Why Watch the Transportation Sector

Why Watch the Transportation Sector

Written by Michele ‘Mish’ Schneider

I have created a video recap for today’s Daily. The link to watch is below.

Transportation stocks are an excellent measure of industrial and manufacturing strength and supply and demand.

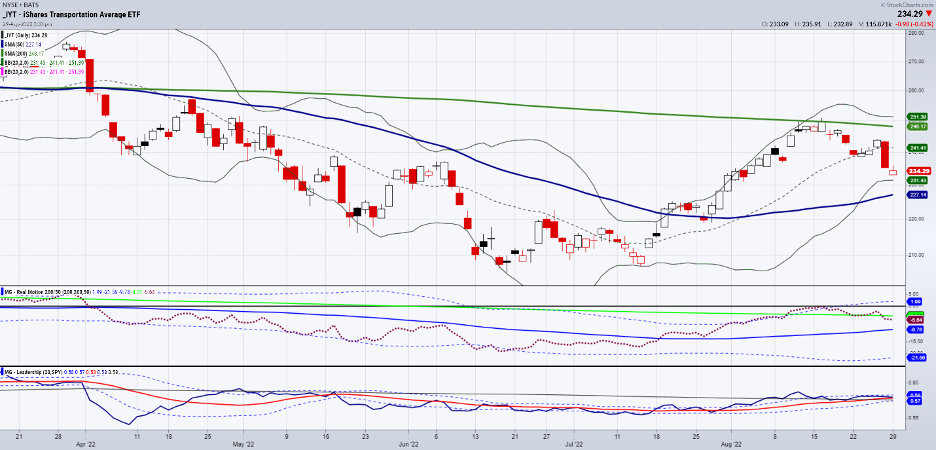

In this video, I discuss the Tran (IYT) ETF – It is a good indicator of economic health as the movement of goods and services across the country is the economy’s lifeblood.

This relates to Charles Dow and his emphasis on tracking transportation to gauge the economy’s health.

We can use IYT to see if goods are moving or not. And in a strong economy, we don’t want to see supply outweighing demand.

The ETF basket broken down

IYT iShares U.S. Transportation ETF

Aug 26, 2022, Percentage of Fund Value

| Transportation Type | Fund |

| Railroads | 31.82 |

| Air Freight & Logistics | 31.71 |

| Trucking | 21.02 |

| Airlines | 13.73 |

| Marine | 1.44 |

| Cash and/or Derivatives | 0.29 |

Generally, transportation companies are busier when economic activity picks up, leading to strong demand for the movement of goods across many economic sectors.

When economic activity increases, transportation businesses are often busier, which fuels significant demand for more commodities across various economic sectors.

When the supply of goods outweighs the demand, that’s a sign that the economy is slowing down. But when demand outweighs supply, that signifies a strong economy.

IYT is a great way to measure that relationship and better understand where the U.S. economy is heading.

So if you want to learn more about how the Tran can be a good indicator of financial health, click the link below to watch my video recap.

Click here to access the video of Mish, Tran IYT and her chart analysis.

Also be sure to watch today’s clip on Bloomberg TV!

Get your copy of “Plant Your Money Tree: A Guide to Growing Your Wealth”

and a special bonus here

Please let us know if you’re not a member and would like to learn more about investing into ETFs.

Reach out via chat, phone, email, or book a call with our Chief Strategy Consultant, Rob Quinn by clicking here for more information.

Bloomberg TV with Caroline Hyde 08-29-22

Making Money with Charles Payne 08-26-22

Stockcharts TV Your Daily Five 08-26-22

CMC Opto Article August 24, 2022

ETF Summary

S&P 500 (SPY) 399 major support 410 pivotal 417 resistance

Russell 2000 (IWM) 190 pivotal, 182 major support, 195 resistance

Dow (DIA) 320 major support

Nasdaq (QQQ) 312.50 pivotal, 303 major support and 319 resistance-clutch hold of the 50-DMA

KRE (Regional Banks) 62.00 the 50-DMA

SMH (Semiconductors) Unconfirmed bear phase if cannot retake 223.50-215 next support

IYT (Transportation) 227 the 50 DMA. 234 area pivotal and 240 resistance

IBB (Biotechnology) Confirmed bear phase. 124 resistance 117 next support

XRT (Retail) 64.25 area the major 50-DMA support and 67 resistance

20220830