Mish’s Daily: A Glimpse at the Next 6 Months in the Markets

Mish’s Daily: A Glimpse at the Next 6 Months in the Markets

Written by Michele ‘Mish’ Schneider

With last week’s strong economic stats and inflation basically flatlined, many believe there will be a soft landing and no recession.

However, there are stats that say with the yield curve so inverted (most since 1983), recession can and probably will still happen.

Recession can take time to emerge with expectations that it won’t occur until 2024 or 2025.

First though, we still see stagflation.

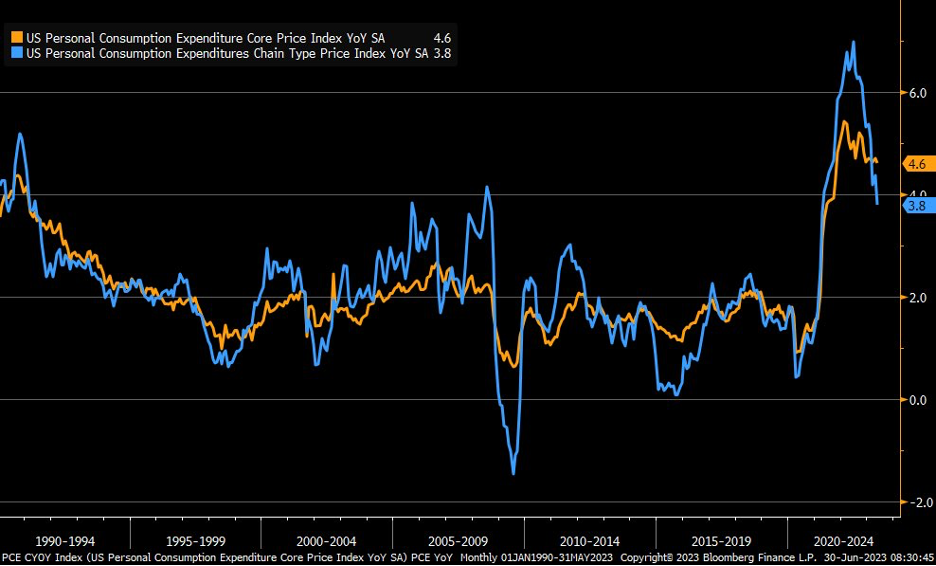

5.4% core CPI in Europe and 4.6% PCE U.S. are just the numbers we need to infer that banks could still raise rates, but the speed (for sure) and perhaps the number of times they raise is coming to an end.

The FED wants a weaker jobs market, and we could see that in the near-future.

Plus, a new round of inflation.

Regardless, the market anticipated a bull run for the first 6 months of the year as it is forward thinking.

The market saw the rate of change for interest rate hikes slowing, the economy most likely not contracting further, inflation potentially peaking and the technology sector cheap and appealing.

We can certainly thank the consumers in large part for the great economic stats as they are the reason the market and economy have been stronger. YOLO?

If we had to define current sentiment into two categories, it appears anger (France) and fatalism (YOLO) win. However, now that GDP rose for 3 quarters consecutively, one must wonder whether the market will continue to project further economic strength for the second 1/2 of the year.

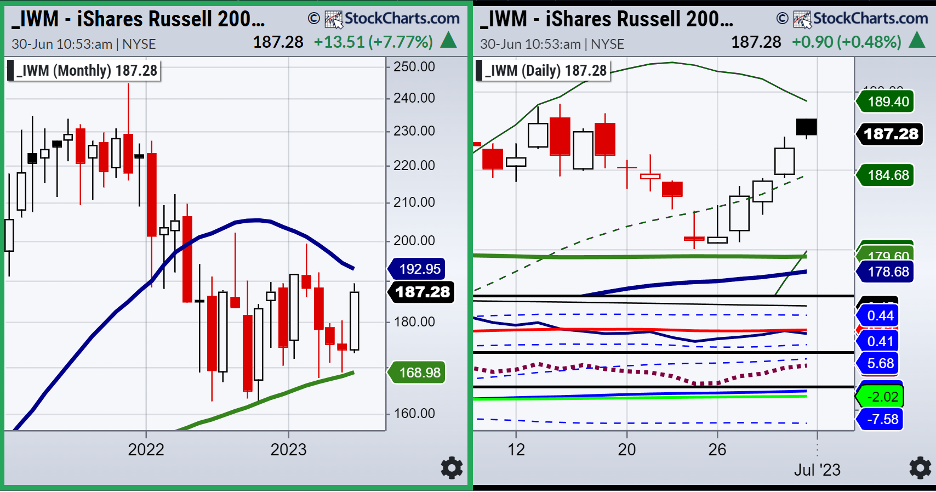

In the case of small caps, a trading range prevails, which means we need to see small caps show new leadership to remain bullish.

We also need to see other consumer areas surface besides the large rallies thus far in airlines and cruise ships.

On the monthly chart, IWM has yet to demonstrate any real expansion.

On the Daily chart, the middle chart or our Leadership Indicator has IWM underperforming the S&P 500 benchmark.

The Real Motion or momentum indicator at the bottom illustrates a bullish divergence. Hence, IWM must get moving in price for a more roseate second ½ of the year setup.

Now, add in the uncertainties around the world such as weather (drought and floods), Russia (is it over?), China (more chip wars) global inflation (still sticky), supply chain (de-globalization), labor (wages rising), and social unrest (France)

And the one-way call for disinflation seems way too one-way.

Flexible and active traders will prevail for the next 6 months.

Other than some volatility in the commodities area along with the recent healthy correction, we still maintain a stagflation environment will persist until 2025. Looking at the 30-year cycles in commodities versus stocks (going back to 1933), the next 15 years starting this week, are projected to see commodities outperforming by potentially more than 3:1

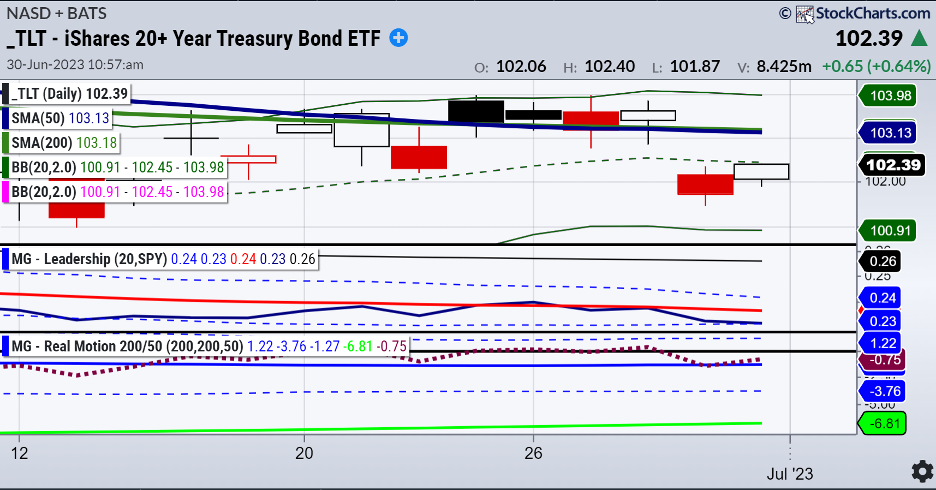

We are watching the 20+ year long bonds (TLT) for clues.

So far, the bonds have not moved much.

A rally from current levels (over 104) and we will become more defensive in equities. And most likely more friendly to commodities and precious metals.

Finally, we have eyes on the U.S. Dollar versus the Euro.

The dollar stopped right at the resistance level of .92.

Under .90, we would expect more dollar weakness.

Last week’s Daily’s were filled with trading ideas including in the oil, energy, materials, and transportation sectors. Don’t miss a Market Beat-sign up for the free updates now!

For more detailed trading information about our blended models, tools, and trader education courses, contact Rob Quinn, our Chief Strategy Consultant, to learn more.

You don’t want to miss Mish’s 2023 Market Outlook E-available now

NOT TOO LATE Click here if you’d like a complimentary copy of Mish’s 2023 Market Outlook E-Book in your inbox.

Get your copy of “Plant Your Money Tree: A Guide to Growing Your Wealth”

Grow Your Wealth Today and Plant Your Money Tree!

“I grew my money tree and so can you!”- Mish Schneider

Mish in the Media

Benzinga Pre-Market Prep 06-30-23

CNBC Asia Short Clip 06-29-23

StockchartsTV Final Bar 06-27-23

Business First AM 06-27-23

Kitco Failed insurrection in Russia Interview 06-25 2023

Complete Trader Live Coaching 06-22-23

Stockcharts Your Daily 5 Where to Have Skin in the Game 06-23-23

Tricks of the Trade: Interviews with world-class traders PDF

CMC Markets Daytrading Forex, Metals, Grains and Dow 06-22-23

Dale Pinkert FACE 06-22-23

Making Money with Charles Payne Fox Business 06-19-23

Coming Up:

July 6 Yahoo Finance

July 7 TD Ameritrade

ETF Summary

S&P 500 (SPY) Needs one more push or begins to look a bit toppy based on lethargic momentum

Russell 2000 (IWM) 190-193 still the overhead resistance to clear

Dow (DIA) 33,500 major support to hold

Nasdaq (QQQ) Still working off a reversal top until it takes out 372.85

Regional banks (KRE) Need a new move over 42

Semiconductors (SMH) 150 support

Transportation (IYT) 250 resistance and a potential correction /mean reversion in store

Biotechnology (IBB) 121-135 range

Retail (XRT) 63 support

20230701