Making Hay Monday – April 15th, 2024

Making Hay Monday

High-level macro-market insights, actionable economic forecasts, and plenty of friendly candor to give you a fighting chance in the day’s financial fray.

Charts of the Week

Hartnett

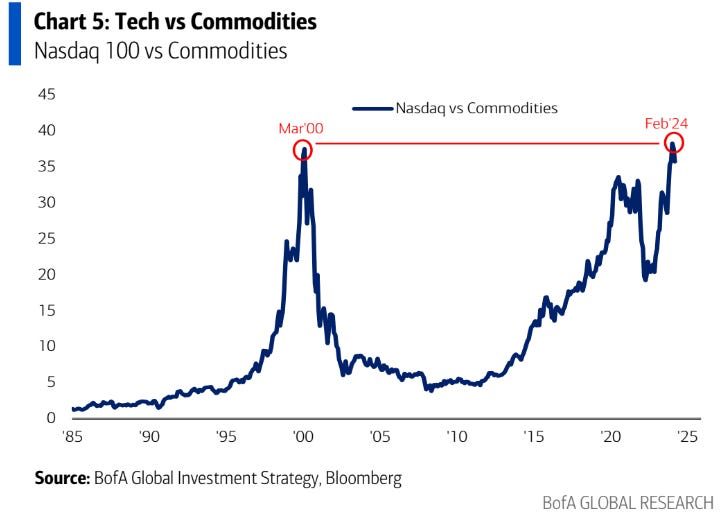

One of the greatest rebalancing opportunities of the last quarter-century was to have dramatically reduced tech holdings in the late 1990s and redeploy the proceeds into commodities. As you can see above, conditions presently look eerily similar. However, some commodities have surged of late, such as gold and silver. Their long-term outlooks remain favorable but holding off on new purchases may be advisable for now. Other commodities remain depressed and, accordingly, have considerable rebound potential, as you will read below.

Rosenberg, BWD

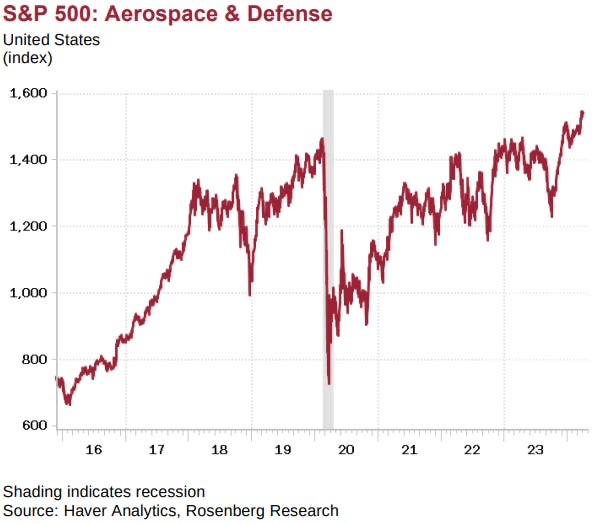

Israel’s vaunted Iron Dome performed admirably this weekend under a withering assault from Iran. The U.S. and other allies also deployed their missile and drone defense systems most effectively. Unsurprisingly, given spreading conflicts around the world, the S&P 500’s Aerospace & Defense sector has broken out to a new multi-year high. What is a bit on the perplexing side is the lagging stock performance by one of America’s premier defense stocks, Lockheed Martin (LMT). It remains down 10% from its 2022 high and trades at a modest P/E multiple of 17.6 times this year’s earnings estimate, a discount to the S&P’s P/E of 21. Consequently, it may be poised to play catch-up.

Evergreen Compatibility Survey

“There is a dislocation between valuations versus fundamentals (in some areas). That happened in 2000. The market might as well be renamed from Nasdaq to DraftKings.” -Baird Managing Director and Technology Desk Sector Strategist, Ted Mortonson

Playing the Palladium

Shutterstock

Champions

One of the many impacts of the mad dash into EVs has been the precipitous fall from grace experienced by both platinum and palladium. The latter has been particularly hammered in recent years, crashing from around $3000/ounce back in early 2022 to just over $1000 today. In the past, both platinum and palladium typically traded at a premium to gold but, as you can see, that’s no longer the case.

Platinum

Bloomberg

Palladium

Bloomberg

Gold

Bloomberg

To help explain this dramatic role reversal, it’s important to understand the primary demand driver for both platinum and palladium: internal combustion engine (ICE) automobiles. If that strikes you as odd, don’t feel bad. It’s fair to say most people are unaware of the key role these metals play in catalytic converters, particularly palladium. Consequently, if the group-think is right that ICEs are headed the way of the dodo bird, it might make sense these metals should trade at mammoth discounts to gold. This week’s Making Hay Monday (MHM) will consider that, in this case, might doesn’t make right.

Gold also has an ally with almost unlimited financial firepower: the planet’s central banks. Per numerous prior Haymaker editions, those awe-inspiring institutions have been reallocating their massive reserve holdings away from dollar-based U.S. Treasurys and into bullion. There has been no such torrent of buying for platinum and palladium since they don’t quality as alternate reserve assets to U.S. government bonds, unlike gold.

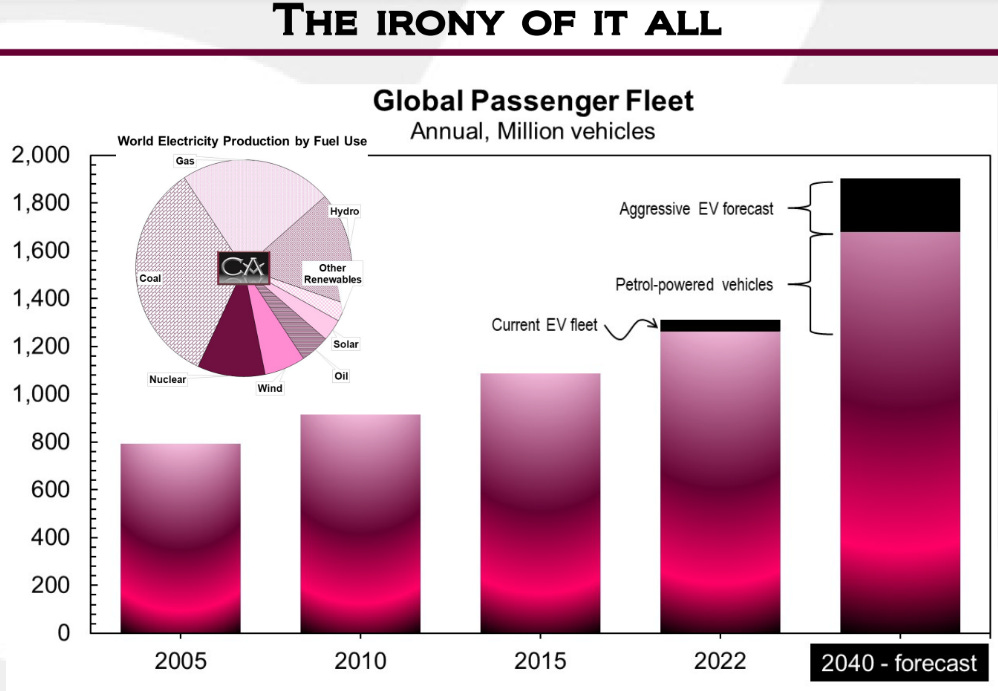

But I’d opine with a fairly high degree of confidence that the reason these two critical metals have been such performance disasters is because of the perception (certainly not yet the reality) that EVs are destined to take over the auto world. Yet, as you can see in the below chart from the savvy folks at Cornerstone Analytics, that assumption may well be erroneous.

Cornerstone Analytics

In some ways today’s MHM is a follow-on to Friday’s Guest Haymaker by Kevin Muir. (By the way, he and I will be doing a joint webinar later this month for all paid subscribers. As has become our recent custom, we will be sending out brief clips to all Haymaker subscribers, even of the non-paying variety. Please do your investment portfolio a favor by coming out from behind the moon and joining us on the bright side.) If you missed that excellent note from Kevin, you can find a link right before this MHM’s paywall.

If the world is, as I believe, waking up to the near impossibility of EVs becoming the main source of automotive transportation, the implications might be extremely bullish for what are often called Platinum Group Metals or PGMs. There are six included in this cohort, including rhodium and iridium. But platinum and palladium are the Big Kahunas.

Not least among the biggest drawbacks for EVs becoming the bulk of auto sales is the rapid and dramatic dominance of China when it comes to the batteries and the critical rare-earth metals that are essential to the production process. Almost overnight, that’s become true for the cars themselves, as China is now the largest producer and exporter of EVs. Yet, that is not the only challenge a nearly complete electrification of the West’s auto fleet faces.

Another hurdle is that consumers simply haven’t been that enamored with the EV experience. The litany of drawbacks is well-known so I will only briefly touch on them: range anxiety, plunging resale values, the high expense of battery replacements, the propensity to being totaled for relatively minor damage, faster wear on the tires, and the difficulty of accessing timely and convenient servicing. Even The New York Times ran an Op-Ed on Saturday, April 13th, with the title “Electric Cars Are Boring”.

In fairness, there are meaningful advantages, as well. Those include fewer moving parts; thus, there are fewer things to go wrong. Further, for those who haven’t purchased an EV yet, collapsing prices are alluring. With some 90 Chinese companies producing and exporting them, they are nearly certain to become even more irresistible for those looking for a bargain-priced vehicle.

But will Western nations allow their domestic auto industries to be gutted by this latest Chinese effort to dominate an important market? With prices in free fall, even the U.S. may retaliate with further tariffs, particularly should, as most polls indicate, Donald Trump be back in the Oval Office come January.

Europe’s car industry has long been the bedrock of its manufacturing base. Will the Continent allow the better part of a hundred Chinese EV makers, most of whom are likely losing money, to destroy its nascent carbon-free auto industry by dumping cheap cars on its shores? (Ironically, EVs in China are largely powered off its grid which is — surprise, surprise — mostly coal-fired; hence, EVs over there are anything but environmentally friendly. Frankly, Europe isn’t much better in that regard, excluding France and its mostly nuclear-powered grid.)

My belief is not for long. If I’m right, ICEs might make a surprising comeback. If they do, the same may be true for platinum and, particularly, palladium. Another irony is that catalytic converters are one reason air quality has improved by 75% in the U.S. over the last 50 years. As converters have evolved, platinum is primarily used to capture the most noxious emissions from diesel engines. Palladium, on the other hand, is the key metal employed in converters for gasoline-powered engines.

Shutterstock

For years, I’ve been advocating it would be much smarter and cheaper for governments to encourage the development of better converters than to attempt to electrify most of the auto fleet. To be clear, I think EVs have a vital role to play, particularly if they can be charged using solar panels. (However, that does again raise the vexing issue of Chinese production dominance.)

So, if you agree with me that there is an opportunity here, how best to capitalize on it?

Subscribe to Haymaker to read the rest.

Become a paying subscriber of Haymaker to get access to this post and other subscriber-only content.

A subscription gets you:

| Subscriber-only posts and full archive | |

| Post comments and join the community |

IMPORTANT DISCLOSURES

This material has been distributed solely for informational and educational purposes only and is not a solicitation or an offer to buy any security or to participate in any trading strategy. All material presented is compiled from sources believed to be reliable, but accuracy, adequacy, or completeness cannot be guaranteed, and David Hay makes no representation as to its accuracy, adequacy, or completeness.

The information herein is based on David Hay’s beliefs, as well as certain assumptions regarding future events based on information available to David Hay on a formal and informal basis as of the date of this publication. The material may include projections or other forward-looking statements regarding future events, targets or expectations. Past performance is no guarantee of future results. There is no guarantee that any opinions, forecasts, projections, risk assumptions, or commentary discussed herein will be realized or that an investment strategy will be successful. Actual experience may not reflect all of these opinions, forecasts, projections, risk assumptions, or commentary.

David Hay shall have no responsibility for: (i) determining that any opinion, forecast, projection, risk assumption, or commentary discussed herein is suitable for any particular reader; (ii) monitoring whether any opinion, forecast, projection, risk assumption, or commentary discussed herein continues to be suitable for any reader; or (iii) tailoring any opinion, forecast, projection, risk assumption, or commentary discussed herein to any particular reader’s investment objectives, guidelines, or restrictions. Receipt of this material does not, by itself, imply that David Hay has an advisory agreement, oral or otherwise, with any reader.

David Hay serves on the Investment Committee in his capacity as Co-Chief Investment Officer of Evergreen Gavekal (“Evergreen”), registered with the Securities and Exchange Commission as an investment adviser under the Investment Advisers Act of 1940. The registration of Evergreen in no way implies a certain level of skill or expertise or that the SEC has endorsed the firm or David Hay. Investment decisions for Evergreen clients are made by the Evergreen Investment Committee. Please note that while David Hay co-manages the investment program on behalf of Evergreen clients, this publication is not affiliated with Evergreen and do not necessarily reflect the views of the Investment Committee. The information herein reflects the personal views of David Hay as a seasoned investor in the financial markets and any recommendations noted may be materially different than the investment strategies that Evergreen manages on behalf of, or recommends to, its clients.

Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this material, will be profitable, equal any corresponding indicated performance level(s), or be suitable for your portfolio. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Investors should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

20240416