead Calm

Dead Calm

Markets are jumping to start the new year but one sector has sat it out…

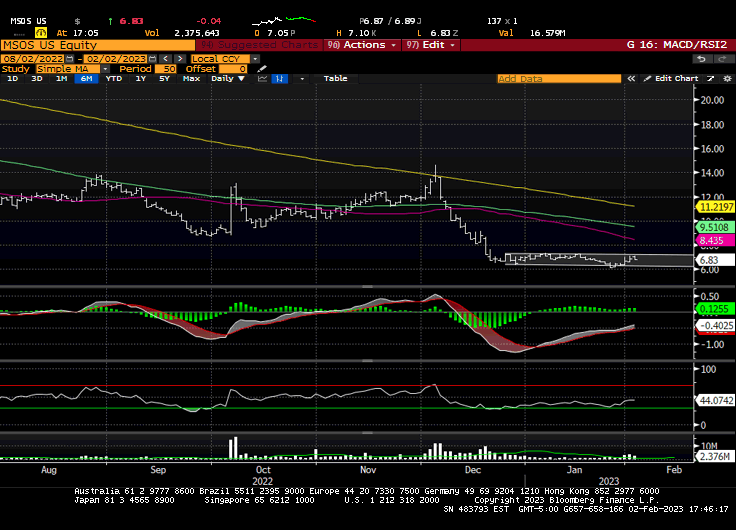

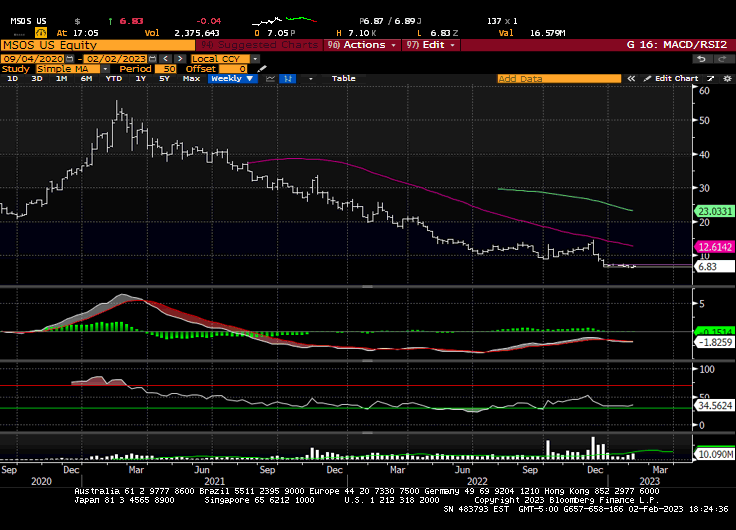

…and that’s U.S cannabis, which was left for dead after SAFE banking was fumbled at the congressional goal line. Following the December crash, which was preceded by a 22-month slow-motion bleed, either nobody cares or nobody can; perhaps a bit of both.

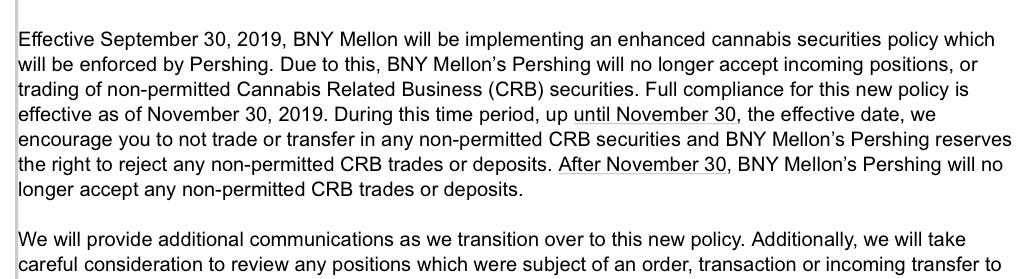

It’s been three years since Pershing first piloted the cannabis custody kamikaze…

…when they pulled the plug on clients’ ability to buy or invest in U.S plant-touching cannabis stocks. That plot repeated itself in several sequels, including JP Morgan in ‘21, UBS last year and EuroClear, which sidelined their show a few sessions ago.

To be clear, custody f*ckery isn’t the only reason U.S cannabis stocks have been in the shitter for 23 months. There were plenty of causes for the punky price action, some of which are likely in the rear-view and others that remain, at least for now.

But the ability to invest in the future of the U.S cannabis industry—or at least bet on the operators who will deftly navigate the status quo—is sort of a big deal, at least if this industry is to evolve into the secular growth engine it aspires to be.

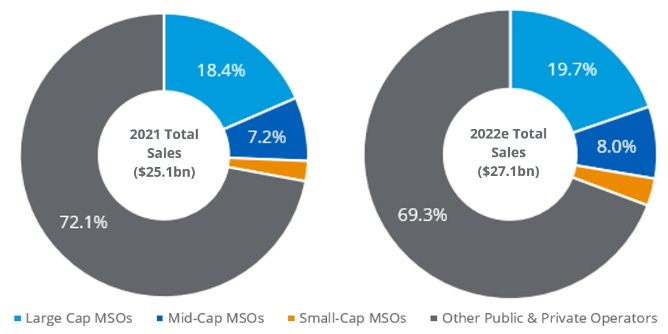

And if the best-of-the-best—those with scaled efficiencies, capex in the rear-view and new states coming online—are struggling to navigate this nascent industry, you know what’s happening to the smaller businesses and fledgling social justice programs.

Turnabout is Fair Play

The last several years have been rollercoaster ride for U.S cannabis.

During the 2020 election cycle, the sector rallied on the specter of regulatory reform; the New York tristate area was adopting adult-use; industry revenues were buoyed by COVID stimulus and stay-at-home restrictions; and there was a sudden, albeit brief, abundance of capital invested across the ecosystem.

Since then, the environment has become decidedly thornier: fundamentally (as prices collapsed/normalized and capital dried up); legislatively (as state regulators, flush with COVID cash, delayed rollouts and political gamesmanship stalled federal progress); and structurally (as custody restrictions gated institutions and algos had their way).

While President Biden announced an expedited scheduling review in October, the epic SAFE fail triggered a mass exodus from the space ahead of perceived extinction. If these companies can’t access capital, the thinking goes, most of them aren’t going to make it; if they do, they’ll be impaired by the tax-treatment and capital restraints.

[note: regardless of federal movement, states continue to onboard as NJ, CT, NY, RI, MD and MO roll out their respective adult-use frameworks]

As onerous economic conditions reduce capacity and operators throttle-back capital expenditures, mature western markets are witnessing broad price appreciation despite the annual “Croptober” supply, which typically depresses prices nationwide.

[note: Glass House Brands pre-reported a 13% QoQ increase in ASPs; while pricing power is relative and nonlinear (pockets of arbitrage persist the further east you go) Cannabis Benchmarks projects U.S. spot will rally from $977 in Jan to $1,025 in July]

Importantly, volume trends remained healthy throughout the recent price collapse so any hint of pricing power is welcome news for scaled/ efficient operators as they chip away at the illicit market (← any uptick in enforcement would be greatly appreciated).

While we anticipate further attrition and consolidation among subscale operators, we expect fundamentals to improve sequentially this year as west coast prices firm, east coast markets ramp and incumbents optimize their assets and execute at scale.

This is our base case sans federal legislation, although we believe the recency bias of persistent congressional failure will soon course correct (←we’re admittedly/ fittingly in the minority in thinking SAFE banking has a shot by the summer if the stars align).

After two years of persistent selling—as banks systematically restricted access, states tried to legislate wealth and congress ignored the will of the people—timing this turn has been an exercise in futility but if Q4222 was the trough for earnings, Q123 should prove to be the cycle trough for stocks, as well.

Someone once said about the Great Depression, “just when they thought it was over, it was really only just beginning.” We sense the same will be said for the U.S cannabis industry with the benefit of hindsight and look forward to having that conversation.

The Path Forward

There have been evolving tensions bw the agendas on the left—mainly, criminal and social justice reform efforts—and the efforts of some the larger US operators.

This percolated as the former fought to deschedule cannabis and certain companies, evidently, have previously lobbied for rescheduling. The inference, of course, is that some companies presumably care more about profits than people.

Putting aside the fact that public companies have a fiduciary responsibility to act in a manner consistent with the best interests of their shareholders, there are complexities and nuances to this discussion, along with a lot of valid and pertinent perspectives.

For starters, there is a difference between criminal justice and social justice. While both are necessary and worthy, we can (should) all be able to agree that nobody should be in prison for a non-violent cannabis offense.

Whether those same people should be bumped to the front of the line (as in New York, ahead of the companies that followed the rules and made significant investments) is a deeper discussion, one that begs the question: can governments even legislate wealth?

While there are some bad actors, most of these companies did nothing wrong. In fact, they’ve built the first / only US canna industry brick-by-brick and state-by-state while paying a 70%+ effective tax-rate and employing 400,000+ Americans.

No, that doesn’t erase the harms of the past but we should remember it was the US government, not these pioneers and entrepreneurs, that is uniquely responsible for the dark stain on the soul of this nation.

The best-of-the-best—the operators who navigated complex / siloed regulations and survived against all odds, federal law, limited access to capital and exorbitant interest rates before that was even a thing—what do they get? Praise? Appreciation? Wealth?

No, they got vilified by the same politicians who held SAFE hostage last year before realizing that doing so helped create the very oligopoly they so desperately sought to avoid. They let the perfect be the enemy of the good and missed a golden opportunity to pass desperately needed incremental reform.

The industry didn’t do itself any favors with its too-little-too-late fractured effort to rally support for SAFE but this is a new year and valuable lessons were learned. For instance, it’s OK to have an ideological view on where cannabis should land as long as we understand that that’s several steps away.

The alcohol/ pharma/ tobacco lobbies only need one step and as we saw in December, it was directly on the throat of cannabis industry progress. Capital is oxygen for an emerging industry; they know it’s possible to hold your breath for one minute under ten feet of water but near impossible to hold it for ten minutes under a foot of water.

My point—yes, I’m getting to it—is that this shouldn’t be an “us vs. them” thing; it’s gotta be a “we and how” thing. Industry stakeholders must stick together bc the real enemies await. You think GTI or Curaleaf are onerous? Blackstone is on line one.

Cannabis—weed, pot, reefer, grass, dope, ganja—has been used by cultures / societies for over 10,000 years as both a wellness supplement and a means to end an argument.

91% of our country —a country that can’t agree on anything or anyone—believes it should be legal in some way, shape or form. More than nine out of ten.

If ever there was an issue, a substance, a plant that could bring people together—even if they look, think or feel differently from one another—this is it.

But before the industry can help reunite our troubled nation, we’ll need to work—and stick—together, which shouldn’t be all that hard so long as our minds are right.

Good luck out there, and keep the faith.

positions/ advisor in stocks mentioned.

20230203