The Fed: Powell Keeps a Dovish Hold

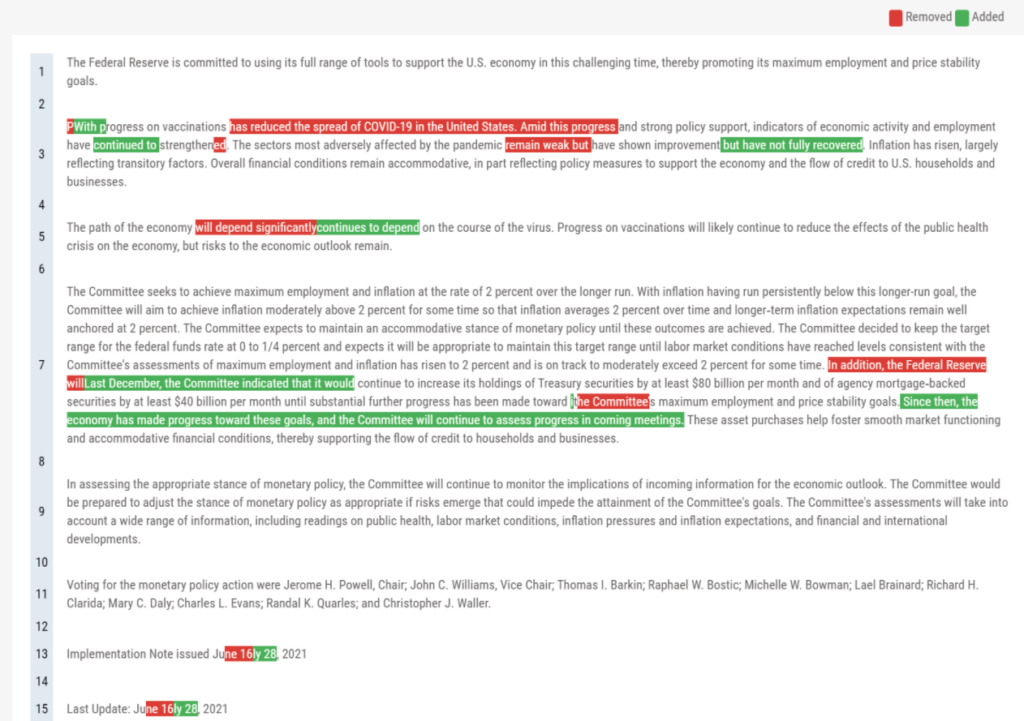

Going into the FOMC the expectations are that Powell would remain dovish and keep this as a holding meeting until Jackson Hole next month. In the end that is pretty much what happened. However, there were some very subtle shifts. The first one being that sectors impacted by COVID-19 were no longer considered to ‘remain weak’. Instead, they were recognised as ‘not yet fully recovered’. You can compare the two last statements here:

Substantial further progress

One key question, as the Fed wants to see substantial further progress, is what does that phrase exactly mean. Really that is a red herring to try to answer. We will only know that this ‘test’ has been met when the Fed say that it has. One outstanding area is jobs with the US still 6 million jobs lower than pre-pandemic levels. On that front, Powell said there is ‘still some ground to cover’. However, it is a slight concession that things are looking more positive.

Bond market?

The recent bid into bonds has Powell puzzled too. He said that it was partly due to technical factors. Technical factors can also be market commentators code for ‘ I have not got a clue’. Technically speaking that is.

Tapering

There is a range of views in the FOMC after it was discussed and timing, pace, and composition were not discussed.

Inflation

Slight wobble from Powell here. It could be more persistent than originally thought.

Goldman Sachs now expect a taper warning in September and an announcement in December. Most economists surveyed by Bloomberg expect a taper signal in September 2021.

The takeaway

There was not much to really get our teeth into and the moves were moderate. The bottom line is that the recovery does remain intact and as/if the USDJPY dips lower it would be reasonable to expect dip buyers at 108.00.

Giles Coghlan