Mish’s Daily: Sugar Prices Soar – What Could it Mean?

Mish’s Daily: Sugar Prices Soar – What Could it Mean?

Written by Michele ‘Mish’ Schneider

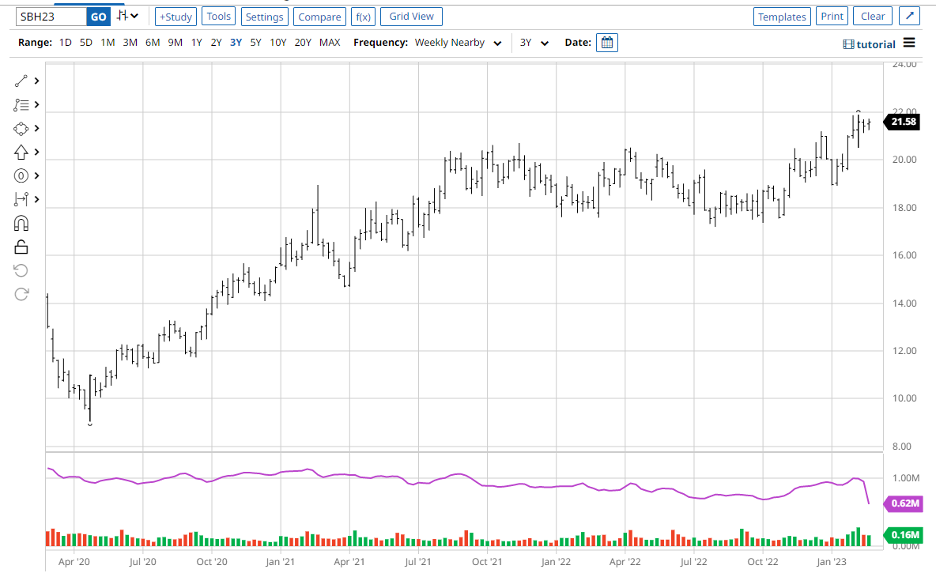

What if sugar futures are really onto something?

What if they are relaying food shortages?

More social disruption?

The Start of Russian hoarding?

Which leads to Geopolitical hell?

And all the inflation theories that could still develop are staring us right in the face?

In the face of a rising U.S. dollar..

In the face of higher yields and a more hawkish Fed..

In the face of some cooling inflation indicators and a correction in gold..

In the face of a soft GDP..

In the face of a persistent trading ranges in the key indices..

Sugar has gone up 225% since April 2020.

Sugar led the inflation rout in 1976 and then again in 1979.

Sugar is in pretty much everything we consume.

Heck, even Apple just announced a way to gauge your sugar levels if you have diabetes (1 in 3 Americans do)..in other words, eat sugar; we (Apple) got you.

The point is this..

Should this rout continue-pay attention-AI and growth stocks will not help feed the planet-not for a long time.

P.S. Tweet 2/22/23 at 8:19 AM ET:

$UNG textbook blow off potential bottom on high volume. One to watch

Price 7.30 at the time. Up over 12% since then.

Commodities-don’t give up.

For more detailed trading information about our blended models, tools, and trader education courses, contact Rob Quinn, our Chief Strategy Consultant, to learn more.

You don’t want to miss Mish’s 2023 Market Outlook E-available now

NOT TOO LATE Click here if you’d like a complimentary copy of Mish’s 2023 Market Outlook E-Book in your inbox.

Get your copy of “Plant Your Money Tree: A Guide to Growing Your Wealth”

Grow Your Wealth Today and Plant Your Money Tree!

“I grew my money tree and so can you!”- Mish Schneider

Mish in the Media

Fox Business-Making Money with Charles Payne 02-20-23

Business First AM-worst trade, best trade, next trade 02-21-23

CMC Markets on Commodities 02-16-23

StockchartsTV Final Bar with Dave Keller 2-14-23

Your Daily Five StockCharts TV 02-10-23

Kitco Article by Neils Christensen on the Gold Market–02-07-23

ETF Summary

S&P 500 (SPY) 390 support with 405 closest resistance

Russell 2000 (IWM) MA support around 184. 190 has to clear again

Dow (DIA) 326 support 335 resistance

Nasdaq (QQQ) 284 big support 300 resistance

Regional banks (KRE) 65.00 resistance 61 support

Semiconductors (SMH) 240 pivotal with 248 key resistance

Transportation (IYT) Why we look for 2-day confirms on phases-back over the 50-DMA-228 support 232 resistance

Biotechnology (IBB) 125-130 new range

Retail (XRT) 66-68 huge area to hold if the market still has legs

20230224