Steno Signals #17: A Historic FX Crisis in Europe

A Historic FX Crisis in Europe

***If you like my free content, you can donate directly here. Thanks very much***

Natural gas debacles, currency crisis and how to play it

During the week where the Baltic pipeline was opened someone decided to blow four holes in the Nordstream 1 and 2 pipelines. I’ll leave the speculations about who did it to you, but it is safe to say this will have an impact going forward. But what are the ramifications for asset markets and the economy? I’ll try and address that in the following!

1) The gas leak on NS1 and -2

With the sabotage of Nordstream 1 and 2 it is probably definitive that we have seen the last gas flow from Russia to Europe ever. As I mentioned in the introduction, I’ll leave the speculations about who is behind up to you but please spare me the ‘Russia had no incentives’ bullshit! On the back of yesterday’s events the first traded Dutch TTF natural gas contract exploded which can only reflect the market’s fears that the Baltic pipeline is in danger since no gas ran through NS1 and NS2. Hitting the Baltic pipeline could trigger Article 5, so we’ll deal with that if it happens! Instead let’s have a look at the other things going on on the back of this in markets. First of all it seems like Robert Habeck has come to his senses and decided to prolong the nuclear power plants in Germany. Hooray for Realpolitik!

2) The currency crisis in UK and EU

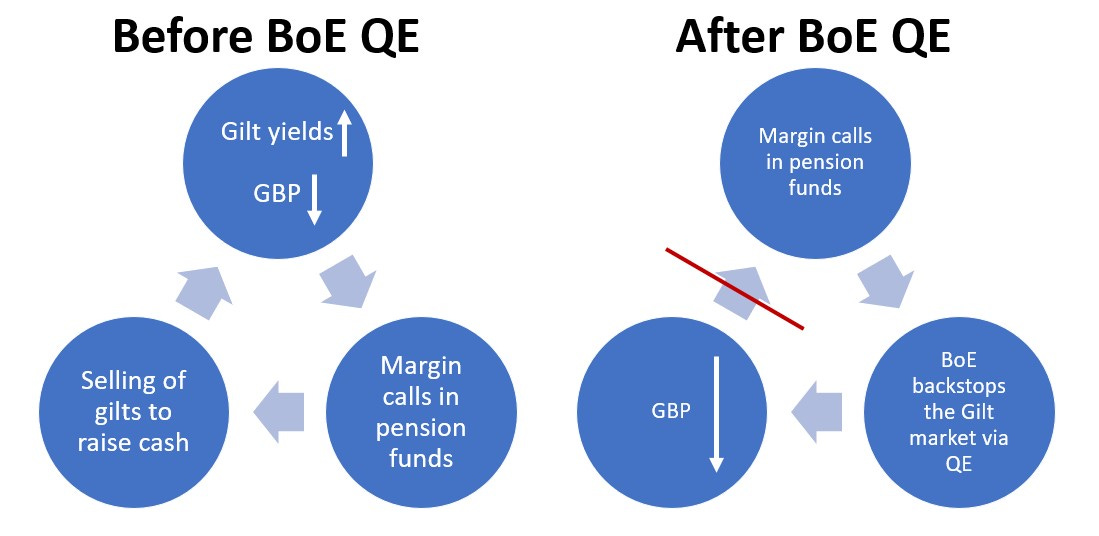

Moving on to FX, where the Great British Pound has not lived up to its name recently. To alleviate fears and mitigate the risk of collateral calls in the Pension Fund sector, the BoE announced “unlimited and immediate” purchase of long-dated bonds. A maneuver which should keep holders of long-dated gilts from force-selling, when interest rates go up. So we now have a cocktail of hikes, QE and a big fiscal deficit in the UK. A batshit crazy policy mix that may be coming to a town or country near you soon.

Chart 1: Before and after the intervention from Bank of England

While the rest of the world has decided to start burning their own currency, BoE has decided to join BoJ in starting up the good old money printer (even if the purchases are sterilized). The can of worms opened in the UK could soon be coming to Europe. We know numerous European countries will want to use their public balance sheets to shield private households and companies from the yuuuge increases in energy bills this winter.

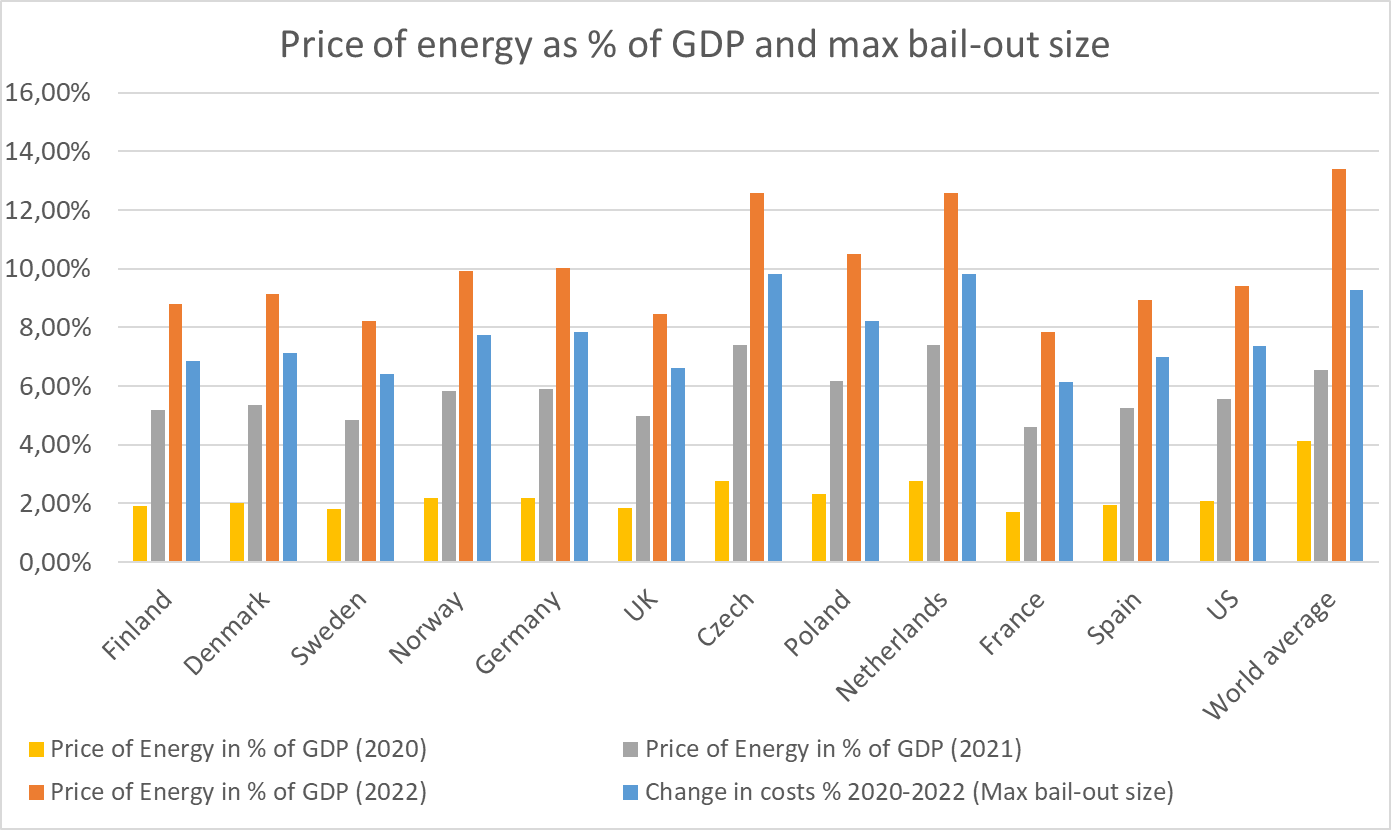

They have already started to allocate funding but it won’t be nearly enough according to my calculations in chart 2, hence we could see deeper public deficits and European bond markets act accordingly over the winter. Take Meloni for instance, her modus operandi will likely be a ‘spend now and let the EU worry about it later’. The EU will be scared to death that a member country caves in and goes to Putin before he also closes the natural gas flow running through Ukraine. Watch out for European sovereign debt this winter!

Chart 2: Potential energy costs are way higher than allocated funding!

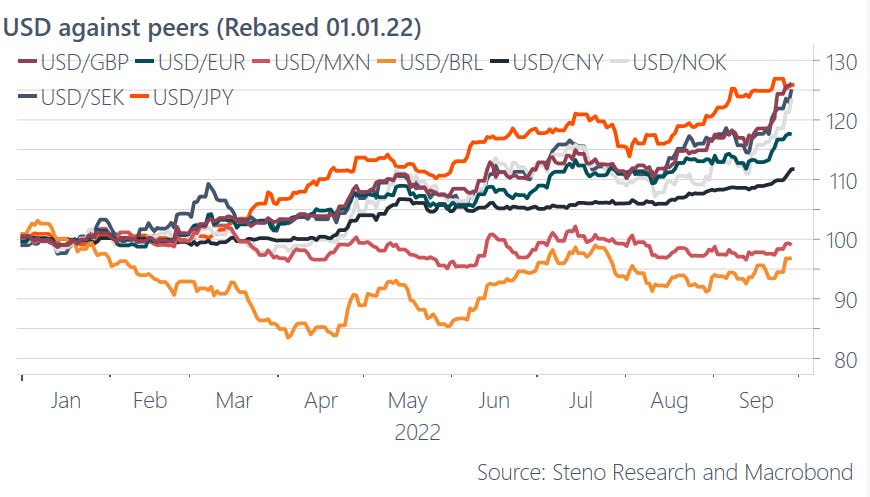

Meanwhile the dollar wrecking ball is in full swing around the globe. Last week BoJ had to intervene, and this week both BoE and PBoC joined the intervention party. Right now policy makers in different parts of the world will be crossing their fingers that the next CPI print coming out of the US is softer, thus giving them a glimpse of hope that there is light at the end of the hawkish Fed tunnel.

We can currently divide central banks into three camps:

First, those who sacrifice the local currency to protect the local bond market. That camp has been led by BoJ for a long time, but is now represented by BoE and PBoC as well. You generally want to be short these currencies.

Second, those who partly sacrifice both the local bond market and the local FX market with the ECB currently being the best example.

Third, those who sacrifice the local bond market to shield the local currency from negative market moves. The best examples are the Fed, BDeM (Mexico) and BCdB (Brazil). You generally want to be long these currencies.

Chart 3: The USD wrecking ball in full swing!

3) How to shield oneself from the current mess?

Finding positive returns has been a tricky exercise this year, and given the inflationary environment topped with massive uncertainty and geopolitical tensions unprecedented to my recollection, the exercise has rather been to find shelter. The traditional hedges, such as gold, have not lived up to their reputations. The dollar on the other hand has, as touched down upon previously, been one of the absolute winners of 2022.

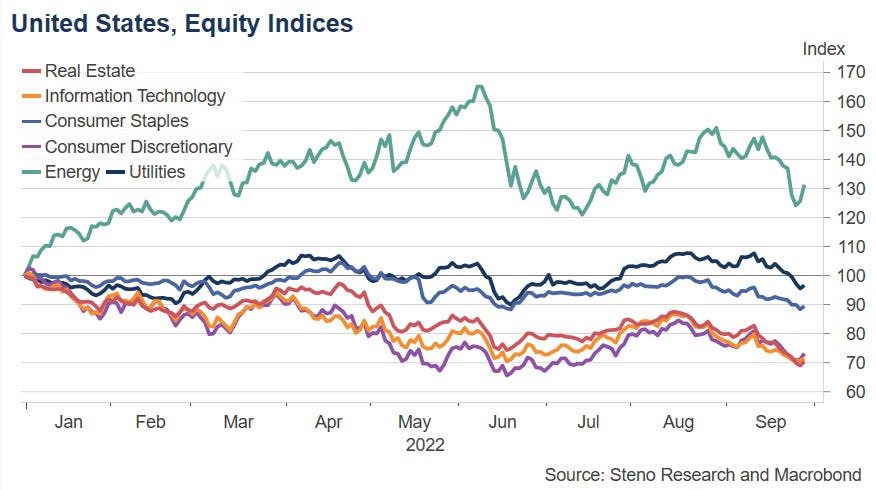

The energy-story has been front-cover year round, and it continues to dominate headlines as well as twitter-trends. Looking in the rear-view-mirror, the best way to shield one-self has been by allocating towards assets with a low sensitivity to energy inflation.

Utilities and consumer staples

With inflation (still) running feverishly hot, investors have shifted allocations towards utilities and staples – a classic move in times of economic uncertainty.

Relative to sub-indices such as IT, discretionaries and real estate all down around 30% YTD, staples and utilities have performed on a relative basis – albeit still in negative territory.

Look at it this way, in a massive cost-of-living crisis, the things you want to buy in financial markets belong to the “base-layer” of Mazlow’s hierarchy, while you want to be short stuff that belongs to the upper layer. Be long stuff you need and short stuff you don’t need.

Chart 4: Equity sub-indices’ performance

US stocks seem ready to sing the bear market blues again after the BoE shuffled sentiment with an abrupt turnaround. Until we see a clear indication of CPI coming down, better seek shelter in low vol assets! The last decade’s near one-way traffic has ended, and risk management is as relevant as ever.

Mexican peso; A compelling case

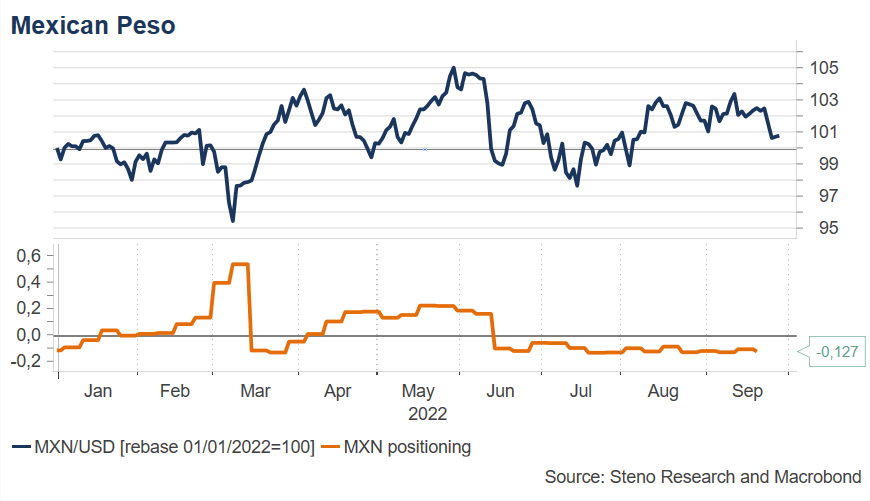

The performance of my portfolio is very much driven by my allocation in US dollar (despite my abysmal timing in TLT), my spread-trade (SPX vs. DAX) and my holdings of Swiss Franc. Recently, I have been closely monitoring possible ways to further diversify, and the Mexican Peso is looking quite compelling IMO. Compared to many other currencies it has weathered the storm very well – actually up against the dollar.

Chart 5: MXN / USD and positioning

Steep inflation is nothing new to Mexico. In 1994 the Mexican central bank had to devalue the peso by 13-15% and raise short-term interest rates to a staggering 32%. With that somewhat fresh memory, it seems that the Mexican central bank is determined to not let that reoccur. While sentiment, determined by open interest, is short on MXN, real yields are positive across maturities – that is a decent backdrop to go long from – at the very least seen from European soil.

For more on the MXN case, you should listen to this week’s edition of “The Macro Trading Floor” where I provide my reasons to go long MXN (versus EUR)

https://embed.podcasts.apple.com/us/podcast/the-macro-trading-floor/id1618502265

I will be on a four-week honeymoon in Italy as of today, but I promise to update you once or twice anyway :).. Take care!

***If you like my free content, you can donate directly here. Thanks very much***

Chart 6: Mexican yields

20221002