Steno Signals #23: Ni Hao China?

Ni Hao China?

Given the rumors surrounding the Chinese reopening story we thought that we would do a deep dive into the China story and look at what is moving. Can we even expect to see a reopening?

Back from the Caribbean after a few interesting days watching the Crypto carnage almost live. The rug is being pulled from under the Crypto complex right now and I think one needs to focus on Genesis now. This is not over..

But enough focus on Crypto.. I promised you a big coverage of the potential Chinese re-opening and we are going to follow up with several stories this and next week. First, we look at the potential effects of a reopening, while we will follow up with our first version of “The Great Game” – our new blog on Gepolitics – focusing on whether it is at all feasible to think of a reopening happening anytime soon.. Let’s have a look at it.

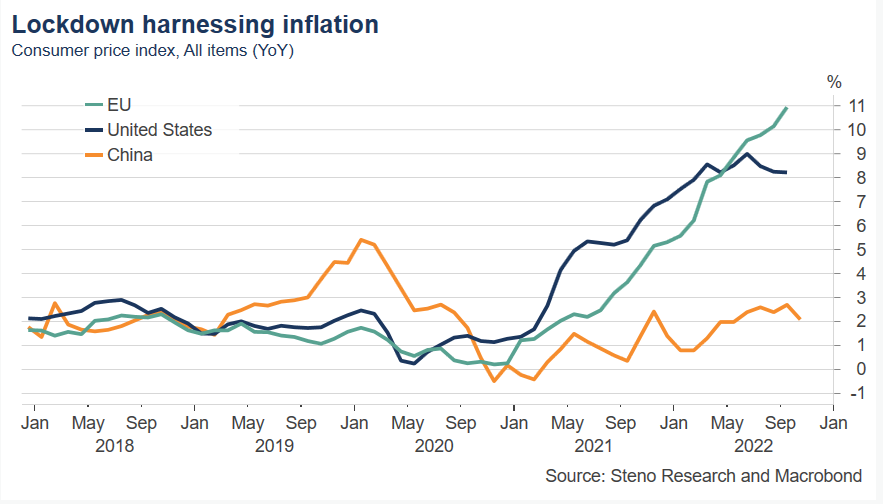

How to deal with inflation? Just lock everyone down

While the rest of the world is trying to maneuver the choppy sea of inflation, without capsizing the economy as a whole, it seems China has steadied the vessel – albeit in a rather unorthodox manner. With almost out-and-out control of his population, Xi has come to understand that inflation really is no biggie, when all you have to do in order to get demand in check with supply, is to incarcerate the population.

Chart 1: No demand, no problem…

Taken into consideration that the well-oiled, wide-ranging manufacturing hub of China has enabled much of the non-inflationary growth we, the west, have benefited from in the past couple decades, it is hardly a surprise that the impact of de-facto shutdowns is to be felt.

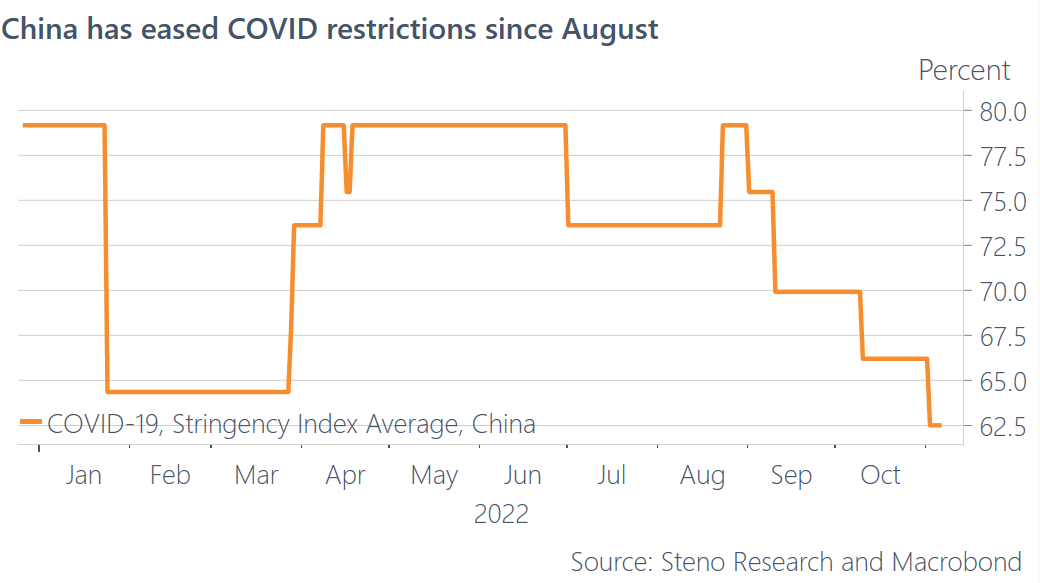

Trying to predict Xi’s next move is a task destined to fail. However, the signals sent from the Chinese government indicate that a long road to recovery is very likely, and that China presumably will enter stints of tighter restrictions. Since I am a ‘cup-half-full’ type of guy, let’s get to the hope-infusing news from last week; China announced a shortening of its quarantine requirements while also simplifying travel rules and ‘adjusting’ its monitoring regime. ‘Adjusting’ is neither here nor there and definitely up to interpretation but restrictions have been eased since August. On the fiscal side M2 y/y is up some 12 %, thus it would appear that Chinese policy makers are (partly) back with support to the economy.

Chart 2: Reopening? Not really, but a slight easing of restrictions for sure

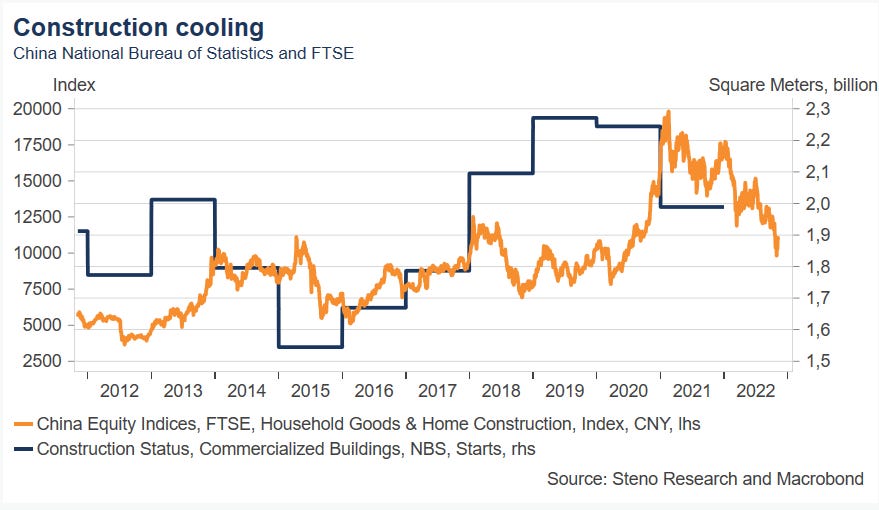

The deeply troubled real estate market

One pickle Xi cannot lockdown his way out of is the deeply troubled real estate market. The political leadership has deliberately orchestrated a crackdown of too lax lending policies, causing some of the biggest real estate developers to default. As a result, many real estate developments have been left unfinished. Citizens who have bought into these development programs have refused to pay mortgages for unfinished products.

The real estate crisis in China threatens to spill into China’s wider economy, China’s GDP growth is below official targets and the housing market is stagnating. The Chinese government has adopted a new trillion-dollar package to ease the crackdown and to control the emerging real estate crisis, but buyers remain hesitant given China’s zero-covid policy which continues to dampen demand. Therefore, a lifting of Covid-restrictions might also help lift the crisis in the real estate market. Particularly, we expect to see lifting of restrictions in the major cities most affected by the real estate crisis, but only if beep hits the fan first.

Chart 3: Real estate climate index and Beijing vacancy

With that said, the Baoshang case with its consequent interventions and investigations into several institutions including banks, homebuyers and overextended borrowers, revealed that China most likely has a systemic problem that has been brewing in their economy for more than a decade.

In most countries GDP is a measure of output delivered by economic actors over a specified period. In China however, GDP is an input determined politically at the start of such a period. And here lay the roots of the problem. Local governments (and, until recently, the property sector) have been given the responsibility of bridging the gap between the GDP growth target and what Beijing likes to call ‘high-quality growth (the growth delivered by the private economy; mostly consumption, exports and business investments). This was not really a problem for the economy during their ‘reform and opening up period’ (late ‘70s until late ‘00s) as the country was deeply underinvested in property, infrastructure and manufacturing capacity – so the politically determined investments were productive.

Fifteen years ago, economic cracks began to show. The economy was showing signs of being unable to absorb the investments productively. With 20/20 hindsight – which every FinTwit pundit, myself included, have -, China should have dialed back on the share of production it reinvested. The tricky part is to rebalance the economy without causing a sharp drop in the growth in economic activity. With a CAGR projecting China to surpass the US economy, China doubled down and overinvested systematically in projects that contributed less to the economy than they cost. Result; a sharp increase in the country’s debt burden.

China has, maybe not in due time, read the writings on the wall and the red-hot construction sector has begun to cool off. Until the systemic problem is addressed and resolved, there can be no permanent stabilization of China’s property market or of its economy more generally.

Chart 4: Chinese construction and equities in the sector are taking a breather

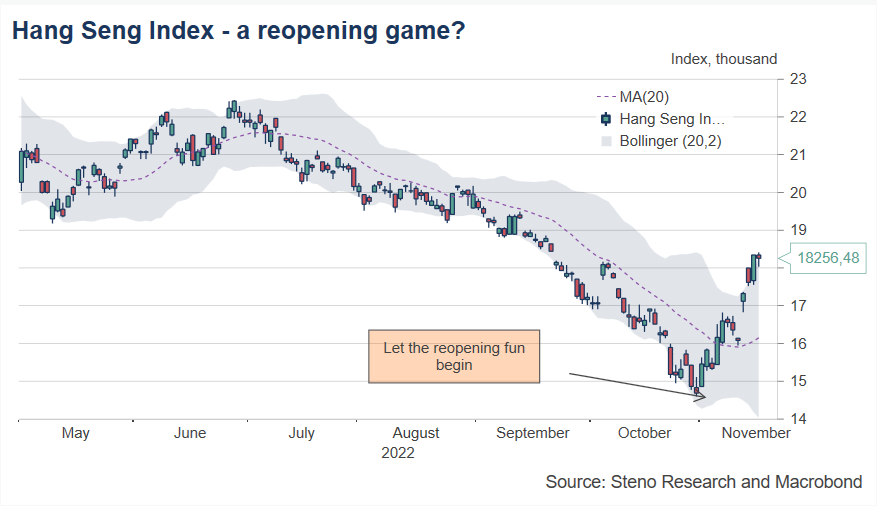

So how about risk assets then?

Markets have reacted to hints of a potential reopening in China as well. The Hang Seng index has been butchered recently but it seems to have bottomed (at least locally) with the turn of October. Since then though, with whispers of a reopening, it has taken to the skies – albeit on a rather low volume compared to the ‘18-’20 average. Trying not to appropriate, but the Chinese people have a reputation for gambling. Is this rally just a reflection of that inherent characteristic, or have buyers gotten the long end of the stick?

Chart 5: The Hang Seng index

The market cheered the news and priced in the outlook of further steps towards China coming online. Friday, following the news, the Hang Seng jumped 7.74%! While the complete reopening might be a mere spec on the horizon, Goldman Sachs estimates that such a scenario could drive 20% upside for Chinese stocks.

Whether this sigh of relief defines a fundamental shift in momentum, what is brewing beneath the surface and which moves we can expect in the various financial markets – these are all questions which I will try to answer in the coming days and weeks. For now this Chinese reopening story paired with disinflationary vibes in the US economy is not working wonders for my bearishly skewed portfolio.

Let me just remind you that a FALLING PPI usually coincides with an earnings recession in the US, so even if the disinflation trends that I rightly predicted are now visible, I consider them a result of a sharp economic downturn that I would not like to lean heavily long risk assets in to.

See you later for more on the China story! Remember to sign up for news on www.stenoresearch.com, if you want to be on top of all of the new exciting projects that we are going to launch soon!

DISCLAIMER

The content provided in Stenos Signals newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.

20221117