Steno Signals #22: Is China re-opening while the Metaverse is closing?

Is China re-opening while the Metaverse is closing?

The REAL world is back. China ponders reopening, while Meta struggles. The stuff that got us into this bubble, will likely not lead us out of this bubble. Buy Industrials vs. Tech.

Time for an update straight from American Airlines en route to Miami. Feels good to travel overseas again – it has honestly been a while…

The real economy is back. Some people will probably lament that the good old industrials are back in fashion, but it is likely symptomatic of the post-mortem assessment of the bubble after a period with too easy access to capital for technology. We have underspent in the real economy for years – not least in infrastructure and energy – maybe because of too lax monetary policy.

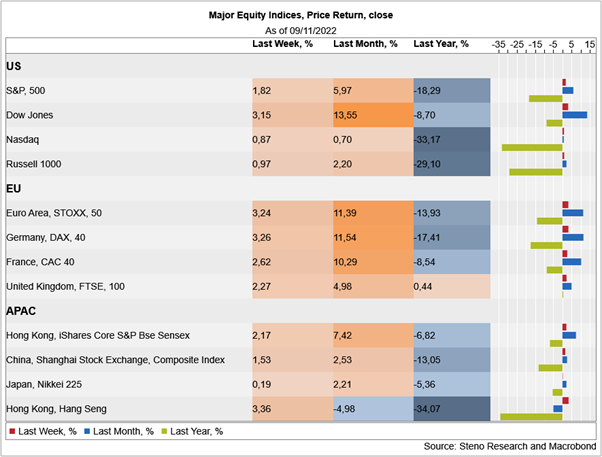

The market is hinting of a change of momentum in the relative performance of the “real” economy and the “un-real” economy. When reality hits, we are simply not able to pay the same multiple to be a part of a journey into the metaverse. Sure… those glasses are good fun, but not when you risk running out of energy. Dow Jones is up 13-14% over the past month, while Nasdaq continues to suffer. This is NOTEWORTHY and something that feels very reminiscent of the post-mortem assessment of the dot.com bubble during 2002/2003.

Chart 1. Equity performance over the past month in various indices

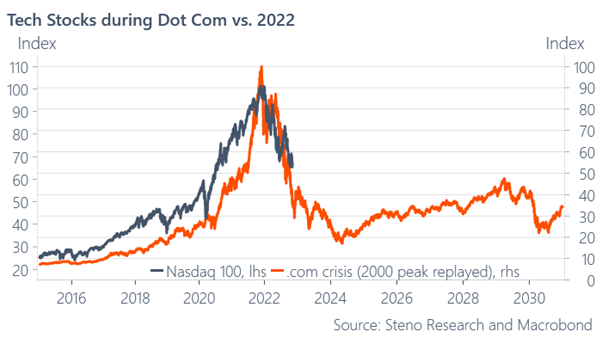

I generally hate the historical overlay charts, as you can basically create a fitted chart for right about every price narrative, but it still makes sense to use the historical overlay chart when there is a decent reason to believe the narrative fundamentally.

What are the similarities to the post dot-com period for Nasdaq? 1) Nasdaq rose too quickly due to lax policies, 2) The spread between Nasdaq multiples and industrial/value multiples widened too much and too fast to be justified, 3) a couple of giants with exponential promises led the way and 4) the vibe around Crypto (today) reminds me of the vibe around Software (in 2000). The big difference is that Nasdaq is a much truer technology index today than twenty years ago where it was still partly, if not mostly, a hardware index.

But.. The price action still looks grim in technology, a lot of retail money is still parked in the sector, and we are yet to see the real spill-overs to earnings for Facebook (Meta) and Google from a wave of bankruptcies among SMEs in to next year. Remember that SMEs are clients of Big Tech and SMEs have had a very hard time lately..

Chart 2. What if we copy/paste the dot.com development?

If this is the dot.com crisis all over again, we ought to have further downside in Nasdaq (I am short QQQ), but also a veeeeeery slow grind back higher over the next decade. The tech sector will simply once again have to grow into their valuations as there will be no more simple zero-yield driven multiple expansions to rely on.

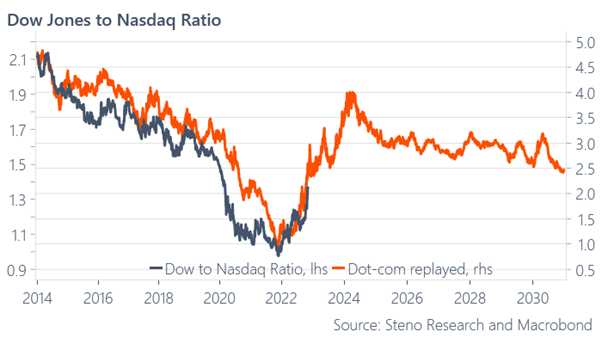

I hosted a fantastic discussion on the Real Vision Daily Briefing yesterday about the potential for a regime-shift in styles like what happened post 2002/2003 where Industrials returned to fashion relative to Tech and I am starting to convince myself that this is the right relative bet in equity space for the coming years.

In 2002/2003 industrials (proxied by Dow Jones) gained relative to Nasdaq due to the positive spill-overs from allowing China to enter WTO and the return of Capex that followed the crisis. Even if the trigger is very different, I envisage a similar style return of investments in particular in Europe but also partly in the US over the coming 3-5 years. The Geopolitical reality is now crystal clear. We need to reshuffle the energy infrastructure fast. We need to build LNG terminals in Europe and the US fast. We need to increase the pipeline infrastructure across the European continent fast. And so and so on and so on.. You get my point. This is one of those very rare opportunities to actually TRULY invest in the physical economy..

Chart 3. Industrials to outperform Tech again? It looks increasingly likely

This bodes well for a return of industrial outperformance of Tech and while I am already short Tech outright (against a long in consumer staples), I ponder adding an outright positive bet on industrials… In particular, if we get further signals out of China that a reopening is likely within 3-6 months.

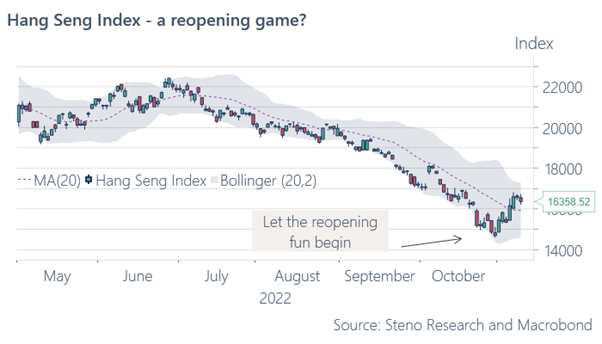

Xi is travelling again. Olaf Scholz was allowed to visit China and he even managed to partly the sell the idea of China allowing the Pfizer/Biontech vaccine… The list is basically getting longer each week and while we will never get an official confirmation that a reopening is on the cards, the market should remain happy as long as it can sniff out bits and pieces every now and then that allows the reopening narrative to stay intact… Got copper?

Chart 4. The Chinese hopetimism is back

My team back in Denmark will investigate this China reopening story further and publish a piece in the coming days…

By the way… If you haven’t heard the news already, then I can just as well highlight it here once again.

We are officially launching what will probably be Europe’s best and biggest independent Macro- and Geopolitical research shop Steno Research 1st of January and my first capital partner Mikkel Rosenvold (Twitter) is one of the best signings I could imagine. The Geopolitical team will be in safe hands with him.

You can stay updated on our news right here. If you want to know more about our upcoming offerings and/or discuss partnerships, please feel free to reach out to me for Macro/Finance at andreassteno@stenoresearch.dk or Mikkel Rosenvold for Politics at mikkelrosenvold@stenoresearch.dk

All the best wishes from Andreas

DISCLAIMER

The content provided in Stenos Signals newsletter is for general information purposes only. No information, materials, services, and other content provided in this post constitute solicitation, recommendation, endorsement or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision. Always perform your own due diligence.

20221109