Steno Signals #34 – From a recession to a soft landing to a raging boom in just under one week!

“From a recession to a soft landing to a raging boom in just under one week!”

Economic data is currently all over the place, but the bottom-line is clear. The recession is NOT here, and judging from our probability models it may take another while (at least until Q3).

Happy Sunday folks and welcome to an FREE extract from our flagship editorial Steno Signals out every Sunday. If you want to join the Steno Research family, you can subscribe here → https://stenoresearch.com/subscribe/

It’s been a CRAZY week in global macro with surprises from central banks, key figures and markets. Nothing points to a recession right now, which is an almost bizarre contradiction of the sentiment and positioning entering the year. We have thankfully leaned the right way almost across assets as we highlighted the extreme sentiment and positioning as a reason to worry for macro bears, not least since our models did NOT support a H1-2023 recession – far from it actually.

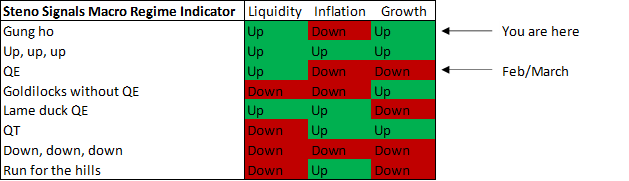

We remain in the “Gung Ho” macro regime in the “Regime Indicator” with 1) added liquidity, 2) waning inflation and 3) a surprise rebound in growth and the only question is which one of the top three tiers of the macro regime indicator that we will place ourselves in during Q1/Q2 – all of the three should leave decent markets ahead for the time being.

We will release our methodical primer on the Macro Regime Indicator next week as we decided to postpone the release due to all of the macro volatility last week. It will include back tests on cross-asset performance during the respective regimes and suggested tactical asset allocation given each regime across asset classes.

This will also be part of our dynamic data dashboard for premium clients shortly. We will have price models across all asset classes, forward looking macro regime indicators with corresponding back tested tactical asset allocation and much more!

Chart 1. Steno Signals Macro Regime Indicator still pointing to solid markets

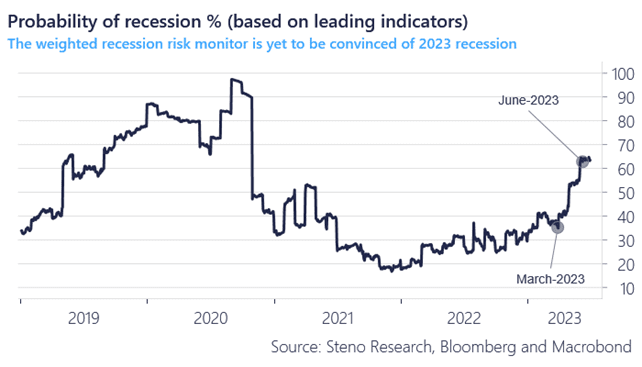

We continue to track leading indicators based on decades of time series studies and how and when to expect a recession given these indicators, and our probability weighted model is not overly convinced (yet).

H1-2023 is still a low risk of recession (meaning that decent growth is likely to take place), while the needle has moved slightly above a coin-toss from Q3 -> onwards.

We have used this extensive lead/lag based model to talk AGAINST the prevailing negativity in asset allocation from the beginning of the year and will continue to monitor risks of a recession relative to the market positioning in equities, fixed income, FX and commodities.

Chart 2. NO recession in H1-2023 according to our extensive data work..

This was an extract of our weekly flagship editorial. We have been leaning long equity risk, long metals, short USD and long bonds from the early parts of 2023 due to our dynamic macro regime indicators, which among other things rely on very detailed liquidity forecasting.

We have thankfully leaned the right way in markets despite all of the recession talk and the extreme pessimism entering 2023. If you want to stay updated and ahead of the curvve, you can find details on how to become a part of Steno Research below.

Step by step: How to become a part of the Steno Research team?

1. Choose one of our offered subscription-packages

- * Basic: Gives access to Steno Signals, The Great Game and Five Things We Watch

- * Premium: Gives access to all of the above, all Watch-series (detailed knowledge on asset allocation) AND our dynamic data-dashboard with price models and asset allocation strategies across assets when it is launched shortly.

2. Subscribe here → https://stenoresearch.com/subscribe/

If you have questions or want to buy a package of licenses and/or live access to the analyst team for your company or institution, please contact info@stenoresearch.com

DISCLAIMER

The content provided in Stenos Signals newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.

20230205