Are You Worried About Rent Inflation?

Sep 15, 2021

Executive Summary

- * The rate of inflation is starting to peak and move lower.

- * The decline in durables inflation will more than offset the increase in services and rent inflation.

- * The combination of durable inflation and commodity price inflation declining will push the rate of inflation lower.

- * An inflation cycle downturn is beginning. Both real economic growth and inflation are set to decline over the next 3-6 months.

Are You Worried About Rent Inflation?

The Bureau of Labor Statistics “BLS” released the August CPI report, and the results showed a sequential decline in the rate of inflation.

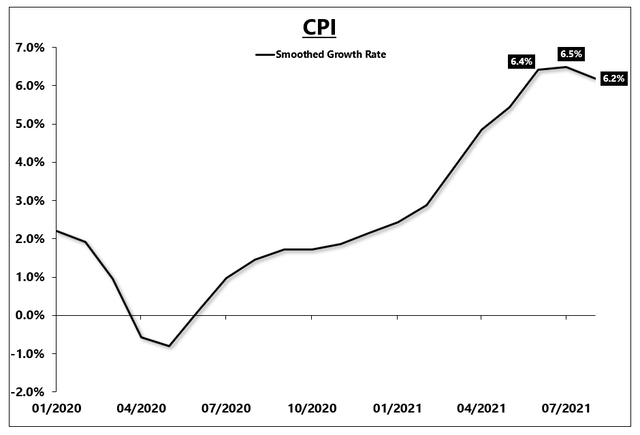

The headline CPI index rose at a 6.2% pace in August when measured on a smoothed six-month annualized basis, down from 6.5% in July and 6.4% in June.

As a reminder, the “smoothed six-month annualized growth rate” has two distinct advantages over the more traditional year-over-year growth rate method. The smoothed denominator of the equation limits the base effect, and the six-month growth rate moves quicker than a 12-month growth rate. The result is a growth rate that moves similar to a year-over-year calculation but smoother and more timely.

Headline CPI: Smoothed Growth Rate

Source: BLS, EPB Macro Research

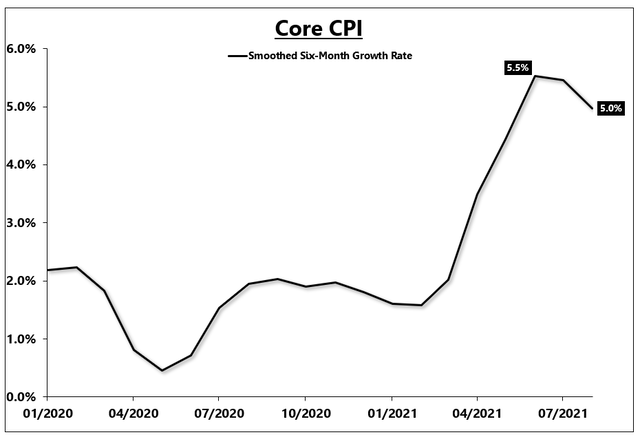

Core inflation dropped markedly in August, falling to 5.0% when measured on a smoothed six-month annualized basis, down from 5.5% in June.

Core CPI: Smoothed Growth Rate

Source: BLS, EPB Macro Research

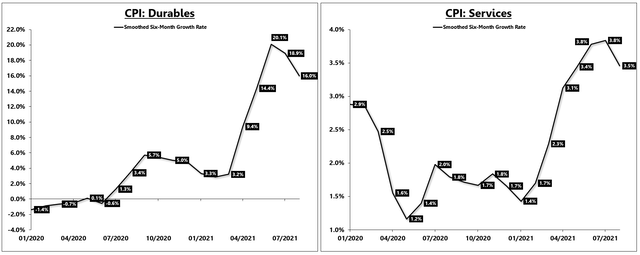

Over the last several months, the popular narrative argued that durable goods inflation would cool and services inflation would increase.

Durable goods inflation has indeed started to decline, falling from 20% in June to 16% in August, but services inflation has also peaked.

The rate of services inflation cooled to 3.5% in August compared to 3.8% in both June and July.

Durables & Services CPI: Smoothed Growth Rate

Source: BLS, EPB Macro Research The same factors that pushed durable goods inflation higher will now contribute to the decline.

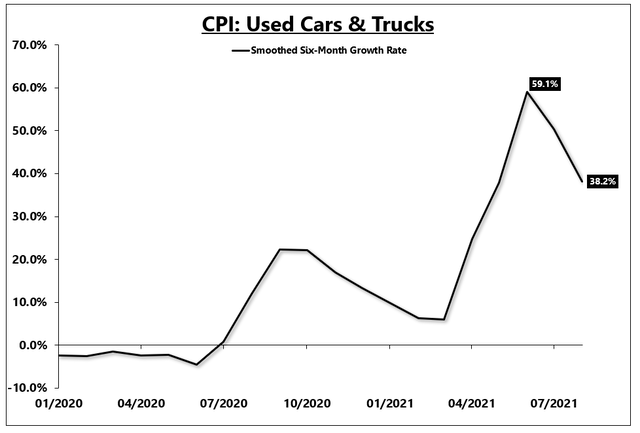

The inflation rate of used cars surged to 59% over the summer and has now fallen to 38% in August.

Even if the price of durables remains flat in nominal terms, the year-over-year growth rate will still plunge from high double digits to 0% or lower.

Used Cars & Trucks CPI: Smoothed Growth Rate

Source: BLS, EPB Macro Research

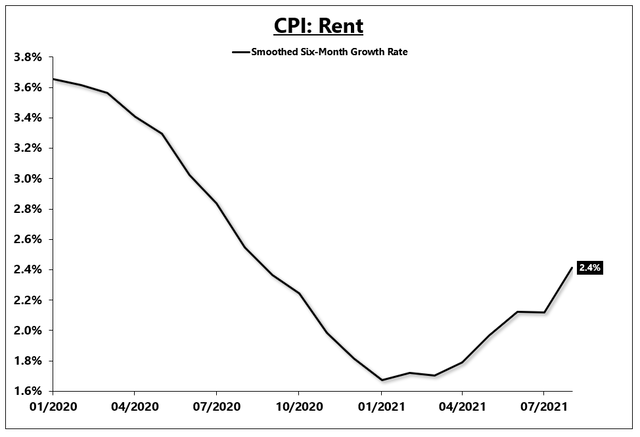

Rent has been a focus of the inflation conversation, given the meteoric rise in home prices.

Rent inflation has started to increase, rising from 1.8% to 2.4% over the last several months.

Rent CPI: Smoothed Growth Rate

Source: BLS, EPB Macro Research

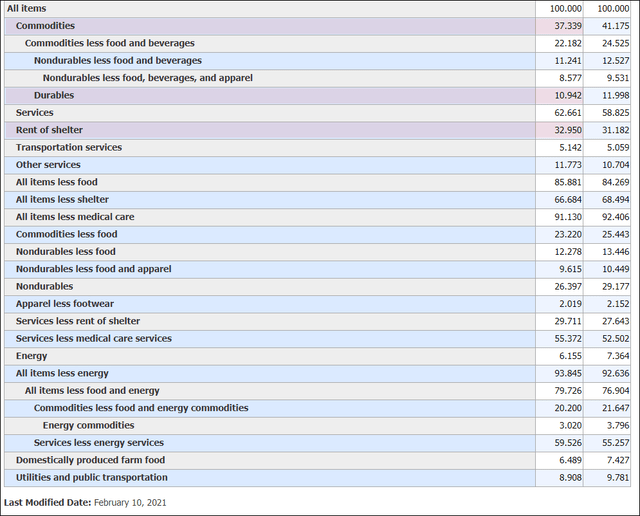

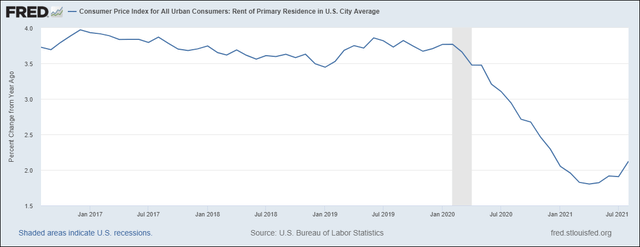

The correlation between rent inflation and home price inflation is well known. Rent inflation generally lags home price inflation, creating speculation that rent inflation could rise as high as 7%.

Given the 33% relative weighting of rent inflation outlined in the chart below, such an increase would impact the overall rate of headline CPI.

It is important to note the relative weighting of commodities and durables as well, at 37% and 11%, respectively.

Source: BLS

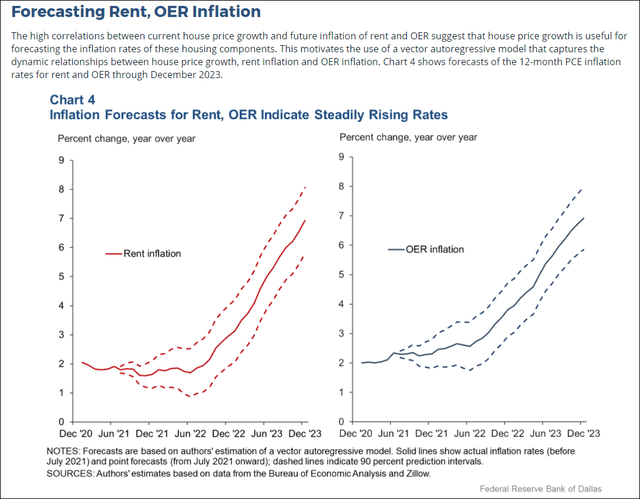

The Dallas Fed recently published an article on the dynamic between home price inflation and rent inflation with a model implying that rent inflation could rise to an average rate near 7% in the coming 1.5 years.

Source: Federal Reserve

Rent inflation is currently 2.1% on a year-over-year basis, so a rise to 7% would mark a 4.9% increase in inflation. With a roughly 33% relative weighting, this 4.9% increase could translate to a 1.6% increase in overall inflation.

Source: BLS, FRED

Looking at one component of inflation, however, is incomplete.

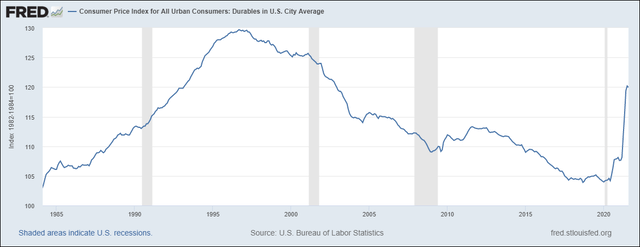

Durable goods inflation has been in secular decline, with prices outright declining for most of the last 20-years.

Durable goods prices spiked during the COVID-recession, mainly due to severe supply chain disruptions.

Source: BLS, FRED

The year-over-year increase in durable goods inflation rose to nearly 15% after spending two decades hovering in negative territory.

If the nominal price of durable goods simply holds flat, the year-over-year change would crash from 15% to 0%.

We already see sharp declines in durable goods inflation in the charts above.

In fact, secular economic trends argue that durable goods inflation will revert to a long-term trend of disinflation or deflation.

If the year-over-year rate of durables inflation falls from 15% to 0%, at an 11% relative weighting, the overall CPI would be dragged lower by 1.65%, totally offsetting the rise in rent inflation.

Source: BLS, FRED

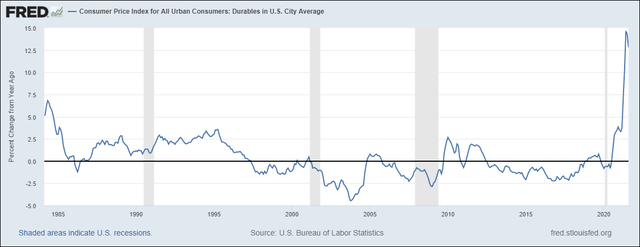

Furthermore, commodity price inflation holds a relative weighting of 37% to headline CPI.

Industrial commodity price growth has already declined from nearly 50% to 30% on a smoothed six-month annualized basis, suggesting that commodity price inflation will have a negative second derivative effect on headline inflation.

Industrial Commodity Price Growth:

Source: CRB, EPB Macro Research

As noted in the September Leading Indicators report, inflation is starting a cyclical downturn.

Inflation has been in a steady upturn since the summer of 2020, but indications are mounting that the peak in inflation is near. Over the next 3-6 months, the rate of inflation is likely to peak and move lower, joining the trend in real economic growth.

Leading indicators of inflation suggest that durable goods inflation and commodity price inflation will continue to decline, more than offsetting the potential rise in rent inflation.

Over the next 3-6 months, the rate of both real economic growth and inflation will trend lower, favoring a defensive asset allocation posture.

____

* If you’re interested in regular updates on the cyclical trends in both growth and inflation, consider our monthly report.

Eric Basmajian

https://www.epbmacroresearch.com/

20210915