The Big Questions Around Inflation, Recession, Banking Contagion, and Fed Rates

The Big Questions Around Inflation, Recession, Banking Contagion, and Fed Rates

Inflation

The growing view is that the banking crisis from Silicon Vally Bank and Credit Suisse is going to be a big deflationary force. Credit will be much scarcer from here on in and that should help the Fed bring down inflation across the world. Higher prices are going to be much tougher if credit is harder to come by. The current credit crunch typically precedes a recession. A US recession seems more likely today than it did 10 days ago.

Fed rates focus

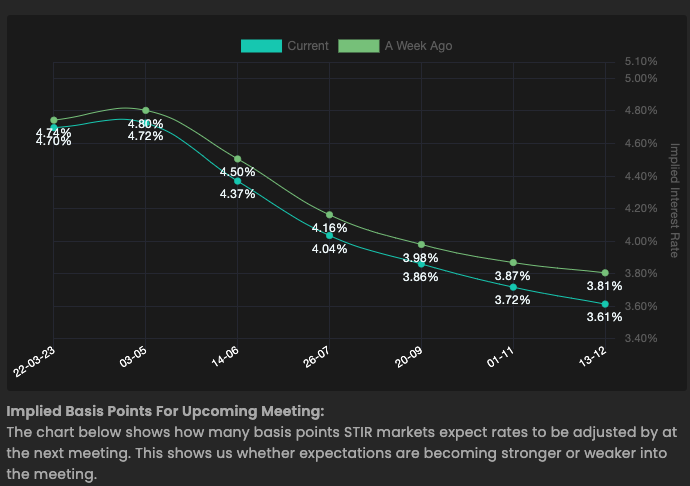

When the Fed meets on Wednesday there is a growing expectation that it will either hike by 25bps or pause rates. The market will want to see whether the Fed will adjust its policy moving forward. Will it hint at the prospect of rate cuts this year? US interest rates are currently at 4.625%, but Short Term Interest Rate markets currently see the Fed cutting by 100bps by the end of the year. Is this projection going to be confirmed by the Fed on Wednesday or will it maintain higher rates to bring down inflation? What’s the message going to be? Some kind of recognition of the present conditions seems unavoidable, but expect big volatility on Wednesday over the meeting.

Banking contagion fears

The Fed balance sheet rose by nearly $300 billion last week as it took the largest jump higher since the Covid pandemic began. Financial institutions are grabbing short-term loans from the Fed as liquidity fades and confidence fears grow.

t may be tempting to see the Fed cutting rates as the salve to heal the banking crisis wound. However, Gerard Macdonell, the senior manager at 22V Research LLC in New York point out that, ‘It is not at all clear that avoiding a rate hike would even help the financial troubles in the banking system’.

Summary

The prospect of a hard landing has just increased over the last 10 days. Major support for US stocks sits around the 3700 region. Note, the 200EMA on the weekly chart as a crucial support level that will need to hold to keep bullish hopes alive for the S&P500.

About: HYCM is the global brand name of HYCM Capital Markets (UK) Limited, HYCM (Europe) Ltd, HYCM Capital Markets (DIFC) Ltd and HYCM Limited, all individual entities under HYCM Capital Markets Group, a global corporation operating in Asia, Europe, and the Middle East.

High-Risk Investment Warning: Contracts for Difference (‘CFDs’) are complex financial products that are traded on margin. Trading CFDs carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information please refer to HYCM’s Risk Disclosure.

20230321