U.S. Cannabis: Running Down a Dream

So, how was your summer? For U.S cannabis stocks, and really most cannabis stocks, the seasonal softness we’ve seen since the solstice was a tough nut to swallow…

U.S cannabis ETF $MSOS, after enjoying a 173% rally from the Sept 2020 low into that infamous February top, subsequently lost 42% before the most recent bounce attempt / the first discernable effort at a higher low since we saw snow on the ground.

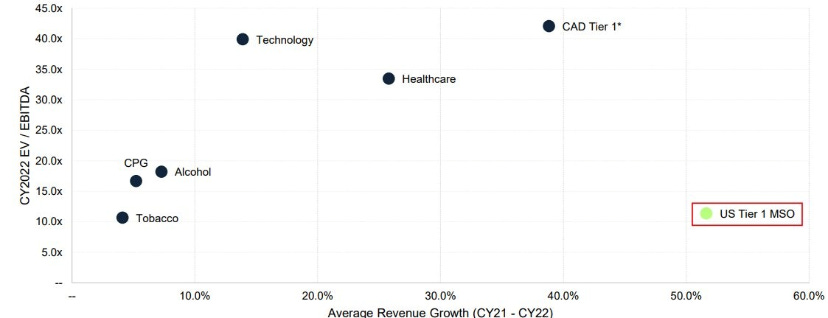

One might assume business fell off a cliff, another sector scandal emerged or perhaps a giant boogie man is masquerading as the FDA or interstate commerce but bottom line: business is good. Real good. And with this latest divergence between the stellar fundies and declining stock prices, we find ourselves back in ‘Growth @ Value’ land.

While definitive unknowns remain—the rate and pace of federal reform, the role the FDA ultimately plays, and the timing of interstate commerce / implications for legacy assets—industry insiders will tell you that the (almost) industry-wide custody f*ckery we’ve been forced to endure is the single-biggest reason we’re still able to access the generational opportunities that are littered across the U.S cannabis landscape.

Which makes the story that broke late last week about Merrill Lynch adopting a more flexible stance on cannabis all the more interesting and potentially profound…

…and while we mustn’t confuse a mandate directed at retail brokers with the sudden ability for institutions to custody US cannabis plant-touching stocks, this is one of those second- or third-derivative shifts we would be wise to pay attention to, if only because every other major U.S institution most definitely is.

[sidebar 1: we heard this decision was driven by brokerage demand and in particular, one extra-large Private Bank client that threatened to pull their account if they weren’t allowed to custody U.S cannabis securities; and we’ve since heard this mandate is for accounts $10M or more (<-not confirmed but if true, wow)]

[sidebar 2: the specter of Merrill reversing course reminds me of the Great Financial Crisis when every effort to stem the bleeding failed until someone, somewhere decided to relax marked-to-market accounting, an opaque ruling that forever altered the course of financial market history. ‘this’ will be ‘that’ when other banks follow]

With the unofficial start of September on Tuesday, our eyes will be trained on three catalysts that could awake this sleeping giant from the sector slumber and potentially trigger an epic fall-to-spring upside fling:

1) Talk to Chuck: I know, I know, “F*ck Chuck” you say; but not so fast, I’ll offer. This dude has done more to elevate the federal cannabis conversation than any other Senate Majority Leader in our country’s history. It’s not his fault he doesn’t have the votes for comprehensive reform—it’s not—and i’ll say it again: if it took Connecticut five years to legalize adult use, it’ll take fifty Connecticuts longer than a year and a half. Still, we continue to hear / believe / expect that SAFE+ (with “+” = social / crim justice reform) is best case and a boilerplate SAFE (would automatically trigger FinCEN/AML guidance) is the worst case as the NY/NJ Senators can’t return to their home states w/o functional banking for their respective social justice programs.

2) New York: With Andrew Cuomo out of office, New York Gov Kathy Hochul wasted no time prioritizing the launch of adult-use cannabis. In naming the chair / executive directors of the Cannabis Control Board and Office of Cannabis Management, she did more in a week than her predecessor did in a year. On record as a staunch believer in the economic (jobs), fiscal (tax revenue) and societal change that will manifest on the other side of prohibition, there is already talk that the expected Q123 adult-use launch could be pulled forward. BTIG cannalyst Camilo (Iron like a) Lyon (in Zion) thinks Curaleaf (Buy; C$34 PT) will benefit most, followed by Green Thumb (Buy; C$73 PT) and Cresco (Buy; C$24PT).

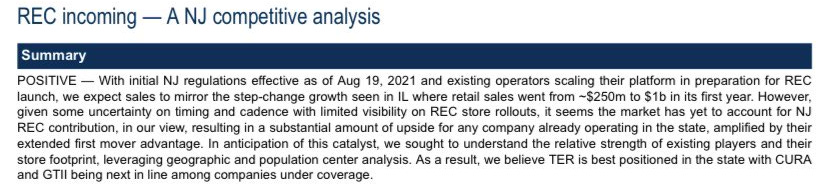

3) New Jersey: The biggest reason New York has pep in it’s step is down by the river…

…because in mid-August, NJ regulators approved rules for adult-use sales to begin w/in 180 days. This is huge bc when NJ voted for adult-use cannabis in November, that was our “all-in” signal as the east coast dominoes had only one way to fall. Still, the delays / uncertainty about the timing of the launch has helped contribute to the seven-month drawdown for U.S canna. Meanwhile, Cura CEO Boris Jordan expects NJ to go from a $180-200 million medical market to a $1.5-2 billion adult use market in twelve months; Stifel’s Greek Freak Andrew Partheniou seemingly agrees, noting that TerrAscend is in particularly stellar shape to capture this conversion.

Random Thoughts

- Another excellent read on the likely path of U.S cannabis at the federal level and it comes with a prediction: prepare to be surprised!

- TerrAscend bought Gage last week for $525M, or an ~18% premium; there was some grousing on twitter but we love this deal looking at yards after the catch. Gage got one of the best jockeys in the space (Jason Wild), the pivot to premium / brands will drive healthier margins, Canopy / COOKIES, and one of the best cap tables in the space. btw it’s trading @ 5.7X 2022 EBITDA. Yes please!

- Speaking of insanely cheap multiples for blue chip U.S cannabis stocks, Verano came public right into the cyclical Feb top as ETF inflows abated / reversed. The result? The missing ‘A’ in U.S canna FAANG was offered @ 4.6X 2022 EBITDA last week which was one of the reasons I posted the thought below:

- There were several sell-side U.S cannabis Zooms last week; three takeaways: 1) this opportunity is real / generational / asymmetric / not w/o challenges2) notable attendees; we counted six size institutions (that’s just what we saw)3) Boris @ Cura noted the improvement in the debt markets relative to stocks…

- After a stellar start, this year has been a lesson in humility and patience for those of us focused on the space. While there are always different strokes for different folks (traders, investors, hybrids) the one thing I think we can all agree is that this is a sector of extremes, which we think will continue.

- For and with our money, we still believe fundamentals will lead technicals; and when the barbarians bust through the gates, they’ll come for the canna FAANG and all their friends. But I get the surly mood as in many ways, this is a super-confusing sector with all the unique state-level structures, onerous federal regs and the naked-short shenanigans on the trading side. In other ways, however, I suppose it’s actually rather simple (and thanks Wolf for the art).

/positions in stocks mentioned

/advisor $MSOS, $VRNOF

Todd Harrison

20210905