Monday Chart Book – Inaugural Edition!

Monday Chart Book

Charting a New Course

Shutterstock

“The economy may already be in recession.” -The Bond King, Jeff Gundlach, in a podcast his firm, DoubleLine, did last week.

Evergreen Compatibility Survey

Season’s Greetings, all Haymaker readers! As we approach year-end, we are considering changes to our format. Our overriding goal is to provide you with content you highly value. Along these lines, it would be greatly appreciated if you could send us a brief note on what you like and what you don’t like about our current Haymaker publications.

It is our belief — and we’d love to know if many of you concur — that our Charts of the Week is a popular section of our Making Hay Mondays (MHM). In fact, I personally suspect it’s THE most popular aspect of those. Based on that, this week we’re running a full chartbook version of MHM. If we’re wrong, don’t hesitate to let us know.

We’ll divide these into distinct parts, focusing on the usual suspects like the economy, inflation, stocks, bonds, commodities, Fed policies, politics (yuk!), to name just a few. Naturally, there will be commentary from yours truly but, befitting the nature of chartbook missives, it will be concise. So here we go!

The Stock Market

#1

My long-held belief is that 2021 was the peak of Bubble 3.0, the third speculative frenzy of the last quarter-century. In my opinion, it was the craziest of them all which is why I refer to that time as “peak insanity”. (By the way, Bubbles 1.0 and 2.0 were, respectively, tech in the late 1990s and housing from 2002 to 2007.)

One persuasive piece of evidence as to how frenetically reckless the stock market became, particularly post-pandemic, is the number of stocks, mostly on the NASDAQ, that have been crushed since 2021. The “Naz” is, of course, the speculative community’s exchange of choice, at least when it comes to equities (as opposed to cryptos). The fact that there are now 464 stocks trading below $1 is indicative of the dash-to-trash that typified the environment in the stimulus-drenched post-Covid era.

WSJ

WSJ

#2

One of the biggest stock market anomalies right now, at least to the Haymaker, is the relentless strength of the homebuilding sector. Despite a stunning nosedive in confidence by its constituents, an 18% swoon in the price of new homes, widespread interest rate subsidies, an utter collapse in homes available for sale, and appallingly bad affordability, the leading homebuilder stocks have been breaking out to new highs. While it makes little sense to me, I will soon be reducing my personal short position in them. My loss-control discipline when taking a negative stance is to respect multi-year breakouts. (Fortunately, I did cover a large portion of that during their correction earlier this autumn.)

Bloomberg

#3

Another remarkable disconnect between fundamentals and market action involves the retail sector. Last month, the Wall Street Journal ran the following headline: “This Holiday Season Is Looking Ho! Ho! Horrible”. It noted that U.S holiday season growth was projected at a diminutive 1%. Then, last week, it ran the below headline and accompanying chart. It’s clear that retail is another sector that is embracing the soft-landing narrative.

WSJ

WSJ

The Bond Market

#4

With apologies to those who saw the following image during our recent webinar, this is one of the most striking charts I’ve come across regarding the febrile enthusiasm for long-term Treasury bonds right now. If you study this closely, you’ll see that as money has been pouring into the long-duration Treasury ETF (TLT), the price has been consistently falling, at least until very recently.

Presently, this degree of ebullience and over-crowding is highly likely to lead to another price plunge. Similarly, BofA’s uber-perceptive and prolific chart publisher, Michael Hartnett, has recently written that his comprehensive Fund Manager Survey shows institutions are the most exposed to bonds since early 2009, as noted last Friday.

Bloomberg

The Economy and the Jobs Market

#5

It’s no secret I’m in the camp that questions the superficially robust jobs numbers put out by the Bureau of Labor Statistics, or BLS (some might suggest dropping off the “L”). Convincing evidence the BLS is pumping out misleading data — unintentionally, I might add — is that there have been downward revisions for every month this year to its originally and, often, much-hyped initial releases. It is likely it is consistently overestimating the labor market’s strength due to the Birth-Death model the BLS uses to estimate business formations and closures. Regardless of the cause, the reality is that 2023 is the third worst when it comes to year-to-date revisions going back to the early 1970s. (Credit to my amiga Danielle DiMartino Booth for highlighting this visual from none other than the BLS. She has also noted that the Birth-Death adjustments for this year now total 1.3 million jobs, a number that is almost certainly nowhere near reality.)

Booth

#6

Numerous prior Haymakers have contended that Gross Domestic Income (GDI) has historically been more accurate in anticipating economic inflection points than has the more familiar GDP. You might reasonably wonder why that is the case. The main factor might be that in order to spend, a consumer usually needs income first. Thus, incomes trends (GDI) should lead production/spending (GDP). Yet, as we all know, American consumers excel at living beyond their means using credit cards and, more recently, buy now/pay later programs. This may be why GDI and GDP have continued to diverge. This gap has now reached unprecedented levels. In my view, this is unlikely to persist much longer.

Rosenberg

#7

Two industries that tend to pull the economy out of downturns, or drive it into recession, are autos and housing. This is probably because a large number of sub-industries rely on them. Bolstering this view, we recently ran a chart showing the tight linkage between the National Association of Homebuilders Sentiment Index and overall unemployment. As you may recall, it has historically been an extremely tight linkage and, presently, homebuilder sentiment is in a power-dive, as noted above. Considering that intentions to buy cars are at subterranean levels, and housing affordability is as well, this is another reason to be skeptical of the prevailing confidence in those predicting a soft landing.

Rosenberg

Bloomberg

The Federal Fiscal Funding Fiasco (my oft-described 4-F scenario)

#8

Being designated as 4-F for military service back in WWII was a humiliating event (which supposedly haunted Hollywood’s most dashing swashbuckler of that era, Errol Flynn). For the current crop of U.S. policymakers, they should be far more ashamed by the spending situation they’ve created. Nearly all aspiring soldiers were rated 4F through no fault of their own (including Flynn, who had a congenital heart defect). Senior government officials, particularly those in Congress, can profess no such innocence. Their fingerprints are all over the weapons that have murdered America’s fiscal health and integrity.

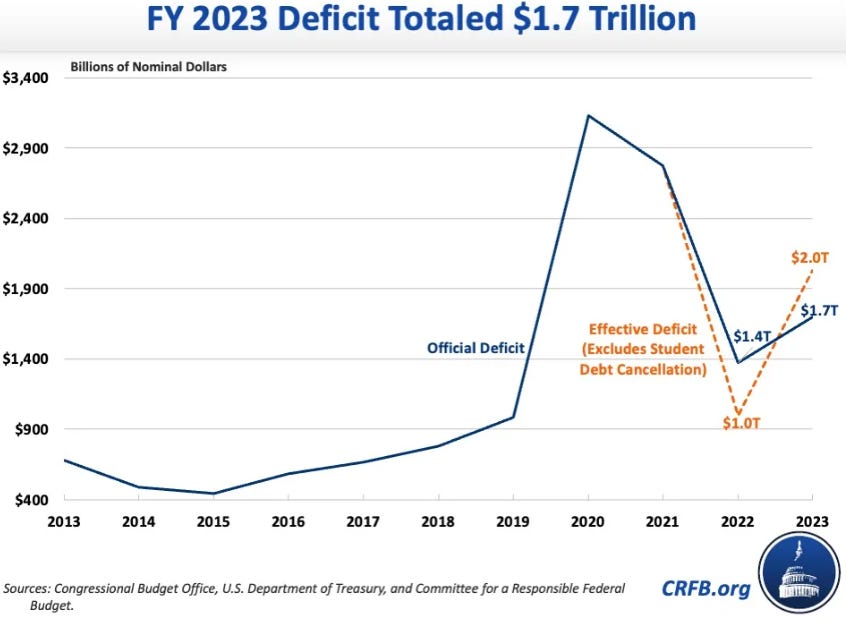

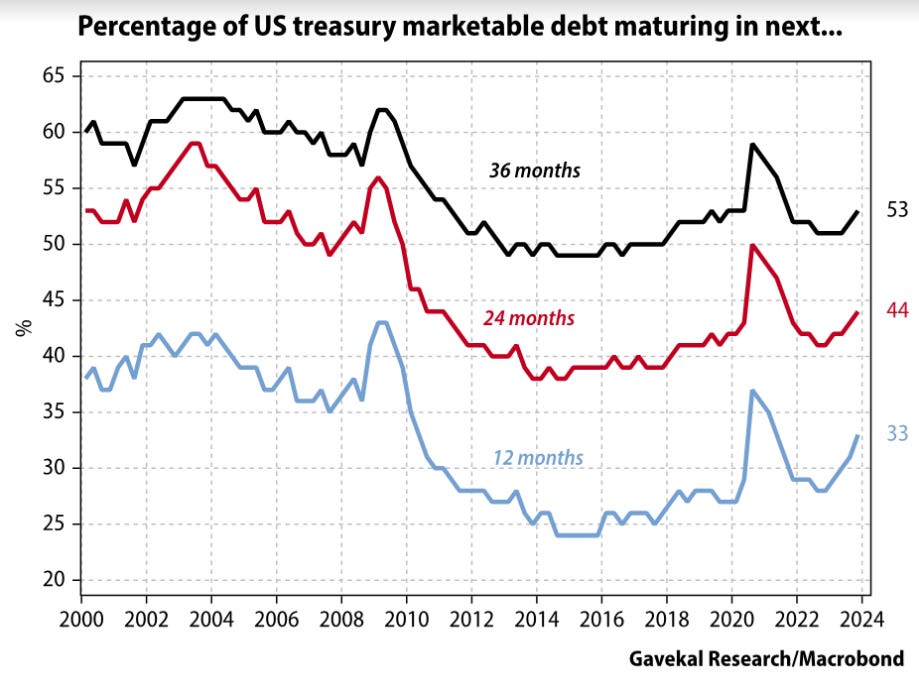

As I’ve written many times before, it is indefensible for the U.S. government to be running $2 trillion annual deficits at a time of sub-4% unemployment. Had rational policies been in place — as opposed to shamefully reckless vote-buying — the deficit should be close to zero right now, if not in surplus. The chickens may soon come home to roost, however, with 44% of Treasury debt maturing over the next two years.

#9

The U.S. is only about 4% of the worlds’ population. Yet, it manages to generate roughly 60% of the planet’s trade deficits. Its budget deficits are a similarly disproportionate 40% of the global total. Consequently, it deserves the unseemly title of Planet Earth’s King of Government debt.

Visual Capitalist

Visual Capitalist

Shutterstock

Now a bonus section for paying subscribers with actionable investment ideas: …

Subscribe to Haymaker to read the rest.

Become a paying subscriber of Haymaker to get access to this post and other subscriber-only content.

A subscription gets you:

| Subscriber-only posts and full archive | |

| Post comments and join the community |

IMPORTANT DISCLOSURES

This material has been distributed solely for informational and educational purposes only and is not a solicitation or an offer to buy any security or to participate in any trading strategy. All material presented is compiled from sources believed to be reliable, but accuracy, adequacy, or completeness cannot be guaranteed, and David Hay makes no representation as to its accuracy, adequacy, or completeness.

The information herein is based on David Hay’s beliefs, as well as certain assumptions regarding future events based on information available to David Hay on a formal and informal basis as of the date of this publication. The material may include projections or other forward-looking statements regarding future events, targets or expectations. Past performance is no guarantee of future results. There is no guarantee that any opinions, forecasts, projections, risk assumptions, or commentary discussed herein will be realized or that an investment strategy will be successful. Actual experience may not reflect all of these opinions, forecasts, projections, risk assumptions, or commentary.

David Hay shall have no responsibility for: (i) determining that any opinion, forecast, projection, risk assumption, or commentary discussed herein is suitable for any particular reader; (ii) monitoring whether any opinion, forecast, projection, risk assumption, or commentary discussed herein continues to be suitable for any reader; or (iii) tailoring any opinion, forecast, projection, risk assumption, or commentary discussed herein to any particular reader’s investment objectives, guidelines, or restrictions. Receipt of this material does not, by itself, imply that David Hay has an advisory agreement, oral or otherwise, with any reader.

David Hay serves on the Investment Committee in his capacity as Co-Chief Investment Officer of Evergreen Gavekal (“Evergreen”), registered with the Securities and Exchange Commission as an investment adviser under the Investment Advisers Act of 1940. The registration of Evergreen in no way implies a certain level of skill or expertise or that the SEC has endorsed the firm or David Hay. Investment decisions for Evergreen clients are made by the Evergreen Investment Committee. Please note that while David Hay co-manages the investment program on behalf of Evergreen clients, this publication is not affiliated with Evergreen and do not necessarily reflect the views of the Investment Committee. The information herein reflects the personal views of David Hay as a seasoned investor in the financial markets and any recommendations noted may be materially different than the investment strategies that Evergreen manages on behalf of, or recommends to, its clients.

Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this material, will be profitable, equal any corresponding indicated performance level(s), or be suitable for your portfolio. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Investors should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

20231211