Steno Signals – 6 Reasons Why the USD Doom and Gloom is Overdone

“6 Reasons Why the USD Doom and Gloom is Overdone”

**** Find out about the USD’o’meter and how to use it in your allocation with a 14 day FREE Trial here → https://stenoresearch.com/watch-series/usdometer-six-reasons-why-the-usd-doom-and-gloom-is-overdone/

Use the code “crisis20” to get 20% off your first subscription. ****

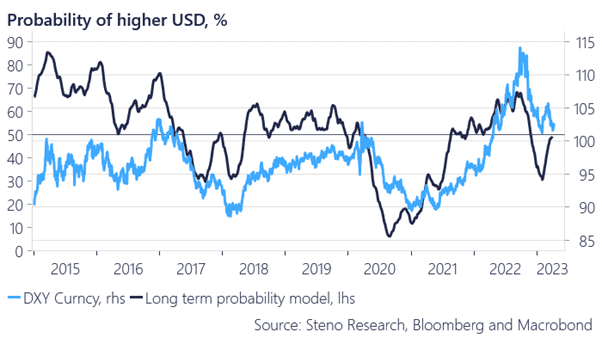

We assess the USD outlook in a structured way in our regular USD’o’meter based on the following six parameters. In this piece, we will elaborate on each of the model parameters and ultimately sum it up in a logistic regression.

- * Technicals

- * ISM – IFO spreads (relative growth)

- * Positioning (% of open interest)

- * Relative rate hike expectations EUR – USD

- * Relative energy prices / Relative banking stress

- * Relative exposure to China

Overall, we find it interesting that the USD has not weakened MORE given the pamphlet of headwinds it has had to deal with in recent months – and statistically the tide is about to turn for the USD in our model framework. Position accordingly?

**** Find out about the USD’o’meter and how to use it in your allocation with a 14 day FREE Trial here → https://stenoresearch.com/watch-series/usdometer-six-reasons-why-the-usd-doom-and-gloom-is-overdone/

Use the code “crisis20” to get 20% off your first subscription. ****

Chart 1: Our logistic USD regression

DISCLAIMER

The content provided in Stenos Signals newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.

20230418