Making Hay Monday – October 30th, 2023

Making Hay Monday

High-level macro-market insights, actionable economic forecasts, and plenty of friendly candor to give you a fighting chance in the day’s financial fray.

Charts of the Week

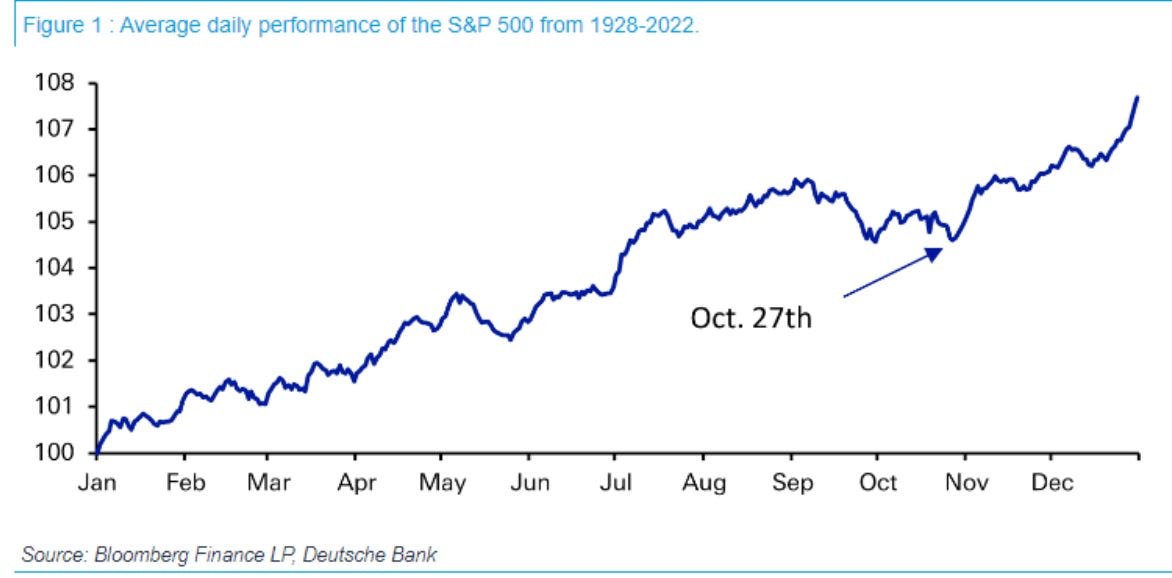

- This year has not brought the typical October rally. That may be a function of the gravitational pull from dramatically higher long-term Treasury yields. It could also be the result of a rising number of disappointing earnings reports (though there have also been some high- profile positive surprises, such as Amazon). Because stocks and bonds are both seriously oversold, a near-term bounce is probable. As you can see in the Jim Reid/Deutsche Bank visual below, the seasonal tendency for stocks to perk up between now and the end of the year is impressive. Consequently, doing a bit of buying now, while retaining a considerable cash reserve, is reasonable.

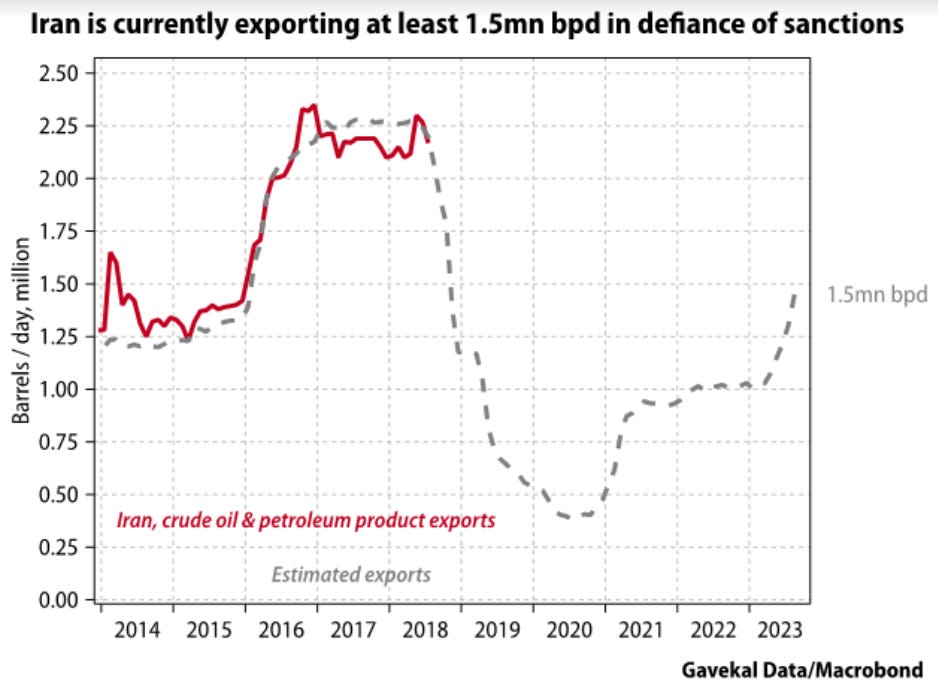

- Oil prices have failed to sustain their initial spike in the immediate aftermath of the heinous attack by Hamas on Israeli citizens. Fortunately, so far, this has only led to sporadic attacks by Iranian proxies. Regardless, in the near future, the Biden administration may turn its attention to the 1.5 million barrels/day that Iran is exporting over its sanction limits. This is despite the former’s desire to prevent gasoline prices from surging during the year leading up to the next U.S. presidential election.

Evergreen Compatibility Survey

“Last week represented a tipping point in the relationship between financial markets and the US economy. Instead of strong economic and earnings data sending stocks higher and bonds lower, the opposite occurred. The key catalyst was earnings outlooks. The breadth of disappointing earnings guidance was so prevalent, it was hard to miss.” -JonesTrading’s Mike O’Rourke

“… things always change, it’s simply our reluctance to accept that inconvenient truth that causes us problems. And, while that’s a trait common to humanity in every area of its existence, perhaps nowhere is that truer or more dangerous than in the world of finance.” -Friend of the Haymaker, Grant Williams

The Boom Before the Gloom?

These are unquestionably strange times. Third quarter U.S. economic growth appears to be coming in between 4% and 5%. Either is an exceedingly vibrant reading. Yet, the stock market is cracking, and at a time of the year when it is typically in rally mode.

It’s certainly possible that the usual October rally is simply being delayed by the agony in the long-term Treasury bond market. It’s also highly likely that a vigorous recovery in U.S. Treasurys (USTs) should produce a snapback in stocks. Based on the highly oversold status of USTs, that’s a distinct possibility.

However, a more enduring rally in extended maturity USTs is challenged by the abovementioned economic buoyancy. Moreover, that 4% to 5% growth rate is exclusive of inflation. This is the standard “real GDP” statistic. Including inflation, otherwise known as nominal GDP, the number is in the 7% to 8% range, potentially even higher.

Last week, while on “vacation”, I listened to a podcast by my great mate Grant Williams, who, coincidentally, graciously hosted my wife and our youngest son’s family on lovely Kiawah Island, South Carolina. Grant recently recorded an interview with one of the smartest macroeconomic thinkers I know of, James Aitkin. In it, James repeatedly made the case that nominal GDP is what truly matters when it comes to economic activity. In his view, it’s the quantity of dollars coursing through the economy’s system that dictates factors such as consumer confidence and Corporate America’s hiring and investing plans.

Similarly, another brainy financial media type, Ben Hunt, observed that when you’ve got 8% nominal GDP growth, it’s totally inconsistent with the Fed’s 2% inflation target. In other words, perhaps the stock market’s recent travails are a function of too much of a good thing.

That’s certainly possible as this situation puts upward pressure on long-term interest rates. It also makes the Fed much less inclined to engage in what almost all of Wall Street is yearning for: the start of an interest rate cutting cycle.

In reality, that’s as unhelpful to stocks and the economy as the un-inversion of the yield curve. History is clear: When the Fed begins aggressively easing, which in turn causes the yield curve to normalize (short rates falling back below long rates), the really serious trouble for stocks and the economy ensues.

For now, though, due to the strength of the third quarter’s economic numbers, “higher for longer” is a potentiality about which stock market bulls are beginning to have an uncomfortable epiphany. The normalization of the yield curve is also not going according to their plans. Instead of that happening due to falling short rates in response to aggressive Fed easing (think 2002 and 2007), the un-inversion has been a result of the radical rise by longer rates. This is a so-called “bear steepener” because it reflects a bear market in long bonds. That’s definitely not the outcome for which bulls have been ardently hoping.

Consequently, I’m in an odd situation. This is because I remain extremely skeptical the economy is nearly as virile as the government bean counters believe it is. Maybe I’m just being stubborn, but when I look at most of the earnings reports coming out for the third quarter they don’t look all that toasty. In fact, a growing number look to be quasi-recessionary.

Subscribe to Haymaker to read the rest.

Become a paying subscriber of Haymaker to get access to this post and other subscriber-only content.

A subscription gets you:

| Subscriber-only posts and full archive | |

| Post comments and join the community |

IMPORTANT DISCLOSURES

This material has been distributed solely for informational and educational purposes only and is not a solicitation or an offer to buy any security or to participate in any trading strategy. All material presented is compiled from sources believed to be reliable, but accuracy, adequacy, or completeness cannot be guaranteed, and David Hay makes no representation as to its accuracy, adequacy, or completeness.

The information herein is based on David Hay’s beliefs, as well as certain assumptions regarding future events based on information available to David Hay on a formal and informal basis as of the date of this publication. The material may include projections or other forward-looking statements regarding future events, targets or expectations. Past performance is no guarantee of future results. There is no guarantee that any opinions, forecasts, projections, risk assumptions, or commentary discussed herein will be realized or that an investment strategy will be successful. Actual experience may not reflect all of these opinions, forecasts, projections, risk assumptions, or commentary.

David Hay shall have no responsibility for: (i) determining that any opinion, forecast, projection, risk assumption, or commentary discussed herein is suitable for any particular reader; (ii) monitoring whether any opinion, forecast, projection, risk assumption, or commentary discussed herein continues to be suitable for any reader; or (iii) tailoring any opinion, forecast, projection, risk assumption, or commentary discussed herein to any particular reader’s investment objectives, guidelines, or restrictions. Receipt of this material does not, by itself, imply that David Hay has an advisory agreement, oral or otherwise, with any reader.

David Hay serves on the Investment Committee in his capacity as Co-Chief Investment Officer of Evergreen Gavekal (“Evergreen”), registered with the Securities and Exchange Commission as an investment adviser under the Investment Advisers Act of 1940. The registration of Evergreen in no way implies a certain level of skill or expertise or that the SEC has endorsed the firm or David Hay. Investment decisions for Evergreen clients are made by the Evergreen Investment Committee. Please note that while David Hay co-manages the investment program on behalf of Evergreen clients, this publication is not affiliated with Evergreen and do not necessarily reflect the views of the Investment Committee. The information herein reflects the personal views of David Hay as a seasoned investor in the financial markets and any recommendations noted may be materially different than the investment strategies that Evergreen manages on behalf of, or recommends to, its clients.

Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this material, will be profitable, equal any corresponding indicated performance level(s), or be suitable for your portfolio. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Investors should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

20231031