Mish’s Daily: 4 of the 6 Economic Modern Family Members Trending

Mish’s Daily: 4 of the 6 Economic Modern Family Members Trending

Written by Michele ‘Mish’ Schneider

MarketGauge has several quantitative trading models.

We use our own proprietary indicator to rank the strongest performers in all the models.

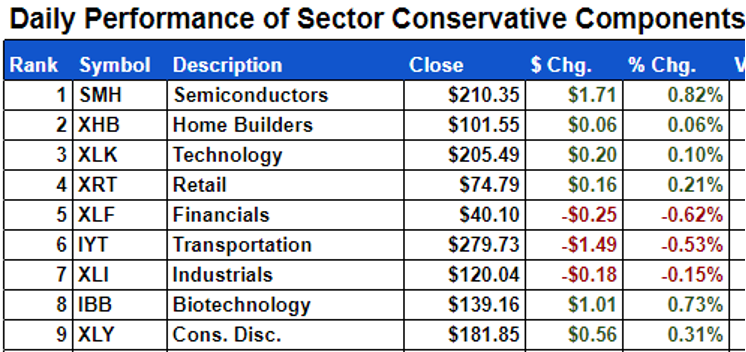

This model is our Sector Rotation Portfolio with conservative risk parameters.

The top TSI ranking sector is and remains Semiconductors-or Sister Semiconductors in the Economic Modern Family.

You can see number 2 and 3-homebuilders and technology.

Technology is close enough to semiconductors.

Homebuilders are not in the Family as they are important, but not the most salient aspects of the US Economy.

The FOURTH ranking sector though, is our Granny Retail. Last nights Daily covered why that is so important to the overall macro.

And what is also exciting is that Transportation or our Tran member is number 6 and Brother Biotechnology is number 8.

That makes four of the six members on the top 10 of the trend strength rankings.

Why is this so exciting?

I created the characters in 2016. The Family represents the economy for sure, but also the market.

The market is often 6 months ahead of the economic statistics. The Family is the best leading indicator as it reflects the market but also tells us what to expect going forward.

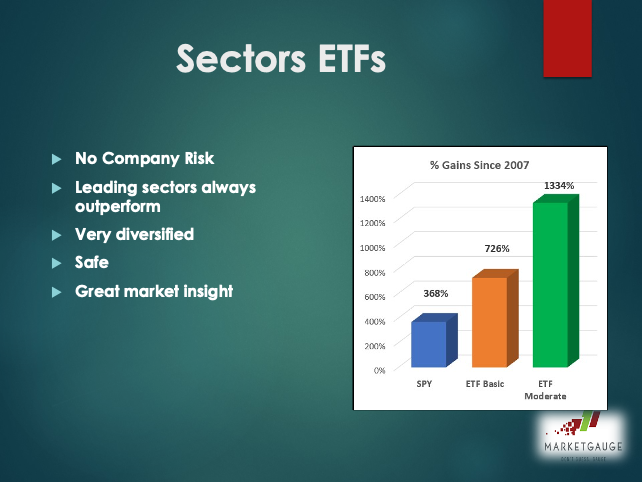

As our Sectors ETF model has well outperformed since 2007, naturally since the Modern Family has made the cut, means that they too can begin to outperform.

“Leading sectors always outperform” is the basis of our quants.

And it is the basis of why we use the Family to gauge how the market will do (and the economy).

We already know how powerful the move in SMH or semiconductors has been to date. Imagine if Granny Retail, Biotechnology, Transportation and even Financials continue up the TSI ranking food chain?

For more detailed trading information about our blended models, tools, and trader education courses, contact Rob Quinn, our Chief Strategy Consultant, to learn more.

Get your copy of “Plant Your Money Tree: A Guide to Growing Your Wealth”

Grow Your Wealth Today and Plant Your Money Tree!

“I grew my money tree and so can you!”- Mish Schneider

Mish in the Media

CMC Markets Technical Set-up in gold, silver, Nvidia and SPX 2-20-24

Business First AM Mish lays out the 3 major criterial and teach you tactical/practical ways to assess a top (all in 3 minutes). HYG IWM January calendar range When Is It Time To Take Profits? 02-20-24

Final Bar with Dave Keller StockChartsTV Guest Mish breaks down the four charts she’s watching during a market pullback and why she remains constructive on stocks 02-14-24

Business First AM Check out Mish’s newest stock pick to keep on your radar 02-13-24

BNN Bloomberg Valentines Day-What stocks do you love, want to marry, regret not holding 02-12-24

Financial Sense with Jim Pupluva Credit card balances for US consumers are climbing. Is this yet a concern for the market and economic outlook? 02-07-24

The Money Life with Chuck Jaffee Where Mish sees the markets going in the short and longer term 2024 podcast 02-06-24

Benzinga Morning Pre Market Mish sits with the team to discuss the recent job report and how a healthy economy is not the worst thing. It just means a reset of how investors invest 02-02-24

Kitco News An Article with Neils Christensen on the direction for gold 01-30-24

Coming Up:

February 29 Yahoo Finance

February 29 Your Daily Five Stockcharts

March 1 Real Vision 3 Crypto Trades

March 6 Trader’s Summit

March 8 Schwab

Weekly: Business First AM, CMC Markets

ETF Summary

S&P 500 (SPY) 500 support 510 resistance

Russell 2000 (IWM) 195 support 205 to clear

Dow (DIA) 385 pivotal

Nasdaq (QQQ) 430 support

Regional banks (KRE) Back to the 45-50 range

Semiconductors (SMH) 200 support

Transportation (IYT 276 should hold

Biotechnology (IBB) Looking at 140-142 next levels to clear

Retail (XRT) 75.50 2023 high cleared, now needs to hold

iShares iBoxx Hi Yd Cor Bond ETF (HYG) 77 big number to hold

20240228