Steno Signals : “Real Estate Watch #2 (USA) – Is a Nationwide 15-20% Drawdown Pessimistic Enough?”

“Real Estate Watch #2 (USA) – Is a Nationwide 15-20% Drawdown Pessimistic Enough?”

The biggest interest rate shock in several decades ought to challenge the Real Estate outlook. Since housing famously is the business cycle, what is the 2023 outlook for US housing?

Last week we launched our first Watch series on Real Estate with an in-depth look at Europe. This week we’ll go across the pond and have a look at housing in the US! Since I have a ton of models on housing and all of them can’t go into a newsletter, I wanted to share one big document with all my models with you guys. So here you go. Feel free to use whatever you find interesting!

Due to the limited format of substack, only selected charts will be commented on in this article. Not to worry though – here you can find an appendix of all my charts and models on housing so far.

The United States

As the below illustration clearly indicates, we are experiencing a significant discrepancy between supply (or rather volume) and price in real estate. Given the at times illiquid nature of the housing market such divergences are not unheard of, but historically price catches up – or down rather. The lack of convergence is mainly due to owners having financed their purchase with fixed-rate mortgages. Given the fixed mortgages, debt-servicing-costs are not influenced by the rapid interest rate increases we have seen throughout 2022.

Thanks for reading Stenos Signals! Subscribe for free to receive new posts and support my work.✓

What could spur a rapid price fall, is If the labor market starts showing weakness and people get laid off. In such a scenario, which we remain convinced of as a base case for 2023, people – especially those who have stretched their leverage – could be forced to sell or foreclose.

Chart 1: Volume leads price

Looking at our models, a 15-20% decline in the nationwide BIS Residential Price Index looks probable. Given the fact that housing accounts for 15-18% of GDP (NAHB), it remains the main driver of the US economy. Based on household debt and savings, CFPB lending laws and regulations, and other parameters we are not predicting as detrimental a shock to the real estate market as seen in the financial crisis of ’08. That does not imply though, that we do not predict a correction or mean reversal.

We see a rapid surge in supply relative to the amount of houses sold as a consequence of suppressed demand due to the increasing interest and mortgage rates (cost of capital).

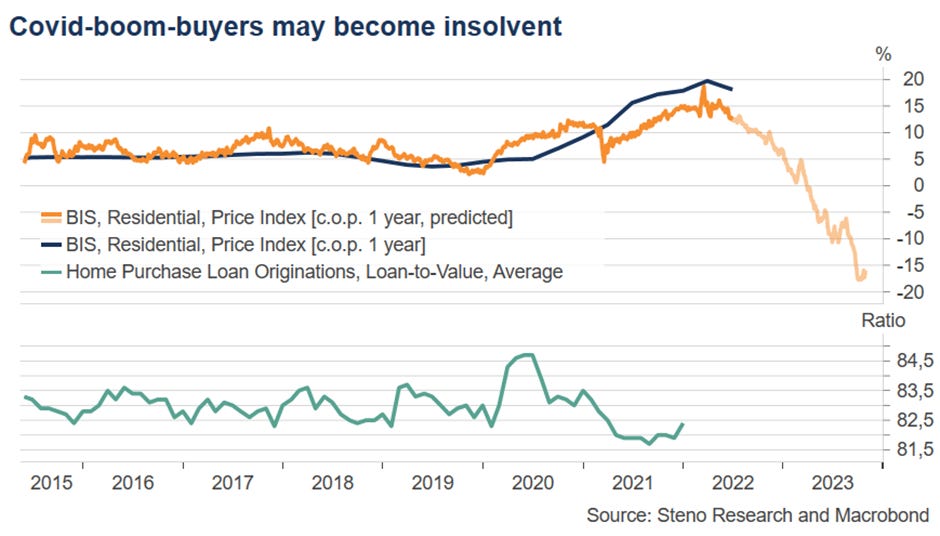

As the average LTV on home purchase loans at origin cornered 84.5% at peak in 2020, we could face a scenario in which people’s liabilities outweigh their equity leaving them technically insolvent once the price – almost inevitably – comes down.

Chart 2: Insolvency on the table

Covid-19 definitely impacted peoples lives. It too provided an opportunity for people to evaluate the lives they wanted to live. Many came to the conclusion that they wanted to work less and preferably from remote. While urbanization has swung the baton for the past century, data suggest that this movement has lost momentum – if not reversed.

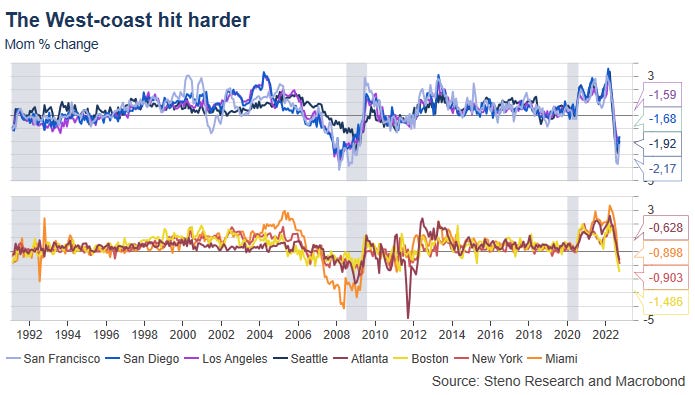

Now, we are experiencing suburbanization if you will. As the bat-flu was being dealt with, people were treading on each other’s toes, bidding up the price, and leveraging to their teeth in order to get a hold of the keys for their dream house or apartment. Now though, we see prices coming down, and the sunny West-coast is at the forefront, it seems. MoM changes in California already look 2008-esque.. Will the East coast follow suit?

Chart 3: The West-/East-coast rivalry – in a real estate context

So where does that leave us?

Evidently, countries differ in their real estate markets’ sensitivity to restrictive monetary policy. The predominant mortgage structure in any given country is the most telling for its economic outlook. As the first line combattant, and the tool currently used to fight rising costs of living, is increased cost of capital (i.e. rising interest rates), debt-servicing-costs eat away people’s disposable income. Hence, the consequential shock of rising interest rates is of a magnitude closely correlated to their floating/fixed-rate-ratio – the closer to one, the higher the hit to the real estate market (all else equal).

Few things are quite as simple as can be deduced to a simple equation. The real estate market definitely cannot. While the rate of ARM’s definitely plays a part, the significance of it depends on each household’s indebtedness. Only when these two variables are held against each other, can one gain useful insight into the state of the real estate markets.

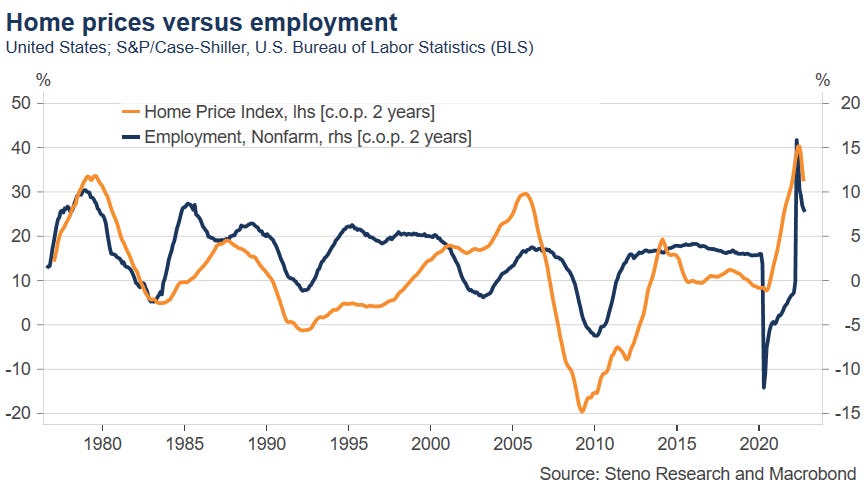

The labor and real estate markets are interlinked as well, adding yet another layer to the story. It is fairly easy to miss the distinction between correlation and causation, and I am not proposing that labor is a derivative of housing prices.

Chart 4: Employment and real estate interlinked

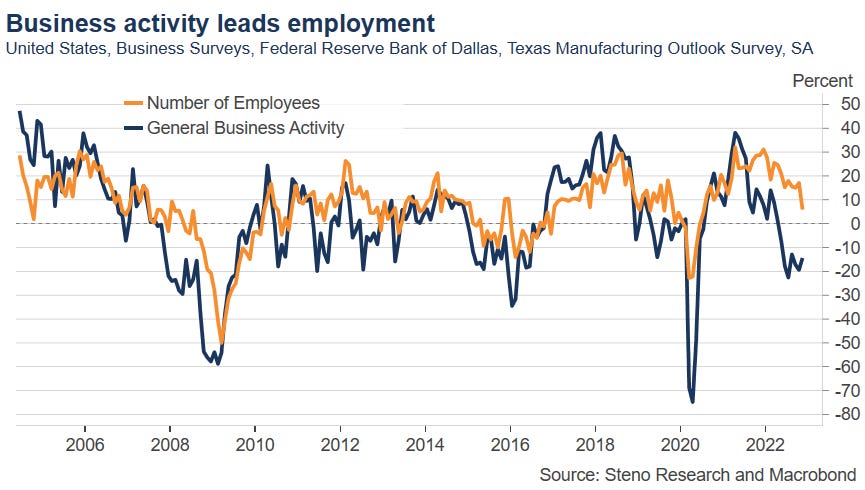

As corporations are currently going through ‘easy money’-withdrawals, we begin to see them dismissing employees – especially those who have been onboarded at an incredible pace. A weakening of the labor market is the catalyst, which could force people out of their homes and thereby offset the spiral in the real estate market. Though it might violate one of the Fed’s two mandates, I actually think that Powell and co. would be somewhat satisfied with such an outcome. I guess the end justifies the means and as I have said before, the most efficient labour supply reform in the current environment is to allow housing and equities to crash.

And housing will crash, it is in fact already happening. The question is if a 15-20% nationwide drawdown is pessimistic enough?

Chart 5: Interest rate doing its job

DISCLAIMER

The content provided in Stenos Signals newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.

20221208