EUR/USD Tests 200-Day Average Ahead of FOMC

EUR/USD Tests 200-Day Average Ahead of FOMC

The FOMC day finally arrives, and all the attention will turn to the Fed’s latest economic projections and Powell’s press conference. Major currency pairs like the EUR/USD, gold and indices will be in focus. But the biggest moves in FX so far this week has been concentrated in the yen pairs as the Bank of Japan finally delivered a 10-basis point rate hike. But this first rate rise since 2007 to end the zero-interest rate policy had a “dovish hike” written all over it and the yen slumped across the board, most notably against the US dollar, as the yield differential between Japan and the rest of the world increased. Given the recent inflation prints in the US, it was hardly surprising to see the greenback being the strongest currency so far this week. This meant that the EUR/USD would also weaken along with other major FX pairs. But can the EUR/USD rebound from here, as the focus turns to the Fed? Is a hawkish Fed already priced in?

EUR/USD undermined by widening rates differential despite hawkish ECB rhetoric

The fact that the EUR/USD has weakened has a lot to do with bond yields moving in the favour of the dollar following the BOJ rate hike, than it has much to do with the euro. Indeed, today we have heard from the European Central Bank’s Christine Lagarde, who said that they cannot commit to rate path even after the first cut, whenever that may be. The ECB are waiting for negotiated wages data for Q1 and a few more inflation reports, before deciding whether to cut. The wages data will be released in late May. So, the first rate cut is unlikely to come before their June meeting. The day before, ECB’s Luis de Guindos also said the ECB needs to wait for June before deciding on a rate cut. These comments are not exactly dovish. We also had better German ZEW numbers on Tuesday which helped to limit the downside for the EUR/USD.

All eyes turn to the FOMC now

The key event on US economic calendar today is the FOMC rate decision at 18:00 GMT. The Fed is expected to keep interest rates unchanged at 5.50%, but it’s not the rates decision that the FX markets are worried about. It is forward guidance. Will the Fed still keep three rate cuts in its dot plots, or will it opt for two rate cuts for 2024 instead? That’s the key question.

Judging by the recent dollar strength you have to say that the market is expecting the Fed to deliver a hawkish surprise in its dot plots i.e., pointing to fewer than the 3 rate cuts in 2024 that it had projected previously. But this outcome is already priced in, with the market now expecting just 68bp of Fed cuts this year. If the FOMC’s dots shifts to 50bp of cuts this year, then there is potentially some room for modest further USD strength. The Fed will need to be quite hawkish to keep the dollar pressing higher at these lofty levels, which is an unlikely event in my view.

Instead, if the median forecast remains at three or somehow rises to more than 3, then this would come as a dovish surprise, and we could well see the dollar weaken across the board. On the back of this potential outcome, we could see gold head towards a new record high; the EUR/USD could rise towards 1.10 handle, while even the USD/JPY might start to fall back following its sharp gains today.

EUR/USD technical analysis and trade ideas

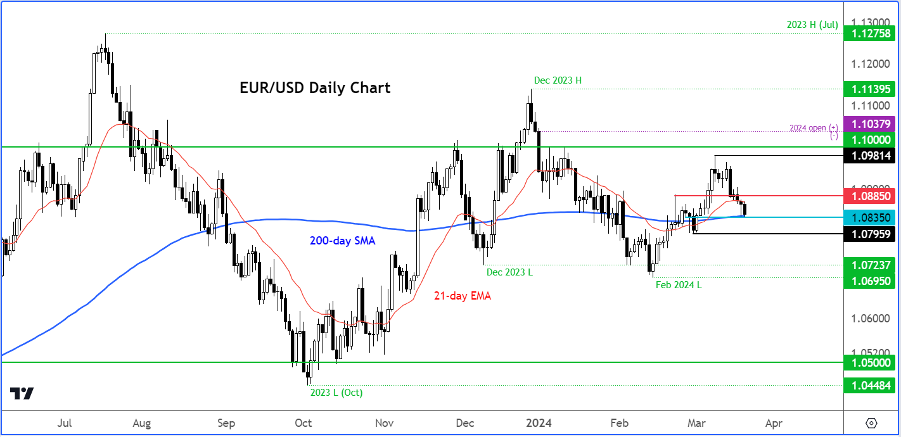

At the moment, there is no clear directional bias on the EUR/USD currency pair. That being said, rates have been going higher over the longer-term period starting from October of 2023 when it made a low at 1.0448. In order to maintain the bullish bias, the 200-day moving average needs to hold as support, which was being tested at the time of writing at 1.0835. This level is key support as far as the short term is concerned. The next level to watch is at 1.0795, which was the law from the end of February, the last low prior to the recent up move. Should 1.0795 break down on a daily closing basis, then the EUR/USD would start to look more appeasing to the bearish camp than the bulls.

That’s a scenario that the bullish traders will not want to see, obviously. Instead, if rates hold around the 200-day moving average and start to rise above resistance at 1.0885 and close above this level either today or ideally tomorrow following the FOMC rate decision, then that would be a rather bullish outcome for this currency pair. In that scenario, we could then see rates go on to climb to a new high for the year above 1.10 handle and possibly head towards the December high of 1.1140 in subsequent days.

Trader | Analyst | TradingCandles.com

e: Fawad.Razaqzada@TradingCandles.com

20240320