NZD Short: The US Hard Landing Hedge?

NZD Short: The US Hard Landing Hedge?

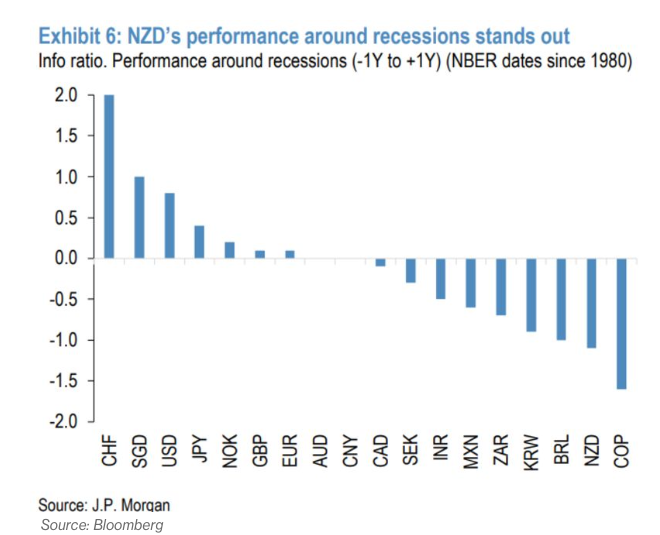

High beta currencies, like the Australian Dollar and the New Zealand Dollar, tend to fare badly when markets are risk off. However, the NZD is one of the worst-performing currencies during a recession. Bloomberg reports that JPMorgan looked back at the last 40 years and found that the NZD tends to perform very badly around a recession and worse than the AUD.

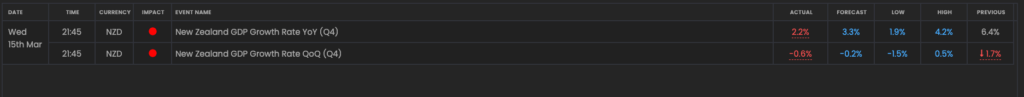

Latest New Zealand GDP numbers

Last week New Zealand GDP came in lower than expected with the Q4 reading at 2.2% vs 3.3% expected. The slower growth outlook means that the RBNZ will be seen as less likely to hike rates and that is an extra headwind for the NZD.

From an index level, the NZD has fallen into a near-term support region which will be crucial for the NZD’s direction. The NZD is also around the lowest levels it has been for this year as US recession fears increase. Watch this key support level marked as a break of this region opens up more technical downside.

The narratives to watch

If the prospects of a US hard landing grow, watch for further bank risk to increase expectations of a US recession, then the USD could find some strength. That could weaken the NZDUSD pair. This is why Morgan Stanley is currently projecting a move down to 0.5800 for the NZDUSD. Watch the price around the 100 and 200 EMA on the daily chart to get a sense of the technical direction of the pair moving forward.

About: HYCM is the global brand name of HYCM Capital Markets (UK) Limited, HYCM (Europe) Ltd, HYCM Capital Markets (DIFC) Ltd and HYCM Limited, all individual entities under HYCM Capital Markets Group, a global corporation operating in Asia, Europe, and the Middle East.

High-Risk Investment Warning: Contracts for Difference (‘CFDs’) are complex financial products that are traded on margin. Trading CFDs carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information please refer to HYCM’s Risk Disclosure.

20230323