Potential CAD opportunity with Inflation Print on Wednesday

Potential CAD opportunity with Inflation Print on Wednesday

This week’s Canadian CPI print could provide some short-term volatility in the CAD. The Bank of Canada surprised markets with a lower than expected 50bps hike at its last rate meeting. See here for the report on October’s meeting.

Struggling housing sector

The BoC raised concerns surrounding its struggling housing sector as the rise in interest rates had impacted housing activity. Furthermore, the BoC saw household spending falling and projected growth to fall in 2023 with the risk of recession. In October it was pointed out that the CAD was very high to cycle highs and a retracement would make sense.

CAD CPI print on Wednesday

Tomorrow the Canadian CPI print will be released at 13:30 UK time. If we see a surprise beat in the print then we would expect the CAD to rally higher on higher interest rate hike expectations. However, that will not change the outlook for the Canadian economy and could only end up putting more pressure on households. Higher interest rates will mean a greater risk of slowing Canada’s economic activity.

In contrast, a weaker than expected CPI print will take the pressure off the BoC needing to hike rates so aggressively and that should allow the CAD to weaken out of the print.

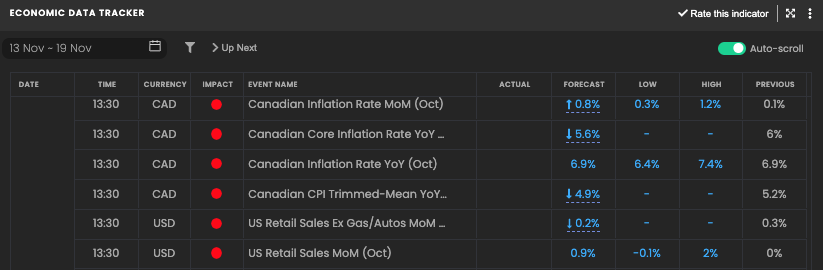

So, here are the expectations from the Financial Source calendar.

- * The headline is expected to come in at 6.9% y/y. Minimum expectations are 6.4%y/y and a maximum of 7.4% y/y.

- * The core reading is expected to be 0.8% m/m with 0.3% m/m minimum and 1.2% maximum.

- * The trimmed mean, one of the BoC’s preferred measures of inflation, is expected to come in at 4.9%.

The likely reactions

If the headline reading comes in at 6.4%, core at 0.3%, and trimmed mean below 4.9% then the Canadian Dollar is likely to weaken out of the meeting. A CADJPY short may potentially be worth considering depending on the latest BoJ activity.

In contrast, if the headline comes in above 6.9% y/y, core above 0.8%, and the trimmed mean above 5.2% then the CAD is likely to strengthen out of the print, but then growth worries could cause that surge higher to be faded. In this case, depending on the latest BoJ activity, a CADJPY short may still be worth considering.

The desire for the BoJ to strengthen the JPY and pressure on the BoJ to shift from its ultra-loose policy does open up the possibility for JPY strength generally against the CAD.

About: HYCM is the global brand name of HYCM Capital Markets (UK) Limited, HYCM (Europe) Ltd, HYCM Capital Markets (DIFC) Ltd and HYCM Limited, all individual entities under HYCM Capital Markets Group, a global corporation operating in Asia, Europe, and the Middle East.

High-Risk Investment Warning: Contracts for Difference (‘CFDs’) are complex financial products that are traded on margin. Trading CFDs carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information please refer to HYCM’s Risk Disclosure.

*Any opinions made in this material are personal to the author and do not reflect the opinions of HYCM. This material is considered a marketing communication and should not be construed as containing investment advice or an investment recommendation, or an offer of or solicitation for any transactions in financial instruments. Past performance is not a guarantee of or prediction of future performance. HYCM does not take into account your personal investment objectives or financial situation. HYCM makes no representation and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or other information supplied by an employee of HYCM, a third party, or otherwise. Without the approval of HYCM, reproduction or redistribution of this information isn’t permitted.

20221115