US Cannabis: A Curtain Call

US Cannabis: A Curtain Call

The earth shook last Thursday with an hour left in the trading day on Wall Street…

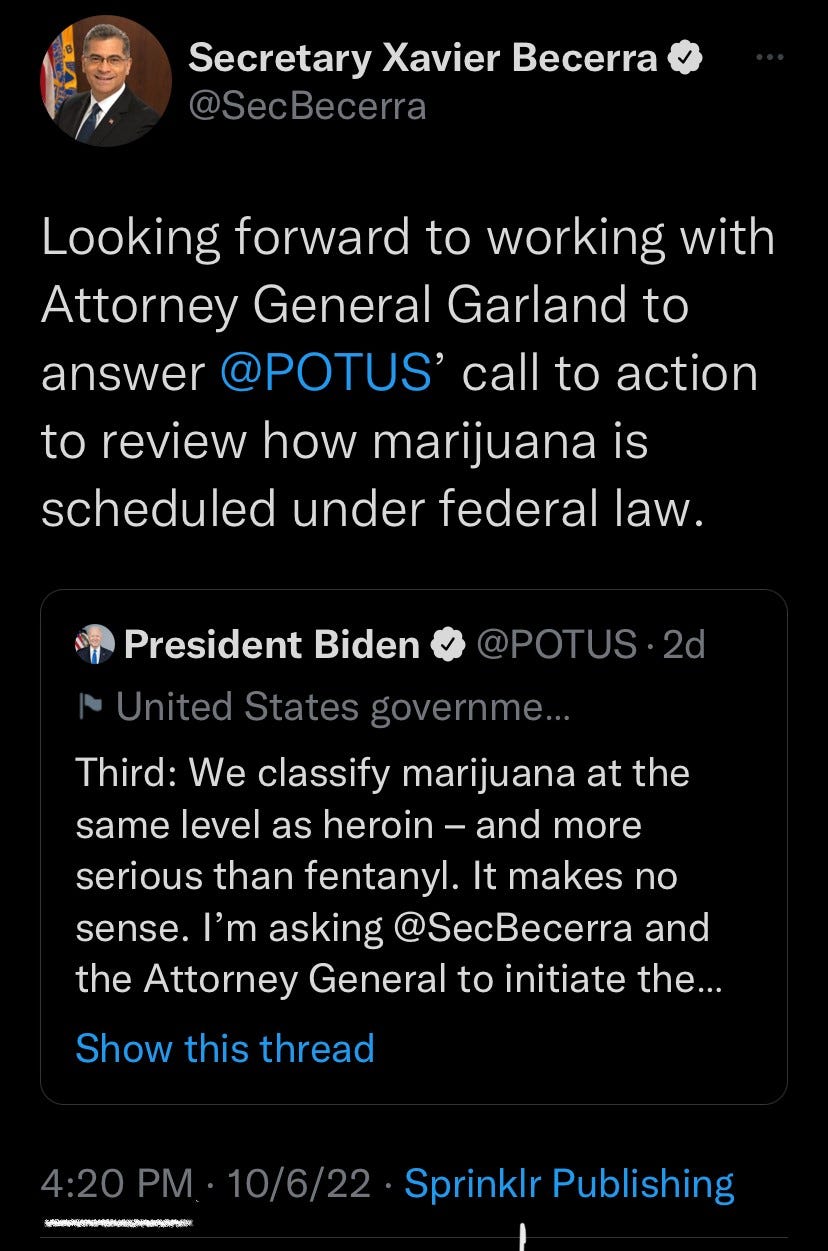

…when Joe Biden shocked the world and announced he was going to fast-track review of the federal scheduling of cannabis and pardon prior federal pot possession charges.

The move, designed to catalyze young voters a month before the midterm elections, “could alter the face of the industry” and expedite the end of the War on Drugs.

We’ve chronicled Weldon Angelos as the man in the criminal justice arena (here, in February, as SAFE+ first took shape, and here, in July, as he helped set it in motion).

We revisit his heroic efforts as last week’s announcement wasn’t a single shot across the bow; in fact, we could see the next sonic boom—the senate version of SAFE+—as early as this week ahead of it potentially passing in the lame duck (Nov / Dec).

All of this is very exciting but to understand where we are, we must first appreciate how we got here; for as Teddy Roosevelt once said, “there is no effort without error and shortcoming.”

Setting the Stage

It’ll be a full decade next month since I first offered this thought on Twitter:

It was an observation that followed several years of extensive research, triggered by my desire to navigate PTSD following the events of 9/11. I knew that cannabis helped me cope with overwhelming emotions and allowed me to sleep at night. I had no idea why, but I was determined to find out.

I studied the sordid history of the War on Drugs and researched the science behind the ECS (exists in all animals, invertebrates and vertebrates, including worms, fish, birds, amphibians, and mammals) and how it interreacts w cannabinoids in cannabis.

[studies, conducted mostly overseas, had already begun to illuminate the potential for efficacious agility across a wide range of disease and conditions ←spend some time]

Six years ago, with this knowledge in hand and a newfound purpose in tow, we started CB1 Capital in an effort to help identify the winners of the eventual legal framework.

We believed, perhaps naively at the time, that cannabis would effect positive change across multiple arenas—criminal / social justice, tax revenues, jobs, medicine—and endeavored to pave a path while illuminating what we found along the way.

That journey, and the structural issues—U.S operators being forced to list on second-tier Canadian exchanges, pay 70%+ effective tax rates and operate in cash—has not been easy. In fact, despite being named as an essential service into the pandemic, the industry is now wrestling with it’s second existential crisis in five years.

I mean, who could reasonably foresee that banks, one after the other, would ban clients from owning U.S plant-touching stocks—and what that would lead to?

Or that democratic leadership would hold basic services like banking hostage?

Or that the narrow chasm between decriminalization and legalization would empower illicit market activity, leading to a much-faster normalization / collapse in pricing?

[that was before the threat of nuclear war; consumers stuck bw the Fed and inflation; or a stock market caught in the crossfire of a U.S dollar that’s been weaponized on a global scale. (← US canna a mostly domestic supply chain / little currency exposure)]

The successful cannabis operators have been consistently targeted by politicians and smaller operators can’t compete in this tax-regime. Big tobacco / alcohol, meanwhile, seem content to circle above and position themselves to patiently pick at the carcasses.

It got so bad that a few weeks ago, I asked, Will the US Cannabis Industry Survive in response to that question being raised by a respected Wall Street analyst who posited whether the current decline was cyclical or secular. (←as in, lights out).

[risks include the axis-of-evil for U.S canna: higher rates, 280E and custody; whisper-thin liquidity ($20-$30M aggregate notional most days); unintended consequences of policy delays (banking / 280E creates the oligopoly the government seeks to avoid)]

We concluded the U.S cannabis industry wasn’t going back in the box anytime soon but that it’s face would be shaped by the sequencing of regulatory change, including banking, taxes and how and when interstate commerce takes shape.

The Purge

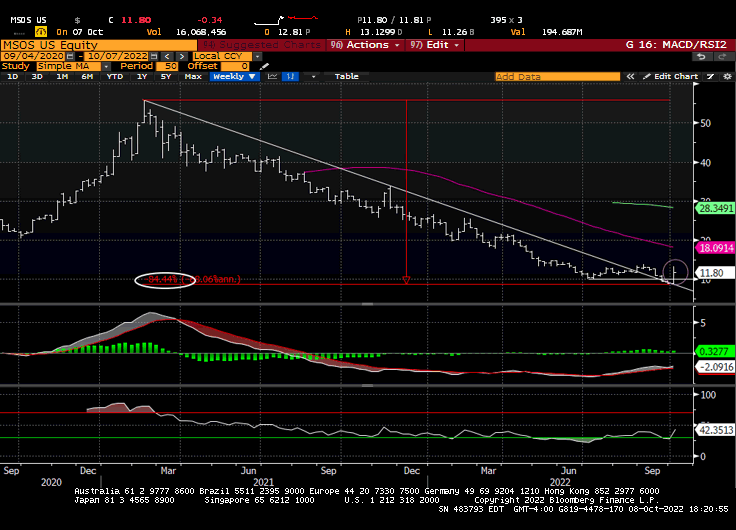

The capitulatory process is never fun—it is, by definition, when investors “give up” on a thesis. That’s what the U.S cannabis sector endured in September as scary macro and sector-specific concerns chased people and negative narratives chased price.

Given the putrid price action, the dubious delays at the state level and the economic conditions suddenly sitting atop an abundance of onerous restrictions / regulations, most retail investors haven’t stuck around to see how this story ends.

Who can blame them? Between the macro landscape, no visibility on federal progress and the complete lack of faith that this senate—or president—would ever honor their promises, the capitulatory process snowballed as we slipped further into the abyss.

What could they possibly miss? While tier-one operators are about to enter a period where they’re expected to generate significant free cash flow (FCF) from operations, that’s a 2023 story on the other side of what’s expected to be a cold and dark winter.

[Q3 / Q4 will show muddled industry growth; an optimization of assets; for those able, levering down of CAPEX to guide free cash flow; consolidation; and much like we saw coming out of the dot-com bubble and bust, a lot of sinners and a handful of winners]

[we expect a more-muted Croptober, eventual easing of pricing pressures (as supply / demand course correct) and for those able to grow low-cost / high-quality cannabis at scale, an unbelievable opportunity to capture share and build upon brand shadows]

Given the crash, most US plant-touching stocks have been priced as call options with no expiration. I don’t have a crystal ball—obviously—but we used the latest leg of this downdraft to add more of those. 4Front .30 forever calls; TerrAscend $1.25 forever calls, pockets of perceived alpha as we attempt to see through to the other side.

Because we know when the dust settles, algos cover and animal spirits subside, this industry, like any industry, will be driven by fundamentals and that is what will drive the institutional money once they’re legally allowed to enter the sector.

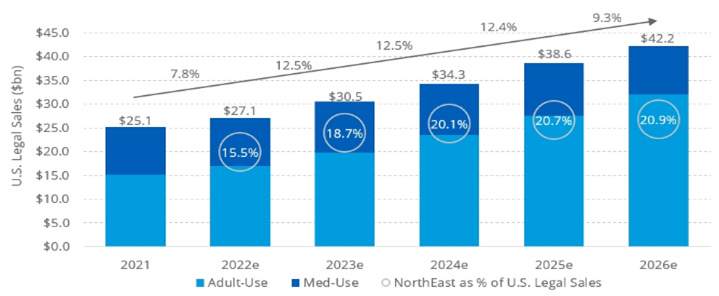

US cannabis market will be worth $42B in 2026 per BDSA, with the Northeast (MA, NJ, NY, PA) driving most of those gains and offsetting mature markets (CA, CO, OR, and WA). (←assumes heightened macro pressures, delayed launch of key AU markets (NY) and FL, OH and PA adopting AU in 2025).

ATB Capital markets noted in early October that the US MSO (Tier 1 and Tier 2) peer group is trading at 6.1x 2023e EV/EBITDA on expected growth of 36%. That compares to CPG at 15.0x 2023e EV/EBITDA (6.0% growth), Alcohol at 11.5x 2023e EV/EBITDA (7% growth) and Tobacco at 9x 2023e EV/EBITDA (4.0% growth).

And Echelon Capital Markets notes that states typically see a 3-5X increase in canna sales when they transition to adult use; in some cases, such as New Jersey and Illinois, AU sales were ten times larger than the medical program.

[in addition ton addition to other regulatory catalysts, such as when FL and PA approved dry flower and medical sales roughly doubled]

With five more states (AR, MD, MO, ND SD) casting ballots next month on adult-use and numerous others taking steps in that direction, the inside-out legalization of the United States should very much continue apace.

What became clear, however, is that cannabis industry has two immediate and critical needs: guidance at the federal level, and clarity on the timing / enforcement in New York and other states. That all seemed like wishful thinking, until a few days ago.

Political Theater

Unsurprisingly and perhaps a sign of the times, a chorus emerged to claim this was political posturing bc stock market crashes usually aren’t great for the incumbents.

That remains to be seen, of course, although it may just have been our chosen course.

If we’ve learned anything navigating this space since inception, however, it’s that the pendulum tends to overshoot both ways. If cannabis has a place in American industry—if its not toe-tagged like some suggest—there should be another side to this cycle.

While most don’t trust what’s to come after the hard-lessons learned, particularly as it pertains to the political spectrum, it’s worth exploring the potential ramifications.

First, if in fact the odds of SAFE banking increased (they have), that could pick off one of the culprits in our tricky trifecta of higher rates, 280E and custody. And while plain vanilla institutions won’t be able to buy until after the fact, fast-money could front-run.

[up-listing to US exchanges will depend on the safe harbor language but previous / boilerplate language required FinCEN to update AML guidance, at the very least]

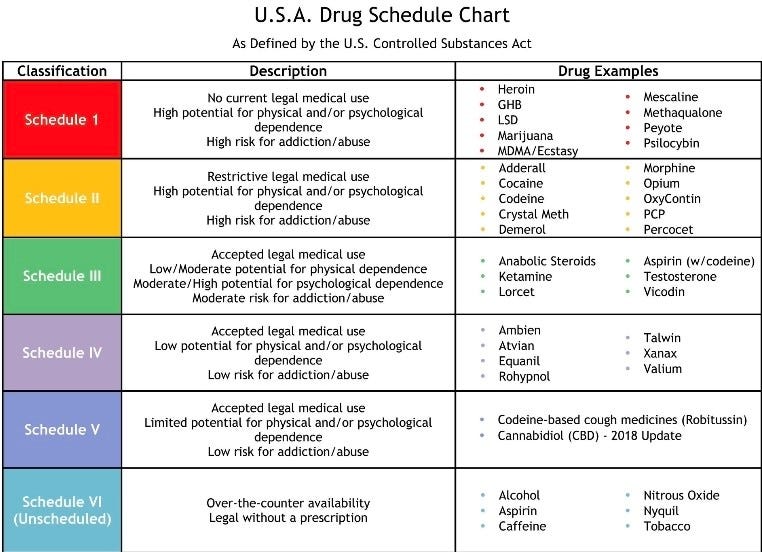

Second, following the presidential order for an expeditious review of how cannabis is scheduled—the DOJ and HHS have already signaled…

…that they’re up to the task, if not already having a plan. Remember, Attorney General Merrick Garland told us four full months ago that the Justice Department will address marijuana issues “in the days ahead” and these have been some long-ass dog days.

Importantly, if cannabis is moved to Schedule III or lower, which seems likely as the president went out of his way to mention how absurd it is to be treated like Fentanyl…

…the second sucker of that tricky trifecta—280E tax treatment—will get taken out back and shot, which would have profound implications for the MSO’s [Echelon].

While we can’t do much about the third headwind—higher rates—we would note that capital markets were all but closed for cannabis companies until late last week; and while these stocks have a ways to go to reclaim fame, we wouldn’t be shocked to see equity offerings into strength.

[balance sheet optionality is a good thing for a sector that’s been left for dead btw]

One thing is for certain: there will be lots of pushing / shoving / speculation re: where this lands and when. Some will say nothing changed, others that everything changed; truth is, we don’t know as we ready for a what’ll likely be a rough reporting season.

With the world at war and recession or worse looming, the process of price discovery should continue for markets at large and cannabis, by extension.

While there are no magic bullets or easy solutions for what ails the world, there are steps that can be taken to right the wrongs of the past and position this industry for the future.

Our path has long been littered by false hope and empty promises but as canna takes center stage into year-end and beyond, there may finally be a light at the end of the tunnel that isn’t affixed to the front of a train.

Good luck out there, and keep the faith.

Note: we talk about this sorta stuff all / every day on Twitter SuperFollows.

position / advisor in stocks mentioned.

20221009