Wavetraders Macro Views – “Germany’s energy quagmire. Can you say Stagflation? Not good for the euro”

Germany’s energy quagmire. Can you say Stagflation? Not good for the euro

Monday 7 March 2022

“The concept of humanity is an especially useful ideological instrument of imperialist expansion, and in its ethical-humanitarian form it is a specific vehicle of economic imperialism. Here one is reminded of a somewhat modified expression of Proudhon’s: whoever invokes humanity wants to cheat. To confiscate the word humanity, to invoke and monopolize such a term probably has certain incalculable effects, such as denying the enemy the quality of being human and declaring him to be an outlaw of humanity; and a war can thereby be driven to the most extreme inhumanity.”

–Carl Schmitt

| Stagflation is characterized by slow economic growth and relatively high unemployment—or economic stagnation—which is at the same time accompanied by rising prices (i.e. inflation). Stagflation can be alternatively defined as a period of inflation combined with a decline in the gross domestic product (GDP). |

If we take an already struggling global supply chain, thanks to the ravages of global covid policy, add in almost universal global sanctions against Russia (which magnifies the existing supply chain problem for real goods), and top it all off with soaring energy prices (especially for Europe), it’s not hard to make the case for global stagflation.

The policy problem: An increasing share of Mr. and Mrs. Consumers disposable income is set aside to do what they cannot avoid doing: 1) heating or air conditioning their homes (caves); 2) fueling their automobiles (horses or donkeys); 3) buying food in order to sustain life (hunting and gathering). Interesting, nothing has really chained much when it comes to essentials despite the panacea of technology.

Thus, the demand for essentials is the demand for energy. As energy costs rise, disposable income falls. Thus, energy is at the core of stagflation. And as most of you well know, energy prices are soaring. Time to worry. You bet!

But maybe our worry is in vain because the International Energy Agency (IEA) is working overtime to solve this pesky energy problem. In fact, the IEA staff has been burning the midnight oil, so to speak, developing a 10-point plan to Reduce the European Union’s Reliance on Russian Natural Gas. You can read the gory details here. So, if you live in Europe and your energy bill rises another 500%, don’t fear. Tick…tick…tick…tick…help is on the way.

It will probably only take about 10-years to fully implement most of the items on the IEA plan; well, we all have to sacrifice—some more than others. Given the US and UK have little dependence on Russian energy, they may sacrifice a bit less–but they are with you in this time of need Europe.

Looking at the IEA plan, we particularly like points 1 (No new gas supply contracts with Russia); and 4 (Accelerate the deployment of new wind and solar projects). The American oil and gas industry likes almost everything in this plan.

It’s almost as if Russia attacking Ukraine was a boon for US energy exporters, weapons manufacturers, and the US capital account (as pricing oil in Euros is now out of the question). But we digress.

Point 1 – No new gas supply contracts with Russia. Well, that is likely to be accomplished very soon when Mr. Putin decides its time to cutoff all gas exports to Europe, as sanctions against Russia begin to bite and more weapons are sent to Ukraine. The 10-point plan implementation sooner than expected. Great.

Point 2 – Accelerate the deployment of new wind and solar projects. Boy those wind and solar projects seem to be working out so well for Germany. Now, eleven years in to the alternative energy transition, and Germany has gone-a-begging for energy; new solar panels and wind mills, supplemented with shutting down nuclear power plants just isn’t cutting the mustard. And importing energy from France must be a bit “galling.” (Sorry, we couldn’t resist that little pun.)

Despite all the good intentions of wind and solar energy, it cannot make up for those dirty fossil fuels; and won’t any time soon.

The reality bites listed below come from Matt Ehret’s Insights, in a piece titled: The EU’s “Fit for 55; Farm to Fork and the Freezing of Nord Stream 2: A Mass Sacrifice to the Gods? This is an excellent piece, with many interesting and ugly details regarding the inadequate capacity of renewable energy, and the staggering costs required to really make a transition, which is still years away. We highlight some key points.

- * We are told that it is the overreliance on natural gas and coal by Europeans and their slow transition to renewables and biofuels that is at the heart of this energy crisis.

- * EU Climate Czar Frans Timmermans declared in his opening remarks at the “Fit for 55” discussion on October 6, 2021: “I want to say clearly, that had we had the Green Deal 5 years ago, we would not be in this position. Then we would have much more renewable energy of which the prices are consistently low and we would not be this dependent on fossil fuels from outside of the European Union.” [FYI Mr. Timmermans, Germany started its green energy transition 11-years ago.]

- * It has become a common theme for political leaders to not accept responsibility for the consequences that their citizens are forced to live, or rather suffer, through. If we were to take Timmermans’ statement as an honest one, why then were countries pressured to downsize their non-renewable energy sources before the renewables were theoretically plentiful enough to responsibly supply energy needs?

- * Either Timmermans is delusional because renewables do not have the ability to compensate for nuclear, natural gas, and coal or he is criminally incompetent since amidst an energy crisis, he does not admit his role as EU Climate Czar for putting Europeans in such a dangerous position.

- * Germany boasts of 45% gross renewable energy but this is not telling the full story. In a 2021 study, The Frauenhofer Institute estimated Germany must install at least 6-8x present solar capacity in order to reach 100% carbon free goals by 2045, with estimated costs reaching into the trillions.

- * The report says that the present gross 54 GW solar capacity must increase to 544 GW by 2045. That would mean a land space of 3,568,000 acres (1.4 million hectares), which is more than 16,000 square kilometers of solid solar panels across the country. This is not even including all the wind stations. Farmland and forests will be destroyed and paved, all for so-called environmentally friendly though unreliable and incredibly expensive solar and wind renewables.

- * In the midst of major food shortages, due to the energy crisis which has reduced fertiliser production, Europeans are also being told that they need to severely cut down on farmland to make way for the new farms of solar panels and windmills. In addition, solar panels present a very serious toxic waste situation with no readily available solutions, unlike the case of nuclear.

- * The International Renewable Energy Agency (IRENA)’s official projections assert that “large amounts of annual waste are anticipated by the early 2030s” and could total 78 million tonnes by the year 2050.

- * “By 2035, discarded panels would outweigh new units sold by 2.56 times. In turn, this would catapult the LCOE (levelized cost of energy, a measure of the overall cost of an energy-producing asset over its lifetime) to four times the current projection. The economics of solar — so bright-seeming from the vantage point of 2021 — would darken quickly as the industry sinks under the weight of its own trash.” (Harvard Business Review)

- * And as of writing this paper, February 22, Chancellor of Germany Olaf Scholz has just announced the freezing of Nord Stream 2 as a “punishment” to Putin’s recognition of the independence of the regions of Donetsk and Luhansk in formerly eastern Ukraine on February 21.

- * Who does Scholz think he is really punishing here?

So, we can expect stagflation to be much worse in Europe than the United States, or China, regardless how the central bankers react. Is it possible for the European Central Bank to raise rates in this environment? Not likely.

However, we expect the US Fed will be hiking in interest rates at the next meeting on March 16th despite the US 2-10 yield spread is pointing to a slowing economy. If this spread gets below zero it means the market is expecting recession.

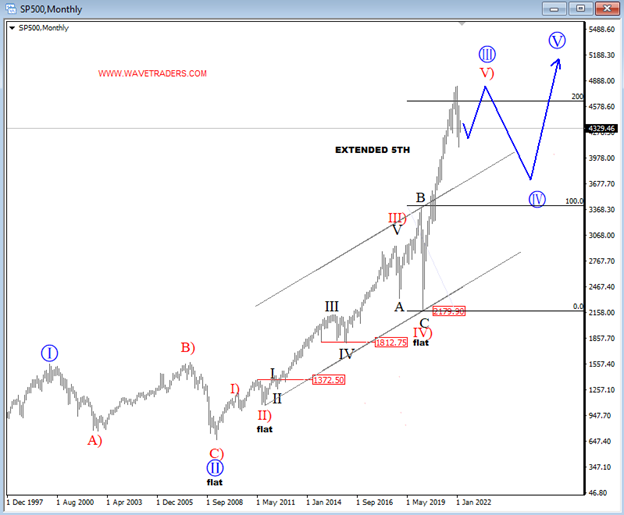

Recessions are usually not good for stocks. Below is our current monthly Elliott Wave Count for the S&P 500 Stock Index. Notice that we are seeing price in late stages of an extended blue wave III, so market may experience a tricky price action for upcoming months to unfold wave four setback. Sometime those can be nice and clear and sometimes complex. But the important is to know that any new longer-term investments should wait in cash for better prices.

Though expectations for US economic growth seem to be falling fast, the yield spread between the dollar and euro should grow further in favor of the dollar.

Maybe this helps explain why the Euro is cratering against the US dollar at the moment, not to mention the dollar safe haven premium. (US safe haven premium is still intact, but we expect the dollar’s reserve status to be challenged more aggressively in the near future.)

We had anticipated the decline in the euro. Not because we knew anything about Russia, or Ukraine, or energy policy, but because we do know a bit about the Elliott Wave Principle.

Below is our current daily view on the euro (EUR/USD). We have been sharing this view with our clients for weeks, and updating the labels along the way. It is playing out nicely. EUR/USD is below 1.1 as we write, and is testing the long-term support we have drawn on the chart—the red upsloping line at the bottom that is going back from 2016. Rhut rho! The reason for bearish euro of course are higher bunds and yield differential as mentioned above.

If the situation in Ukraine continues to deteriorate, we could see another major leg down in the euro.

Stay tuned. And be careful out there.

If you like what you see here, you can learn more about us, and subscribe to our service at our website. We also have live customer chat support to serve you.

Regards,

Gregor and Team

Register for EW-Forecast Macro Views

Love what we do? Please follow us twitter. https://twitter.com/GregaHorvatFX

20220307