Timing the S&P500 & the midterm rally; does it make sense?

Timing the S&P500 & the Midterm Rally; does it Make Sense?

Going into the US midterm elections analysts were mostly split between three different positions:

- * Those analysts who pointed to the strong seasonal pattern in US stocks post the US midterm elections,

- * Those who recognised the strong seasonals but said that it is different this time and stocks won’t rally,

- * Those who wanted to wait and see.

This article will look at some of the main points to consider when trying to track a way through by looking at the strengths and weaknesses of each position.

The seasonal strength

It can’t be denied that the seasonals are very strong. Every US midterm election since 1950 has resulted in a higher S&P500 6 months later. That is a key statistic that can’t be ignored.

According to other analysts, this time is different and high inflation and the risk of the Fed giving a hard landing should mean that stocks don’t perform so well. However, if you take a longer view we have to ask when will the Fed signal a pause in rates? It is likely to when/if the US economy shows signs of slowing.

Jobs and inflation

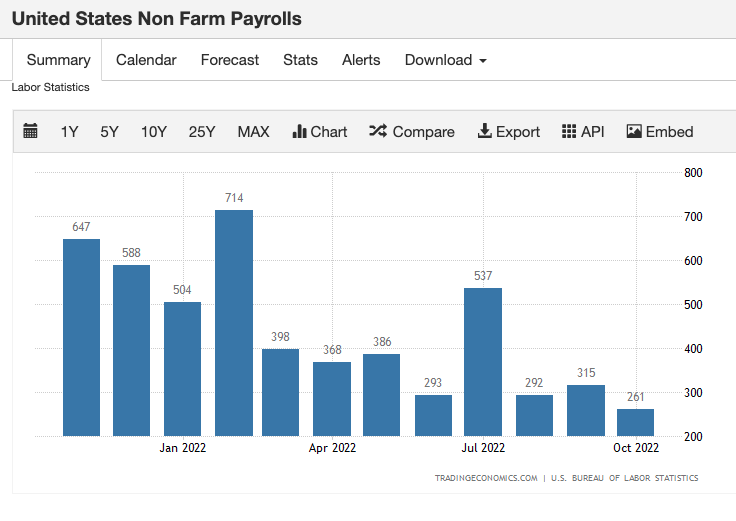

US jobs are still ok although the trend is tracking lower. The Fed will likely press the pause if/when the jobs market starts to slow down significantly.

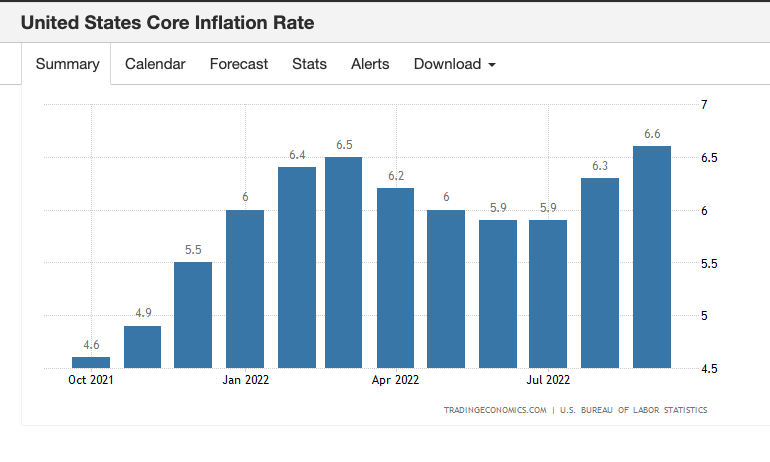

Core inflation is moving higher and that will be a key metric going forward. If core inflation can show signs of slowing then that will give the Fed space to pause rates. Remember the Fed’s preferred measure of inflation is PCE.

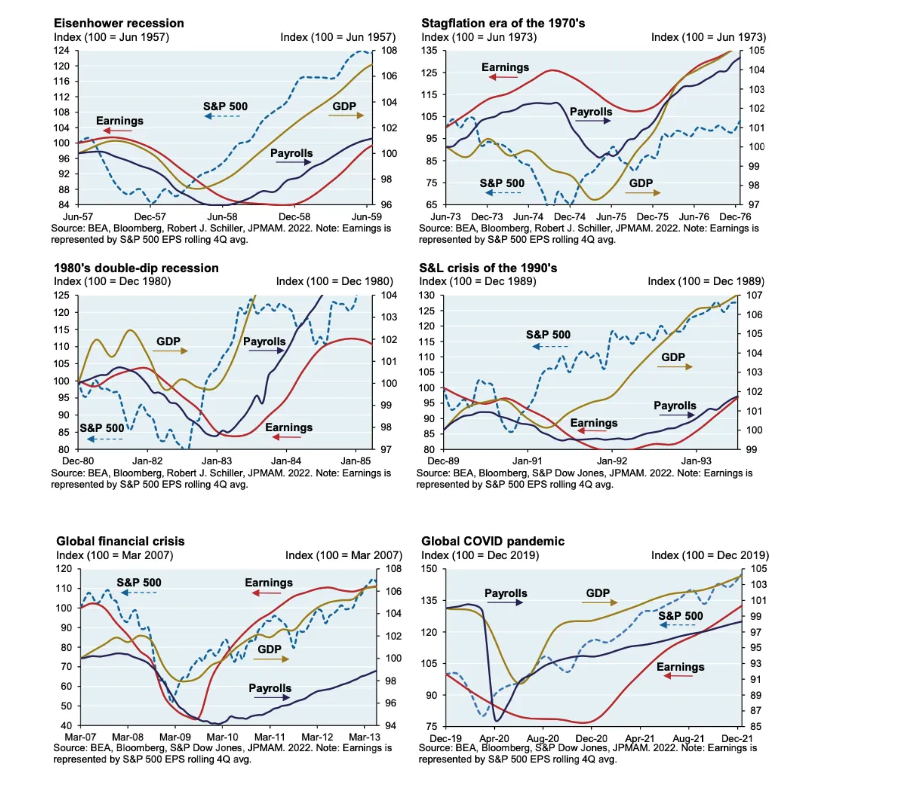

So, one key thing to remember is that the Fed will try to pre-empt a downturn in the economy and signal a pause before the effects really impact. The Fed has already said that there is a lag effect and that it will be mindful of that. The lag effect is due to the time for interest rate hikes to cool demand. There is usually a 6 month+ lag effect which means the Fed will not want to wait until the economy is struggling in order to signal a pause. This has been born out in history with many stock rallies occurring while the economy is still slowing. See the graphs below to see this effect in play.

About: HYCM is the global brand name of HYCM Capital Markets (UK) Limited, HYCM (Europe) Ltd, HYCM Capital Markets (DIFC) Ltd and HYCM Limited, all individual entities under HYCM Capital Markets Group, a global corporation operating in Asia, Europe, and the Middle East.

High-Risk Investment Warning: Contracts for Difference (‘CFDs’) are complex financial products that are traded on margin. Trading CFDs carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information please refer to HYCM’s Risk Disclosure.

*Any opinions made in this material are personal to the author and do not reflect the opinions of HYCM. This material is considered a marketing communication and should not be construed as containing investment advice or an investment recommendation, or an offer of or solicitation for any transactions in financial instruments. Past performance is not a guarantee of or prediction of future performance. HYCM does not take into account your personal investment objectives or financial situation. HYCM makes no representation and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or other information supplied by an employee of HYCM, a third party, or otherwise. Without the approval of HYCM, reproduction or redistribution of this information isn’t permitted.

20221111