Making Hay Monday – November 6th, 2023

Making Hay Monday

High-level macro-market insights, actionable economic forecasts, and plenty of friendly candor to give you a fighting chance in the day’s financial fray.

Charts of the Week

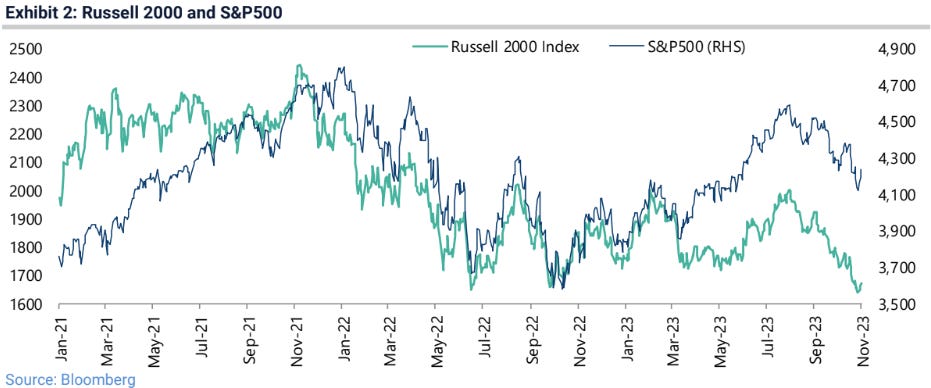

Last Friday’s Haymaker made the point that small cap stocks and the banking sector have dramatically trailed the S&P in recent years. Lest you think I was overstating this case, please see the below images. They did snap back smartly during the recent rally in stocks and bonds; despite attractive valuations, I’d be careful chasing them, given the magnitude of the move.

Despite widespread views that there are no serious storm clouds on the economic horizon, corporate commentaries both in the U.S. and Europe are much less sanguine. In fact, worries over demand have exceeded the level seen during the Great Recession.

Evergreen Compatibility Survey

Mind the Megatrends

“Wars are inflationary.” -Louis Gave

“When rates were practically zero, every Tom, Dick, Harry, and Mary in the United States refinanced their mortgage,” Druckenmiller said. “Unfortunately, we had one entity that did not, and that was the US Treasury.”

“If there’s one thing today’s Fed Chairman Jermone Powell doesn’t want to be known as, it’s another Burns.” –Barron’s Kenneth Pringle, referring to the Fed chairman for most of the 1970s, Arthur Burns

Among the global investment community’s most widely held beliefs is that central banks are winning — or, even, have won — the war against inflation. The lone exception is, ironically, in Japan. The irony stems from the reality that, for decades, Japanese policymakers have struggled against deflation, mostly in vain. Lately, though, Japan is now the land of the rising CPI.

It’s unquestionable that inflation in the West has been easing from its stunning peaks in 2021 or 2022, depending on the country. As noted in prior Haymakers, a wicked bear market in commodity prices since early last year has lent central banks a tremendous and largely unexpected assist. Weakening global economic activity has also aided their efforts, despite the oft-publicized view of a resilient — or, to some, booming — U.S. economy. The fact of the matter is that international trade is extremely flaccid, as evidenced by the implosion in shipping rates. Another irrefutable data point is that maritime transportation powerhouse Maersk just announced 10,000 job cuts.

The bullish counterargument is that the Atlanta Fed’s GDPNow pretty much nailed it with its Q3 forecast of 5%-type growth. That struck me and other more high-profile financial commentators as implausibly high. Score one for the Atlanta Fed. However, what’s getting very little press is its projection of a Q4 GDP increase of just 1%. That’s not very soft-landing-like, and it raises the risks that an actual recession might be fanning out from international trade and the manufacturing sector to the ultra-critical U.S. consumer. The latter seems to be the Atlas of the global economy, carrying the planet’s economic vitality on its shoulders. Ergo, it better not shrug under the weight of its burden.

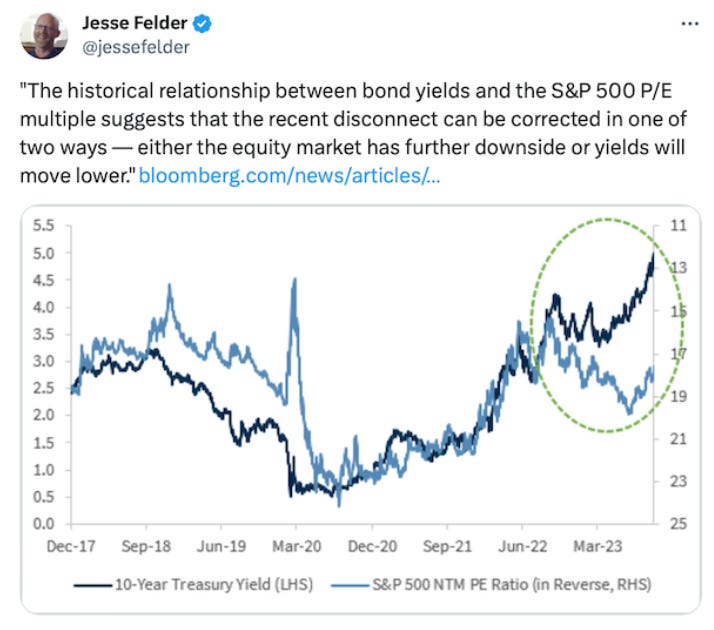

The recent key manufacturing PMI was shockingly weak, helping to fuel the bond market rally that began in late October. (Friday’s Services PMI release was also a dud.) The bounce in bonds was one of the main catalysts of the concurrent recovery in stocks which had been on their heels since mid-summer. But this could be a classic case of be careful what you wish for, because you might get it good and hard — as in, the dreaded hard landing.

That’s not the prevailing zeitgeist; rather, the consensus assumption is of a not-too-hot, not-too-cold scenario, otherwise known as Goldilocks. But those are very low–probability outcomes, particularly with interest rates still highly elevated, notwithstanding the recent bond market snapback. Debt levels are also dangerously inflated for a multitude of companies and individuals. Of course, the most egregiously indebted entity is the federal government.

Unfortunately, there is little hope the current inexcusable $2 trillion federal deficit will improve. In fact, it may well worsen due to soaring interest costs and rapidly rising military expenditures. Treasury Secretary Janet Yellen recently reassured that America can afford to support both Ukraine andIsrael. That might be comforting, except that this is the same individual who totally whiffed on the chance to lock in nearly zero interest rates for a decade or more back in 2020 and 2021.

This has enraged the outspoken and often-prescient Stanley Druckenmiller. (He is a self-made billionaire, by the way, much of it produced by betting against half-witted government policies.) Last week, he riffed on this inexcusable failure to employ the most basic financial common sense, as follows: “I think… if you go back to Alexander Hamilton, it was the biggest blunder in the history of the U.S. Treasury.”

Of course, the federal government has been able to live way beyond its means for the last 15 years. The assumption by the professional pundits is that this can continue indefinitely (though, the almost always bullish Ed Yardeni is one of the few to be expressing serious doubts). But what’s different is that both the U.S. government’s debts and interest costs have gone postal. Adding in the cost of supporting two beleaguered allies is concerning enough, but what happens if we do experience the first real recession in 15 years?

The answer is unquestionably that federal deficits will go much higher, potentially doubling. That would be $4 trillion in annual red ink.

The natural assumption is that in recessions interest rates will plunge across the Treasury yield curve. Yet, Stan Druckenmiller begs to differ. He’s massively long short-Treasurys, and still at least somewhat short long-term Treasurys in his personal account. (A quick Google search reveals he’s worth north of $6 billion; thus, we’re likely talking serious money.) You may notice that’s a stance I’ve long been advocating; it’s worked extremely well for Evergreen clients and in my own portfolio (which is just a tad smaller than Stan’s!)

The reality is that the U.S. government can’t allow interest rates to rise to a level that enables the market to clear at the kind of supply/issuance we’re looking at now, much less in a recession-driven budget blow-out. So, what likely happens next?

First, the Fed will need to stop QT, its Treasury bond selling program that is supposed to total in the trillions. (In my view, it will never get close to that target). Second, there will be intense political pressure on the Fed to restart QE, what I’ve long called its Magical Money Machine.

This is why I have a hard time — make that, impossible time — believing inflation will stay down longer term. Yes, it can continue to cool in the short run, just as it did during the recessions of the 1970s. But that’s likely to be a fleeting interlude during which wise and agile investors should be reducing their exposure to even higher interest rates, at least on long-duration debt.

To give you some intel on this from sources more credible than yours truly, we’re sharing with our paying subscribers a bonus article today, one from a familiar source, my good friend Vincent Deluard, Director – Global Macro Strategy at StoneX. As I’ve often expressed, Vincent is one of the brightest big-picture strategists I know. That’s a view shared by my partner, Louis Gave, often referred to as the smartest man in Asia.

In the accompanying piece, Vincent is doing a deep dive into the reasons why he sees persistent inflation through the balance of this decade. It’s my belief that his logic is much closer to reality than those who expect a return to the economic conditions that have prevailed for most of the past 40 years.

Here’s one snippet to motivate you to check out the full piece:

Secular* inflation arises when great powers compete rather than cooperate. When institutions are perceived as illegitimate. When social trust ebbs. When stores of value and reserve currencies are challenged. When political parties are decaying, and elections are contested. When governments and experts are not trusted. When society splinters into rival tribes. When young men fail to find their place in society.

Does that sound to you like a description of the world we live in today? It sure does to me and, for now, I don’t see viable solutions on the horizon. To quote another brilliant man, Neil Howe, “The Fourth turning Is Here”. It’s fair to say that all those points described by Vincent above are classic Fourth Turning indicators. Invest accordingly.

*Secular is financial jargon for structural or long-lasting. …

Subscribe to Haymaker to read the rest.

Become a paying subscriber of Haymaker to get access to this post and other subscriber-only content.

A subscription gets you:

| Subscriber-only posts and full archive | |

| Post comments and join the community |

IMPORTANT DISCLOSURES

This material has been distributed solely for informational and educational purposes only and is not a solicitation or an offer to buy any security or to participate in any trading strategy. All material presented is compiled from sources believed to be reliable, but accuracy, adequacy, or completeness cannot be guaranteed, and David Hay makes no representation as to its accuracy, adequacy, or completeness.

The information herein is based on David Hay’s beliefs, as well as certain assumptions regarding future events based on information available to David Hay on a formal and informal basis as of the date of this publication. The material may include projections or other forward-looking statements regarding future events, targets or expectations. Past performance is no guarantee of future results. There is no guarantee that any opinions, forecasts, projections, risk assumptions, or commentary discussed herein will be realized or that an investment strategy will be successful. Actual experience may not reflect all of these opinions, forecasts, projections, risk assumptions, or commentary.

David Hay shall have no responsibility for: (i) determining that any opinion, forecast, projection, risk assumption, or commentary discussed herein is suitable for any particular reader; (ii) monitoring whether any opinion, forecast, projection, risk assumption, or commentary discussed herein continues to be suitable for any reader; or (iii) tailoring any opinion, forecast, projection, risk assumption, or commentary discussed herein to any particular reader’s investment objectives, guidelines, or restrictions. Receipt of this material does not, by itself, imply that David Hay has an advisory agreement, oral or otherwise, with any reader.

David Hay serves on the Investment Committee in his capacity as Co-Chief Investment Officer of Evergreen Gavekal (“Evergreen”), registered with the Securities and Exchange Commission as an investment adviser under the Investment Advisers Act of 1940. The registration of Evergreen in no way implies a certain level of skill or expertise or that the SEC has endorsed the firm or David Hay. Investment decisions for Evergreen clients are made by the Evergreen Investment Committee. Please note that while David Hay co-manages the investment program on behalf of Evergreen clients, this publication is not affiliated with Evergreen and do not necessarily reflect the views of the Investment Committee. The information herein reflects the personal views of David Hay as a seasoned investor in the financial markets and any recommendations noted may be materially different than the investment strategies that Evergreen manages on behalf of, or recommends to, its clients.

Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this material, will be profitable, equal any corresponding indicated performance level(s), or be suitable for your portfolio. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Investors should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

20231107