Making Hay Monday – September 5th, 2023

Making Hay Monday

High-level macro-market insights, actionable economic forecasts, and plenty of friendly candor to give you a fighting chance in the day’s financial fray.

(Special note: The three-day weekend gave me a chance to create a somewhat longer article and on a topic I’ve been meaning to address. The main message is that there is hope for America to restore its finances to some semblance of respectability… and sustainability. To aid those who prefer a shorter read, we’ve bold-fonted the sections that we feel are the most critical. We will run the follow-up to the Kevin Muir note on the bond market next week.)

Charts of the Week

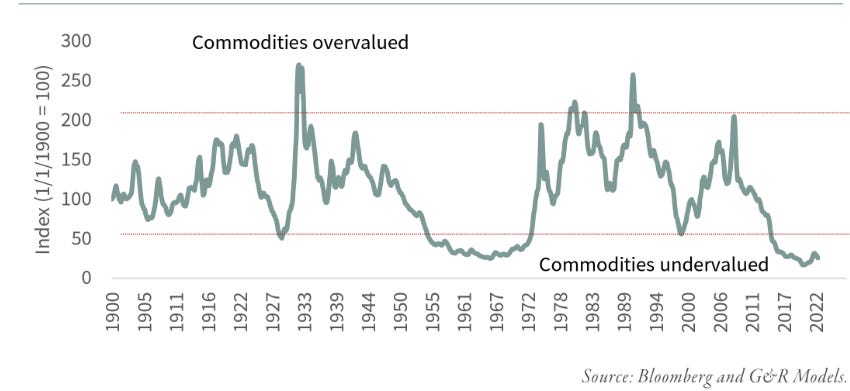

It’s fortuitous for investors who believe natural resource-based investments are among the best positioned to benefit from current macro trends that they remain extremely undervalued. This is particularly true versus the U.S. stock market. Today’s Making Hay (Almost) Monday edition explores the demographic forces that are likely to cause a drastic shift in the dynamics that have heretofore favored growth stocks, like the Magnificent Seven, and U.S. Treasury bonds. This transition thus far seems dimly perceived by the majority of investors. In my view, that significantly enhances the investment opportunity.

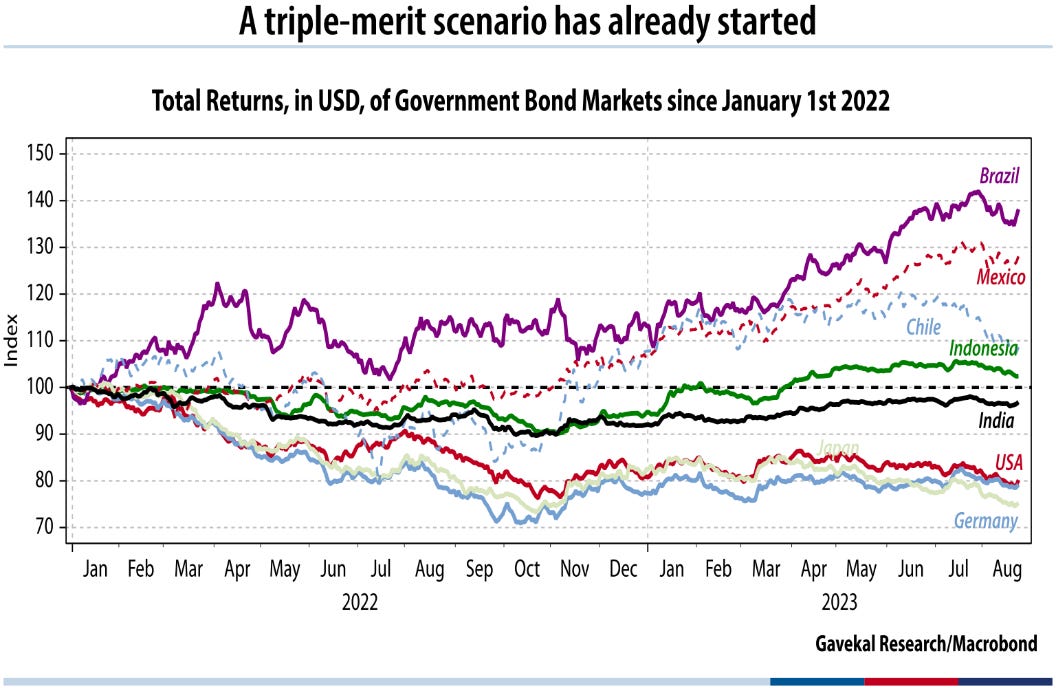

Bonds from the stronger emerging markets (EM) have been a favored asset class of this newsletter over the last two years. EM debt was also recommended in my book Bubble 3.0 which was digitally published in early 2022. Despite one of the worst bond bear markets in history last year, this has been a rewarding stance. The strength of the U.S. dollar against many currencies since 1/1/2022 makes this performance even more notable. (As I’ve admitted before, my worst call of 2022 was my anticipation of a weak dollar; however, it did fall against some of the EM currencies, a positive contributing factor to the returns shown above.) Compared to U.S. Treasurys and German government bonds (bunds), EM debt has massively outperformed.

Myopia in Utopia?

“The old American republic is collapsing. And a new American republic, as yet unrecognizable, is under construction.” -Bestselling author and demographic expert, Neil Howe.

Referring to America these days as utopian seems borderline absurd. Not to disrespect our beloved nation, but I think most citizens would see the word and immediately swap the “u” for a “dys” to better reflect how they presently see the country. Sadly, it wasn’t that long ago (like the end of the 1990s) when the former version could have been legitimately bandied about.

Not yet a paid Haymaker subscriber? Complete the brief survey linked below and we’ll set you up with a 90-day trial at no cost.

Costly foreign wars, over $100 trillion in unfunded entitlements, and a reliance on Bubblenomics — inflating asset prices to extreme levels via the Fed’s Magical Money Machine — have left the U.S. in arguably the most precarious financial condition of its 250-year history. Frankly, I don’t think there’s much arguing about it – America’s government is as bankrupt as that trucking company famous for its yellow vehicles. (Fortunately, the private sector is a much different — and superior — story, as I will soon cover.)

Yellow is also the relevant color for our current collection of political leaders, who have only excelled at leading us deeper and deeper into a national debt crisis. Fortunately, though, there are solutions available if our policymakers are willing to face reality and capitalize on America’s myriad strengths. Yes, a mammoth “if”, I realize.

As some of you are aware, I’m in the process of reading famed demographer Neil Howe’s latest bestseller, The Fourth Turning Is Here. For those who’ve never read his various books or heard him speak, Mr. Howe has done voluminous research on generational cycles and the master cycle, or saeculum, within which these fall.

Saeculum is an ancient Latin word (actually, Etruscan, a Roman precursor) that basically measured the longest a human lived in a given society. It roughly equates to 80 to 100 years. This is lengthy enough to cover four different generations, a critical part of Neil Howe’s way of looking at history and the surprisingly repetitive cycles of life. The formidable historian Arthur Toynbee expressed similar views a century earlier: “Underlying this periodicity, the workings of a Generation Cycle, a rhythm in the flow of Physical Life” which had “imposed its dominion on the Spirit of Man.”

Another historian, Quincy Wright, observed war’s persistent periodicity, according to Mr. Howe. Ominously, major wars that occur every 70-90 years are a major focus in The Fourth Turning Is Here.

Noting the parallel with nature, Neil Howe wrote:

The fourfold rotation of phases resembles the ritualized season of nature: a springlike era of growth followed by a summerlike era of jubilation, and an autumnal era of fragmentation followed by a wintery death—and regeneration.

For those who find themselves increasingly in the throes of despair, note the regeneration aspect. In my opinion, if there is any country on Earth with the ability to dynamically regenerate, it is America. To do so, however, we need to stop being a nation of lions led by donkeys.

IMPORTANT DISCLOSURES

This material has been distributed solely for informational and educational purposes only and is not a solicitation or an offer to buy any security or to participate in any trading strategy. All material presented is compiled from sources believed to be reliable, but accuracy, adequacy, or completeness cannot be guaranteed, and David Hay makes no representation as to its accuracy, adequacy, or completeness.

The information herein is based on David Hay’s beliefs, as well as certain assumptions regarding future events based on information available to David Hay on a formal and informal basis as of the date of this publication. The material may include projections or other forward-looking statements regarding future events, targets or expectations. Past performance is no guarantee of future results. There is no guarantee that any opinions, forecasts, projections, risk assumptions, or commentary discussed herein will be realized or that an investment strategy will be successful. Actual experience may not reflect all of these opinions, forecasts, projections, risk assumptions, or commentary.

David Hay shall have no responsibility for: (i) determining that any opinion, forecast, projection, risk assumption, or commentary discussed herein is suitable for any particular reader; (ii) monitoring whether any opinion, forecast, projection, risk assumption, or commentary discussed herein continues to be suitable for any reader; or (iii) tailoring any opinion, forecast, projection, risk assumption, or commentary discussed herein to any particular reader’s investment objectives, guidelines, or restrictions. Receipt of this material does not, by itself, imply that David Hay has an advisory agreement, oral or otherwise, with any reader.

David Hay serves on the Investment Committee in his capacity as Co-Chief Investment Officer of Evergreen Gavekal (“Evergreen”), registered with the Securities and Exchange Commission as an investment adviser under the Investment Advisers Act of 1940. The registration of Evergreen in no way implies a certain level of skill or expertise or that the SEC has endorsed the firm or David Hay. Investment decisions for Evergreen clients are made by the Evergreen Investment Committee. Please note that while David Hay co-manages the investment program on behalf of Evergreen clients, this publication is not affiliated with Evergreen and do not necessarily reflect the views of the Investment Committee. The information herein reflects the personal views of David Hay as a seasoned investor in the financial markets and any recommendations noted may be materially different than the investment strategies that Evergreen manages on behalf of, or recommends to, its clients.

Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this material, will be profitable, equal any corresponding indicated performance level(s), or be suitable for your portfolio. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Investors should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

20230906