Steno Signals #18: The winners and losers of energy nationalism in Europe

The winners and losers of energy nationalism in Europe

***If you like my free content, you can donate directly here. Thanks very much***

Electricity-nationalism

With the turmoil surrounding natural gas still looming large, electricity has become a scarce and sought after resource. With European gas storages near full capacity, the winter of ´22 is more or less covered, depending on the mood of mother nature. I won’t partake in the conspiracy theories about who blew up NS1 and 2, but the fact of the matter remains that gas won’t be flowing through them any time soon, if ever again. Consequently, the electricity situation ought to turn from bad to worse looking into 2023 and 2024 – all else equal.

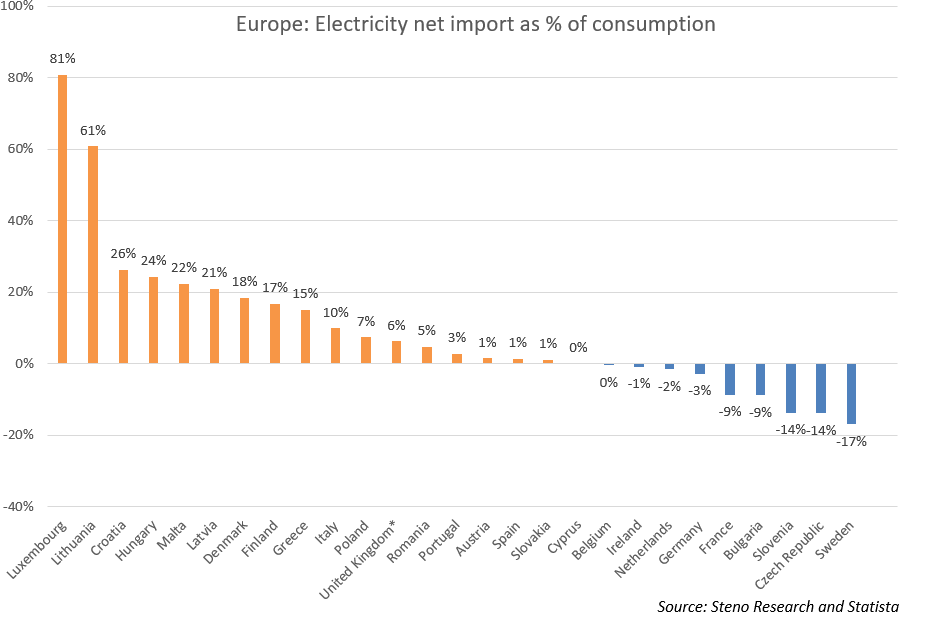

With gas being the primary marginal input in peak-load electricity production and with Russia having accounted for roughly 45% of gas supplies to Europe historically, let us have a look at the electricity trade balance for members of the EU.

Chart 1: Electricity trade balance in Europe 2020 (Data: Net import, Consumption)

While European institutions increasingly mention energy solidarity in their Strategies and Communications, it has not yet been subject of any common European definition. Noble and honorable as solidarity may sound, it’s every ‘man’ for himself when push comes to shove.

I firmly believe that electricity-nationalization to some extent is inevitable, and in such a scenario the net importers would be debilitated. Countries like Italy, Lithuania, Croatia and Hungary are very dependent on electricity imports while Sweden, France and Slovenia are typically net exporters. I reckon some will call for solidarity more than others.

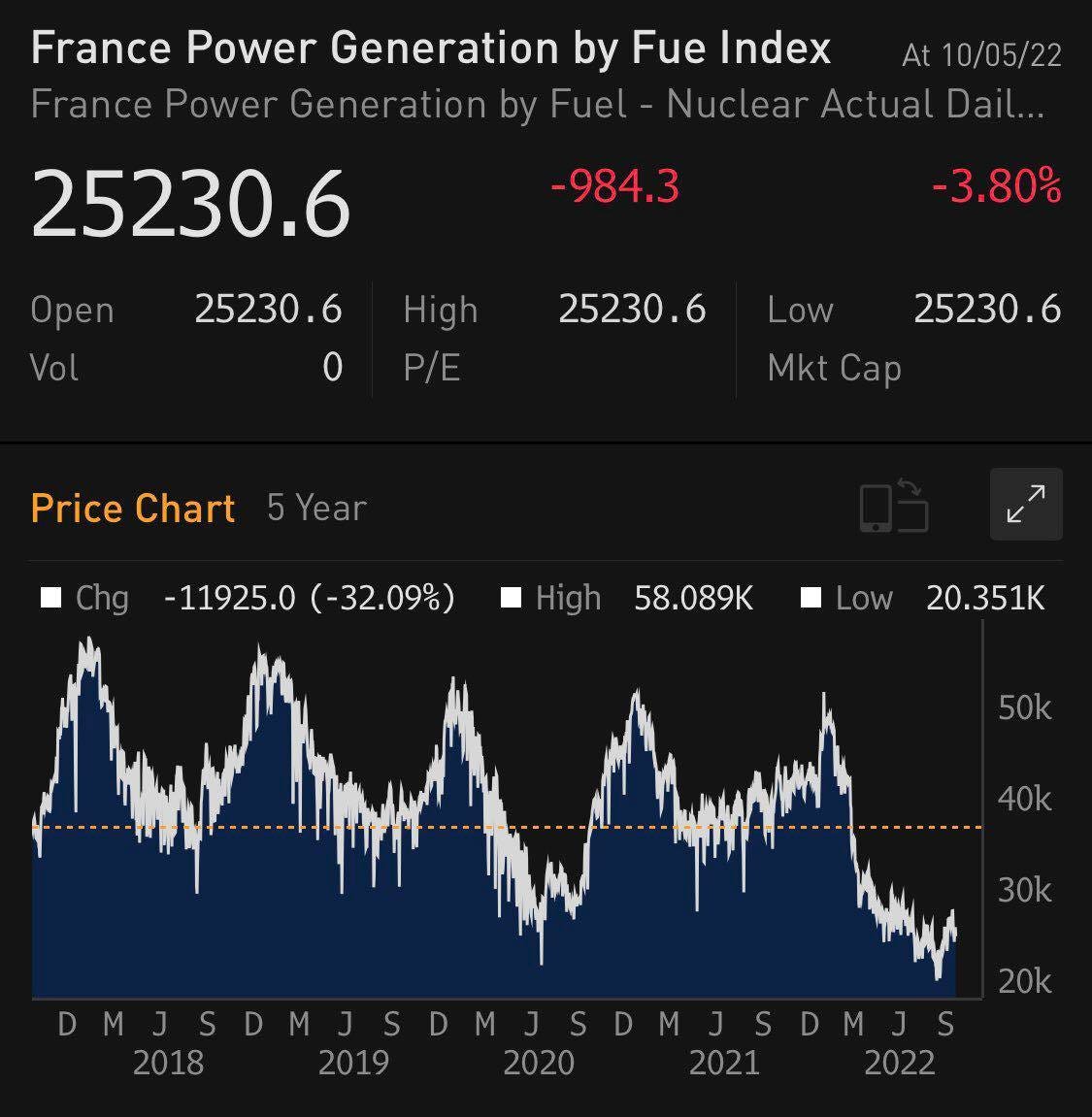

France is typically the biggest nominal electricity exporter, but with nuclear capacity running at alarmingly low levels, it seems VERY unlikely that France will be able to net export electricity to the same extent as in earlier years. Italy imports roughly 5% of its annual electricity consumption from France, but what happens if Electricite De France pulls the rug from under Italy? It is a scenario that France has allegedly already threatened with. French electricity production is still TOO low to take any comfort in, and if they are to bring capacity online in time for the winter-season they better get started soon.

Chart 2: French electricity production

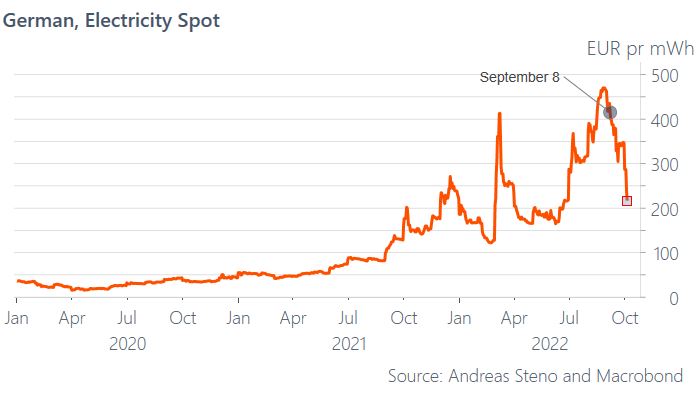

On Sep 8 I wrote that electricity prices didn’t reflect fundamentals as the price levels included a liquidity risk similar to what happened to LIBOR in 08/09. With liquidity bail-outs on the cards at the time, it was time to FADE the price pressures hard, and they indeed have faded.

Since the 8th of September prices are down roughly 50%. By now all countries besides Hungary have reached the target of 80% fill levels of natural gas – the main marginal input in electricity production – which is well ahead of time.

Chart 3: Prices sharply DOWN… for now

Before you remortgage your house in celebration of prices coming down, we mustn’t forget that 1) our storages were front loaded over summer when NS1 was still operational – albeit on cutdown capacity – and 2) that we paid a hefty premium on filling those storages.

Chart 4: European supply of gas

The situation concerning electricity is very much linked to the gas story. We now know for a fact, that Russian flows won’t be coming through the North Sea, and the Ukrainian Naftogaz is likely to be sanctioned one way or the other. While we may have secured storage to get us through the winter, the real headache seems to be ahead of us.

A scenario in which European countries are short on gas and relying on each other’s unanimity is very likely. A complete lack of supply from Russia will lead to a combat for the remaining supply.

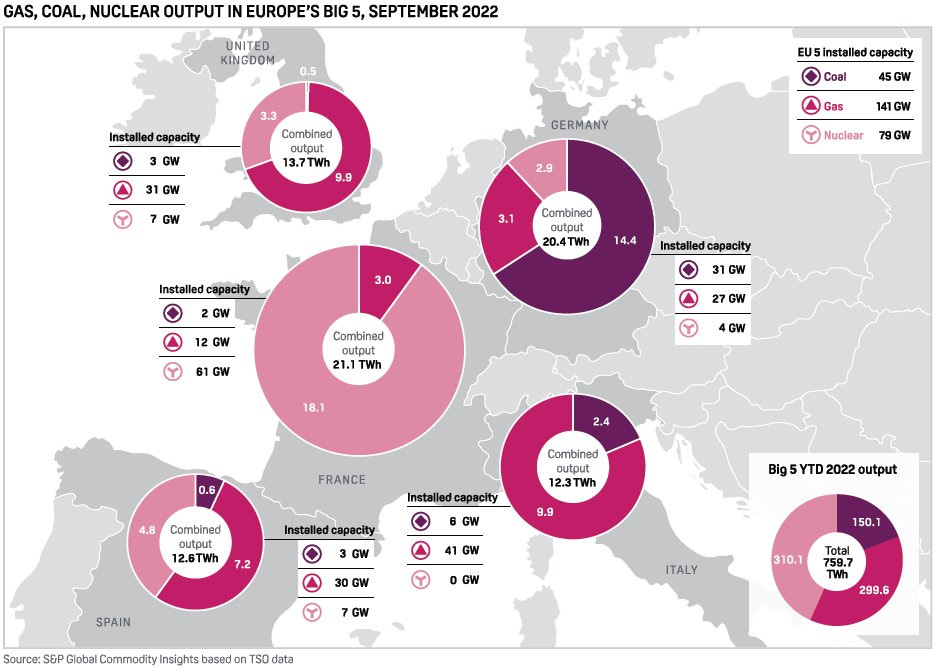

Chart 5: Output in Europe’s big 5

From the above chart it is clear that, however much we’d like not to be, Europe remains very dependent on gas. Note that Southern European countries such as Spain and particularly Italy are very exposed to the cost of gas. It will be interesting to see how solid the diplomatic ties built on solidarity really are, when we all fight for the same scarce resource. And the use of natural gas in electricity production is UP 13% Y-T-D compared to 2021. Weren’t we supposed to ration?

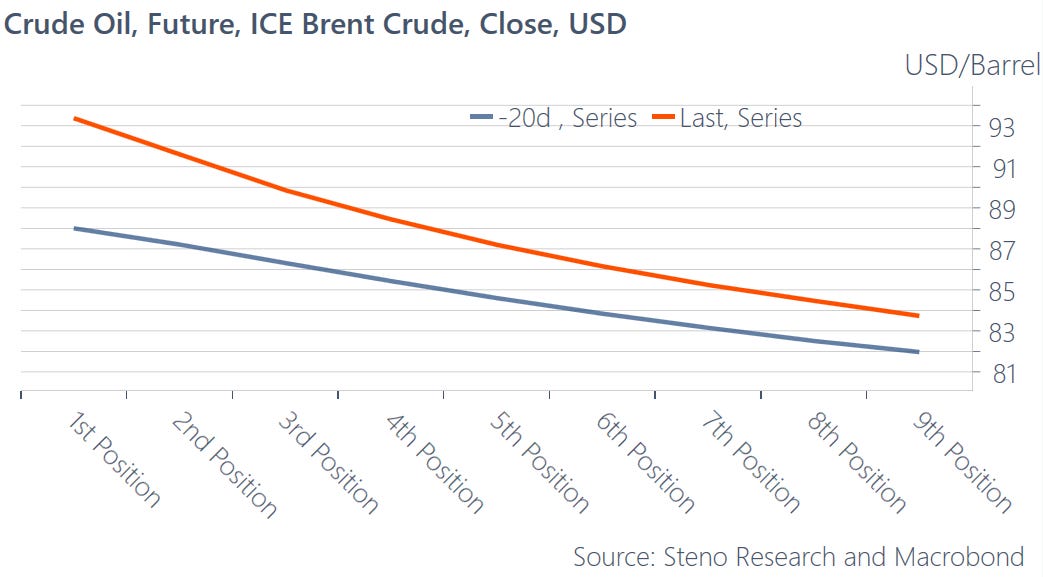

Broadly speaking, positioning in energy commodities remains long with natural gas being the only net short. The OPEC+ meeting in Vienna led to the largest production cuts since 2020 and the front-end versus belly of the oil futures curve has been bid up relative to a month ago again.

This is bullish for spot oil prices short-term and it remains to be seen whether the overall global demand destruction will be enough to counter OPEC+ supply cuts. Electricity and natural gas prices have been dropping ever since storages were filled ahead of schedule in Europe, but the natural gas price will come back into focus after the 1st of November when the heating season starts.

It is hence NOT clear that a broad short Commodity position is a good idea in Q4 and into 2023. Instead, I consider 1) Long precious metals vs. short industrial metals and 2) Long Nat Gas vs. Oil as potential Q4-Q1 trades.

Chart 6: The OPEC+ production cut moved the front of the oil-curve UP

Watch out for massive deficit spending coming to a country near you!

This Monday Truss & co got the message from the bond market and made a u-turn on their proposed fiscal plan. Even though they decided not to proceed with the abolition of the 45p tax rate, the UK government is still keen on shielding UK households and corporates from the massive increase in energy bills coming up this winter.

As I mentioned last week, that bill could be well north of what is currently expected. So the question remains, is the bond market going to play more shenanigans with policy makers once it realizes that we are in for a far more expensive winter than first thought? I tend to think so.

And this issue does not just pertain to the UK. We are going to go through this in the rest of Europe as well. Germany has launched a massive EUR 200 billion energy aid bill financed through new debt and many member countries are lining up to plead with them to issue common debt ala during the coronavirus. Whether common debt will be issued or not will just determine how much pain each European country will have to go through this winter. Fact is that there will be pain!

Chart 7: An abating energy crisis is a prerequisite to EUR strengthening again

Just as the BoE, the ECB will be finding themselves in a tightening cycle in which it is damned if you do, damned if you don’t. Whatever they do, markets won’t for one second believe the story of a stronger currency in the current environment. Add to that, we cannot rule out that the ECB will have to step in as lender of last resort, just like the BoE did last week, in order to keep spreads tight and avoid pension funds from blowing up. Hike all you want, ECB, until the energy situation has been solved or the Fed pivots you will not see EUR/USD back at 1.10 any time soon.

Portfolio update: Jumping back on the ‘Long USD’ bandwagon and a trade for the electricity nationalism risks

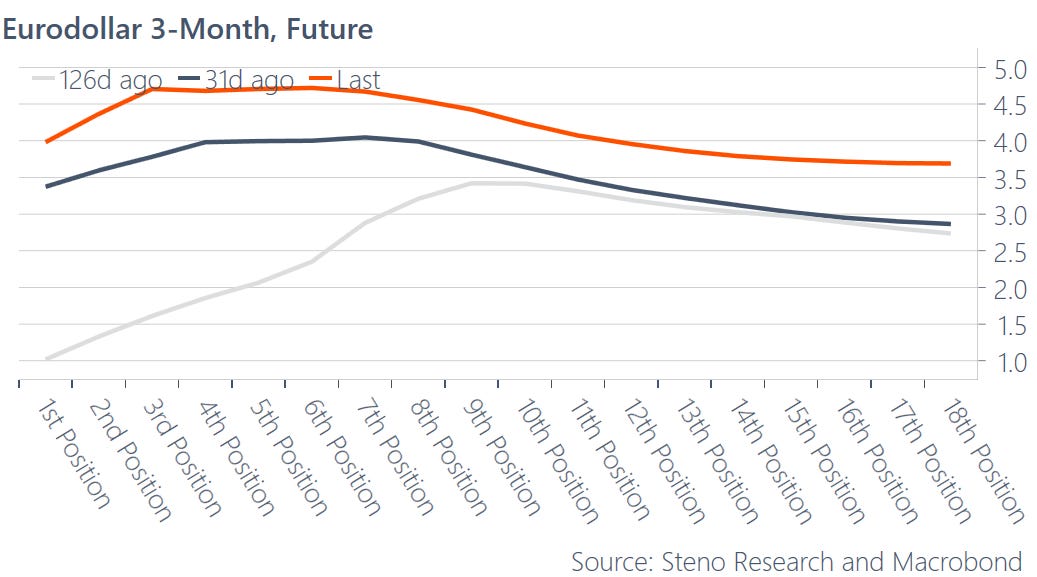

On the back of this analysis, I am adding a long USD position to my portfolio via the UUP ETF. EUR/USD has jumped back levels around parity on the back of two things: Electricity prices have come down from their insane levels in August and the BoE has calmed bond markets (for now), which in turn has made expectations about the Fed’s fund rate drop back a tad. If the Fed pivots that would be positive for the EUR vs USD. That pivot is currently still months away according to the bond market.

There is just one glaring problem for the EUR. It is early October and we haven’t even reached winter yet in Europe. Things could get a lot worse! Where markets were overdramatized a couple of months ago that risk/reward has now changed, hence short EUR/USD. My target in the UUP ETF is 31.75 with a S/L at 29.09.

Chart 8: Pricing of the USD-libor in Eurodollar futures

So all in all, keep an eye out for the energy situation as we go into the winter. Energy nationalism will pop up when shit really hits the fan and this will continue to be a topic in 2023. With the energy crisis also comes potential trouble in sovereign debt markets. Governments will want to shield households and corporates from the increase in energy bills and this will test the bond markets. So greater abundance of cheap energy means less debt issues, which means currency appreciation against countries with greater energy costs. Stay long USD!

In terms of how to play the risk of electricity nationalism, I find Hungary or Italy to be the two WORST positioned to deal with such nationalism, while Sweden or Czech Republic are typically big net exporters of electricity and hence the BEST positioned to deal with electricity nationalism. A long CZK/HUF position seems like a good electricity nationalism risks bet or else a trade could be implemented via relative equity market exposure in the two countries.

All in all, I add long UUP and long CZK/HUF to my portfolio, while I am on watch to close my SALL ETF (short commodities) after a decent positive performance since June.

***If you like my free content, you can donate directly here. Thanks very much***

20221007