Shameless in Chicago

Shameless in Chicago

In early June, after receiving an email announcing the upcoming Benzinga Cannabis Conference in Chicago along with a note from the BZ team asking if I’d be interested in helping out (bc producing events is in our DNA), I was quick to respond:

I’ve known Benzinga CEO Jason Raznick since he had peach fuzz— we were former allies / adversaries in the early days of online financial media when our small circle of platforms were vying to be fin-twit before fin-twit was fin-twit— and he recently rang the register in an extremely well-timed sale.

And besides, Illinois, with all due respect to our friend Abe Froman…

…is the true Cannabis King of the United States with several of the largest multistate operators—Verano, Green Thumb, Cresco, PharmaCann—based there and numerous others, including Curaleaf, 4Front and Ascend, having a large presence.

As the summer was starting, US cannabis stocks were already cut in half for the year and after sixteen straight months of seeing how the sausage was made, I viewed it as an opportunity to set a milestone on the horizon. By the time it arrived, there might be something to talk about. Good things even.

Well, the conversations certainly continued. There were the cuts at Cowen…

…more caution at Cantor…

…even some pot shots at Piper.

By the time I got to Chicago, I didn’t know what to expect but what I found was kind-ness in the form of a friendly ride / Dogwalkers© handshake from my new pal Dan G.

Maybe this town has got some heart, I thought to myself; I just gotta poke around.

I arrived at the Palmer Hotel late Monday and said hello to the spirits before running into the host who, bw texting his team and speaking on the phone hurriedly said, “our cannabis conference is about to start and we have no cannabis!”

He googled ‘cannabis’ and the two closest dispensaries were Sunnyside, which was .8 miles away, and Zen Leaf, which was 1.1 miles away.

“I have a call in 20 minutes,” he said, “let’s go to Sunnyside.”

“We’re going to Zen Leaf,” I said with a smile as I realized what was about to happen, “and when we do, you’re going to know exactly where that extra quarter-mile went.”

Off we went to Greektown, where Manager Joe greeted us and walked Jason through the nuances of the form factors and the variations in strains. And while I’ve been in my fair share of dispensaries in the spirit of due diligence, I’m not gonna lie that this New Yorker had pangs of Pretty Woman as I carefully made my personal picks.

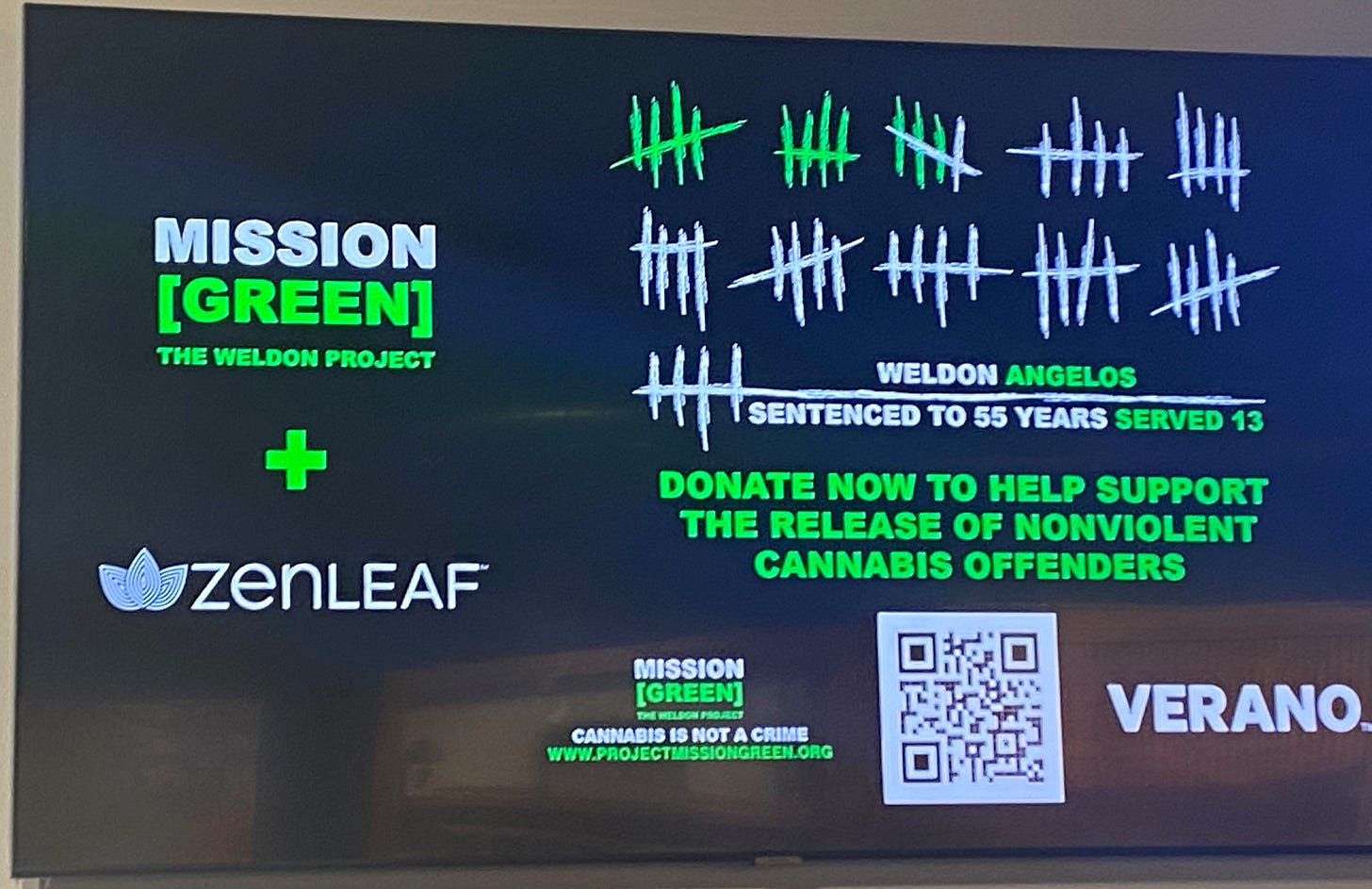

While Verano is to flower what Wildberry is to pancakes, the best part for me wasn’t the weed—it was that the walls were awash with efforts to support Weldon Angelos.

It was a sign, perhaps, of some serendipity in the universe; full circle sorta stuff. Jason and I gathered our loot, thanked Joe for his hospitality and headed back to the hotel…

… where the crowd was quickly gathering. Despite the carnage in cannaland, the room was a vast collection of operators, investors and analysts, many of whom I either never met in person or hadn’t seen in a long time; and it was nice to see some familiar faces…

…and old friends, particularly given the industry headwinds.

How you doing? “I’m alive!”

What’s going on? “Survive till ‘25!”

[spent some time / shook some hands / had a few chats before a most sincere effort at a last-second group dinner unraveled when I got lost for 40 minutes trying to find a restaurant that ended up being seven blocks away (←I blame Verano)]

I was up early on Tuesday to hear Green Thumb CEO Ben Kovler:

“slow and steady wins the race; we said we’d do a billy in sales / 30% ebitda margins and we did it; return on incremental capital driving results; NY very confusing; Cali a disaster but there are ways to make money; More optimistic than ever on SAFE but not sure I’d bet on it; Industries need open markets / access to capital; NJ robust; CT / RI will be vg; excited for MN OH VA; If we can’t create it, we learn and find it.”

Followed by Cresco CEO Charlie Bachtell:

“We’ll get some sort of federal legislation this year; that’s the incremental catalyst we need; we’ve never been closer, never gotten this far; local→ state→ federal change; the industry continues to get better / optimize / scale; legislation + oversold now; they just need access.”

Rep Troy Carter spoke about SAFE / CLIMB (up-listing) and the need for the industry to access capital; said GOP and democratic feedback has been great and progress has been made; there is a multibillion dollar impact bw jobs, taxation; “we recognize the gravity of where we are;” it’s “all hands on deck” and it’s “not a partisan issue.”

Richard Carleton, CEO of the CSE, said regulators have been looking for wrongdoings and in the last six months they found it (naked shorts); “this should have a significant impact on these activities.” They are also working on alternative custody solutions and talking with retail platforms, and exploring inclusion of select companies in the listed small cap indices (←all of which would increase liquidity).

Dave Joyce noted, “It’s third and one—you don’t throw a bomb (CAOA)” and noted there are palatable additions to SAFE that might include HOPE and / or CLIMB.”

Aaron Miles (Verano), Emily Paxhia (Poseidon), Jamie (Ben Affleck) Mendola spoke about the east coast, noting how SOPs are transferring to new states, operations are getting smarter; need for legislators and regulators to work together; how availability, consistency and pricing will eat into illicit share over time; how allocation sequencing will differentiate operators as stewards of capital.

There was more—a lot more—but my head was spinning at this point with items still on the agenda. I stepped out, walked up the stairs and slipped past some of the many spirits that still inhabit that old Chicago haunt. A quick shower later, I made my way to the Tortoise Supper Club to help Benzinga host some of their sponsors…

…after which many of the attendees headed over to Tao for the after-hours party…

https://www.youtube-nocookie.com/embed/KZbQSyohZbE?rel=0&autoplay=0&showinfo=0&enablejsapi=0

…but as I’m adhering to a sober September / was spent / markets sucked—I found my way back to my room, where I embarked on an hour-long honor bar orgy for the ages.

There, somewhere between the dark chocolate covered almonds and Kit-Kats, I got to thinking about the day. I hadn’t seen much new money on the buy side but there were good, smart people and a handful of bad-ass companies that would survive and thrive.

“Just when they thought it was over, it was really only just beginning,” I remembered somebody once saying about the Great Depression as I turned off the lights, rested my weary head and tried not to think about the calories I had just inhaled.

Maybe, I thought, the same will one day be said about the U.S cannabis industry.

20220915