Haymaker – Friday Edition

Haymaker – Friday Edition

Sector- and industry-specific market analyses to fill your weekend with ample food for thought.

Quill Intelligence/Danielle DiMartino Booth

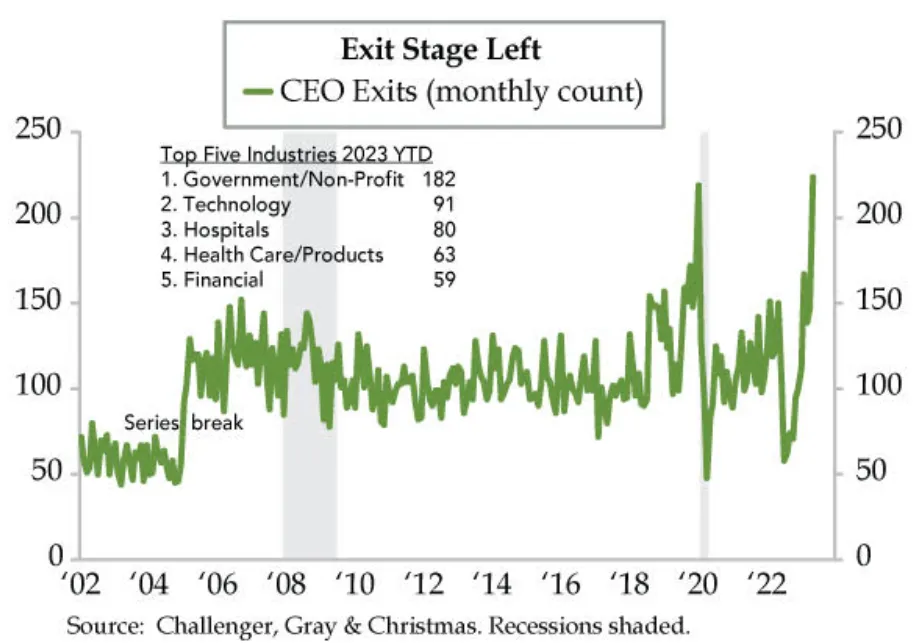

Haymaker’s Analysis: The consensus clearly is becoming increasingly convinced that a recession is a fading risk. However, the behavior of CEOs is at odds with that rosy view. Historically, they’ve tended to head for the hills (or the mountains of Aspen, or Sun Valley where they have their 20,000 square-foot homes) when they see trouble coming. Despite the pervasive economic optimism, I continue to see more data indicating the CEOs are right to be worried that Jim Cramer’s no-landing call is correct. Given the criticality of semiconductors to the global economy, growth bulls might reflect on the fact that the industry is seeing a revenue decline of 22%. The ultimate commodity semi producer, Micron, just reported a jaw-dropping 57% plunge in its sales. No landing? Really?

The Seven-Per-Cent (Bond) Solution… Redux

“I have what might be disconcerting news: It’s not over” -Bill Dudley, former president of Federal Reserve Bank of New York, 2009-2018, referring to the bear market in long-term U.S. government bonds.

Champions

The stock market’s going up, so why bother with boring old bonds? Well, speaking of old, or at least on the mature side of life, that probably includes most of you reading this note. If so, generating reliable cash flow should probably take precedence over betting on a frothy stock market becoming even frothier.

To provide a little food for thought on why that might be the preferred course of action, please take a gander at the following chart. What this is measuring is the well-known (at least by investment pros) equity risk premium. This metric compares the earnings yield on stocks with the interest rates on offer from government bonds.

(Click chart to expand)

Don’t let the “earnings yield” term throw you. It’s very simple to calculate. You merely divide the estimated earnings of the S&P by the market price. For now, the earnings per share for the S&P is projected to be $221 and the market price is $4,435. So, $221 divided by $4,435 is an earnings yield of 5%. Think of it like a cap rate on real estate, as I’ve noted in the past.

If the P/E was 10, as it often has been, then the earnings yield would be 10%. Those were the days when it paid to be a perma-bull! Of course, to get to a 10% earnings yield now would require the market to get cut in half, not a happy, or likely, prospect. However, per the following, a much higher earnings yield than 5% is a distinct possibility, if not a probability.

What’s also clear from the chart above is that the current status isn’t typical. In fact, it’s most atypical, at least over the last decade. Admittedly, this was a period of unusually — and artificially — suppressed interest rates. Yet, the last time the equity risk premium (ERP) was this low was in 2007. You may recall that what followed was a 50% “value restoration process” by the stock market — i.e., a brutal bear market.

It’s my belief, perhaps a misguided one, that one of the main services this newsletter provides is to highlight income-producing investment opportunities. As longer-term Haymaker subscribers are aware, due to my position as Co-CIO of Evergreen Gavekal, a registered investment advisor

1, I’m highly restricted on what I can write about individual securities. However, I can provide generalized recommendations and even some guidance on what type of securities might hold special appeal.

In that regard, I personally find intermediate-term corporate bonds yielding in the vicinity of 7% – 7.5% to be especially appealing. This is particularly the case vis-à-vis the S&P 500 trading at 19 times hoped-for earnings. (Unsurprisingly, I’m taking the under on those forward estimates.) My suspicion is that many of you do, as well. It’s fair to note that to attain this type of return with a maturity later this decade, you generally need to be willing to buy a BB-rated bond. (Some bank debt-rated investment grade, at least for now, also offer yields in this range, but I’m not all that confident they won’t be downgraded.)

A bond I find holds considerable interest, literally, has that rating, but don’t be alarmed. The fact of the matter is that BB-rated debt has an historical default rate of around 1%. Said differently, 99% don’t go into Chapter 11 on a yearly basis. Further, it’s been my experience you can improve your odds by doing some research into the specific credit story.

Presently, traditional media bonds trade relatively inexpensively due to real risks like cord cutting and an ongoing shift to digital entertainment and news distribution platforms. There is also the valid concern about a recession-induced dropoff in advertising revenues. (However, a major offset to that might be a high level of political spending in what promises to be a contentious and chaotic presidential election).

Consequently, I’d encourage you to look for entities in the media business which continue to boast healthy margins, like in the upper 20s, and where those have been rising. Throwing off half a billion of excess cash flow, and a bit less than that in reported earnings, would be another nice attribute. Paying down a considerable amount of debt in recent years, like $1 billion, roughly 25% of the former debt outstanding, would be another reason to be interested in the debt of such a company. A healthy cash balance never hurts, either.

Some struggling old-media entities have seen shrinking revenues, so seeking out one that is still growing sales is advisable. Having an extensive collection of major network-affiliated stations also creates more of a moat. This strength might be indicated by being among the top two or three broadcasters in the country. It would also be encouraging if it generated 40% or more of its revenue from digital advertising, as that portion of its business is likely to continue growing. It would be even more impressive if its after-tax profits had doubled since the eve of the pandemic.

Another bond I find attractive is issued by one of America’s largest automakers. In fact, it literally invented mass production of cars over a century ago. Its financial division has debt outstanding due in 2030 yielding around 7%. This particular issue trades very close to par, or face value, but it also has some discounted issues with a yield-to-maturity of approximately 6½%. The discount gives you a bit more upside in the event that the Fed begins to cut rates aggressively over the next year or two. The media bond mentioned above also trades at a discount with a coupon (stated interest rate) a tad below 5%. Both of these have a reasonable possibility of being bumped up to investment grade. This often produces price appreciation, all else being equal.

When it comes to the auto industry, I think there is a relevant parallel with homebuilders. Both sell big-ticket items. Each sector is interest-rate and economically sensitive. You may have noticed builders have been reporting surprisingly (including to me) strong earnings. This is despite a dramatic decline in sales, the latter undoubtedly due to very challenged affordability. The homebuilding industry seems to have learned how to thrive even at greatly reduced volumes. In my opinion, there also appears to be abundant evidence of that happening with the auto industry.

To expand on the risk aspect of both of these bonds, I do worry that credit spreads will widen again, perhaps dramatically, as they did last year. Moreover, per the Bill Dudley quote, overall interest rates may be headed even higher soon. Despite those legitimate risks, in my mind, merely holding these two debt instruments to maturity at a 7% type yield is highly likely to beat the S&P’s returns over the rest of this decade.

Returning to my regulatory handcuffs, prior to a recent SEC rule change, I was able to name names. Frankly, though, with bonds, even when I did, it was only the more motivated among you who figured out how to buy them. With debt instruments, it’s simply not as simple as it is with stocks. Often, they trade infrequently and it’s easy to overpay through a retail custodian or broker. There is no ticker symbol for bonds, which also makes it trickier to buy and sell them.

To learn more about Evergreen Gavekal, where the Haymaker himself serves as Co-CIO, click below.

While I realize most Haymaker readers are do-it-yourselfers, I’m not sure it’s all that smart with bonds unless you’re fairly sophisticated and have an excellent broker (and, of course, you do some Sherlock-like sleuthing into some of my highlights). Thus, you might want to consider continuing to manage your stocks yourself but retain professional money management for the fixed-income side of your portfolio. For some reason, I’m partial to Evergreen Gavekal.

My team and I specialize in comprehensive credit analysis, but we also subscribe to somewhat pricey services, like the superb Grant’s Interest Rate Observer. (Hat tip to Grant’s for the first bond idea.) We for sure make mistakes, occasionally, but we also heavily diversify. Additionally, our interest-rate calls over the years have been solid. You can verify this by reviewing past issues of the Evergreen Virtual Advisor (EVA), focusing on periods when rates were poised to significantly rise or fall.

We also have the ability, which many firms don’t, to source bonds from a wide range of market makers. This allows us to both access a wide range of offerings and also have a much better chance to get the best possible execution prices. Both of these benefits are very challenging for a retail investor to attain on his or her own.

Okay, that’s the end of the commercial message and I will say there are some outstanding bond management firms out there, like Jeff Gundlach’s DoubleLine. However, finding a quality bond manager that runs separately managed accounts, populated with individual corporate bonds, at a retail size (i.e., an amount of money most people have available to invest) is not an easy task. Personally, I believe Evergreen’s bond expertise is one of our main competitive strengths but, again, I’m not exactly objective.

Champion Picks

Oil and gas producer equities (both domestic and international)

Japanese yen

Gold & gold mining stocks

Farm machinery stocks

Select financial stocks

U.S. Oil Field Services companies

S. Korean stock market

Copper-producing stocks

For income:

BB-rated bonds from dominant media companies and healthy automakers with upgrade potential

BB-rated intermediate term bonds from companies on positive credit watch

Certain fixed-to-floating rate preferred stocks

Select LNG shipping companies

Emerging Market debt closed-end funds

Mortgage REITs

ETFs of government guaranteed mortgage-backed securities

BB-rated energy producer bonds due in five to ten years

Select energy mineral rights trusts

Contenders

Several pipeline operators have seen their share prices ease back down in recent weeks. For those Haymaker readers who are willing to receive a K1, you may want to do some digging into a midstream* company affiliated with one of Berkshire Hathaway’s largest energy-producer holdings. (ESG-leaning investors might like its aggressive push into carbon capture.) It yields just under 8% and its price has retraced about 9% from its 52-week high. The current P/E is in the high-single digits. In my view, this isn’t a screaming buy, hence the Contender status, but it should provide a nice total return from here over the next couple of years.

* “Midstream” is the official name for entities that own pipelines and other energy infrastructure assets

Top-tier midstream companies (energy infrastructure such as pipelines)

Uranium

Short-intermediate Treasurys (i.e., three-to-five year maturities)

Japanese stock market

European banks

U.S. GARP (Growth At A Reasonable Price) stocks

Telecommunications equipment stocks

Swiss francs

Singaporean stock market

Intermediate Treasury bonds

Small cap value

Mid cap value

Select large gap growth stocks

Utility stocks

Down For The Count

The thesis that holders of extended-duration T-bonds might continue to get fleeced by both rising rates and stubborn inflation seems to be gaining adherents. Bill Dudley, who ran the powerful NY Fed for roughly a decade, is warning that the yield on the 10-year T-note is headed to at least 4½%. In fact, he’s strongly suggesting it could exceed that level (presently, it is around 3.9%).

Basically, he’s looking for another down-leg in the bond bear market that began in the fall of 2020, and I agree with him. This is similar to my view that U.S. stocks will also re-enter a corrective phase. These two markets now appear to be moving together, as they did back in the 1970s. As a result, it’s now the photographic-negative of how they behaved for most of the last 40 years, when they had a counter-balancing relationship.

A fundamental flaw I believe the longer-term Treasury market presently has is a growing realization that the only way the federal government can repay bondholders is with money that ultimately comes out of the Fed’s “Magical Money Machine”. That magic-wand money is likely to be worth much less when those Treasurys mature than it is today. Accordingly, I remain wary of long-term government bonds at yields below 4%, despite my recession anticipation.

Long-term Treasury bonds yielding sub-4%

Homebuilders stocks

Electric Vehicle (EV) stocks

Meme stocks (especially those that have soared lately on debatably bullish news)

The semiconductor ETF

Junk Bonds (of the lower-rated variety)

Financial companies that have escalating bank run risks

The semiconductor ETF

Bonds where the relevant common stock has broken multi-year support.

Profitless tech companies (especially if they have risen significantly recently)

Small cap growth

Mid cap growth

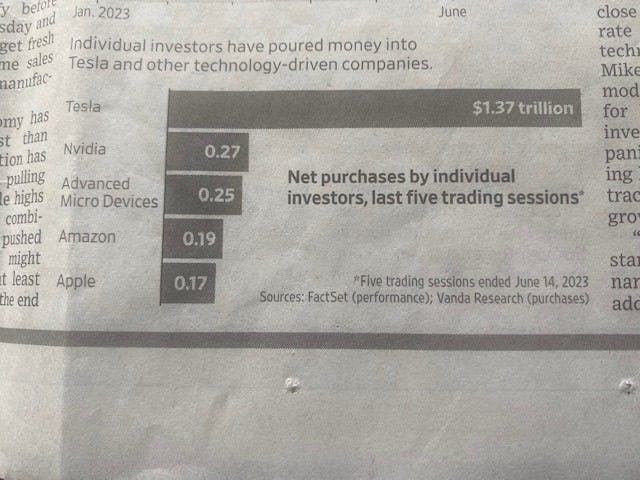

Please allow me to make a minor correction. In our previous Haymaker – Friday Edition, we ran a chart from The Wall Street Journal showing inflows into Tesla and a few other ultra-large-cap growth stocks. While I was dubious it was a valid statistic, as I wrote at the time, I was working off a hard copy that showed over $1 trillion flowing into TSLA, as shown below. However, the digital version we published had corrected it to “billions”, but I missed that when we hit “send”. My apologies for that oversight.

IMPORTANT DISCLOSURES

This material has been distributed solely for informational and educational purposes only and is not a solicitation or an offer to buy any security or to participate in any trading strategy. All material presented is compiled from sources believed to be reliable, but accuracy, adequacy, or completeness cannot be guaranteed, and David Hay makes no representation as to its accuracy, adequacy, or completeness.

The information herein is based on David Hay’s beliefs, as well as certain assumptions regarding future events based on information available to David Hay on a formal and informal basis as of the date of this publication. The material may include projections or other forward-looking statements regarding future events, targets or expectations. Past performance is no guarantee of future results. There is no guarantee that any opinions, forecasts, projections, risk assumptions, or commentary discussed herein will be realized or that an investment strategy will be successful. Actual experience may not reflect all of these opinions, forecasts, projections, risk assumptions, or commentary.

David Hay shall have no responsibility for: (i) determining that any opinion, forecast, projection, risk assumption, or commentary discussed herein is suitable for any particular reader; (ii) monitoring whether any opinion, forecast, projection, risk assumption, or commentary discussed herein continues to be suitable for any reader; or (iii) tailoring any opinion, forecast, projection, risk assumption, or commentary discussed herein to any particular reader’s investment objectives, guidelines, or restrictions. Receipt of this material does not, by itself, imply that David Hay has an advisory agreement, oral or otherwise, with any reader.

David Hay serves on the Investment Committee in his capacity as Co-Chief Investment Officer of Evergreen Gavekal (“Evergreen”), registered with the Securities and Exchange Commission as an investment adviser under the Investment Advisers Act of 1940. The registration of Evergreen in no way implies a certain level of skill or expertise or that the SEC has endorsed the firm or David Hay. Investment decisions for Evergreen clients are made by the Evergreen Investment Committee. Please note that while David Hay co-manages the investment program on behalf of Evergreen clients, this publication is not affiliated with Evergreen and do not necessarily reflect the views of the Investment Committee. The information herein reflects the personal views of David Hay as a seasoned investor in the financial markets and any recommendations noted may be materially different than the investment strategies that Evergreen manages on behalf of, or recommends to, its clients.

Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this material, will be profitable, equal any corresponding indicated performance level(s), or be suitable for your portfolio. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Investors should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

20230701