Gold/Silver: Dollar Direction and a Small-Cap Hedge

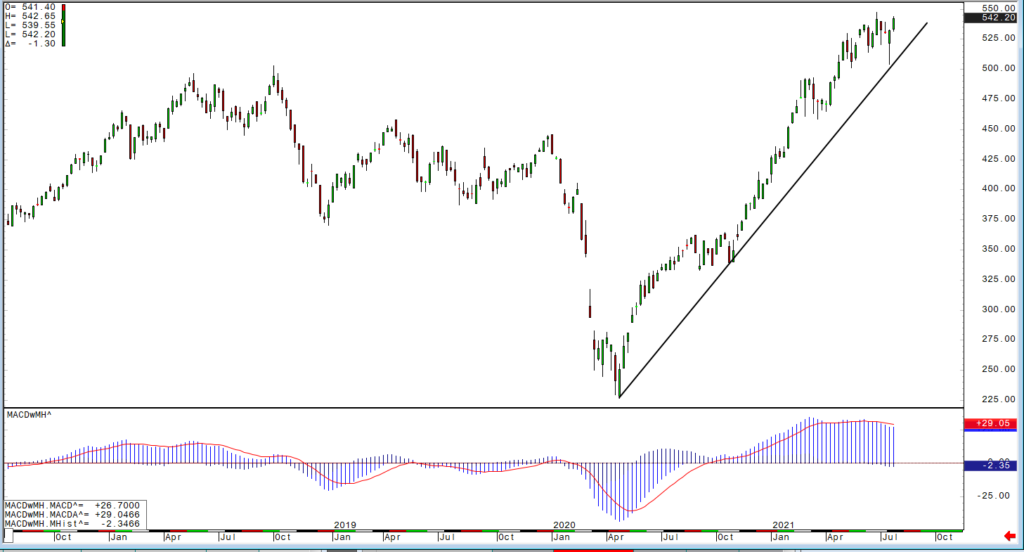

As we pivot into August and phase transition from the booming reflationary recovery to stagflation, we at Blue Line Futures will shift our focus targeting more tactical plays before heading into Jackson Hole on August 26-28. As an individual investor, it is crucial to focus on basic strategies that are simple and effective given the current economic backdrop. For instance, in a stagflation environment, we will want to continue to sell small-caps (Russell 2000) on rallies, buy Gold on corrections, target specific undervalued Commodities, and pay strict attention to the Dollar.

How much juice is left in the Dollar? Now I know what you all will say “the Dollar is worthless,” but let’s keep focus and look for opportunities to make more of these worthless dollars and convert them into things that can potentially store value. Technically, although rising from early June into the latter half of July, the Dollar Index has failed for the sixth time, signaling lower lows, and appears poised to retest 90. The critical breakdown will cause another run on the so-called “transitory” inflation and boost commodities. Let us look at the two charts below.

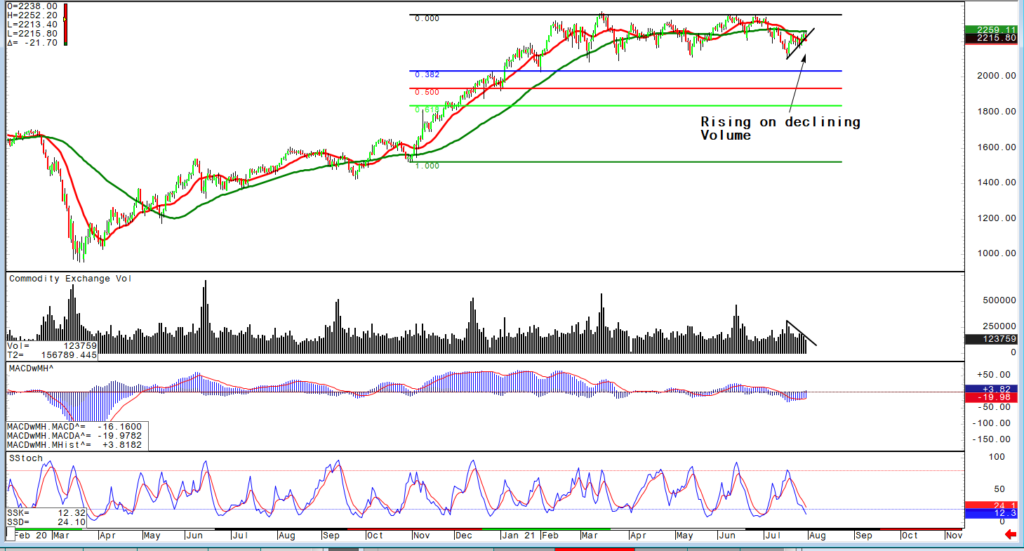

The next chart is the S&P GSCI (formerly the Goldman Sachs Commodity Index)

Looking at the weekly chart above, you can see that commodity prices have been ramping up since the pandemic lows resulting in anything but “Transitory.” Fed Chairman Powell was asked about transitory this week, and he stated that “price increases will happen and may not reverse…” That does not sound good; therefore, I want to continue to provide you with ideas that we have been recommending to clients. Over the past few weeks, I had outlined a strategy in the Gold market, and to further help you understand the quantitative analyses of the precious metals markets, we created a free “Gold Trends Macro Book,” updated with silver slides. You can request yours here: Free Gold Trends Macro Book.

Gold continues to hold above key psychological support at $1800/oz while firmly above trendline support at $1775/oz. We are monitoring for another “Breakout” above the downward sloping channel near the $1825-1835/oz pocket resistance. If you are one of our clients or looking to become one of our clients and would like to position in Gold for the long run, we suggested considering using FOUR Micro 10 oz December Gold contracts per $25,000 and buying TWO at 1775 and TWO at 1685, with a stop at 1640. Doing such would ideally risk $3,600. We would look to a gold target of 2100/oz, which would allow for a profit of $14,800. If you would like to learn more about the strategies we are implementing or learn more about technical analysis, we created a guide to provide you with all the steps to create an actionable plan used as a foundation for entering and exiting the market. You can request yours here: 5-Step Technical Analysis Guide to Precious Metals.

Small-Cap hedging strategy

Knowing that the markets remain fragile coming into the Jackson Hole meeting and the “VIX” has been the popular “go-to” for hedging in the event of a 10% drop in the market, we believe that adjusting your strategy to include shorting “Small-Cap” stocks against your core positions. Using the Micro Emini-Russell, at $5 a point, we recommend clients with $25,000 to sell TWO Micro Emini-Russell at 2254 and ONE at 2300 while risking the trade up to 2375. Ideally, this would risk $1585 while looking for a potential 10% drop in small caps and look to cover TWO on a decline below 2000 and ONE at 1800. If you would like to be up to date on the developments of our specific strategies in the futures and commodities markets, please register for a Free two-week trial by clicking on the link here: The Blue Line Express Two-Week Free Trial Sign up.

https://www.bluelinefutures.com