Making Hay Monday – August 21st, 2023

Making Hay Monday

High-level macro-market insights, actionable economic forecasts, and plenty of friendly candor to give you a fighting chance in the day’s financial fray.

Charts of the Week

Goldman Sachs Profitless Tech Index

Profit-free tech stocks have long been in the Haymaker’s penalty box. My antipathy toward this highly speculative cohort hit a crescendo in 2021. That was when they went vertical, led by the memorable meme stock moonshot. From the first quarter of 2021 peak through mid-October of last year, their return to earth was nearly as spectacular. Per the chart above, they vaporized by 76%. This year, though, they enjoyed a blistering 50% run through late July, before tumbling 19% in just a few weeks. The big problem with highly volatile investment plays like this is that they suck in the most clueless speculators unsophisticated participants when they are close to their inevitable flame-out. As a result, it’s much more than just a situation of foregone profits. For most, it’s a case of incurring large and painful losses. (The crypto world has been particularly prone to this phenomenon.) It amazes me that, despite appalling losses, the true-believers in these names keep coming back for even more punishment.

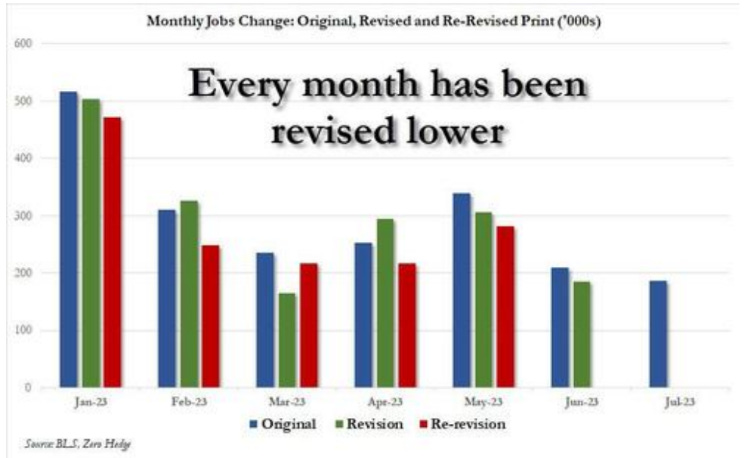

One of the strongest arguments in support of the soft-/no-landing view is the relentlessly resilient jobs market, at least based on the U.S. government’s initial releases. As usual, the subsequent revisions, which are inherently more accurate, receive scant media coverage. As you can see in the ZeroHedge chart above, each month this year, through June, has ultimately been revised down. As the Fed’s extremely muscular tightening campaign bites harder on a daily basis, this trend is likely to continue, possibly even intensifying. (Note, this chart was produced before the downward revision to June was reported.)

To learn more about Evergreen Gavekal, where the Haymaker himself serves as Co-CIO, click below.

Maybe Not So Easy

“Bear markets have three stages — sharp down, reflexive rebound, and a drawn-out fundamental downtrend.” -Bob Farrell

“Never in history has a bull market been launched in such a hostile monetary environment.” -InvesTech founder, Jim Stack

In the July 28th Making Hay Monday (MHM), I stuck my neck out like Marie Antoinette in her last moments by having the temerity to suggest the mighty NASDAQ 100 (QQQ) might be vulnerable. Part of my logic was derived from a typically no-question-about-it declaration from Jim Cramer in mid-July that:

It’s just so darned easy to bet on the ‘Magnificent Seven’ because everything seems to go right with them.

As I’ve often observed, the hyperventilating star of CNBC’s Mad Money frequently leaves his acolytes feeling angry indeed with his repetitive off-the-mark proclamations. As you likely have noticed, they are usually conveyed with supreme confidence. To be fair, over the following two weeks, the heavily Mag-Seven-driven QQQ continued higher, rising another 5%. In addition to Mr. Cramer’s enthusiasm for them, the fact that this handful of names represented roughly 50% of the NASDAQ 100’s market value convinced me that a correction was nigh. The added appreciation over the second half of July only made that more likely in my view.

But there was much more that led me to believe the QQQ was overextended after its incredible 47% run this year through late July. For one thing, speculative juices were flowing freely. This headline from the July 20th Wall Street Journal captured the then-prevailing the mood:

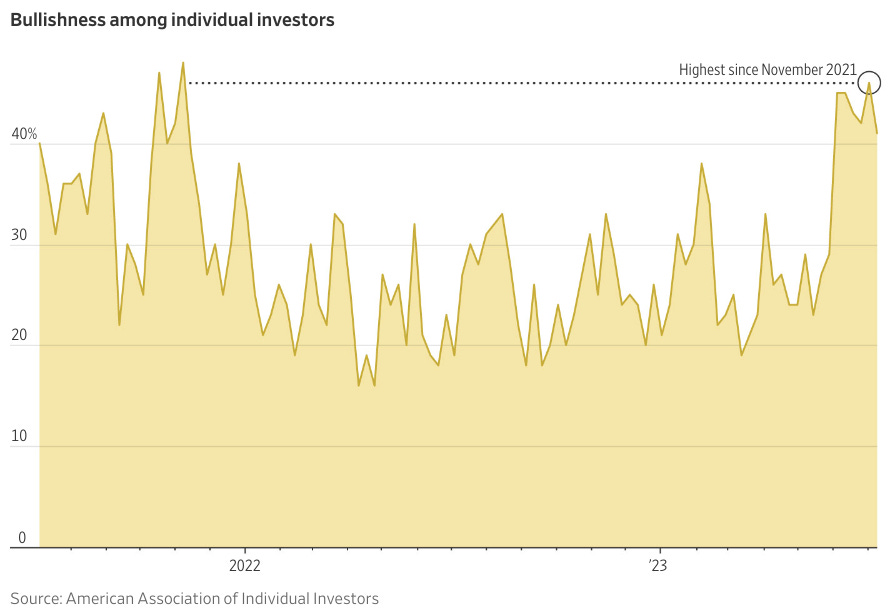

The article included the following chart which is remarkable considering how ragingly bullish investors were in late 2021:

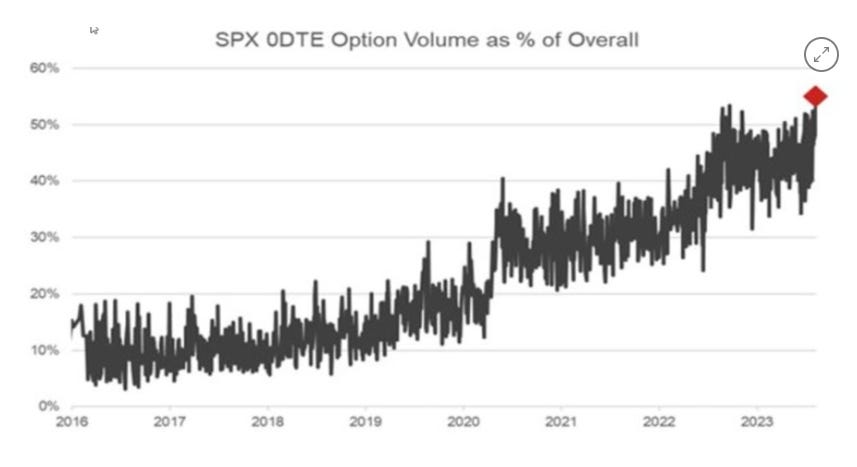

Another trigger for me was the frenzied activity in options, mostly of the bullish (or call) variety. Option volumes have roughly quadrupled since the pre-pandemic days. The shortest term, like those that expire the same day, Zero Days To Expiration or 0DTE (it’s hard to get shorter than that!) have also soared in popularity.

Similarly, premiums for bearish (put) options collapsed to the lowest level for at least 10 years, according to RBC Capital Markets. In addition, demand for “long volatility” options, another way to position for market indigestion, has collapsed. This has driven down the value of those bets to a fraction of their normal prices. In turn, that has caused the demise of a high-profile firm that was betting on a swan dive by stocks. This is despite that it was run by one of the brightest macro (big picture) minds around. Carl Icahn, the once widely feared activist, at least in corner suites, has also been laid low by his bearish market bets.

Nearly all of the pain these folks have suffered has been due to the M7, my new short-hand for the Magnificent Seven. It certainly hasn’t been caused by smaller companies. The index of those, the Russell 2000, is up a wimpy 9% from the market bottom last October.

As another extremely bright market maven, InvesTech’s Jim Stack, has correctly pointed out, historically small caps lead coming out of bear markets. On average, they are up 75% one year into a new bull run. Unless they have a monster move between now and mid-October, it will be further non-confirmation that this is truly a fresh bull market, as opposed to a bear market rally.

The spectacular rise of several of the usual meme suspects was another strident alarm bell for me. The Wall Street Journal picked up on that, too, with this August 7th headline:

Adding to my negativity, insider buying recently fell to its lowest level of the last 10 years. Considering how wildly frothy the stock market was in 2021, that’s a surprising factoid.

Maybe I was just lucky — and I’m superstitious enough to concede exactly that — but since my July 28th negative call on the QQQ, it has slipped 7%, heavily impacted by the M7’s 8.6% tumble. One of them, Tesla, has plunged 25% from its mid-July peak. The S&P has held up better, off 5%, and that dip is undoubtedly mostly due to the negative drag from the M7, as well. They make up 26.85% of that supposedly highly diversified index.

In fact, as I noted on Friday to paying subscribers, the most speculative reaches of the stock market have been behaving badly of late. Those have been the asset classes — using that term very liberally, in many cases — about which this newsletter has been particularly critical. For sure, the recent retreat by the most speculative areas might be merely a healthy correction of a severely overbought condition. However, I suspect it’s something more serious.

Per Jim Stack’s quote above, it would be highly unusual for a new bull market to begin with the Fed on the warpath. As you (should) know, we are experiencing an extremely rare double-tightening, where it has both raised rates — a lot! — and is shrinking its balance sheet at about a $1 trillion annual rate. The latter is the inverse of its legendary QEs, or Quantitative Easings. Accordingly, my money is on this being a very vigorous bear market rally that hit the wall last month.

Additionally, one of my mega-fears of serious dislocations in the longer end of the U.S. Treasury market has been at least partially realized. The brainy folks at hedge fund behemoth, Bridgewater Associates, are referring to this as a “liquidity hole”. This basically means the government is sucking up so much money to finance its gargantuan deficits, that it creates a shortage of liquidity for both the financial markets and the real economy. Funding subscribers saw what I referred to as one of the most ominous charts around last Friday. For those who still haven’t placed their bets on the Haymaker, the 4.3% yield level on the 10-year T-note is exceedingly critical, in my view. (It appears to be breaking above that so far today.)

This is a longer free MHM than normal because we are now going to offer our paid constituents a relevant short missive from my bestie and partner, Louis Gave. (By the way, Louis was recently the star of a glowing Barron’s article; I thought it was exemplary because he endorsed one of my favorite investments: emerging market debt.)

Louis’ piece is titled The End Of The Echo Boom, which is a more polite reference to what I have been calling the “Echo Bubble”. (That’s a line I stole, by the way, from someone else, though I’m embarrassed to say I can’t recall their name.) As Louis points out at the end, another conspicuous reason to be on alert right now is that we are moving into “hurricane season”. This is the time of the year when market accidents have historically so often occurred. Consequently, you might want to check your portfolio’s storm shutters while the ill winds are only beginning to blow.

IMPORTANT DISCLOSURES

This material has been distributed solely for informational and educational purposes only and is not a solicitation or an offer to buy any security or to participate in any trading strategy. All material presented is compiled from sources believed to be reliable, but accuracy, adequacy, or completeness cannot be guaranteed, and David Hay makes no representation as to its accuracy, adequacy, or completeness.

The information herein is based on David Hay’s beliefs, as well as certain assumptions regarding future events based on information available to David Hay on a formal and informal basis as of the date of this publication. The material may include projections or other forward-looking statements regarding future events, targets or expectations. Past performance is no guarantee of future results. There is no guarantee that any opinions, forecasts, projections, risk assumptions, or commentary discussed herein will be realized or that an investment strategy will be successful. Actual experience may not reflect all of these opinions, forecasts, projections, risk assumptions, or commentary.

David Hay shall have no responsibility for: (i) determining that any opinion, forecast, projection, risk assumption, or commentary discussed herein is suitable for any particular reader; (ii) monitoring whether any opinion, forecast, projection, risk assumption, or commentary discussed herein continues to be suitable for any reader; or (iii) tailoring any opinion, forecast, projection, risk assumption, or commentary discussed herein to any particular reader’s investment objectives, guidelines, or restrictions. Receipt of this material does not, by itself, imply that David Hay has an advisory agreement, oral or otherwise, with any reader.

David Hay serves on the Investment Committee in his capacity as Co-Chief Investment Officer of Evergreen Gavekal (“Evergreen”), registered with the Securities and Exchange Commission as an investment adviser under the Investment Advisers Act of 1940. The registration of Evergreen in no way implies a certain level of skill or expertise or that the SEC has endorsed the firm or David Hay. Investment decisions for Evergreen clients are made by the Evergreen Investment Committee. Please note that while David Hay co-manages the investment program on behalf of Evergreen clients, this publication is not affiliated with Evergreen and do not necessarily reflect the views of the Investment Committee. The information herein reflects the personal views of David Hay as a seasoned investor in the financial markets and any recommendations noted may be materially different than the investment strategies that Evergreen manages on behalf of, or recommends to, its clients.

Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this material, will be profitable, equal any corresponding indicated performance level(s), or be suitable for your portfolio. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Investors should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

20230822