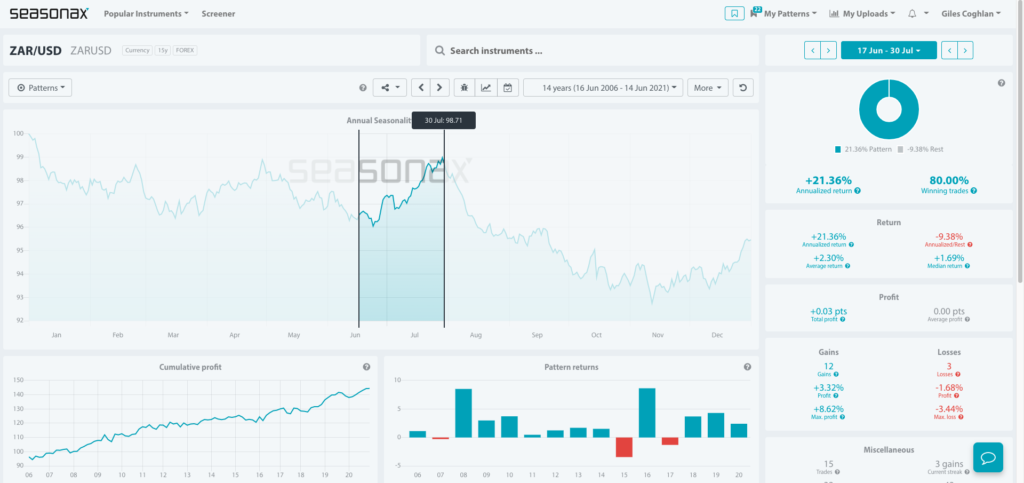

The South African Rand has a Strong Seasonal Pattern

The fallout from the Federal Reserve meeting will be key to whether this seasonal pattern plays out. If the market sees sooner tapering and interest rate hikes than before the Fed meeting then emerging market currencies like the South African Rand are liable to see weakness. However, if the market embraces USD weakness once again and the FED is dovish in their actions then this seasonal pattern could be perfect for emerging market currency traders. A dovish action by the Fed would be the dot plot unchanged, no talk of bond tapering, and downside risks stressed.

Over the last 15 years, ZARUSD has gained in value twelve times between June 17 and July 30. The largest gain was in 2016 with an 8.62% profit. The largest loss was -3.44% in 2015 and the average return over the last 15 years has been 2.30%.

Major Trade Risks: A hawkish tone from the Federal Reserve would invalidate this outlook as it will cause USD bears to step aside and allow the USD to rally. So, the markets considered reaction to the latest Fed meeting will be key.

Giles Coghlan