Steno Signals #50 – Singing Hallelujah while being asleep at the wheel!

“Singing Hallelujah while being asleep at the wheel!”

AI is mana sent from heaven, while McCarthy and Biden have allegedly agreed on a debt ceiling deal. We continue to favor positions with a positive beta to slowing inflation despite the recent concerns.

Due to popular demand, we have now opened for paid subscriptions for Steno Signals (our weekly flagship editorial) via Substack. If you want access to our EM and Geopolitical basic coverage, you will get that at the same price (including Steno Signals) over at www.stenoresearch.com.

Our premium coverage and live-portfolio/data-hub will only be available at www.stenoresearch.com as well

Sing Hallelujah!

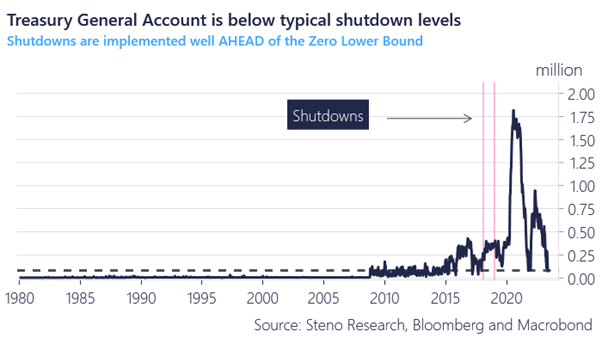

Biden and McCarthy have allegedly agreed on the principles for a 2-year debt ceiling deal, which could prevent the US government from a forced shutdown early next week. We now know that USD liquidity will dwindle in coming months as 1) The TGA cannot drop further, 2) QT is still running and 3) the FDIC may repay further emergency loans on behalf of banks

The “fuel” from a depletion of the TGA is hence no longer a thing as of this week, which is likely going to test risk appetite in markets and lead to further tailwinds for the USD.

Chart 1: The TGA is practically empty – time to rebuild

A debt ceiling deal is not necessarily good news for equities on an equal-weighted index level.

Want to know why? Find out more below!

A withdrawal of liquidity via issuance of a combination of bills and mostly 3-10yr bonds (they are the cheapest) will 1) lead to a depletion of private sector USD liquidity, 2) a renewed marketing case for money market funds trying to tempt individuals and SMEs to park excess liquidity in bills and 3) potentially a stronger USD.

The debt ceiling deal of late 2021 coincided with (or triggered?) a sell-off in S&P 500 as the TGA was replenished.

Chart 2: The TGA matters more risk appetite than you think

DISCLAIMER

The content provided in Stenos Signals newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.

20230528