Payrolls Preview: Keep an eye on Growth Rate

Growth Rate

Executive Summary

- * The consensus is looking for a gain of about 740,000 jobs on Friday, which would mark an increase in total payrolls growth.

- * A headline jobs reading below 620,000 would mark a sequential decline in payrolls growth on a smoothed six-month annualized basis.

- * Also, look at the labor force participation rate, the employment to population ratio, and the growth cycles of cyclical vs. non-cyclical payrolls.

Payrolls Preview: What To Look For In Friday’s Jobs Report

On Friday, the Bureau of Labor Statistics “BLS” will publish the Employment Situation report for the month of August.

The upcoming jobs report takes on additional significance because it is the last labor market update that the Federal Reserve will see before announcing their plans to reduce the pace of asset purchases at their September meeting.

Wall Street consensus widely believes the FOMC will announce a taper plan in September, most likely to begin in November unless the Friday labor report wildly misses expectations.

In his Jackson Hole speech, chairman Powell noted that the 3-month average in job gains had been about 830,000, and continued progress would be a green light to begin tapering the pace of asset purchases.

Jerome Powell Comment on Labor Market:

Source: Federal Reserve

The criteria for rake hikes as opposed to a balance sheet taper are far more stringent and a discussion for 2022.

Wall Street is expecting August to bring roughly 740,000 net jobs, more than enough to keep the FOMC on track to announce a taper in September (despite the cyclical slowdown in growth).

Investors that are familiar with the economic process at EPB Macro Research know that the direction of growth rate cycles is the most important factor, far more critical than a “beat” or “miss” relative to expectations.

The trending direction of economic growth, of which the labor market is an important component, drives asset price performance.

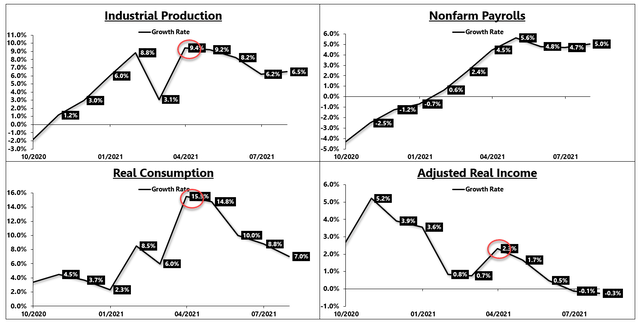

Real economic growth is already declining in the economy as industrial production growth and real consumption growth have cooled notably since May.

Employment growth hasn’t started a downtrend like the other coincident data points, partly because labor is more lagging than other coincident metrics like production.

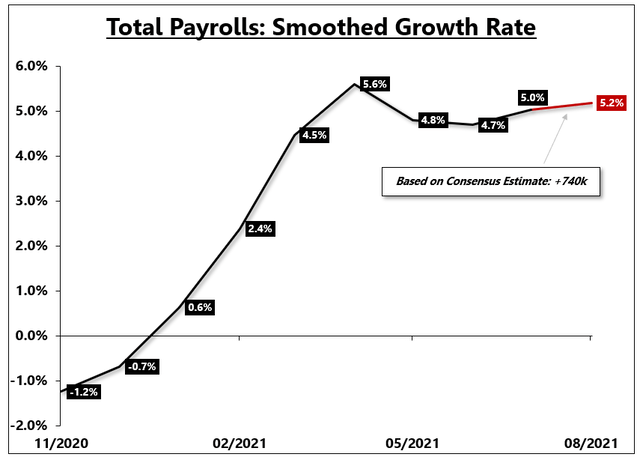

If the headline job figure comes in at 740,000, that will represent a sequential increase in the rate of total payrolls growth when measured on a smoothed six-month annualized growth rate.

Total Payrolls: Consensus Estimate Impact on Growth

Source: BLS, EPB Macro Research

The smoothed six-month annualized growth rate is superior to a year-over-year calculation, particularly when the base effect has a large impact.

Any jobs reading above 620,000 will bring a sequential increase in payrolls growth. If the headline payrolls reading surprises below 620,000, then total payrolls growth will decline sequentially and join the other coincident indicators in highlighting a broad-based economic slowdown.

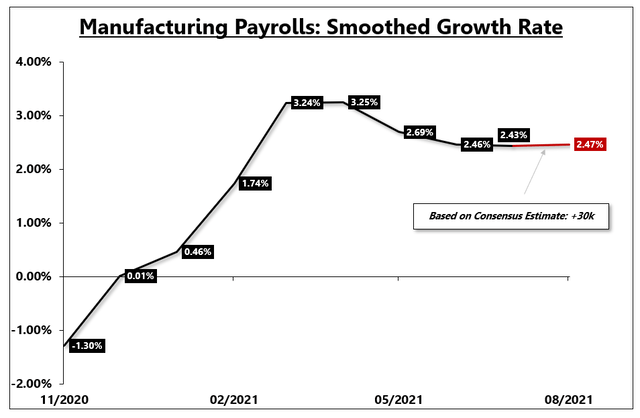

Manufacturing payrolls are expected to rise 30,000, which keeps manufacturing payrolls growth roughly flat. Below 30,000 and manufacturing payrolls will mark four consecutive declines in growth.

Manufacturing Payrolls: Consensus Estimate Impact on Growth

Source: BLS, EPB Macro Research

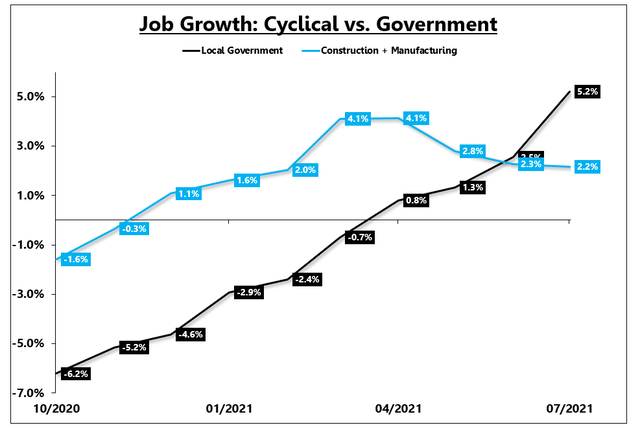

In addition to total employment growth, breaking out the growth rate of “cyclical” employment growth, namely construction + manufacturing, is highly revealing.

In the last employment report, cyclical employment growth declined while non-cyclical employment growth such as local government doubled.

Cyclical Vs. Government Employment: Growth Rate

Source: BLS, YCharts, EPB Macro Research

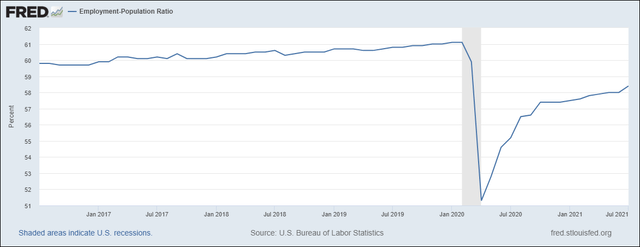

The employment-population ratio or the labor force participation rate are far superior metrics to the U-3 unemployment rate.

Focus on these broad, secular labor metrics over the U-3 unemployment rate.

Source: BLS, FRED

The growth rate of industrial production, real consumption, and real income have declined notably over the last 3-5 months.

Source: BLS, BEA, Federal Reserve, EPB Macro Research

Employment, while more lagging, remains the strongest of the four main coincident growth metrics.

On Friday, focus on the direction of total payrolls growth and the difference between cyclical payrolls growth and non-cyclical payrolls growth.

A jobs reading over 620,000 keeps the positive momentum in the labor market, but the cyclical vs. non-cyclical breakdown is important as construction and manufacturing payrolls growth has already been close to cut in half.

Disclaimer: EPB Macro Research is published as an information service. It includes opinions as to buying, selling, and holding various stocks and other securities. However, the publishers of EPB Macro Research are not brokers or acting as investment advisers and do not provide investment advice or recommendations directed to any particular subscriber or in view of the particular circumstances of any particular person. All data is supplied by sources is believed to be reliable, and the calculations herein are made using such data, and that such calculations are not guaranteed by these sources, the information providers, or any other person or entity, and may not be complete.

EPB Macro Research does not guarantee that you will out-perform the stock market. The information provided by EPB Macro Research is obtained from sources believed to be reliable but is not guaranteed as to accuracy or completeness. At various times, the publishers and employees of EPB Macro Research may own, buy or sell the securities discussed for purposes of investment or trading. EPB Macro Research and its publishers, owners, and agents are not liable for any losses or damages, monetary or otherwise, that result from the content of EPB Macro Research. Past results are not necessarily indicative of future performance.

Eric Basmajian

https://www.epbmacroresearch.com/

20210901