Midterm seasonality: Is there a 100% chance of a higher S&P500 in 3 months’ time?

Midterm seasonality: Is there a 100% chance of a higher S&P500 in 3 months’ time?

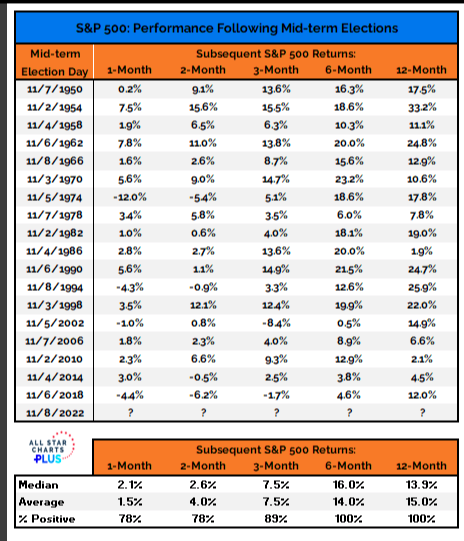

According to Bloomberg, there is a possibility for S&P500 to rise over 0.5% if the Republicans hold onto Congress but to fall by 3.3% if the Democrats hold Congress. However, the medium-term picture for the midterm elections looks fairly strong.

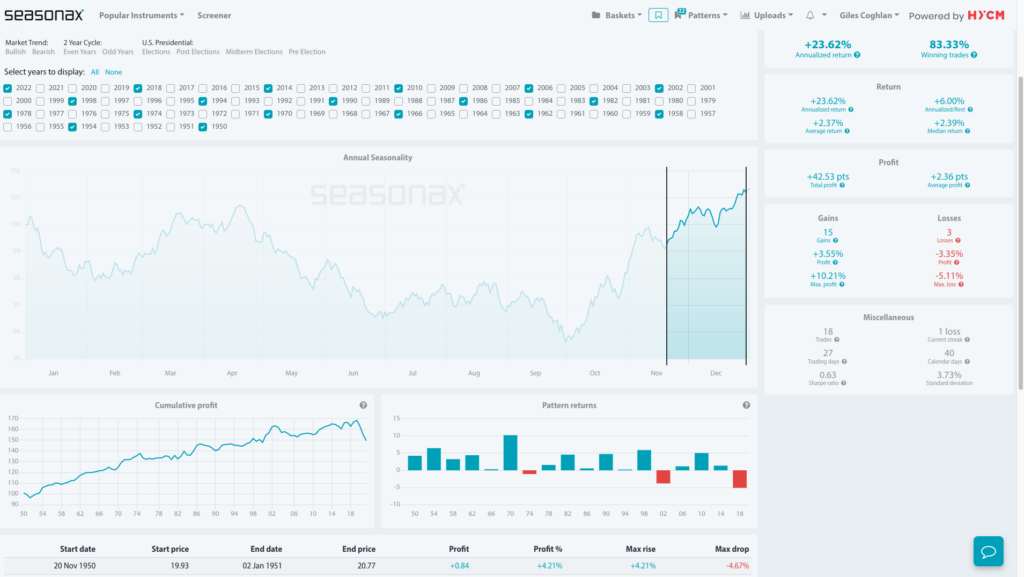

Midterm seasonality from Nov 20 – Dec 30

Seasonax shows that since 1950 the S&P500 has only lost value three times. That was in 1974, 2002, and 2018. The rest of the years saw an average profit of 3.55%. See below for the info on the S&P500 from 1950.

In fact, according to All Star Charts, the S&P500 was up 7.5% on average 3 months after the midterms. Furthermore, the S&P500 was up 100% of the time over the last 6 months. So, according to recent history, there is a 100% chance of the US S&P500 being positive 6 months from now.

The main risks to this view

The obvious risk to this view is that the Federal Reserve is maintaining its very hawkish stance. In last week’s Fed meeting, Jerome Powell pushed back against the idea of a lower terminal rate and kept the pressure on stocks. However, the idea of a Fed pause is not out of the realm of possibility, so these strong seasonals are certainly worth keeping in mind.

About: HYCM is the global brand name of HYCM Capital Markets (UK) Limited, HYCM (Europe) Ltd, HYCM Capital Markets (DIFC) Ltd and HYCM Limited, all individual entities under HYCM Capital Markets Group, a global corporation operating in Asia, Europe, and the Middle East.

High-Risk Investment Warning: Contracts for Difference (‘CFDs’) are complex financial products that are traded on margin. Trading CFDs carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information please refer to HYCM’s Risk Disclosure.

*Any opinions made in this material are personal to the author and do not reflect the opinions of HYCM. This material is considered a marketing communication and should not be construed as containing investment advice or an investment recommendation, or an offer of or solicitation for any transactions in financial instruments. Past performance is not a guarantee of or prediction of future performance. HYCM does not take into account your personal investment objectives or financial situation. HYCM makes no representation and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or other information supplied by an employee of HYCM, a third party, or otherwise. Without the approval of HYCM, reproduction or redistribution of this information isn’t permitted.

20221109